The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act), was enacted on December 18, 2015. The PATH Act contains several changes to the tax law that affect individuals, families, and

All current year tax returns that claim EITC and/or ACTC filed before February 15th, will contain a C- freeze on the account, to hold the refund.

Prior to February 15th, the refund cannot be released for any reason:

- Not even by inputting any type of adjustment to the

account

- Not even due to

a hardship (hardships will not be considered as long as the C- freeze is on the account). This includes the part of the refund that is not associated with the EITC or ACTC.

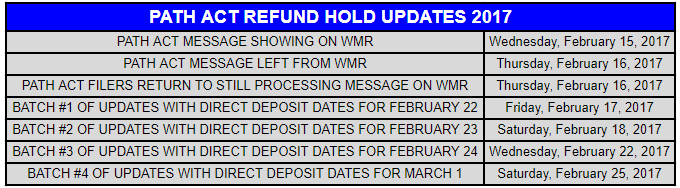

After the PATH ACT message when was the first updates?

Based off of previous year’s tax Filing Season the PATH message lifted at 11:59:59 pm Feb. 15th and at 12:00 am Feb. 16 and all taxpayers affected by the path message returned back to the Still Processing Message.

Everybodys Where’s My Refund? statuses changed to the Still Processing because the PATH hold came to an end at 11:59:59 on February 15th.

- During 2017 tax season the first Direct Deposit Dates started pouring in at 3:30 am Friday,

Febuary 17, 2017 withupdate for the majority of early filers with daily accounts with 2/22 Direct Deposit Dates. The majority of early filer weekly accounts that were approved and held under the PATH Hold updated Saturday, February 18,2017 with Direct Deposit Dates of 2/23. Then the following week the IRS returned to normal processing of daily accounts receiving updates on Wednesday mornings and weekly accounts received updates on Saturday Mornings.

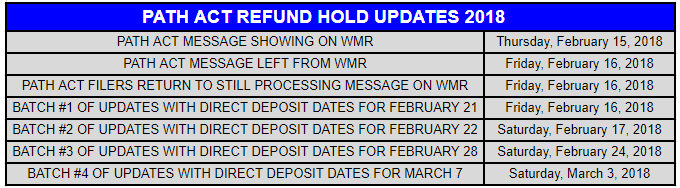

- During 2018 tax season the first Direct Deposit Dates started pouring in at 3:30 am Friday, February 16, 2018, with an update for the majority of early filers with daily accounts with 2/21 Direct Deposit Dates. The majority of early filer weekly accounts that were approved and held under the PATH Hold updated Saturday, February 17, 2018, with Direct Deposit Dates of 2/22. Affective starting in 2018 all major tax refund updates for both daily and weekly accounts see most updates on Saturday mornings. Starting the following week Saturday, February 24, 2018, the IRS returned to normal processing of daily and weekly accounts with both receiving updates on Saturday Mornings.

In 2018 the IRS said that the majority of the early filers would see an update by Feb. 18, 2018. It took two batches Friday the 17th and Saturday 18th to push out the large number of returns that were approved and held by the PATH ACT Hold.

I want to share my predictions on how the first set of deposits could roll out.

This year could be the same way the PATH message should update to still processing message tonight Feb. 15th after 11:59 pm. And some could see an update as soon as Friday morning 3:30- 6 am for daily accounts with 2/21 DDD. Then weekly accounts will update Saturday 3:30-6am with 2/22 DDD.

The PATH message this year reads that the majority of early filers held under the PATH hold should see an update by Feb. 17, 2018. So if the IRS follow the same schedule they did in 2017. Thier is a good chance this Friday and Saturday morning is going to be big days for updates.

Transcripts should be updating tonight into Friday and some should start to see 846 Refund issued codes showing up on their transcripts.