Refundtalk

@admin

-

Refundtalk wrote a new post 3 years ago

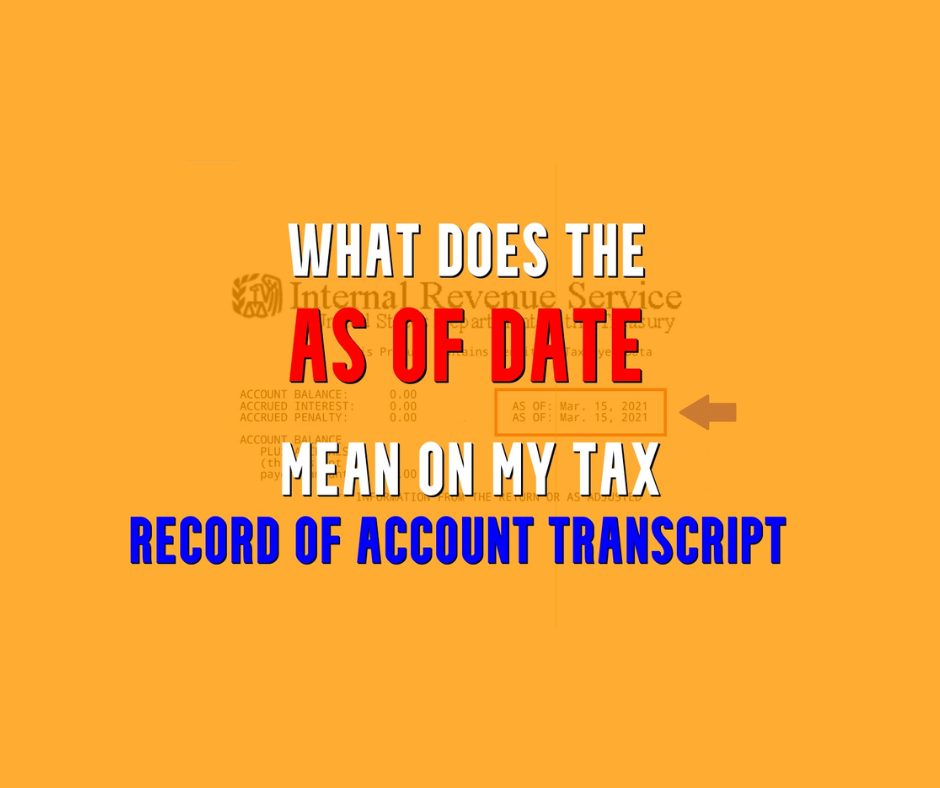

What is the "As Of" Date on the Tax Record of Account Transcripts

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case…

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case… -

Refundtalk wrote a new post 3 years ago

The Internal Revenue Service has issued another round of refunds to workers who paid taxes on their unemployment benefits in 2020.

This round of refunds totaled more than $510 million and went to 430,000…

-

Refundtalk wrote a new post 3 years ago

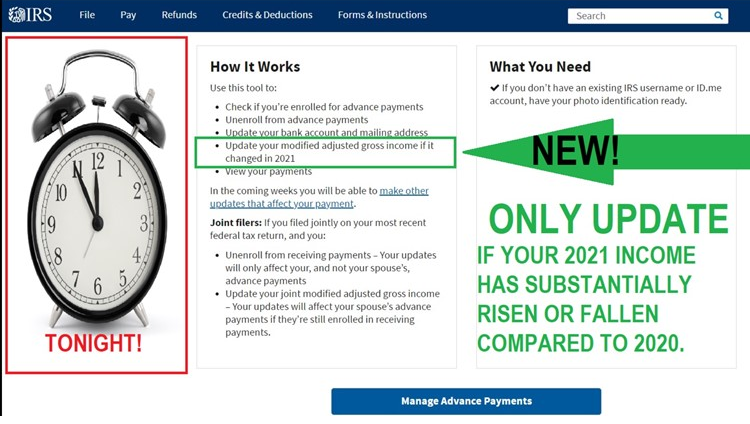

The next round of the advance child tax credit is set for Nov. 15. But if you’re worried that you’re getting too much or too little money, well, the IRS is asking that some people who saw their incomes change…

-

Refundtalk wrote a new post 3 years ago

An IRS online account is a safe and easy way for individual taxpayers to view specific details about their federal tax account. The IRS recommends that tax professionals share with their clients the benefits o…

-

Refundtalk wrote a new post 3 years ago

In the fall of 2020, the Internal Revenue Service announced that it was adding QR, or Quick Response, codes to some of the notices it sends taxpayers. Specifically, the codes are going on tax due…

-

Refundtalk wrote a new post 3 years ago

The advance child tax credit allows qualifying families to receive early payments of the tax credit many people may claim on their 2021 tax return during the 2022 tax filing season. The IRS will disburse these…

-

Refundtalk wrote a new post 3 years ago

If the IRS does call a taxpayer, it should not be a surprise because the agency will generally send a notice or letter first. Understanding how the IRS communicates can help taxpayers protect themselves from…

-

Refundtalk wrote a new post 3 years ago

The Internal Revenue Service (IRS) will send a notice or a letter for any number of reasons. It may be about a specific issue on your federal tax return or account or may tell you about changes to your account,…

-

Refundtalk wrote a new post 3 years, 1 month ago

Even with the extended tax filing deadline this year, some taxpayers may still have needed extra time to file their taxes. Most tax software companies make it easy to file Form 4868 to ensure their clients get t…

-

Refundtalk wrote a new post 3 years, 1 month ago

The IRS is now making monthly child tax credit payments to eligible families. Depending on the age of your child, those payments can be as much as $300-per-kid each month from July to December. That’s an extra…

-

Refundtalk wrote a new post 3 years, 1 month ago

The Biden administration has revised a controversial plan that would require banks and other financial services institutions to report account data to the Internal Revenue Service (IRS) in an effort to c…

-

Refundtalk wrote a new post 3 years, 1 month ago

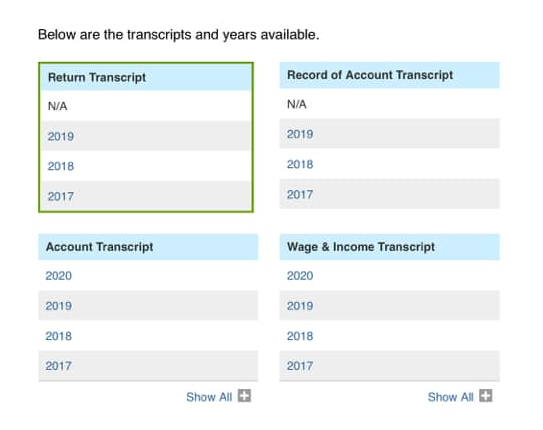

Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Transcripts are often used to validate income and tax filing status for…

-

Refundtalk wrote a new post 3 years, 1 month ago

The IRS announced a new webpage that provides information to taxpayers whose large refunds are subject to further review by the Joint Committee on Taxation (JCT or Joint Committee).

By law, when taxpayers c…

-

Refundtalk wrote a new post 3 years, 1 month ago

Originally enacted on July 4, 1966, the Freedom of Information Act established a statutory right of public access to Executive Branch information held by the federal government. The FOIA provides that any pe…

-

Refundtalk wrote a new post 3 years, 1 month ago

The American Rescue Plan Act of 2021 modifies the IRS reporting requirement from $20,000 in aggregate payments and 200 transactions to a threshold of $600 in aggregate payments, with no minimum transaction n…

-

Refundtalk wrote a new post 3 years, 1 month ago

Whether you’re in Arizona to Washington, we have you covered with this in-depth guide on the latest news concerning financial help being sent out on a state level amid the coronavirus crisis. Find out what economic…

-

Refundtalk wrote a new post 3 years, 1 month ago

As many taxpayers with children likely already know, there were some changes made to the child tax credit for 2021. Most notably, part of the credit was delivered to eligible taxpayers in advance of the 2022 tax…

-

Refundtalk wrote a new post 3 years, 1 month ago

It’s almost time for the fourth batch of monthly child tax credit payments. The first three payments were sent on July 15, August 13, and September 15, while the next payment is scheduled for October…

-

Refundtalk wrote a new post 3 years, 1 month ago

The IRS began issuing advance payments of the Child Tax Credit (CTC) in mid-July. Similar to certain other credits with an advance payment option, taxpayers who receive these advance payments will have to…

-

Refundtalk wrote a new post 3 years, 1 month ago

The IRS lets you access most tax tools with one account

ID.me uses the latest in identity verification technology to authenticate your identity quickly and easily. They specialize in digital identity…

- Load More