Tax transcripts are a vital resource provided by the IRS that can help you track your tax return, resolve issues, and verify your financial history. Here’s everything you need to know about tax transcripts, how to access them, and how they can be used.

If you’re Where’s My Refund? Status Bars Have Disappeared PLEASE READ!

One way to determine what is going on with your tax return is to visit the IRS website and request an account transcript. The IRS has provided a free tool “Get Transcripts” to users so they can instantly view their tax records online if available. You can also call 800-829-1040 to request a transcript, but creating a login and viewing your transcript online in real-time is the easiest and most accurate way to track your progress. With an IRS online account, you can check the status of your account transcript daily for updates

Should I order Transcripts by mail?

Ordering tax transcripts by mail won’t do you any good. Ordering transcripts in the mail will just waste paper and end up in the trash after you wait up to 2 weeks to receive them and realize that the information is out of date.

Things to Remember:

- For the most updated and accurate information on your tax transcripts, you have to create an online account with IRS. Mailed tax transcripts are not good for checking current updates.

- If your Transcripts are available for viewing through the IRS “Get Transcript Tool” you know the IRS has received your return and is processing it!

What is a Tax Transcript?

IRS Transcripts enable taxpayers to obtain a record of their tax filings or subsequent adjustments to their return. A tax transcript is a line-by-line reprint of your original return whereas an account transcript includes both the original return information and any subsequent changes. The account transcripts provide critical dates such as the date you filed the return, the payments you made, and additional assessed taxes. Account transcripts also indicate whether the tax return was filed by a taxpayer or was filed by the IRS as a substitute return for the taxpayer. Account information reflects changes made to the original return such as amendments and adjustments. Tax Account Transcripts are available for any account that is active in the Master File. An account transcript provides the following information:

- Amount of estimated payments

- The penalty paid/assessed

- Interest paid/assessed

- Interest paid to the taxpayer by the Service

- Balance due with accruals

Obtaining a copy of your IRS transcript is relatively easy, but understanding the codes listed on the transcript can prove more difficult. Here we will show you how you can use your Account Transcript to help you get a better understanding of what is going on with your tax account.

Why would I want an Account Transcript?

Here are some ways you can start implementing the use of your account transcripts.

- Investigating Delays Beyond 30 Days

- If you’ve been waiting more than 30 days for an update on your tax return, reviewing the transaction codes on your account transcript can provide valuable insights. These codes often reveal what is causing the delay or what actions the IRS has taken on your return.

- Tracking IRS Letters & Notices

- Any notice or letter sent by the IRS will be listed as a line item on your account transcript. This allows you to track correspondence from the IRS even before you receive it in the mail.

- Preventing Tax Return Fraud

- Regularly reviewing your transcripts can help you identify unauthorized tax returns filed using your information. If a fraudulent return is filed, it will appear as a line item on your transcript.

- By catching fraudulent activity early, you can alert the IRS before the refund is issued, minimizing the damage and speeding up resolution. Cases of identity theft can take up to 180 days—or longer—to resolve, so early detection is crucial.

- Identifying Tax Refund Delays

- If your Where’s My Refund? status bars disappear or your refund is delayed, your transcript can provide updates on processing, notices, or other changes to your account.

- Verifying Income for Financial Applications

- Tax transcripts are often required by lenders for mortgages, loans, or other financial applications. They provide official proof of income and tax information.

- Resolving Disputes with the IRS

- A tax transcript can help clarify discrepancies with your tax account, such as missing payments, adjustments, or penalties.

- Confirming Amended Returns

- Use the Tax Account Transcript to verify that changes to your return, such as an amendment, have been processed by the IRS.

- Rebuilding Lost Tax Records

- If you’ve lost important tax documents like W-2s or 1099s, the Wage and Income Transcript can help you reconstruct your records. This is especially useful for filing prior-year returns or resolving discrepancies.

By using tax transcripts strategically, you can stay informed about your tax return status, address issues proactively, and safeguard your financial records. Regularly reviewing your transcripts ensures you’re always in the know when it comes to your tax account.

How do I obtain my tax account transcripts?

The IRS provides multiple ways to obtain your tax transcript:

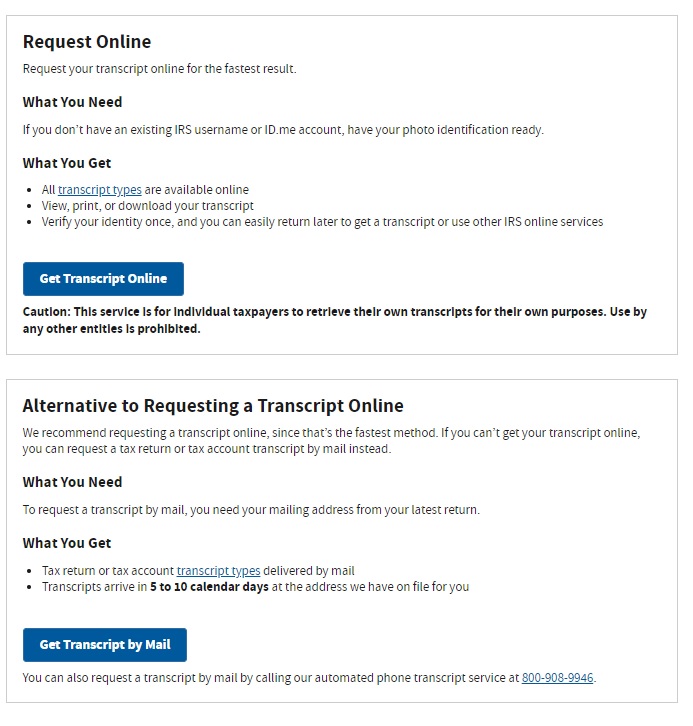

- Online Access Through the IRS Website

- Use the Get Transcript Online tool for instant access to your transcripts.

- You’ll need to verify your identity by creating an IRS account. Be prepared with:

- Email address

- Social Security Number or Individual Taxpayer Identification Number (ITIN)

- Tax filing status and mailing address

- Financial account information, such as a credit card, mortgage, or loan account number

- By Mail

- Use the Get Transcript by Mail option to receive a transcript within 5-10 business days.

- Limited to Tax Return and Tax Account Transcripts.

- By Phone

- Call the IRS at 800-908-9946 to request a transcript by mail.

- Form 4506-T

- Submit Form 4506-T to request transcripts by mail. This option is especially useful for third-party verification.

To securely access Get Transcript Online, first-time users must:

- Submit their name and email address to receive a confirmation code;

- Enter the emailed confirmation code;

- Provide their SSN, date of birth, filing status, and address on the last filed tax return;

- Provide some financial account information for verification such as the last eight digits of their credit card number or car loan number or home mortgage account number or home equity (second mortgage) loan number;

- Enter a mobile phone number to receive a six-digit activation code via text message;

- Enter the activation code;

- Create a username and password, create a site phrase and select a site image.

Returning taxpayers who have not completed the new secure access process:

- Log in with an existing username and password;

- Submit financial account information for verification, for example, the last eight digits of a credit card number or car loan number or home mortgage account number, or home equity (second mortgage) loan account number;

- Submit a mobile phone number to receive an activation code via text;

- Enter the activation code.

Returning taxpayers who have completed the new secure access process:

- Log in with an existing username and password;

- Receive a security code text via the mobile phone provided with the account setup;

- Enter the security code into secure access.

If at any point, you cannot validate your identity – for example, you cannot provide financial verification information or you lack access to a mobile phone – you may use Get Transcript by Mail.

Get Transcript by Mail allows you to go online and select a return or account transcript type to be mailed to your address of record and delivered within five to 10 days. You may also call 1-800-908-9946 to order these transcripts by phone.

The Best Way to Check Updates on your Transcripts is to obtain & view your IRS Transcripts Online

1.)Obtain FREE Access to Get Transcripts Online or by mail

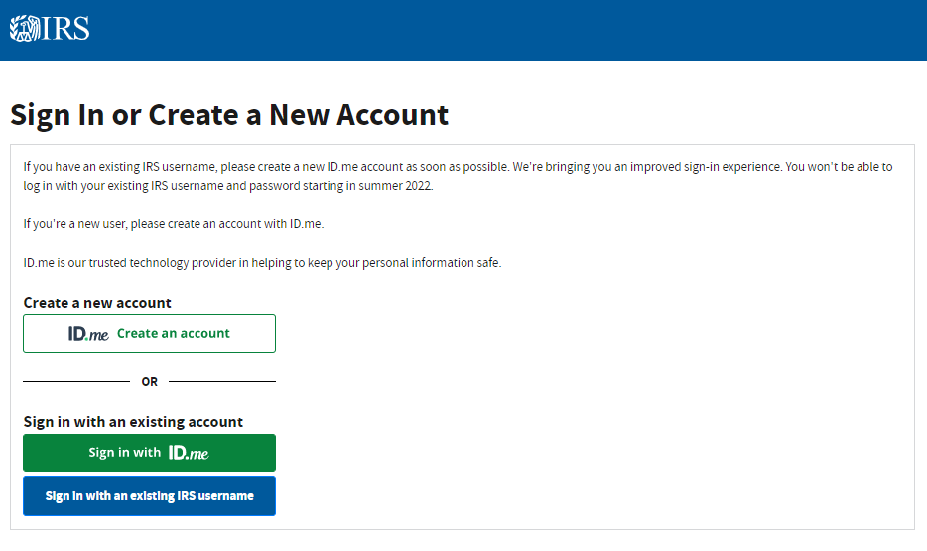

2.) Sign In or Create a New Account

ID.me Frequently Asked Questions

How do I verify my identity?

To verify your identity with ID.me, you’ll need to provide a photo of an identity document such as a driver’s license, state ID, or passport. You’ll also need to take a selfie with a smartphone or a computer with a webcam. If you need help verifying your identity or submitting a support ticket, you can visit the ID.me IRS Help Site.

What if I can’t verify my identity?

If you need help verifying your identity or submitting a support ticket, you can visit the ID.me IRS Help Site. If you can’t verify your identity online, please see the alternative options.

What is ID.me?

ID.me is our trusted technology provider in helping to keep your personal information safe. They specialize in digital identity protection and help us make sure you’re you—and not someone pretending to be you—before we give you access to your information.

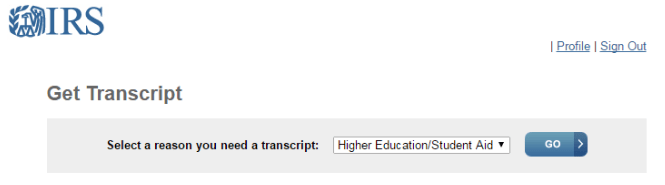

3.) Select the reason you need the Transcripts from the drop-down list and click Go. (We usually click Higher Education/Student Aid)

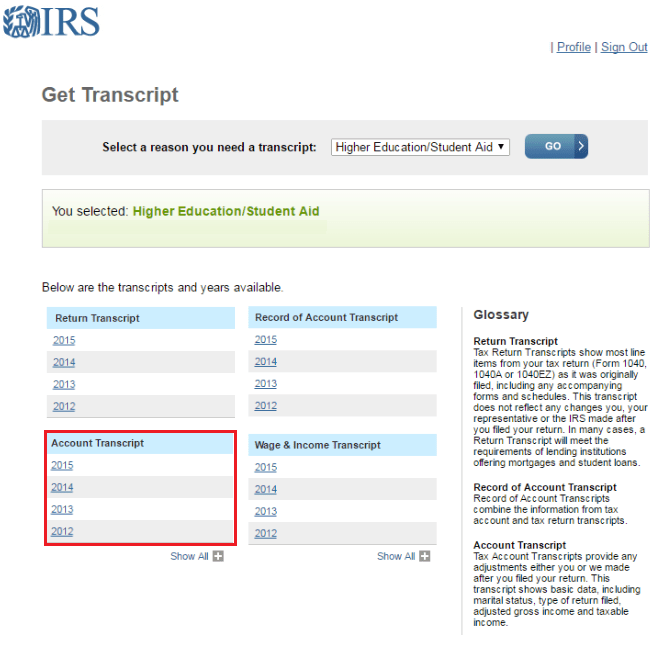

4.) In the Account Transcript box, click the year for the tax account transcript you want to download.

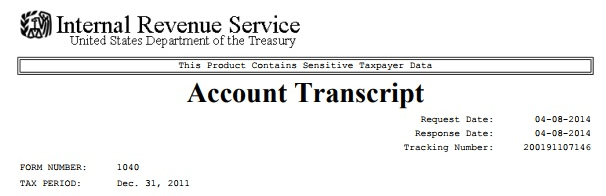

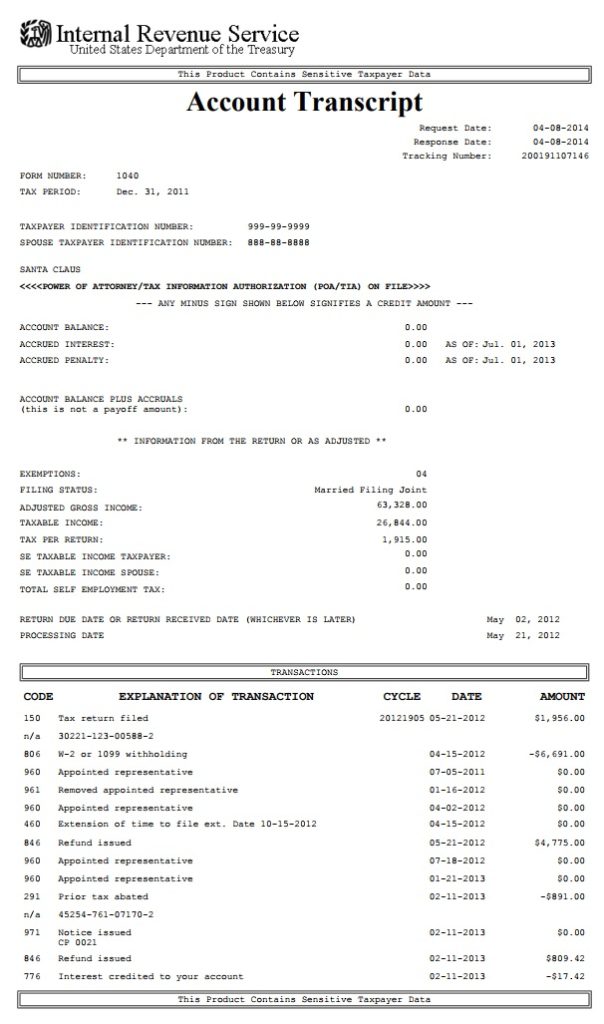

This is an example of an Account Transcript

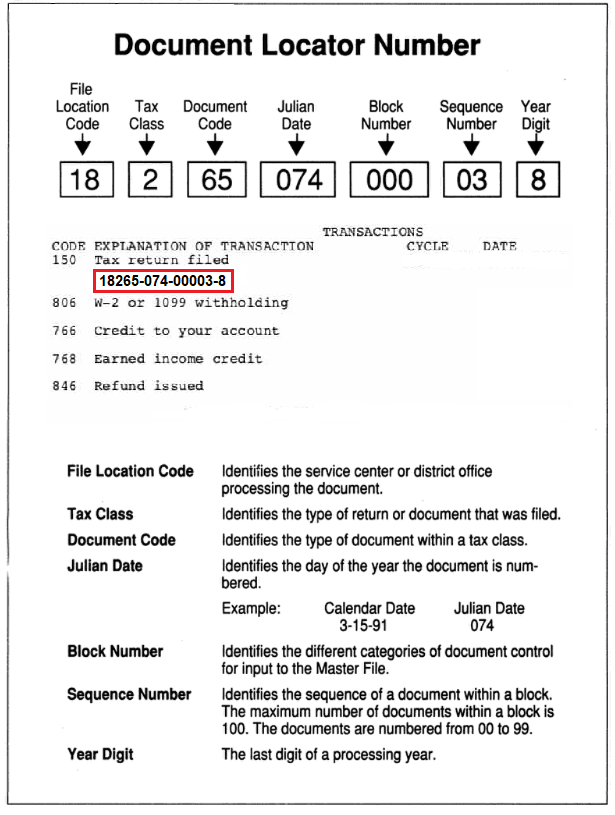

Document Locator Number

What is the Document Locator Number(DLN)?

Document Locator Number is the number assigned to each return or other document introduced into processing for control and file reference purposes.

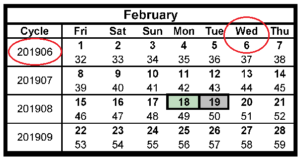

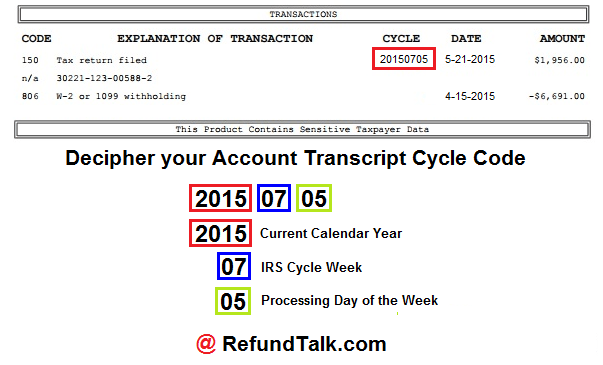

How to determine your transcript Cycle Code?

What is an IRS Cycle Code?

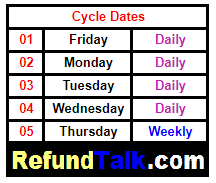

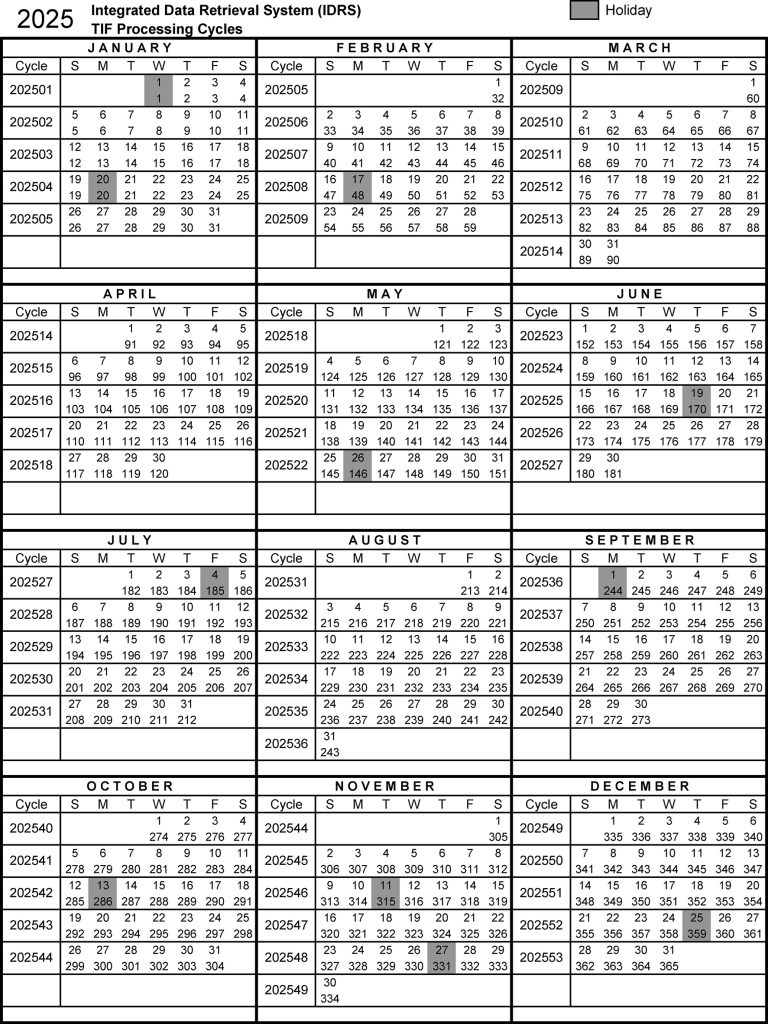

The cycle code is an eight-digit code found on your account transcripts. The cycle code indicates the day your account was posted to the IRS Master File. This date indicates the 4 digits of the current cycle year, two-digit IRS cycle week, and two-digit processing day of the week.

Example: 20190604 = (2019 – Cycle Year) (06 – Cycle Week) (04 – Cycle Day) = Wednesday, February 6, 2019

Here is an example of cycle code 20190604 on the 2019 IRS Posting Cycles

20190604 = (201906 – Cycle)(04 = Wednesday) = Wednesday, February 6, 2019

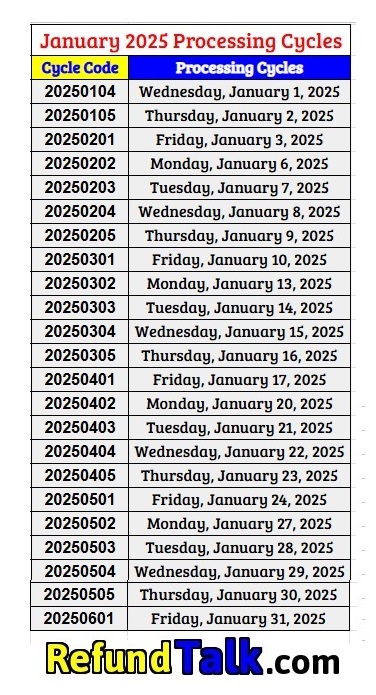

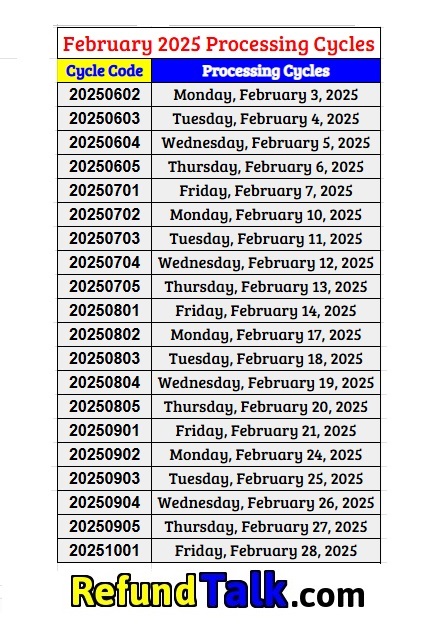

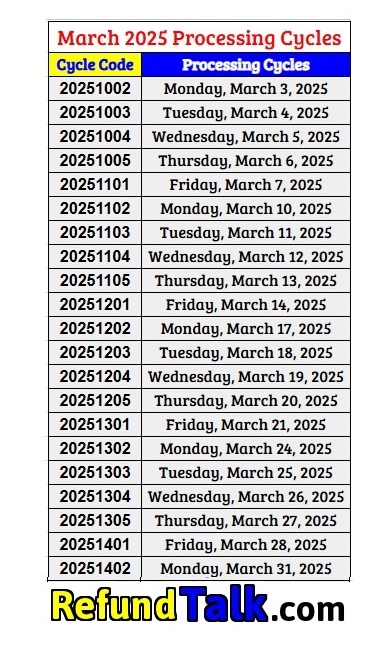

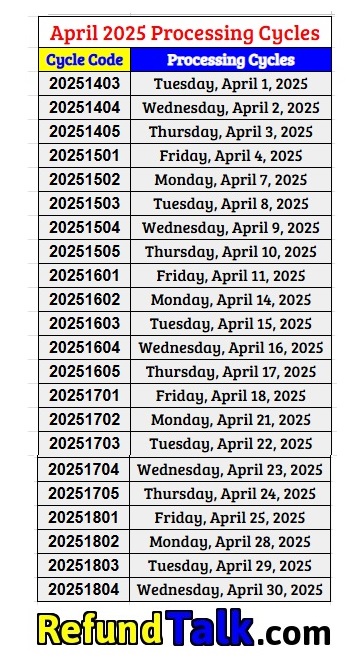

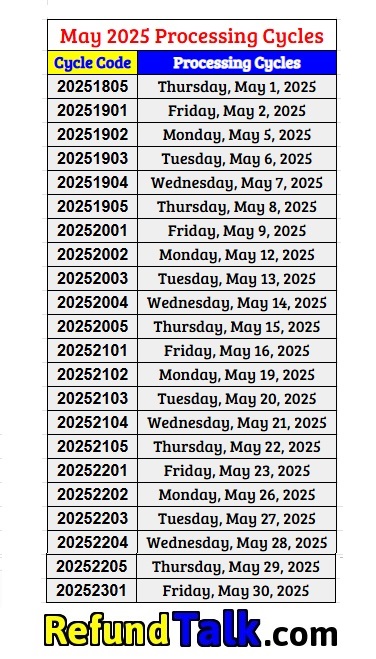

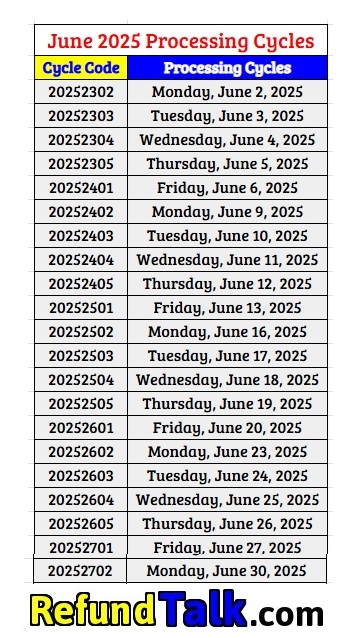

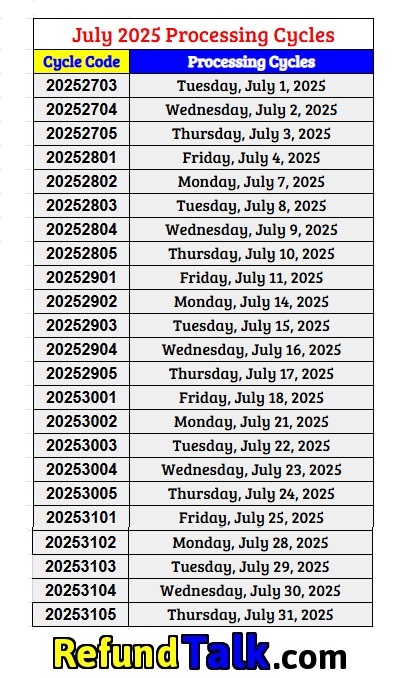

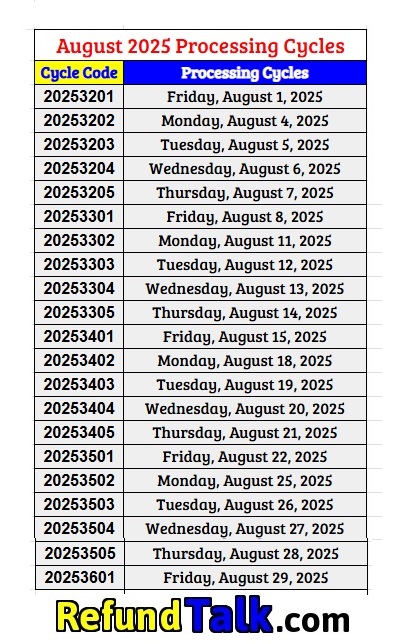

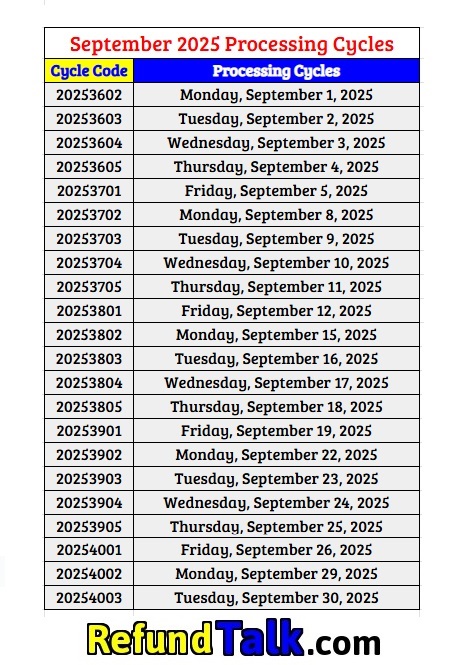

2025 IRS Processing Cycles

We have simplified the IRS Processing Cycles from above to make them easier to read. All you have to do is find your cycle code on your account transcript and use these charts below to determine the day the IRS began to process your tax return.

Find your Cycle Code on the charts and determine the day the IRS began processing your tax return.

More IRS Processing Cycle Codes! 2018 | 2019 | 2020 | 2021 | 2022 | 2023

Tax Transcript FAQs

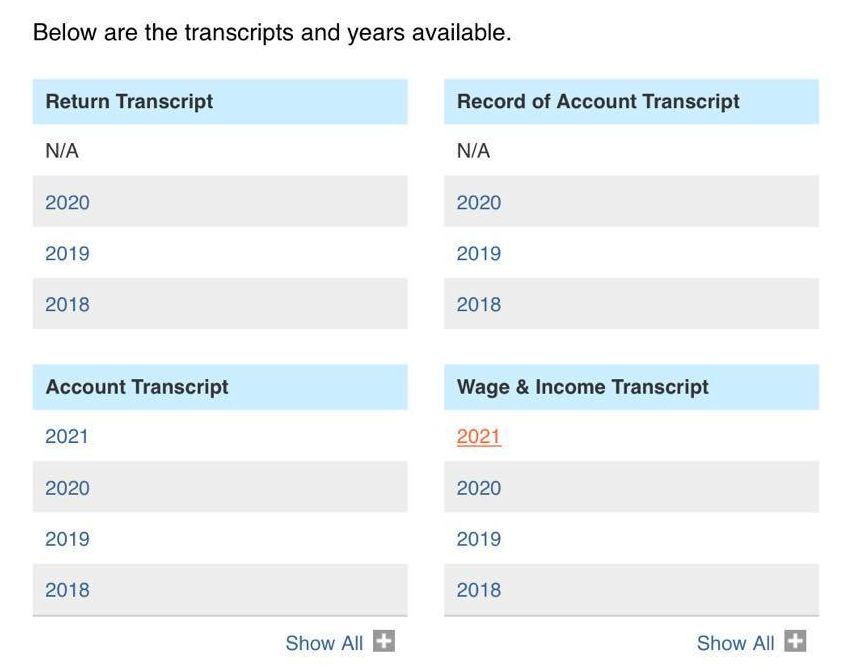

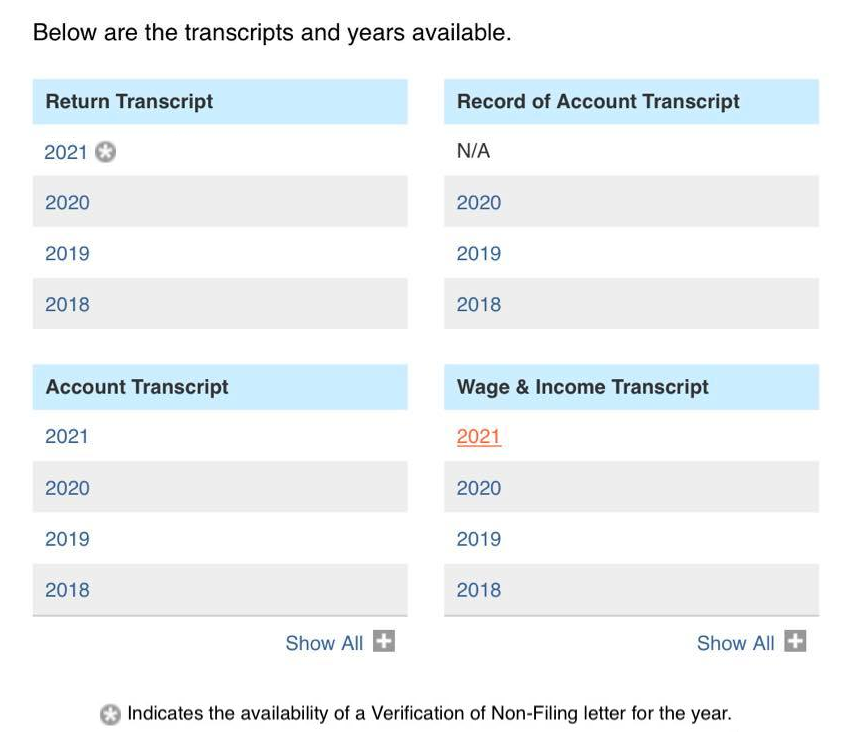

What does N/A on my tax transcripts mean?

When checking your tax transcripts if you see an N/A in place of the most recently filed tax transcripts. The N/A is letting you know that your transcripts for the current filed tax year are Not Available yet.

Why don’t my Tax Transcripts reflect the return I just filed?

The most recently filed tax return isn’t reflected on your transcripts yet because the IRS has not begun processing the return. Your return should be posted to your account transcript within about one week of the IRS accepting it. The return transcript takes longer for the IRS to post to your account.

What does the star mean next to my current year return transcript?

The Grey star indicates that the IRS has no record of a processed Form 1040-series tax return as of the date of the request.

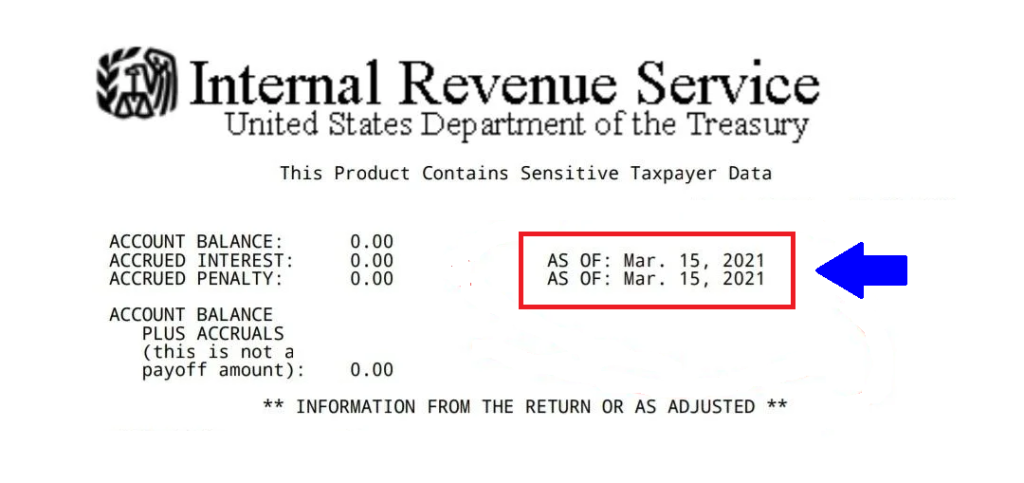

What does the “As Of” Date mean on Tax Transcripts?

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund.

How do you find out when Transcripts Update?

Daily Accounts have Tuesday Transcript Updates and Weekly Accounts have Friday Transcript Updates. You can view our IRS update calendars here and they will show you what days transcripts update for taxpayers.

Account Transcript Overview

At the top right of the account, the transcript is the date of request, the date of response, and the tax period covered by the transcript.

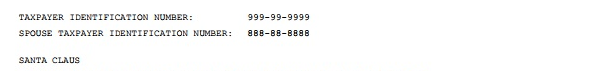

Check the taxpayer identification numbers below, as well as the taxpayer name or names, to make sure they are accurate.

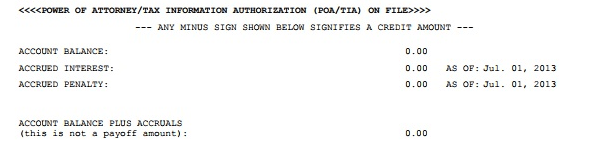

The account transcript next lists the account balance, meaning the tax liability due and still outstanding. Following that are the interest and penalties, if any, levied on the balance and the most current date of these levies.

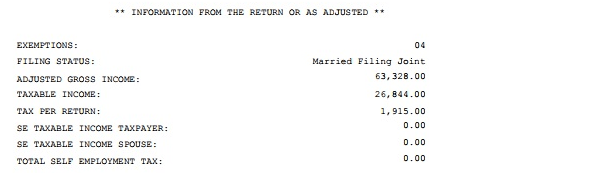

The next section lists basic calculations from the return you submitted to the IRS. Included in that are the number of exemptions, the adjusted gross income, the taxable income, and the total tax liability. Following these calculations is the amount of self-employment tax owed by yourself and your spouse. These amounts may have been adjusted by you with an amendment to the return or by the IRS, according to its records and corrections.

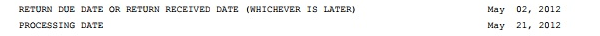

The transcript next gives the date on which the return was due or received, whichever was later.

The processing date is when they are expected to process. This date could change if certain transactions post to your transaction codes that need more time.

The final section lists transactions for the tax period, including the tax assessment amount and date, payments made and their dates, and any credits or refunds made and their date(s).

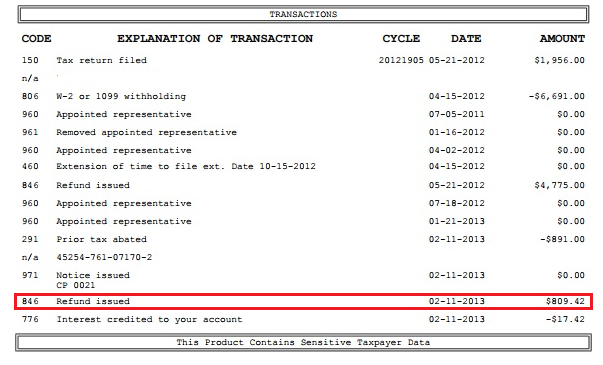

Once your Account Transcript shows an 846 Refund Issued Code you will know the IRS has completed your tax return and you are getting your money on the date next to the 846 Refund Issued Code as highlighted below.

The date next to the transaction means that the IRS has until this date to complete the work on this transaction.

Trying to decipher your account transcripts?

Decoding an IRS account transcript can feel overwhelming, but understanding the basics can make it easier to interpret. Your transcript provides a detailed history of your tax account, including return data, transactions, and any changes made after your original filing. Here’s what you need to know to make sense of them:

- What Does a Transcript Show?

- Your transcript can include details about your tax return (such as filing status, adjusted gross income, and tax liability) and your account activity.

- It also reflects any changes or transactions made after you filed your original return, such as corrections, adjustments, payments, or refunds issued.

- Understanding Transaction Codes

- Transaction codes are three-digit numbers used by the IRS to identify specific actions or updates to your account.

- These codes track the “history” of your account, such as when your return was received, processed, adjusted, or if a refund was issued.

If you’re checking your IRS transcript, you’ll come across various transaction codes. Here’s what some of the most common ones mean:

✅ Code 150 – Return Filed & Tax Liability Assessed

This is one of the first codes you’ll see. It confirms that your return has been accepted by the IRS and added to their master file for processing.

✅ Code 806 – W-2 or 1099 Withholding

Shows the total federal taxes withheld by your employer or payor during the tax year.

✅ Code 766 – Credit to Your Account

Indicates a credit on your account, which could be from a refund, an overpayment from a previous year, or a credit from the current return.

✅ Code 768 – Earned Income Credit (EIC)

Represents the refund amount you’re receiving due to the Earned Income Tax Credit.

✅ Code 846 – Refund Issued

Great news! This means your refund has been approved and will be sent on the date shown.

⚠️ Codes That May Require Action ⚠️

🚨 Code 570 – Additional Account Action Pending

Your return is being reviewed, and adjustments may be needed. You may also see Code 971, meaning the IRS has sent a notice explaining the issue, or Code 571, which means the issue has been resolved.

🚨 Code 810 – Refund Freeze

Your refund is currently on hold. You’ll likely receive a letter explaining the next steps.

🚨 Code 420 – Examination of Tax Return

Your return is under manual review. While this doesn’t always mean an audit, it increases the likelihood.

🚨 Code 421 – Examination Request Closed

The IRS has completed its review of your return.

🚨 Code 424 – Examination Request

Your return has been selected for further manual examination.

🚨 Code 290 – Additional Tax Assessed

Indicates that you owe more taxes than originally calculated. The additional amount will be listed on this line.

🚨 Code 971 – Notice Issued

The IRS has sent you a letter regarding your account. Be sure to check your mail or IRS account for details.

By familiarizing yourself with these codes and their meanings, you can better understand what is happening with your tax return and account. The IRS Transaction Pocket Guide available below provides a Master List of Transaction Codes to help decode these entries.

Learning to read your transcript can give you greater insight into your tax return status and any actions the IRS has taken. It’s a useful skill for taxpayers who want to stay informed about their accounts.

Common Tax Transcript Transaction Codes

The following codes are the most common transaction codes that can be found under the explanation of transaction section on the tax account transcript.

- TC 150 – Indicates that your tax return has been filed and is currently being processed. This means that it has been successfully submitted and posted to your account.

- TC 196 – This code on your tax transcript indicates the assertion of interest by the IRS.

- TC 276 – Signals a “Failure to Pay Tax Penalty” from the IRS. It indicates that a penalty has been imposed for not meeting the specified tax payment obligations.

- TC 290 – Signals an Additional Tax Assessed, indicating that the IRS has identified and imposed an additional tax liability beyond the initially reported amount.

- TC 291 – Abatement Prior Tax Assessment

- TC 300 – Additional Tax or Deficiency Assessment by Examination Division or Collection Division

- TC 420 – Examination Indicator reflects that a return is under examination consideration though the return may or may not ultimately be audited

- TC 428 – Examination or Appeals Case Transfer

- TC 460 – Extension of Time for Filing

- TC 480 – Offer in Compromise Pending

- TC 494 – Notice of Deficiency

- TC 520 – IRS Litigation Instituted

- TC 530 – Indicates that an account is currently not collectible

- TC 570 – Additional Liability Pending or Credit Hold

- TC 571 – Reversal of TC 570 code releases the Freeze

- TC 582 – Lien Indicator

- TC 766- Credit to your Account – signifies a credit applied to your account. This code on your IRS transcript indicates a positive adjustment, potentially reflecting a refund or credit that has been applied to your tax account.

- TC 767- Reduced or removed credit to your account Generated Reversal of Refundable Credit Allowance or Rejected TOP Offset

- TC 768 – Earned Income Credit – signals that you claimed the Earned Income Tax Credit (EITC) on your tax return.

- TC 776 – Indicates that interest has been credited to your account. This code on your IRS transcript reflects any accrued interest added to your tax account.

- TC 806 – Reflects any credit the taxpayer is given for tax withheld, as shown on the tax return and the taxpayer’s information statements such as Forms W-2 and 1099 attached to the taxpayer’s tax return

- TC 810 – Refund Freeze

- TC 811 – Refund Release

- TC 820 – Refund used to offset prior IRS Debt

- TC 836 – Refund you chose to apply for next year’s taxes.

- TC 840 – Manual Refund

- TC 846 – Refund Issued or approved; When the credits and withholding exceed the tax amount owed, and there are no problems with the return, the system will generate a refund for the taxpayer.

- TC 898 – Refund used to offset FMS Debt

- TC 922 – Review of unreported income

- TC 971 – Misc. Transaction

- TC 971 – Notice Issued

- TC 976 – If a duplicate return is filed, TC 976 is attached to your account to indicate more than one return has been posted. Duplicate filings are a strong indication that identity theft may have occurred, and you should contact the IRS to conduct a further investigation into the issue. Your account will be marked TC 971 when identity theft is suspected either by IRS or by your report to the agency.

- TC 977 – Amended Return Filed

Here’s a Full List of All the IRS Transaction Codes

Transaction Codes (TC) consist of three digits. They are used to identify a transaction being processed and to maintain a history of actions posted to a taxpayer’s account on the Master File. Every transaction processed by the IRS must contain a Transaction Code to maintain Accounting Controls of debits and credits, to cause the computer to post the transaction on the Master File, to permit the compilation of reports, and to identify the transaction when a transcript is extracted from the Master File. Transaction codes that are unique to IDRS are also included. The definitions of several transaction codes are necessarily changed since there will be no resequencing, offsetting, or computer-generated interest. In addition, all refunds will be scheduled manually with the refunds posted to the IMF using TC 846.

The abbreviations used under the heading “File” are as follows:

- Individual Master File (IMF) “I”,

- Business Master File (BMF) “B”,

- Employee Plan Master File (EPMF) “E”,

- Individual Retirement Account File (IRAF) “A “,

- Payer Master File (PMF) “P”.

If you have any questions about deciphering your account transcripts or would like to help other users seeking a tax refund, please comment below and let us know the codes and transcript info you are deciphering while you wait for your tax refund.