-

Refundtalk wrote a new post 4 years, 10 months ago

Initially, the ACA’s individual shared responsibility provisions required most individuals to obtain “minimum essential health insurance” coverage for themselves, and any dependents, or pay a penalty. Through…

-

Refundtalk wrote a new post 4 years, 10 months ago

The Internal Revenue Service confirmed that the nation’s tax season will start for individual tax return filers on Monday, January 27, 2020, when the tax agency will begin accepting and processing 2019 tax year…

-

Refundtalk wrote a new post 4 years, 10 months ago

The IRS has been no stranger to attacks by cybercriminals over the past few years, as we saw when Russian thieves stole $50 million in tax return money in 2015 as a result of a major flaw in the security of the…

-

Refundtalk wrote a new post 4 years, 10 months ago

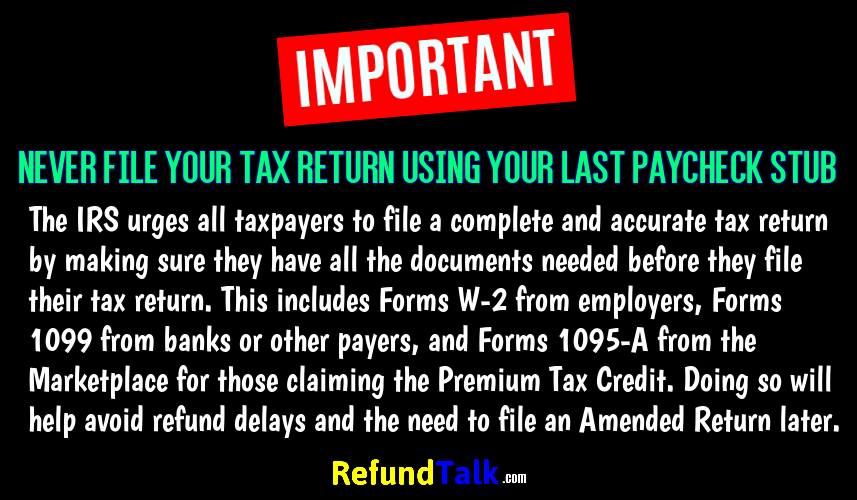

No, you should NOT file your tax return using your last paycheck stub. It is against the law and it can and will cause major delays in receiving your tax refund.

Your last paycheck stub is not guaranteed to…

-

Refundtalk wrote a new post 4 years, 10 months ago

Seniors and retirees whose income is under $69,000 a year should explore IRS Free File for free online tax preparation.

Seniors are one of the key constituents for Free File which has served 57 million…

-

Refundtalk wrote a new post 4 years, 10 months ago

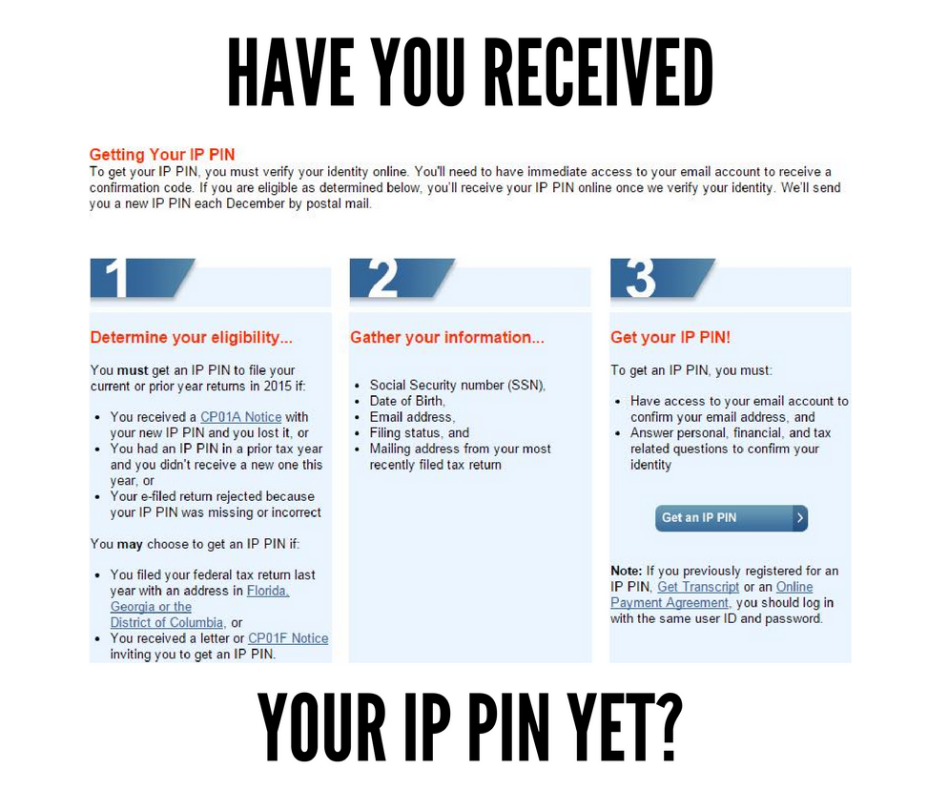

When the IRS kicks off the 2020 tax filing season, taxpayers in selected locations will be eligible to opt into the online Identity Protection IP PIN program.

Taxpayers will be eligible for this voluntary…

-

Refundtalk wrote a new post 4 years, 10 months ago

When you check your tax refund status at IRS.gov or on the IRS2GO app you may get a refund status from the IRS Where’s My Refund? site telling you “We are sorry, we cannot provide any information about your…

-

Refundtalk wrote a new post 4 years, 10 months ago

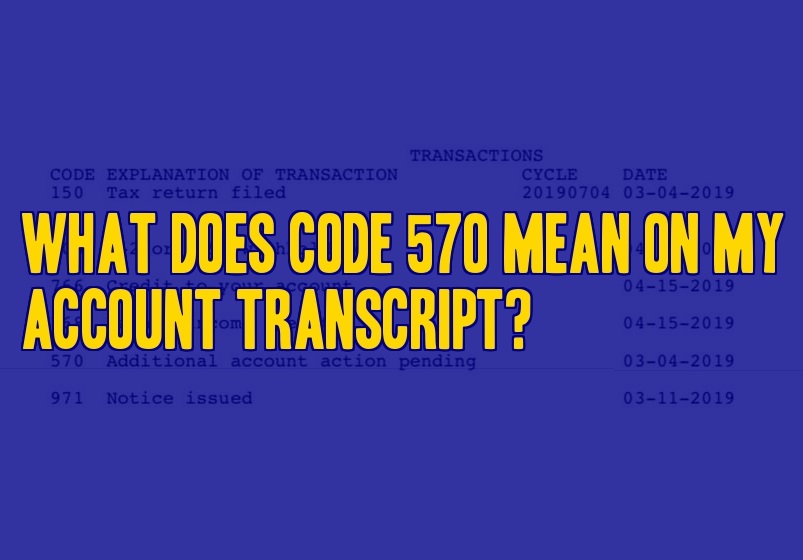

The Transaction Code TC 570 Additional Account Action Pending is a Freeze Code the IRS uses that will hold/stop a refund from being issued until the impact of the action being taken on the account and the refund…

-

Refundtalk wrote a new post 4 years, 11 months ago

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it’s possible your tax return may require to be held for an additional review and take longer. Where’s My Refund? has the most up to dat…

-

Refundtalk wrote a new post 4 years, 11 months ago

The IRS has many different types of notices that they may send out to taxpayers. A notice will cover a very specific issue about the taxpayer’s account or tax return. Generally, the IRS sends notices when they b…

-

Refundtalk wrote a new post 4 years, 11 months ago

In order to be declared uncollectible by the IRS, you will have to prove to the IRS that if they were to collect the tax that is owed to them it would create an unfair economic hardship. The IRS will consider each…

-

Refundtalk wrote a new post 4 years, 11 months ago

Even though the IRS issues most refunds in less than 21 days, it’s possible a taxpayer’s refund may take longer. Several factors can affect the timing of a taxpayer’s refund after the IRS receives their tax retur…

-

Refundtalk wrote a new post 4 years, 11 months ago

The Taxpayer Bill of Rights groups the dozens of existing rights in the Internal Revenue Code into ten fundamental rights, and makes these rights clear, understandable, and accessible for taxpayers and IRS…

-

Refundtalk wrote a new post 4 years, 11 months ago

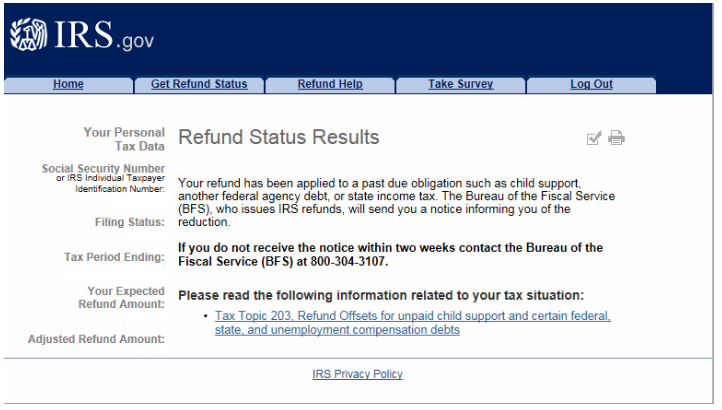

The Department of Treasury’s Bureau of the Fiscal Service (BFS) issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program (TOP). Through the TOP program, BFS may reduce your r…

-

Refundtalk wrote a new post 4 years, 11 months ago

A cycle code is an 8 digit code found on your account transcripts. The cycle code indicates the day your account posted to the IRS Master File. This date indicates the 4 digits of the current cycle year,…

-

Refundtalk wrote a new post 4 years, 11 months ago

Do you have any idea how many tax returns are filed in the United States each year?

The answer, according to the IRS, over 140 million through May 2019 for the current tax year. Now, how many of them do you…

-

Refundtalk wrote a new post 4 years, 11 months ago

The Earned Income Tax Credit (EITC) is an income tax credit given to low- and moderate-income workers through filing a tax return. It is a refundable tax credit, meaning that you will receive it if you are…

-

Refundtalk wrote a new post 4 years, 11 months ago

If a legally enforceable debt is reported to the Treasury Offset Program, the IRS intercepts the tax refund to pay the debt or obligation. For married couples that file joint returns, a debt reported under…

-

Refundtalk wrote a new post 4 years, 11 months ago

Did you know that you can amend a tax return? If you notice that you made an error on a tax return you already filed, you can (and should) amend your return to make sure you don’t run into trouble with the I…

-

Refundtalk wrote a new post 4 years, 11 months ago

Most of the time, children are considered to be an extension of their parents when it comes to a legal application until the age of majority. Therefore, many taxpayers are surprised to learn their child is a…

- Load More

Activity

Advertisement

Related Posts