-

Refundtalk wrote a new post 3 years, 2 months ago

The last thing you want to do is frantically run up to your boss asking “How many allowances do I claim on my W-4?”.

Being aware of the number of allowances you are claiming on a Form W-4 [Employ…

-

Refundtalk wrote a new post 3 years, 2 months ago

Unemployment benefits saved a lot of American households this past year. Furloughs and lay-offs were at an all-time high due to the pandemic, leaving many without a lot of options.

However, unemployment c…

-

Refundtalk wrote a new post 3 years, 2 months ago

A taxpayer’s filing status defines the type of tax return form they should use when filing their taxes. Filing status can affect the amount of tax they owe, and it may even determine if they have to file a tax r…

-

Refundtalk wrote a new post 3 years, 2 months ago

The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit (CTC) payment for the month of November. Low-income…

-

Refundtalk wrote a new post 3 years, 2 months ago

The year 2020 is going to go down in the history books for a lot of reasons, and one of them is the enormous increase in the number of math errors that taxpayers made on their tax returns. The result has been…

-

Refundtalk wrote a new post 3 years, 2 months ago

The Internal Revenue Service today encouraged taxpayers, including those who received stimulus payments or advance Child Tax Credit payments, to take important steps this fall to help themselves file their…

-

Refundtalk wrote a new post 3 years, 2 months ago

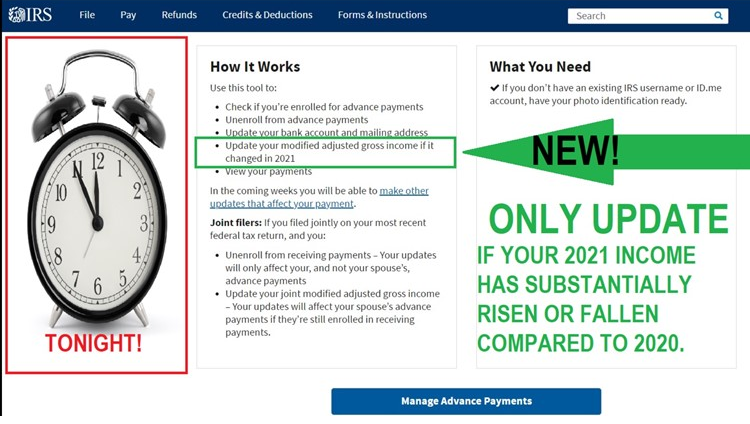

The Internal Revenue Service today updated frequently-asked-questions (FAQs) for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of y…

-

Refundtalk wrote a new post 3 years, 2 months ago

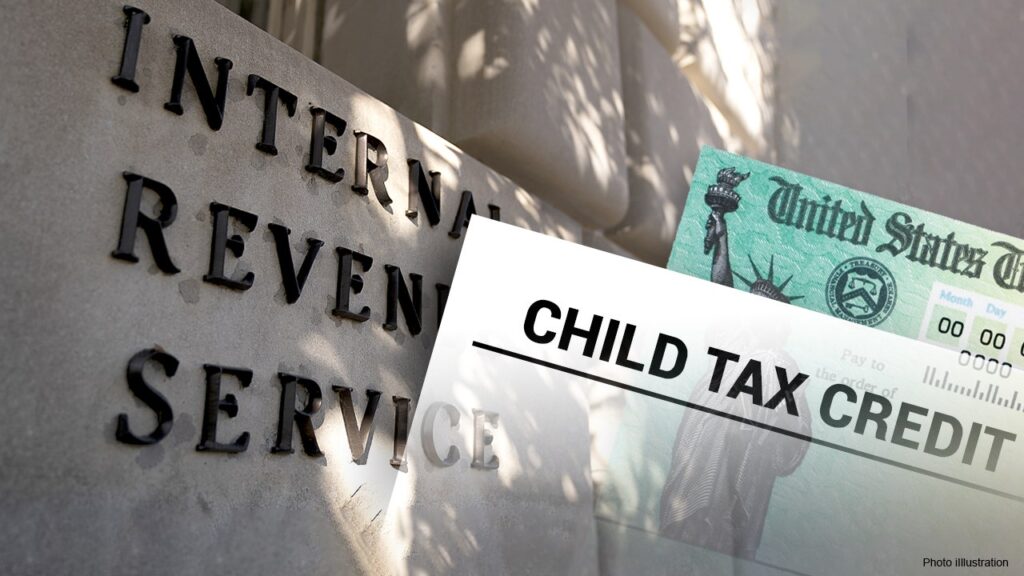

What day does IRS Update Tax Transcripts?

Daily & Weekly Tax Transcript updates Tax Transcripts typically reflect updates and changes each week on Tuesdays and Fridays Tuesday Transcript Updates – Daily accounts are processed on Monday,…

Daily & Weekly Tax Transcript updates Tax Transcripts typically reflect updates and changes each week on Tuesdays and Fridays Tuesday Transcript Updates – Daily accounts are processed on Monday,… -

Refundtalk wrote a new post 3 years, 2 months ago

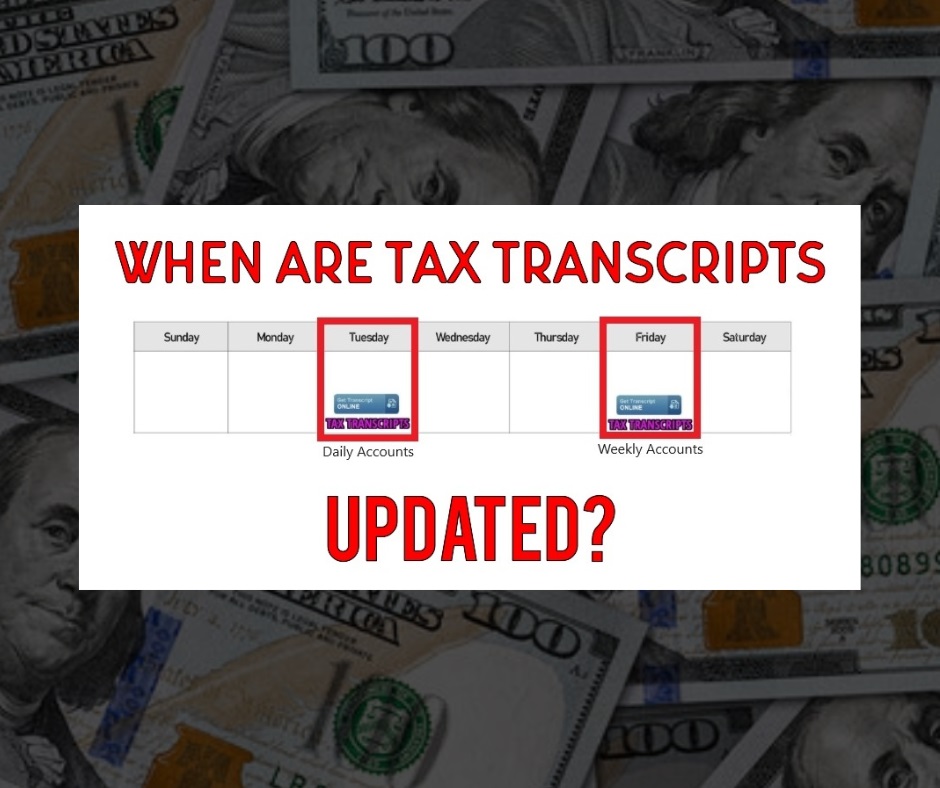

What is the "As Of" Date on the Tax Record of Account Transcripts

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case…

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case… -

Refundtalk wrote a new post 3 years, 2 months ago

The Internal Revenue Service has issued another round of refunds to workers who paid taxes on their unemployment benefits in 2020.

This round of refunds totaled more than $510 million and went to 430,000…

-

Refundtalk wrote a new post 3 years, 2 months ago

The next round of the advance child tax credit is set for Nov. 15. But if you’re worried that you’re getting too much or too little money, well, the IRS is asking that some people who saw their incomes change…

-

Refundtalk wrote a new post 3 years, 2 months ago

An IRS online account is a safe and easy way for individual taxpayers to view specific details about their federal tax account. The IRS recommends that tax professionals share with their clients the benefits o…

-

Refundtalk wrote a new post 3 years, 2 months ago

In the fall of 2020, the Internal Revenue Service announced that it was adding QR, or Quick Response, codes to some of the notices it sends taxpayers. Specifically, the codes are going on tax due…

-

Refundtalk wrote a new post 3 years, 2 months ago

The advance child tax credit allows qualifying families to receive early payments of the tax credit many people may claim on their 2021 tax return during the 2022 tax filing season. The IRS will disburse these…

-

Refundtalk wrote a new post 3 years, 2 months ago

If the IRS does call a taxpayer, it should not be a surprise because the agency will generally send a notice or letter first. Understanding how the IRS communicates can help taxpayers protect themselves from…

-

Refundtalk wrote a new post 3 years, 2 months ago

The Internal Revenue Service (IRS) will send a notice or a letter for any number of reasons. It may be about a specific issue on your federal tax return or account or may tell you about changes to your account,…

-

Refundtalk wrote a new post 3 years, 2 months ago

Even with the extended tax filing deadline this year, some taxpayers may still have needed extra time to file their taxes. Most tax software companies make it easy to file Form 4868 to ensure their clients get t…

-

Refundtalk wrote a new post 3 years, 2 months ago

The IRS is now making monthly child tax credit payments to eligible families. Depending on the age of your child, those payments can be as much as $300-per-kid each month from July to December. That’s an extra…

-

Sharon Hook posted an update 3 years, 3 months ago

Avoid the Pitfalls Writing the Common Application Essay

Writing the common application essay should not be a slap-dash affair. You write your experience logically with interesting details, add somel color and you are set, but keep in mind all that you have learned about essay writing in the past and avoid those common mistakes that hundreds of…[Read more]

-

Sharon Hook became a registered member 3 years, 3 months ago

- Load More

Activity

Advertisement

Related Posts