-

Refundtalk wrote a new post 6 years, 4 months ago

With Refund Transfer, you can pay your tax preparation fees and other authorized amounts from your refund. Plus, it’s a convenient, secure way to get your tax refund. When filing your taxes with us, you can use R…

-

Refundtalk wrote a new post 6 years, 4 months ago

With millions of tax refunds being processed, the Internal Revenue Service reminds taxpayers they can get fast answers about their refund by using the “Where’s My Refund?” tool available on IRS.gov and through…

-

Refundtalk wrote a new post 6 years, 4 months ago

National Taxpayer Advocate Nina E. Olson today released her 2018 Annual Report to Congress, describing challenges the IRS is facing as a result of the recent government shutdown and recommending that Congress…

-

Refundtalk wrote a new post 6 years, 4 months ago

With a new tax law in effect and a surge of tax returns expected during the Presidents Day weekend, the Internal Revenue Service is offering taxpayers several tips and various time-saving resources to get them…

-

Refundtalk wrote a new post 6 years, 4 months ago

Today, towards the end of the second full week of the 2019 tax filing season, the Internal Revenue Service warned taxpayers to avoid unethical tax return preparers, known as ghost preparers.

By law, anyone…

-

tara berks replied to the topic IRS Reference Code 1541 in the forum IRS Reference Codes 6 years, 4 months ago

Reference code 1541 is an internal code that the IRS uses to identify returns that have been “Delayed”. This means your return was flagged and put under further review(45-60Days) or until they can get the issue resolved. This message typically means that they are holding your refund until you resolve past filling issues related to:

⦁ Adding a D…[Read more] -

Refundtalk started the topic IRS Reference Code 1541 in the forum IRS Reference Codes 6 years, 4 months ago

Do you have IRS Reference Code 1541?

Share your experience with filing your tax return and seeing “IRS Reference code 1541”If you check where’s my refund? and see this status share what you found out here!

-

Refundtalk wrote a new post 6 years, 4 months ago

These are some of the most common questions we see on a daily basis.

All Refunds Are Delayed

The IRS issues more than nine out of 10 refunds in less than 21 days. Eight in 10 taxpayers get their refunds…

-

Refundtalk wrote a new post 6 years, 4 months ago

Daily or Weekly Accounts

IRS Daily and Weekly Account Processing What is the difference between IRS Daily and Weekly Accounts? The difference is when your tax return is processed, and when updates are made and posted to your…

IRS Daily and Weekly Account Processing What is the difference between IRS Daily and Weekly Accounts? The difference is when your tax return is processed, and when updates are made and posted to your… -

Refundtalk wrote a new post 6 years, 4 months ago

Every year, the IRS accepts several batches of tax returns to test in a Controlled Launch before they are officially open.

What is HUB testing?

HUB Testing or Controlled Launch is the period when the IR…

-

Refundtalk wrote a new post 6 years, 4 months ago

Things to Consider before signing for a Tax Refund Advance Loan

Tax refund loan products are staging a comeback in recent years, with various vendors rolling out enticing perks tied to your tax refund. Leading tax preparation services are introducing new offerings for tax…

Tax refund loan products are staging a comeback in recent years, with various vendors rolling out enticing perks tied to your tax refund. Leading tax preparation services are introducing new offerings for tax… -

Refundtalk wrote a new post 6 years, 4 months ago

Where's My Refund – PATH ACT Message Facts

The Protecting Americans from Tax Hikes (PATH) Act required the IRS to hold all refunds for returns claiming the earned income tax credit (EITC) and additional child tax credit (ACTC) until February 15. PATH…

The Protecting Americans from Tax Hikes (PATH) Act required the IRS to hold all refunds for returns claiming the earned income tax credit (EITC) and additional child tax credit (ACTC) until February 15. PATH… -

Refundtalk wrote a new post 6 years, 5 months ago

You may have submitted your tax return form weeks ago and you still do not have it in your bank account. Read on to learn about tracking your income tax return status and more.

How Long Do I Have to Wait For…

-

Refundtalk wrote a new post 6 years, 5 months ago

What Is the Usual Turnaround Time to Get a Tax Refund?

The IRS sends the tax refund within 21 calendar days. Of course, the timeframe assumes your tax return is accurate and free of any red flags or errors.…

-

Refundtalk wrote a new post 6 years, 5 months ago

In preparation for the tax season, it is imperative that you have a strategy to complete your taxes quickly, accurately, and with as little hassle as possible… all while keeping the cost down.

With those th…

-

Refundtalk wrote a new post 6 years, 5 months ago

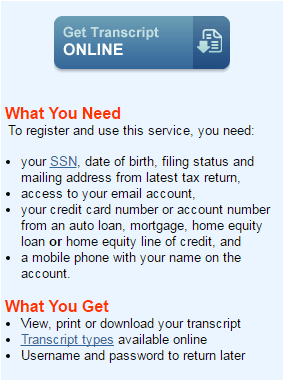

A new transcript format is now in place to better protect your information from identity theft. This new transcript partially masks the personally identifiable information of everyone listed on the tax return.…

-

Refundtalk wrote a new post 6 years, 5 months ago

What You Need to Know About Filing as Head of Household

Who Can File as Head of Household?

To file as a head of household, you have to meet a few guidelines set by the IRS. To qualify, you have to…

-

Refundtalk wrote a new post 6 years, 5 months ago

The Internal Revenue Service announced today that it is waiving the estimated tax penalty for many taxpayers whose 2018 federal income tax withholding and estimated tax payments fell short of their total tax…

-

Refundtalk wrote a new post 6 years, 5 months ago

The IRS has announced that the 2019 tax filing season will begin on January 28, 2019. Tax preparation companies will be participating in the controlled launch of the e-file system (HUB Testing) with the IRS…

-

Refundtalk wrote a new post 6 years, 5 months ago

The IRS announced the 2019 opening day of its Free File program, which provides free electronic filing to qualifying taxpayers, generally those who earned $66,000 or less last year. The program is opening before the…

- Load More

Activity

Advertisement

Related Posts