-

Refundtalk wrote a new post 5 years, 11 months ago

The IRS faces a particularly challenging rollout to the 2019 filing season, best summarized in four words: more work, fewer employees.

President Donald Trump signed the latest tax reform law in December 2017,…

-

Refundtalk wrote a new post 5 years, 11 months ago

2018 is the Final year for the Insurance Coverage Penalty

Yes, the ACA’s individual mandate penalty is still in effect, and will continue to be in effect in 2018. If you’re uninsured in 2018 and not eligible for an exemption, you’ll owe a penalty when you file your…

Yes, the ACA’s individual mandate penalty is still in effect, and will continue to be in effect in 2018. If you’re uninsured in 2018 and not eligible for an exemption, you’ll owe a penalty when you file your… -

Refundtalk wrote a new post 5 years, 11 months ago

Integrity & Verification Operation (IVO) department provides leadership and direction to employees responsible for fraud detection and prevention, revenue protection, and account correction.

Integrity and…

-

Refundtalk wrote a new post 5 years, 11 months ago

When you’re doing your income taxes, you will require a number of forms and probably the most significant one is the W2 form.

Every business that you were employed at in the course of the previous year is l…

-

Refundtalk wrote a new post 5 years, 11 months ago

Taxpayers generally want to avoid filing errors because they lead to tax problems and inconveniences. There are times when a taxpayer might experience tax filing mistakes due to complicated and sometimes…

-

Refundtalk wrote a new post 5 years, 11 months ago

Are you wondering who can qualify as a dependent on your tax return? This is your guide to assessing whether one of your family members may be able to be classified as a qualifying dependent when you file your…

-

Refundtalk wrote a new post 5 years, 11 months ago

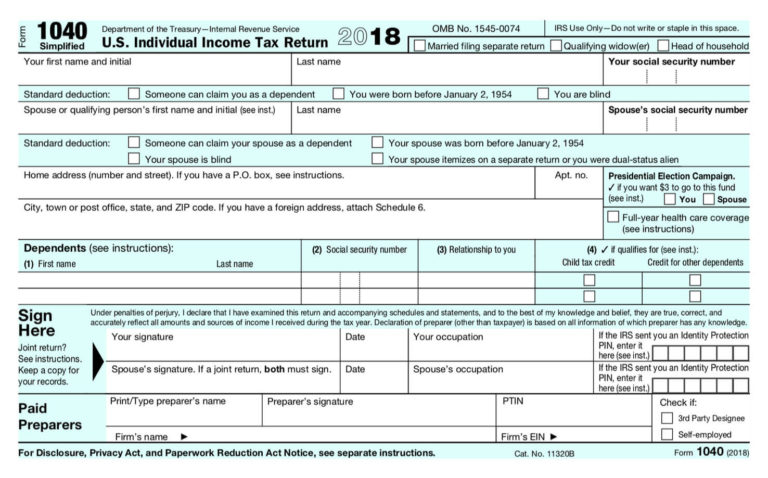

The Treasury Department and the Internal Revenue Service have announced a redesign of the 1040 individual income tax return form that is being touted as one that will fit on a single postcard. The new, postcard-size…

-

Refundtalk wrote a new post 5 years, 11 months ago

Everybody knows the old saying about death and taxes, yet a surprising number of people fail to file an income tax return. If you’re one of those people and you think you’ll be able to slide by, you need to rec…

-

Refundtalk wrote a new post 5 years, 11 months ago

If you’re married, you have the option to file one or two tax returns every year. While most people file together on one return due to the increased standard deduction, in some situations, it makes more sense to f…

-

Refundtalk wrote a new post 5 years, 11 months ago

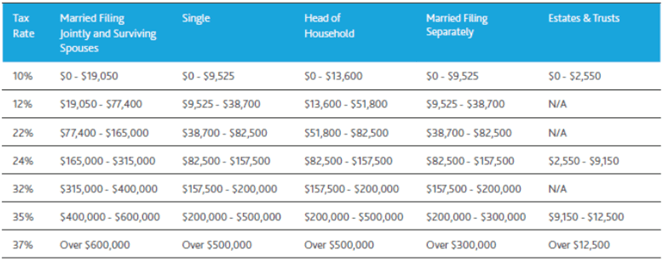

After months of intense negotiations, the President signed the $1.5 trillion tax reform legislation known as the “Tax Cuts And Jobs Act Of 2017” (the “New Law”) on December 22, 2017 – the most significant tax refo…

-

Refundtalk wrote a new post 5 years, 11 months ago

The Premise

It’s one of the most important questions that every American tax filer has to answer: should I itemize or take the standard deduction instead? With the Tax Cuts and Jobs Act of 2017 making some fai…

-

Refundtalk wrote a new post 5 years, 11 months ago

What Day Does Where's My Refund Update?

Where’s My Refund? is an IRS online tool you can use to check the status of your tax return within 24 hours after the Internal Revenue Service has received your e-filed tax return or four weeks after you mail…

Where’s My Refund? is an IRS online tool you can use to check the status of your tax return within 24 hours after the Internal Revenue Service has received your e-filed tax return or four weeks after you mail… -

Refundtalk wrote a new post 5 years, 12 months ago

Many taxpayers, at risk for having too little tax withheld from their pay, can avoid a surprise year-end tax bill by quickly updating the withholding form they give to their employer, according to the Internal…

-

Refundtalk wrote a new post 6 years ago

Every year, the IRS works a large batch of ”unpostable” tax returns. An Unpostable tax return happens when your tax return is unable to be posted to the master file. An unpostable condition occurs if there is a…

-

Refundtalk wrote a new post 6 years ago

More families will be able to get more money under the newly revised Child Tax Credit, according to the Internal Revenue Service.

The Tax Cuts and Jobs Act (TCJA), the tax reform legislation passed in December…

-

Refundtalk wrote a new post 6 years, 1 month ago

Before you start your search, you might be wondering about all the different kinds of tax pros out there or who can do your taxes. Basically, anyone can call himself a tax preparer and file your return for you.…

-

Refundtalk wrote a new post 6 years, 2 months ago

Systemic verification is one element of the IRS’s Return Review Program (RRP), its primary system to detect fraud and noncompliance. The Return Review Program is a platform that runs individual tax returns through a…

-

Refundtalk wrote a new post 6 years, 2 months ago

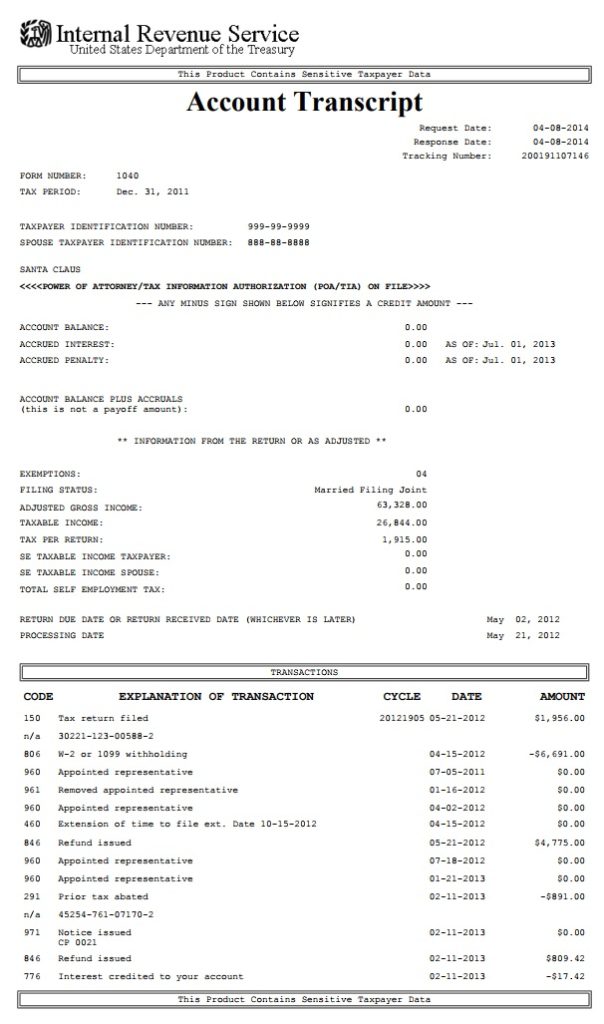

What Is an IRS Tax Transcript?

An IRS tax transcript serves as a record of an individual’s tax-related information. This document contains details about one’s previous tax returns, with information such as…

-

Refundtalk wrote a new post 6 years, 3 months ago

Need Help with Your Tax Troubles?

Dealing with tax issues can be frustrating, confusing, and frightening.

The IRS Taxpayer Advocate Service is made up of individuals who are knowledgeable about the inner…

-

NYMOM's profile was updated 6 years, 8 months ago

- Load More

Activity

Advertisement

Related Posts