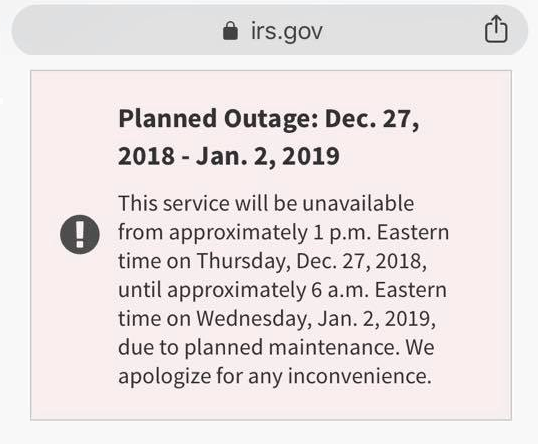

The IRS Modernized e-file, the system that processes electronically-filed business returns, will shut down after December 27, 2018, so the agency can perform annual maintenance and

During this extended IRS maintenance window;

- E-file for both Federal and State business income tax returns will be closed and no new acknowledgments will become available.

- Acknowledgments received from the IRS prior to the IRS shutdown will remain available.

- The option to continue transmitting business returns from 2016 and 2017 is available.

- Tax Year 2016 and 2017 business returns will resume with the opening of the IRS Business e-File season in January 2019.

Exceptions during this shutdown period:

- FBAR returns are not affected. These returns will continue to be available for transmission, and acknowledgments will continue to post.

- California business returns are not affected. These returns will continue to be available for transmission, and acknowledgments will continue to post.