As tax season approaches, the IRS engages in a crucial process known as IRS HUB Testing to ensure the smooth and accurate handling of tax returns. For 2025, IRS HUB Testing is set to play a significant role in preparing for the official opening of the tax filing season.

What is IRS HUB Testing?

IRS HUB Testing, or “Holding, Uploading, and Batch Testing,” is a critical process conducted by the IRS to test the electronic systems used for processing tax returns. This ensures that the e-filing system, tax software providers, and IRS systems are functioning seamlessly before the tax season officially begins.

During IRS HUB Testing, the IRS works with authorized tax professionals, software developers, and financial institutions to:

- Identify and resolve potential issues in e-filing systems.

- Test the integration of tax software with IRS databases.

- Ensure compliance with updated tax codes and regulations.

Key Dates for IRS HUB Testing in 2025

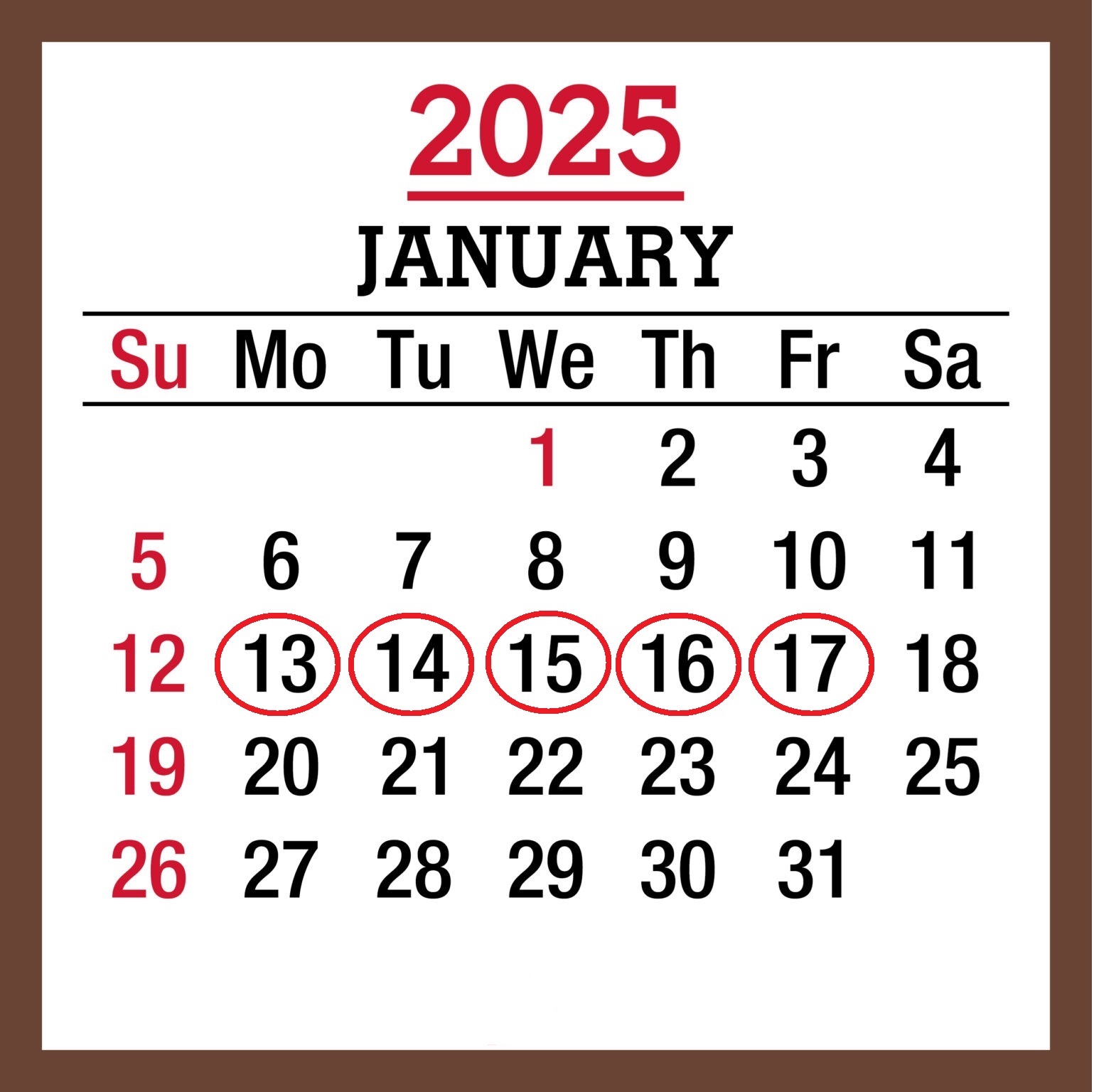

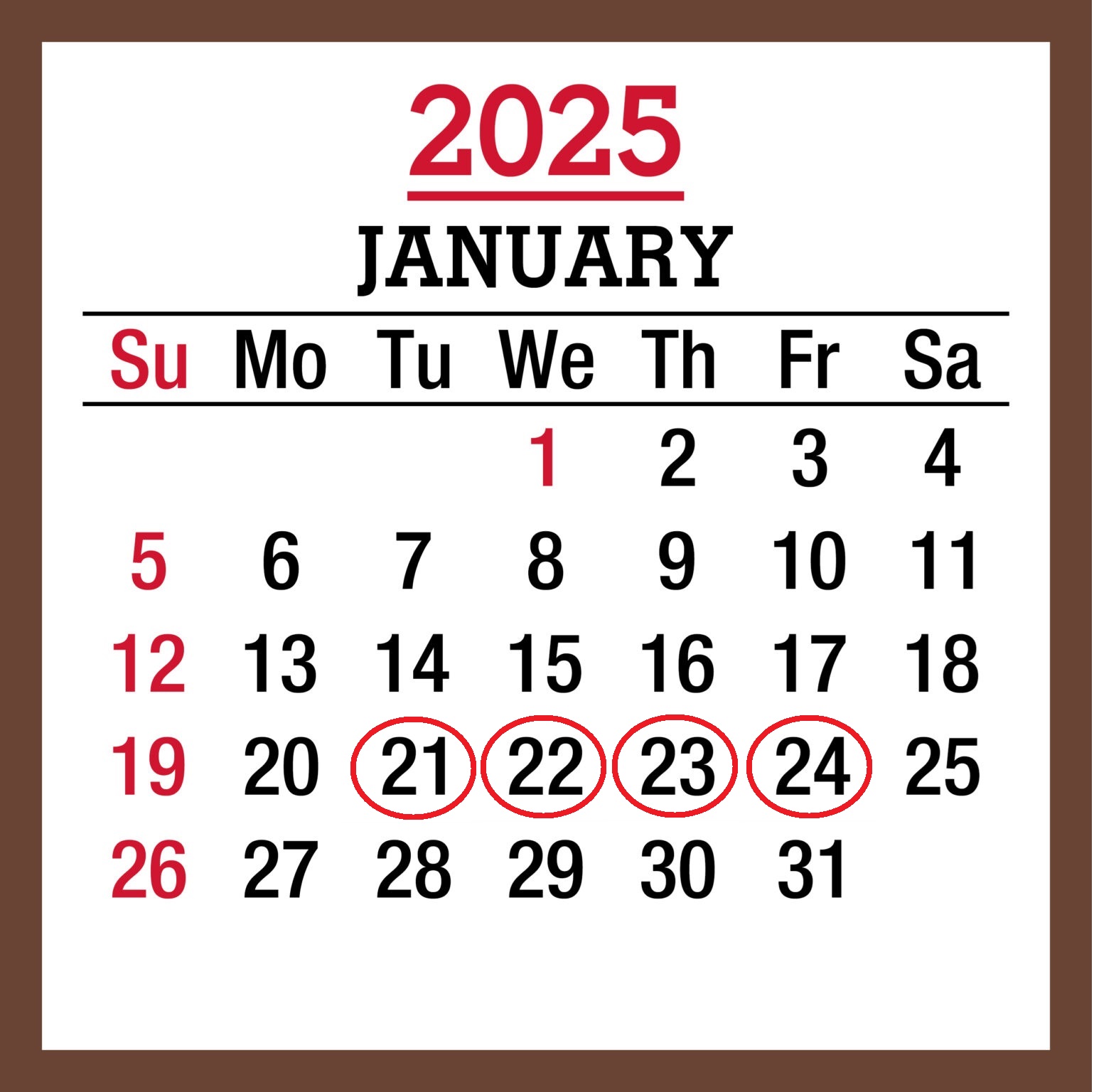

For the 2025 tax filing season, IRS HUB Testing will take place over several days in January. The dates are as follows:

- Round 1 Testing:January 13, 2025 – January 17, 2025

- Round 2 Testing:January 21, 2025 – January 24, 2025

These sessions allow the IRS to collaborate with participating partners to identify and correct any system-related issues before the tax filing season opens to the public.

Why Does the IRS Conduct IRS HUB Testing?

IRS HUB Testing is essential for several reasons:

- System Validation:Ensures the IRS systems are ready to process millions of tax returns electronically without errors.

- Error Detection:Identifies potential issues in tax software, IRS databases, and data transmission protocols.

- Compliance with Tax Law Changes:Verifies that all updates to the tax code have been properly integrated into the e-filing system.

- Data Security:Tests and strengthens security protocols to protect taxpayer information from cyber threats.

- Efficiency Testing:Ensures that systems can handle high volumes of traffic and process returns efficiently.

- Stakeholder Coordination:Provides software developers and tax professionals with an opportunity to validate their systems against IRS requirements.

How Does IRS HUB Testing Work?

IRS HUB Testing involves the following steps:

- File Submission:Participating software providers and tax professionals submit sample tax returns using test scenarios provided by the IRS.

- System Analysis:The IRS reviews the submitted test returns to identify errors, inconsistencies, or system failures.

- Feedback:The IRS provides detailed feedback to participants, highlighting issues that need to be addressed.

- Corrections and Retesting:Participants correct identified issues and resubmit test returns to ensure the system functions correctly.

- Approval:Once the IRS confirms that all issues have been resolved, the systems are approved for use during the filing season.

Who Participates in IRS HUB Testing?

IRS HUB Testing involves a collaborative effort between:

- Tax software developers (e.g., TurboTax, H&R Block, etc.).

- Financial institutions that handle direct deposits and refunds.

- Tax professionals and Enrolled Agents.

- IRS personnel are responsible for e-filing systems and data security.

Impact of IRS HUB Testing on Taxpayers

While IRS HUB Testing primarily involves backend processes, it directly benefits taxpayers by:

- Reducing system downtime during the tax season.

- Minimizing errors in tax return processing.

- Ensuring faster processing of refunds.

- Protecting sensitive personal and financial information.

What to Expect Post-HUB Testing

Once IRS HUB Testing is complete, the IRS will:

- Finalize preparations for the official start of the tax season.

- Prepare for the opening date for e-filing on January 27, 2025.

- Ensure that all systems are operational and ready to handle taxpayer submissions.

Was your tax return part of the IRS HUB Testing in 2025?

IRS HUB Testing is a vital step in ensuring a seamless tax filing experience for everyone. By conducting rigorous testing and collaborating with key stakeholders, the IRS ensures that its systems are secure, efficient, and ready to handle millions of tax returns. As a taxpayer, understanding the importance of HUB Testing can help you appreciate the efforts made to improve the accuracy and reliability of the e-filing process.