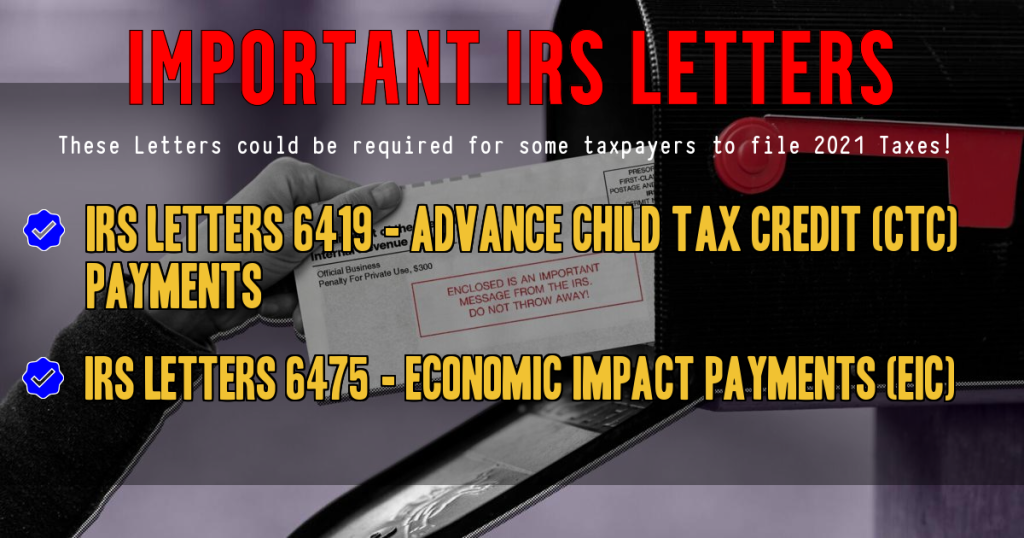

Before you file your tax returns, the IRS may be sending you these letters if you received the third stimulus check or child tax credit.

The IRS started issuing information letters to advance child tax credit recipients in December. Recipients of the third round of the Economic Impact Payments will begin receiving information letters at the end of January. Using the information in these letters when preparing a tax return can reduce errors and delays in processing your tax return.

People receiving these letters should keep them. Do not throw them away.

These letters can help taxpayers, or their tax professionals prepare their 2021 federal tax return.

Advance child tax credit payments letter can help people get the remainder of 2021 credit

To help taxpayers reconcile and receive all the 2021 child tax credits to which they are entitled, the IRS started sending Letter 6419, 2021 advance CTC, in late December 2021 and will continue into January. This letter includes the total amount of advance child tax credit payments taxpayers received in 2021 and the number of qualifying children used to calculate the advance payments. People should keep this and any other IRS letters about advance child tax credit payments with their tax records.

Families who received advance payments need to file a 2021 tax return and compare the advance payments they received in 2021 with the amount of the child tax credit they can properly claim on their 2021 tax return.

The letter contains important information that can make preparing their tax returns easier. People who received the advance payments can also check the number of their payments by using the CTC Update Portal available on IRS.gov.

Eligible families who did not receive any advance child tax credit payments can claim the full amount of the child tax credit on their 2021 federal tax return. This includes families who don’t normally need to file a tax return.

What is a letter 6419?

You can think of this letter as a tax form. The letter 6419 is the official documentation that has the details you need to report your advance Child Tax Credit (CTC) payments.

Specifically, it will show you:

- The total amount of advance CTC payments you received for 2021. This information will go on Schedule 8812, line 14f or 15e as applicable.

- Number of qualifying children counted in determining the advance CTC

In addition to the details above, letter 6419 outlines how the IRS calculated your amount and the conditions for repayment.

Do I really need the 6419 letter to file? Can I just use my bank statement?

We strongly encourage you to reference IRS letter 6419 before you file your taxes. Using incorrect amounts on your return could trigger a manual review of your return, which could delay your return—and refund for weeks.

Referencing your bank statements may not be the best route. In some cases, amounts may have been adjusted due to a variety of reasons, including if the processing of a 2020 return after an initial advance CTC payment was made. Or, the amounts may have changed from one payment to the next as you made changes in the IRS Child Tax Credit portal.

Ready to file but don’t have your letter? Read on to learn about using the IRS Child Tax Credit portal as an alternative.

Who receives a letter 6419?

Anyone who received at least one advance Child Tax Credit payment from July to December 2021 will receive Letter 6419. So, even if you stopped payments at some point, you should still expect to receive a letter.

Married filers should take note: You’ll both receive your own IRS Letter 6419. You’ll need to have both documents to file an accurate return and claim the second half of your credit.

What if I can’t find my Letter 6419?

If you’re ready to file, but don’t have your letter, there is an alternative. You can use the IRS Child Tax Credit portal with an ID.me account to verify the details from the letter.

Here’s how to check your advance child tax credit payments:

- Create a new ID.me account (if you don’t have one) by going to: https://www.irs.gov/credits-deductions/child-tax-credit-update-portal

- Click Manage Advance Payments

- Click ID.me Create New Account

- Follow the on-screen instructions to provide information to set up the secure ID.me account. Note that users may be asked to create a live video of themselves (using phone or webcam) and/or upload photo identification. For help, visit the ID.me help page.

Once you’ve created an ID.me account, you can access the portal at the link directly above.

Economic Impact Payment letter can help people claim the 2021 recovery rebate credit

The IRS will begin issuing Letter 6475, Your Third Economic Impact Payment, to EIP recipients in late January. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022.

Letter 6475 only applies to the third round of Economic Impact Payments, which were issued in March through December of 2021. The third round of Economic Impact Payments, including “plus-up” payments, were advance payments of the 2021 recovery rebate credit that would be claimed on a 2021 tax return. Plus-up payments were additional payments the IRS sent to people who received a third Economic Impact Payment based on a 2019 tax return or information received from the Social Security Administration, Railroad Retirement Board, or Veterans Affairs. Plus-up payments were also sent to people who were eligible for a larger amount based on their 2020 tax return.

What is IRS Letter 6475?

IRS Letter 6475 is the official way the Internal Revenue Service is recording your 2021 Economic Impact Payment (EIP, also known as a stimulus payment).

Similar to a tax form, the letter will:

- outline your personal information, specifically your name and address, and

- show the total 2021 EIP amount the IRS issued you

Anyone who received a 2021 stimulus payment will be sent letter 6475.

Is letter 6475 really needed to file? Can’t I use my bank statement or IRS Letter 1444-C?

We encourage you to use your letter 6475 before filing taxes for 2021 vs. using other documents. Having the wrong amount on your return could trigger a manual review of your return, which could cause long delays in your tax refund for weeks.

While you may have received a Letter 1444-C after receiving your stimulus payment, that’s not the document the IRS recommends you use to prepare your tax return.

What if I can’t find my Letter 6475?

If you’re ready to file, but don’t have your letter, there is an alternative. You can create an ID.me account to verify the details from the letter.

Here’s how to check your Economic Impact Payment:

- Create a new ID.me account (if you don’t have one) by going to: https://www.irs.gov/payments/your-online-account

- Click Sign into your Online Account

- Click ID.me Create New Account

- Follow the on-screen instructions to provide information to set up the secure ID.me account. Note that users may be asked to create a live video of themselves (using phone or webcam) and/or upload photo identification. For help, visit the ID.me help page.

Once you’ve created an ID.me account, you can access your online account at the link directly above.

What should you do with IRS Letter 6475?

Once you receive your letter, you will use the amount shown on your Recovery Rebate Worksheet to determine if any credit applies.

“I’m not required to file taxes. Is there a benefit to reporting this money?”

In short, the reason is more money.

For example:

- If you believe you didn’t receive the full stimulus payment amount that you were due, you can file a 2021 federal income tax return to claim the additional money. This is known as a Recovery Rebate Credit.

- You may be entitled to a refundable credit, such as a Child Tax Credit or Earned Income Credit. That means, when you file, you’ll get money back. But the catch is, you have to actually file a return.

Most eligible people already received the payments. However, people who are missing stimulus payments should review information on IRS.gov to determine their eligibility and whether they need to claim a recovery rebate credit for 2020 or 2021. This includes people who don’t normally need to file a tax return.

The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax returns.