-

Refundtalk wrote a new post 5 years, 1 month ago

The term “exemption” is often one that inspires bewilderment and perplexity among the most intelligent individuals. When filing your personal tax return or even filling out a W-4 for your employer, you may not be…

-

Refundtalk wrote a new post 5 years, 1 month ago

There are several ways in which education expenses can be used to decrease your tax burden. In addition to the Hope Credit, the Lifetime Learning Credit, and the student loan interest deduction, there is also a…

-

Refundtalk wrote a new post 5 years, 1 month ago

When filing your personal income tax return, there are primarily two ways to reduce your tax liability: deductions and credits. Although any way to pay Uncle Sam less is greatly appreciated, there are advantages to…

-

Refundtalk wrote a new post 5 years, 1 month ago

In all the complexity of tax preparation, it is easy to miss a deduction or credit. This is a particular advantage to utilizing a professional tax service because they ask all the questions you may otherwise…

-

Refundtalk wrote a new post 5 years, 1 month ago

Basically, when it comes to filing your personal tax return, there are five filing statuses you may choose from: single individual, married person filing jointly or surviving spouse, married person filing…

-

Refundtalk wrote a new post 5 years, 1 month ago

Of all the intricacies of tax preparation, few aspects are as beneficial as electronic filing or e-filing. Not only is this advantageous to the Internal Revenue Service, as it reduces paperwork, it is also a benefit…

-

Refundtalk wrote a new post 5 years, 1 month ago

Every year, the National Taxpayer Advocate’s Annual Report to Congress identifies at least 20 of the nation’s most serious tax problems. These issues can affect taxpayers’ basic rights and the ways they pay t…

-

Refundtalk wrote a new post 5 years, 2 months ago

Tax Credits vs Tax Deductions

Tax credits and tax deductions are two different types of tax breaks. Both can lower your tax bill, but they work in different ways. What is a tax deduction? A tax deduction is an expense that you…

Tax credits and tax deductions are two different types of tax breaks. Both can lower your tax bill, but they work in different ways. What is a tax deduction? A tax deduction is an expense that you… -

Refundtalk wrote a new post 5 years, 2 months ago

The percentage of tax returns being audited each year has steadily declined, due in part to dwindling government resources. Still, if you’ve been notified of a pending audit, those percentages don’t mean muc…

-

Refundtalk wrote a new post 5 years, 2 months ago

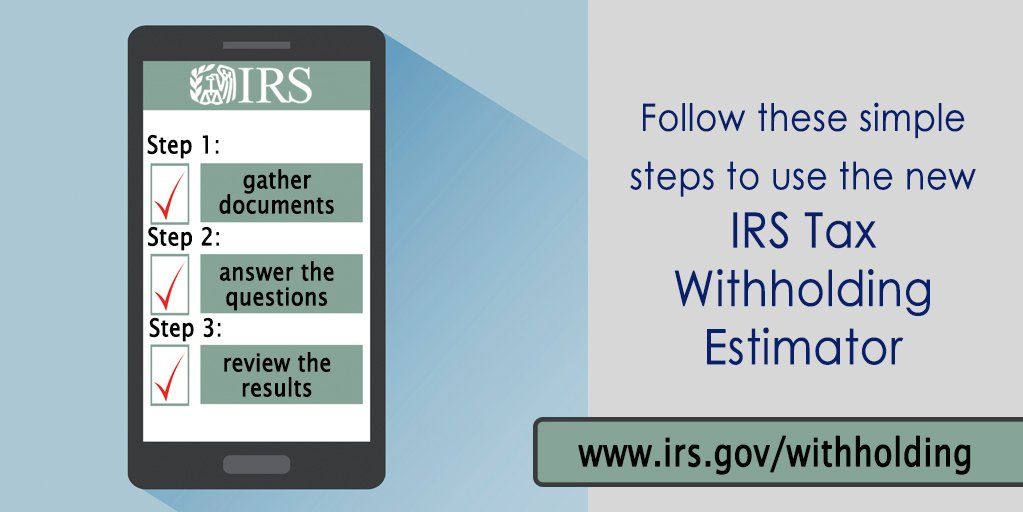

The Internal Revenue Service launched the new Tax Withholding Estimator, an expanded, mobile-friendly online tool designed to make it easier for everyone to have the right amount of tax withheld during the…

-

Refundtalk wrote a new post 5 years, 3 months ago

The Internal Revenue Service and its Security Summit partners today warned taxpayers and tax professionals about a new IRS impersonation scam campaign spreading nationally on email. Remember: the IRS does not…

-

Refundtalk wrote a new post 5 years, 3 months ago

How quickly will I get my refund?

The IRS issue most refunds in less than 21 calendar days.

I’m counting on my refund for something important. Can I expect to receive it in 21 days?

Many different f…

-

Refundtalk wrote a new post 5 years, 3 months ago

Taxpayers know that there are tax deductions out there to be utilized to reduce the taxes paid on your income. Most are aware of the common deductions, but there are many deductions that simply get overlooked…

-

Refundtalk wrote a new post 5 years, 3 months ago

The Hope credit (renamed the American Opportunity credit) and the Lifetime Learning credit are tax credits for taxpayers who pay certain higher education costs. These credits depend on the amount of qualified…

-

Refundtalk wrote a new post 5 years, 3 months ago

The Taxpayer Roadmap – An Illustration of the Modern United States Tax System

The map below illustrates, at a very high level, the stages of a taxpayer’s journey, from getting answers to tax law questions, all t…

-

Refundtalk wrote a new post 5 years, 3 months ago

A tax refund is the amount refunded if the tax paid exceeds the tax liability. In other words, if you qualify for a tax return, you will get back the excess amount paid as taxes in the previous…

-

Refundtalk wrote a new post 5 years, 3 months ago

As lawmakers pushed their tax overall package in 2017, Republican leaders would sometimes display a tax form printed on a postcard as proof that the Tax Cuts and Jobs Act would simplify life for millions of…

-

Refundtalk wrote a new post 5 years, 4 months ago

If you owe the IRS a substantial amount, be sure not to ignore it. Review options such as installment agreements, extensions, or personal loans, and always seek legal advice from a professional tax…

-

Refundtalk wrote a new post 5 years, 4 months ago

What happens when the IRS Offsets Your Tax Refund? If you get a notice or status of an offset, your tax refund is going to be seized and put towards the debt you owe to the IRS or another government agency. As…

-

Refundtalk wrote a new post 5 years, 4 months ago

The first reaction by most taxpayers when they find out they are being audited by the IRS is crippling fear. An audit occurs when the IRS has reason to believe that the tax you paid is not what should have…

- Load More

Activity

Advertisement

Related Posts