-

Jon Cribbs became a registered member 3 years, 10 months ago

-

Refundtalk wrote a new post 3 years, 10 months ago

If you see that the IRS sent a notice claiming they made a change to your refund check amount, there’s no need to be alarmed. Every year, the IRS issues thousands of adjusted refund letters to taxpayers across t…

-

Refundtalk wrote a new post 3 years, 10 months ago

College is a time for you to become independent, make lasting memories, and pursue an education that leads to a career you’re passionate about. However, higher education can come at a cost. Once you graduate, y…

-

Refundtalk wrote a new post 3 years, 10 months ago

IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit (CTC) payments as well as stimulus payments (i.e., third-round economic…

-

M Kotelnicki became a registered member 3 years, 10 months ago

-

Davis Mize became a registered member 3 years, 10 months ago

-

Refundtalk wrote a new post 3 years, 10 months ago

IRS Letter 6316

Audits are nothing new. Taxpayers may find themselves in the unfortunate situation of opening their mailboxes to an IRS examination letter. The IRS Letter 6316 (“Letter 6316”) is one such letter. The IRS iss…

Audits are nothing new. Taxpayers may find themselves in the unfortunate situation of opening their mailboxes to an IRS examination letter. The IRS Letter 6316 (“Letter 6316”) is one such letter. The IRS iss… -

Katina Needham became a registered member 3 years, 10 months ago

-

M Cooper became a registered member 3 years, 10 months ago

-

Molly Marzano became a registered member 3 years, 10 months ago

-

Refundtalk wrote a new post 3 years, 10 months ago

The Internal Revenue Service is sending more than 2.8 million refunds this week to taxpayers who paid taxes on unemployment compensation that new legislation now excludes as income.

IRS efforts to correct…

-

Refundtalk wrote a new post 3 years, 10 months ago

As part of our response to the COVID-19 situation, we have taken steps to protect employees, taxpayers, and their representatives by minimizing the need for in-person contact. Taxpayer representatives have…

-

Joan Noyes became a registered member 3 years, 10 months ago

-

Refundtalk wrote a new post 3 years, 10 months ago

The IRS will have two online child tax credit portals open by July 1. That’s where you’ll change your status and more.

The child tax credit payments are coming — the good news is 88% of American f…

-

Dutch Kuhn became a registered member 3 years, 11 months ago

-

Daniel Dougard became a registered member 3 years, 11 months ago

-

Shanon Maloy became a registered member 3 years, 11 months ago

-

Kiefer Warren became a registered member 3 years, 11 months ago

-

Refundtalk wrote a new post 3 years, 11 months ago

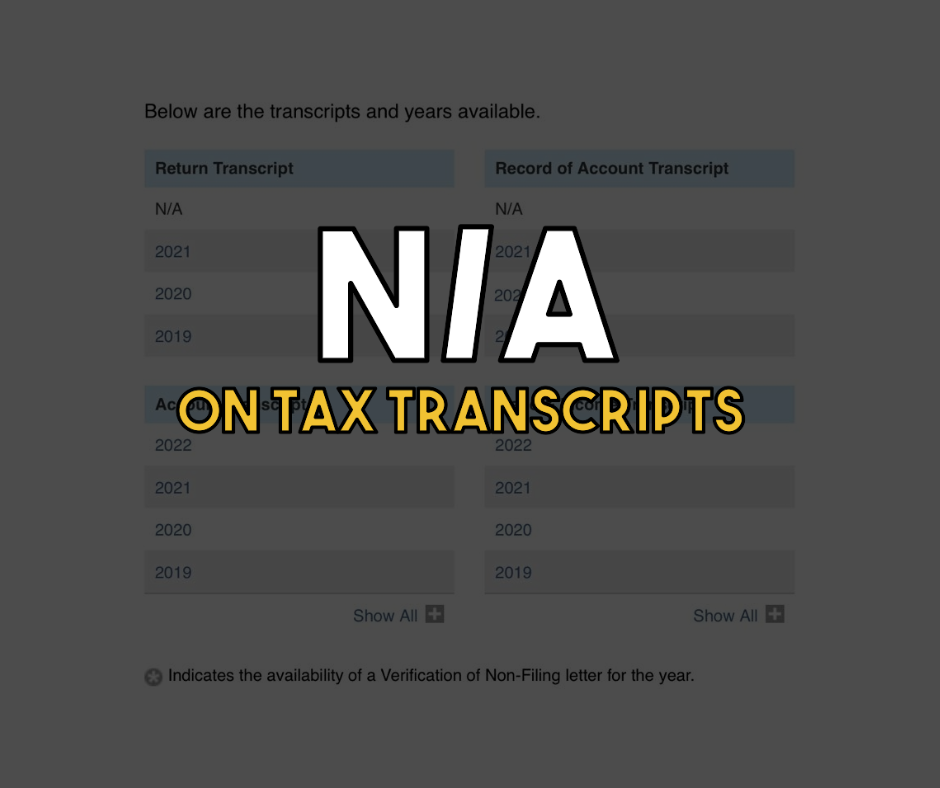

What does N/A on my Tax Transcripts mean?

What does N/A on my tax transcripts mean? When checking your tax transcripts and if you see a N/A in place of the most recently filed tax transcripts. The N/A is letting you know that your transcripts for the…

What does N/A on my tax transcripts mean? When checking your tax transcripts and if you see a N/A in place of the most recently filed tax transcripts. The N/A is letting you know that your transcripts for the… -

Jose Ricardo Garcia Sr. became a registered member 3 years, 11 months ago

- Load More

Activity

Advertisement

Related Posts