The good news for taxpayers is that the risk of being audited is historically low. While just over one percent of taxpayers were audited in 2010, that number dipped to 0.45 percent in 2019. Still, a significant number of American taxpayers faced audits last year for a variety of reasons. Some of the causes are outside of their control, but many can be avoided. Below is a list of deductions and other actions taken on federal tax returns that could land you on the IRS’ radar.

- Claiming the Earned Income Tax Credit (EITC). This is one of the most common deductions. This credit is commonly used by working-class parents and some childless taxpayers with significantly low incomes. However, it has a reputation for being abused. Claiming the EITC will usually warrant a closer look by the IRS at your reported income and eligibility to use this credit.

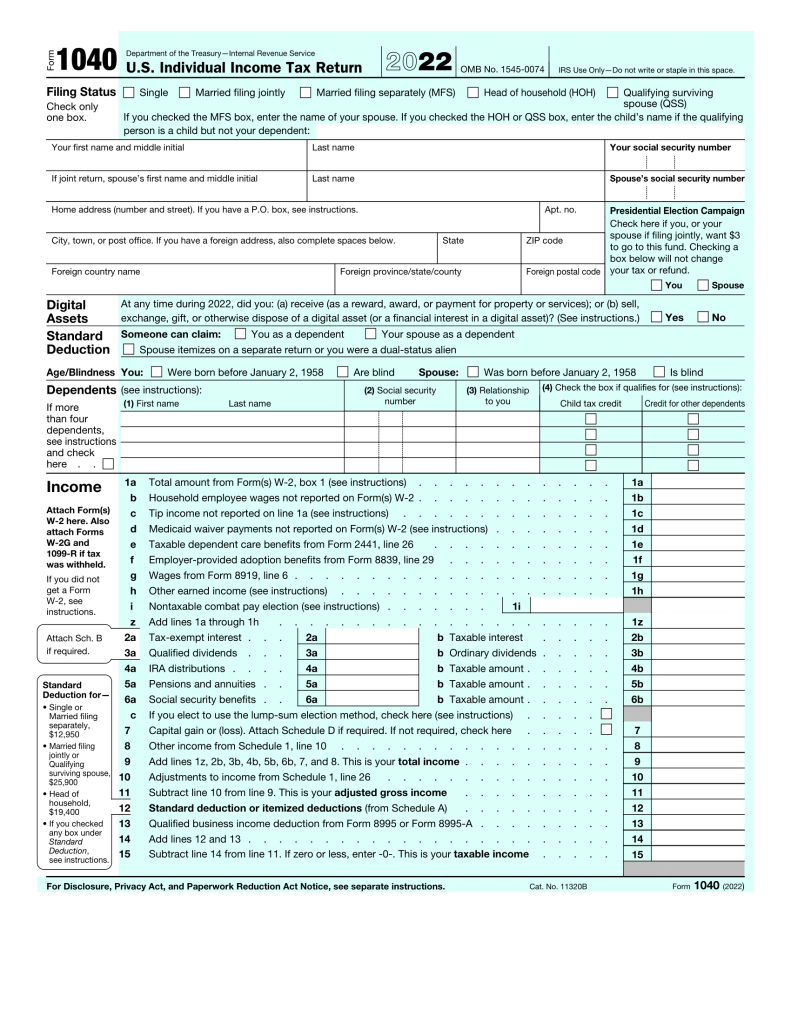

- Having unreported income. Your tax return is not the only document the IRS has on you. Apart from your W-2, the IRS is also likely to have various 1099 forms that contain information about your income. If the amount of income you report on your return does not align with other information, you are almost certain to get a letter from the IRS.

- Alimony deductions. A common practice for divorced spouses is to claim the alimony deduction on their yearly tax returns. There are several prerequisites for rightfully claiming this deduction, though, and many do not satisfy all of them before claiming the deduction. Also, both parties (the payer and the recipient) must report it correctly on their respective returns, which provides double the opportunities to improperly claim it.

- Claiming a large charitable donation deduction amount. Whenever taxpayers claim this deduction, the IRS uses an automated system to calculate the reported donation amount relative to your reported income. If the ratio is outside of the normal range, you have piqued the interest of the IRS. Also, bunching your donations – claiming two years’ worth of charitable donations in one year in order to benefit from the deduction – is another practice that garners attention.

- Claiming your home office. As more people work from home, the use of this deduction has increased. However, the rules are quite stringent; for example, you are severely restricted in the ways you may use your home office other than working.

Simple, honest mistakes on your tax return usually won’t cause serious problems between you and the IRS. Either way, if the IRS has focused its attention on you and your recent tax return, you may need to consult a tax professional.