Combating identity theft is a top priority, and across the IRS many important steps are being taken to fight it. A key part of this involves the Security Summit Initiative, a unique partnership between the IRS, state revenue departments and the private-sector tax industry leaders.

This unprecedented Security Summit Initiative is the first public-private partnership of its kind. Our objective was putting new and innovative safeguards in place to protect taxpayers in time for the 2017 filing season.

By working together, the IRS, state tax administrators, and private-sector tax industry leaders will help protect taxpayers’ information and the integrity of the federal and state tax systems.

In addition, through the “Taxes. Security. Together.” campaign, the Security Summit Initiative is reaching out to taxpayers to enlist their help in the battle against identity theft and refund fraud. The campaign urges everyone to take an active role in protecting their personal and financial information both online and at home. With the public’s help, the Security Summit Initiative participants hope to amplify the new security protections it’s putting in place.

Refund Fraud Detection and Prevention

For several years, the IRS has fought aggressively against refund fraud, which includes identity theft. In the calendar year 2015, through November, the IRS rejected or suspended the processing of 4.8 million suspicious returns. So far, the IRS has stopped 1.4 million confirmed identity theft returns, totaling $8 billion. Additionally, through November IRS stopped $2.9 billion worth of refunds in other types of fraud. That’s a total of $10.9 billion in confirmed fraudulent refunds protected.

Many new safeguards in place will be invisible to taxpayers but invaluable in helping fight against the stolen identity refund fraud. Many changes are designed to better authenticate the taxpayer’s identity and the validity of the tax return at the time of filing.

The most visible change will be new password protections for private-sector tax software accounts. New standards require a minimum 8-digit password using a combination of letters, numbers and special characters. There also will be new security questions, new lock-out features and new ways to verify emails.

The password standards are intended to help protect taxpayers from identity thieves who take over their software accounts and file fraudulent tax returns using their names and Social Security numbers.

Many states also have enacted their own new safeguards. In an effort to protect you, some states may request driver’s license numbers and release refunds only after verifying data or issue paper refunds. Visit your state’s tax agency website to see if there are changes for the current year. (Although you may e-file your federal and state tax returns together, they are processed separately by the IRS and your state tax agency.) Please note taxpayers will not need a driver’s license to file their federal return.

The tax software industry also will be sharing many new data elements with the IRS and the states which will help determine if the return is valid. The IRS continues to increase both the number and efficiency of the identity theft data models and filters that are used to identify potentially fraudulent returns. These pre-refund filters stop the vast majority of fraudulent returns. Additionally, the IRS continues to expand its partnerships with financial institutions to identify and stop fraudulent refunds.

The IRS, states and tax industry also will routinely share information about identity theft trends or new schemes so that all parties can react quickly and appropriately.

Increasing Efforts to Help Victims

The IRS understands that identity theft is a frustrating, complex process for victims. While identity thieves steal information from sources outside the tax system, the IRS is often the first to inform a victim that identity theft has occurred. The IRS is working hard to resolve identity theft cases as quickly as possible.

While the IRS has made considerable progress in this area, more work remains. Fighting identity theft is an ongoing battle as identity thieves continue to create new ways of stealing personal information and using it for their gain. Identity theft cases are among the most complex handled by the IRS. The IRS is continually reviewing processes and policies to minimize incidents of identity theft and to help those who find themselves victimized. Among the steps underway to help victims:

Centralizing victim assistance work: During 2015, the IRS centralized most of its victim assistance work within one function and created an Identity Theft Victim Assistance organization. The agency also is reviewing its process and procedures to better serve taxpayers and to help reduce the time it takes to resolve cases. A typical case can take 120 days to resolve, but complex cases can take longer.

IP PIN: The IRS Identity Protection PIN (IP PIN) is a unique six-digit number that is assigned annually to victims of identity theft. It helps show a particular taxpayer is the rightful filer of the return. For 2017, everyone with an IP PIN must have it entered on the return. This includes primary and secondary taxpayers as well as dependents. Please be aware: some states also may have new security PINs this year. If the IRS issued you an IP PIN you must use it to file your federal tax return.

IP PIN Pilot: The IRS will continue its IP PIN pilot program that allows taxpayers who filed tax returns last year from Florida, Georgia or the District of Columbia to opt into the IP PIN program.

IRS Criminal Investigation

In the most recent three fiscal years, Criminal Investigation (CI) has helped convict approximately 2,000 identity thieves.

In the fiscal year 2015, the IRS initiated 776 identity theft-related investigations, which resulted in 774 sentencings through CI enforcement efforts. The courts continue to impose significant jail time with the average months to serve in the fiscal year 2015 at 38 months — the longest sentencing being over 27 years.

The nationwide Law Enforcement Assistance Program (LEAP) provides for the disclosure of federal tax return information associated with the accounts of known and suspected victims of identity theft with the express written consent of those victims. There are now more than 1,100 state/local law enforcement agencies from 48 states participating. For FY2015, more than 6,700 requests were received from state and local law enforcement agencies.

The Identity Theft Clearinghouse (ITC) continues to develop and refer identity theft refund fraud schemes to Criminal Investigation Field Offices for investigation. Since its inception in FY2012, ITC has received over 10,750 individual identity theft leads. These leads involved approximately 1.72 million returns with over $11.4 billion in refunds claimed.

CI continues to be the lead agency or actively involved in more than 70 multi-regional task forces or working groups including state/local and federal law enforcement agencies solely focusing on identity theft.

Detecting and Preventing Tax Refund Fraud

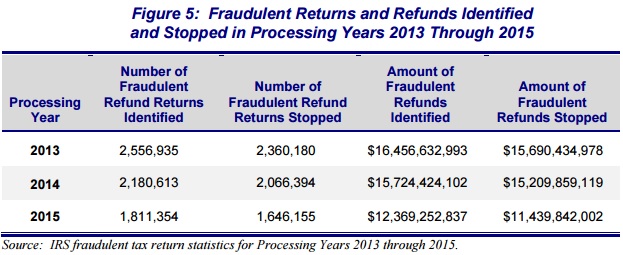

As of March 5, 2016, the IRS reported that it identified 42,148 tax returns with $227 million claimed in fraudulent refunds and prevented the issuance of $180.6 million (79.6 percent) of those refunds. Figure 5 shows the number of fraudulent tax returns identified by the IRS for Processing Years 2013 through 2015 as well as the refund amounts that were claimed and stopped.

The decrease in the number of fraudulent tax refunds the IRS detects and stops continues to be attributable to expanded IRS processes to prevent fraudulent tax returns from entering the tax processing system (i.e., rejecting e-file tax returns and preventing paper tax returns from posting). For example, as of February 29, 2016, the IRS had locked approximately 30.4 million taxpayer accounts of deceased individuals. The locking of a tax account results in the rejection of an e-filed tax return and prevention of a paper tax return from posting to the Master File if the SSN associated with a locked tax account is used to file a tax return. According to the IRS, as of February 29, 2016, it has rejected approximately 35,000 fraudulent e-filed tax returns and stopped 741 paper tax returns from posting to the Master File. In addition, in response to concerns raised by TIGTA regarding multiple refunds going to the same address or bank account, the IRS developed and implemented a clustering filter tool during the 2013 Filing Season. The clustering filter tool groups tax returns based on characteristics that include the address, ZIP code, and bank routing numbers. For the tax returns identified, the IRS applies a set of business rules in an attempt to ensure that legitimate taxpayers are not included. Tax returns identified are held from processing until the IRS can verify the taxpayer’s identity. As of March 3, 2016, the IRS reports that using this tool, it identified 328,908 tax returns and prevented the issuance of approximately $1.4 billion in fraudulent tax refunds.

Detection of tax returns involving identity theft

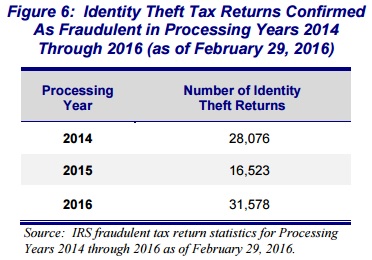

The IRS continues to make improvements to its process to detect identity theft. For example, for the 2016 Filing Season, the IRS is using 183 identity theft filters to identify potentially fraudulent tax returns and prevent the issuance of fraudulent tax refunds. The identity theft filters incorporate criteria based on characteristics of confirmed identity theft tax returns, including amounts claimed for income and withholding, filing requirements, prisoner status, taxpayer age, and filing history.

Tax returns identified by these filters are held during processing until the IRS can verify the taxpayer’s identity. The IRS attempts to contact the individual who filed the tax return and, if the individual’s identity cannot be confirmed, the IRS removes the tax return from processing. This prevents the issuance of many fraudulent tax refunds. As of February 29, 2016, the IRS reported that it had identified and confirmed 31,578 fraudulent tax returns and prevented the issuance of $193.8 million in fraudulent tax refunds as a result of the identity theft filters. Figure 6 shows the number of identity theft tax returns the IRS identified and confirmed as fraudulent in Processing Years 2014 through 2016.

In an effort to further reduce the issuance of fraudulent tax refunds, the IRS began limiting to three the number of direct deposit refunds that can be sent to one bank account. The IRS will convert to a paper refund check the fourth and subsequent direct deposit refund requests and will mail the check to the taxpayer’s address of record.

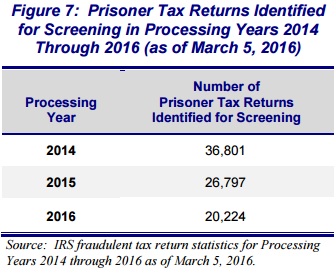

Screening of prisoner tax returns

As of March 5, 2016, the IRS reports that it identified for screening 20,224 potentially fraudulent tax returns filed by prisoners. Figure 7 shows the number of prisoner tax returns identified for screening in Processing Years 2014 through 2016.

To combat the continuing problem of refund fraud associated with tax returns filed using prisoner SSNs, the IRS compiles a list of prisoners (the Prisoner File) received from the Federal Bureau of Prisons and State Departments of Corrections. Various IRS offices and functions use the Prisoner File in an effort to prevent and detect fraud. The Prisoner File is the cornerstone of the IRS’s efforts to prevent the issuance of fraudulent refunds to individuals filing false tax returns using a prisoner SSN. The Electronic Fraud Detection System is the primary system used by the IRS to identify tax returns filed using prisoner SSNs. The Electronic Fraud Detection System consists of a series of filters the IRS has designed to evaluate tax returns for potential fraud. Tax returns are processed through the system, where the primary and secondary SSNs listed on the tax return are matched to the Prisoner File to determine if the tax return is filed using a prisoner SSN. If the SSN on the tax return matches the SSN of a prisoner on the Prisoner File and it is a claim for a refund, a prisoner indicator is assigned to the tax return. Tax returns with a prisoner indicator that meet specific criteria are evaluated to determine if the tax return is fraudulent. This evaluation includes screening and verifying the wage and withholding information reported on the tax return. The American Taxpayer Relief Act of 2012, enacted in January 2013, expanded the Secretary of the Treasury’s authority to share false prisoner tax return information with Federal and State prisons and gave the IRS permanent authority to share such information. This authority was granted because Congress believes the ability of the IRS to share information with prison officials will enable them to take action to punish prisoners for perpetrating fraud and will help stop the abuse of the tax system. In September 2014, we reported that as of June 2014, the IRS had not completed needed agreements to begin sharing information related to false prisoner tax return information with Federal and State prison officials. As of February 25, 2016, the IRS has completed memorandums of understanding with eight State Departments of Corrections. Fourteen State Departments of Corrections have elected not to participate in this program. IRS management stated that the Department of Corrections officials from nonparticipating States cited various reasons for not participating in the program. These included resource constraints and the fact that there was no specific benefit for the State to investigate prisoners.

Filing Fraudulent Tax Returns

Tax fraud is a federal crime with serious consequences and a crime that rarely stays hidden. Between the IRS’s audit computers and the Whistleblower program, high dollar tax fraud is nearly impossible to hide. Low dollar tax fraud sometimes can be hidden for a time, but eventually, most people get caught. Filing a fraudulent return can result in fines up to $250,000 for an individual or $500,000 for a corporation and up to 3 years in jail along with the cost of prosecution for high dollar tax fraud. For lower dollar tax fraud you can face penalties of as much as $5000.00 or 100% of the unpaid tax. If the IRS is charging you with high dollar tax fraud, you must hire an attorney and be prepared for a long, difficult and humiliating process.

Keep in mind that the IRS is not out to get responsible taxpayers. In fact, in order to be found guilty of filing a fraudulent tax return, the IRS must prove that you: “Willfully makes and subscribes any return, statement, or other documents, which contains or is verified by a written declaration that is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter.” (Title 26 USC § 7206(1)) In other words, you must intentionally and knowingly lie on your taxes or other tax-related documents. This includes actions such as recurrently leaving certain income off of your tax statements or changing your income forms to reflect false information.