There are two different being processed messages. One is “still being processed” and the other is “being processed” and they both have different meanings.

What does “Your tax return is still being processed” mean?

The “your tax return is still being processed” tax refund status can mean many things, but the main one is that the tax return is still in the IRS system and still being processed.

The IRS Where is my refund? uses the “your tax return is still being processed” status message to inform taxpayers that the IRS is still processing their tax returns, but the IRS system may have detected a problem that may delay the tax refund longer than the original 21-day processing timeframe.

What things could trigger the “Your tax return is still being processed” tax refund status?

- Identity Verification

- Errors found on the tax return

- Questionable Refundable Tax Credits

- Wage and Withholding verification

Where’s My Refund “still being processed” refund status

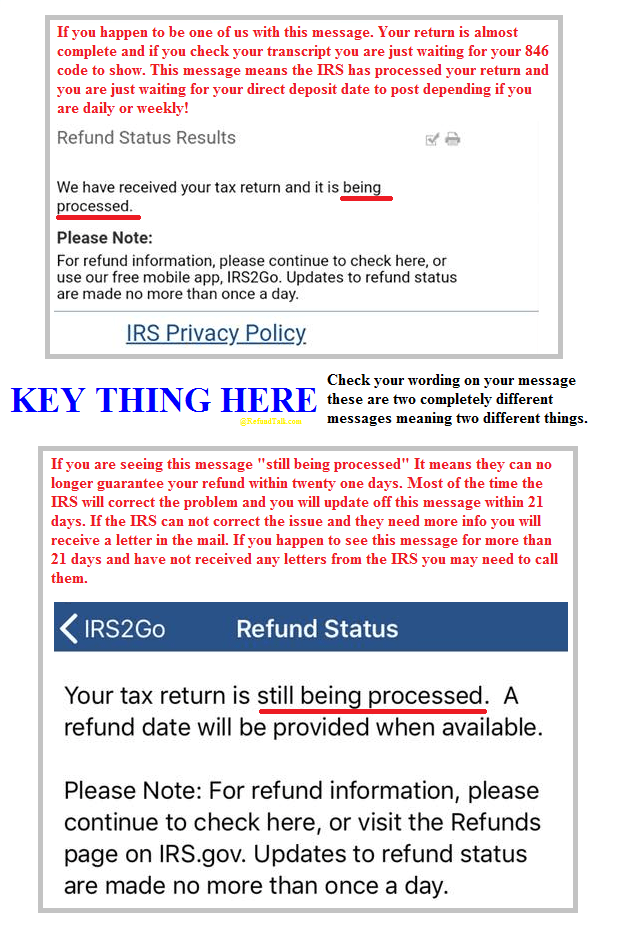

If you are seeing this refund status “still being processed” it means the IRS can no longer guarantee your refund within the 21-day time frame. In some cases, the IRS will correct the issue without further information being needed and you will update from this message to the “being processed refund status. If the IRS can not correct the issue and they need further information you will receive a letter by US Mail explaining what is going on with your tax return. If you see this message for 21 days or 3 cycle weeks and have seen no letter or updates to your refund status you may need to contact the IRS.

There are two different being processed messages. One is “still being processed” and the other is “being processed” and they both have different meanings.

- If you have the “Still being processed” message the “still being processed” refund status. The IRS is still working to complete your tax return but the processing has been paused until the IRS corrects the return or mails you a letter requesting additional information from you to complete the processing of your tax return.

- If you have the “Being Processed” message “being processed” message is a good sign. If you are seeing this message most likely your tax return is close to being completed and you are waiting for your tax refund to be approved. Hopefully in the next update. Taxpayers seeing this message should see an 846 refund-issued code posted to your account transcript soon. We recommend you check the next major update Wednesday for daily and Saturday for weekly Accounts.

What should I do if I have the “Still Being Processed” tax refund status?

Most taxpayers that are stuck on this refund status message could see it for a few cycle weeks maybe even longer depending on your tax situation. And some taxpayers seeing this refund status could receive an update to a Direct Deposit Date without needing any further information. But for other taxpayers stuck with this message, there is a really good possibility that they may be required to provide additional information or verify their identity with the IRS. If you are seeing this message the best advice we can give is to get Informed Delivery® by USPS® or keep an eye on your mail because you may be receiving a notice and could have to provide the IRS with additional information.

Remember: If you are stuck on the still being processed message we recommend you try to view your account transcripts online. By viewing your transcripts you will know the codes that are showing up on your account and you will also be able to see if you have any notices issued by the IRS.

Click to find out more about the “Still Being Processed” tax refund status here!

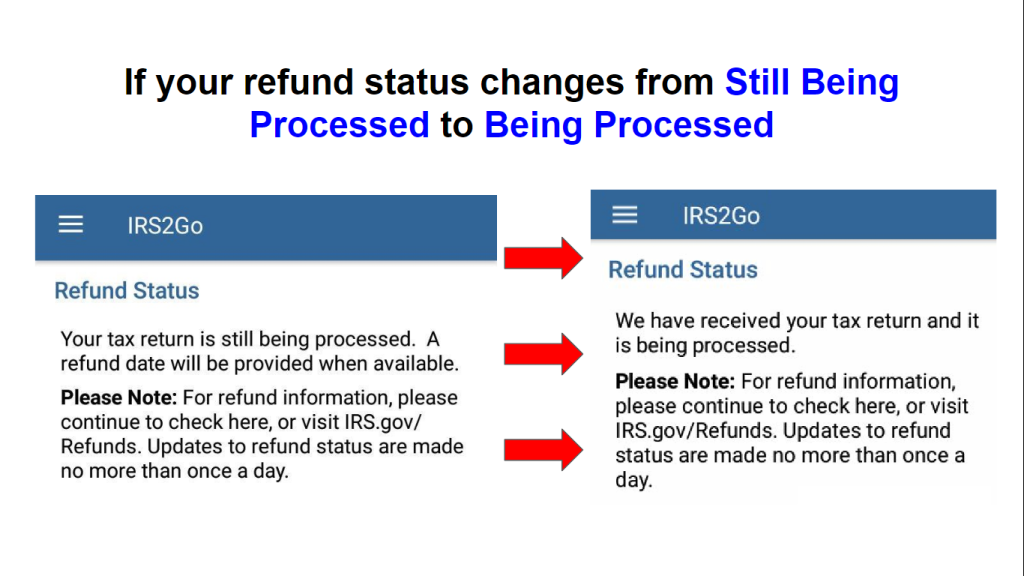

Why did my tax refund status change from “Still Being Processed” to “Being Processed” message?

If your tax refund status changes from “still being processed” to “being processed” this is a good sign you are getting closer to an 846 Refund Issued. When the “still being processed” lifts this means they have resolved the issue that was holding up your tax return. Once the issue with your tax return is resolved some may update straight to a direct deposit date and others that see this the “Still Being Processed” will update to the “Being Processed” refund status for a few cycle weeks and then update to a direct deposit date.

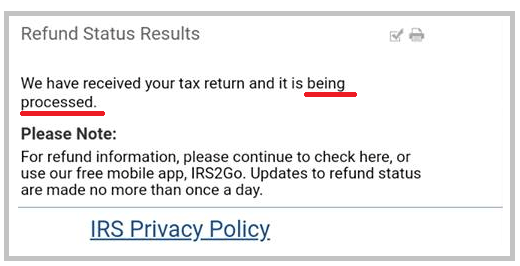

What does the “Being Processed” tax refund status mean?

The “Being processed” refund status indicates your tax return is being processed, but your tax refund has not been approved for a refund yet. The IRS is systematically releasing direct deposits week by week. The system is waiting for your tax return to be completed so the system can issue you a refund approval date.

Where’s My Refund “being processed” refund status

If you are seeing the “Being Processed” refund status. Your tax refund should only be a few cycle weeks away from your tax return being completed and a refund approval date posted- to the tax account. If you check your tax account transcripts you are just waiting for your 846 Refund Issued code to post to your Account Transcripts. This message means the IRS has been working to process your tax return and you are just waiting for your tax return to be completed so the system can generate a tax refund approval date to post to the tax account.

Click to find out more about the “Being Processed” tax refund status here!

Why does my tax refund amount disappear?

- If your refund amount disappears there is a good chance your refund amount may be different than the amount you originally filed. Your refund amount may change if the IRS has made adjustments to your account or if you have past-due obligations or debt. If you don’t owe anything then don’t worry, your refund amount will show back up once it is approved.

Why do I see the Tax Topic 152 message?

Tax topic 152 is a good sign you are getting a tax refund You would want to see Tax Topic 152 this message is general information pertaining to your tax refund. Tax topic 152 outlines the standard procedures the IRS follows for distributing tax refunds. Your tax topic will change if there is an issue affecting your return.