Refundtalk

@admin

-

Refundtalk wrote a new post 3 years, 1 month ago

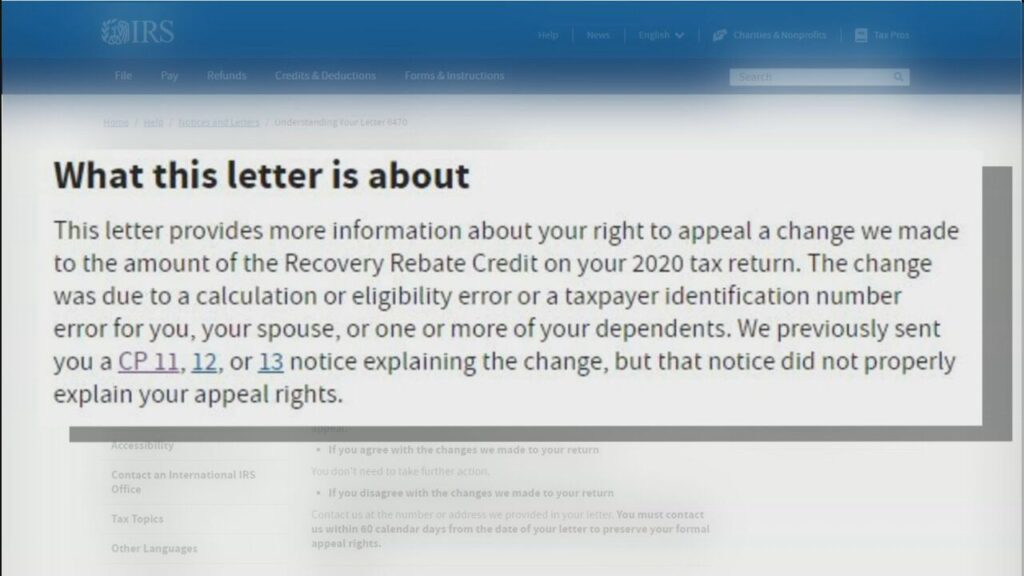

The Internal Revenue Service has sent out more than 11 million letters to taxpayers showing them they owe more or are not getting back as much in a refund as they thought.

That’s five times more than in 2019,…

-

Refundtalk wrote a new post 3 years, 2 months ago

Stimulus payments are being sent out by the federal government this fall. The next payment is scheduled to be delivered in about three weeks. The payments are part of the American Rescue Plan that President Joe…

-

Refundtalk wrote a new post 3 years, 2 months ago

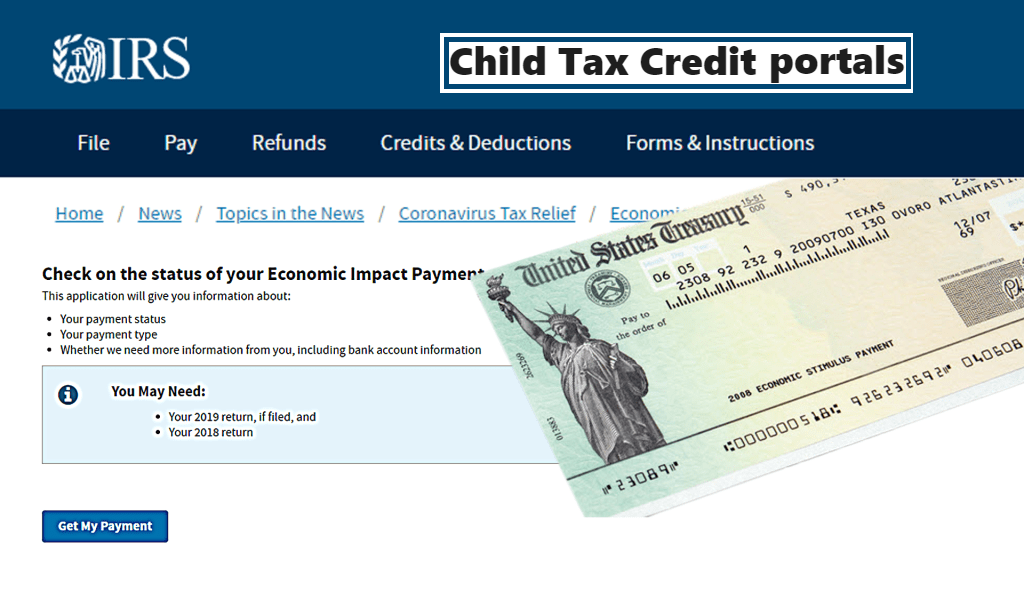

After parents were issued their child tax credit check on Sept. 15, they’ll have three more monthly payments this year and one next year. Due to changes made in the American Rescue Plan to help families, h…

-

Refundtalk wrote a new post 3 years, 2 months ago

Here’s a frustrating scenario that is affecting way too many Americans this tax season: You’ve been waiting months and months for a refund, but instead of getting a check from the Internal Revenue Service (IRS)…

-

Refundtalk wrote a new post 3 years, 2 months ago

Tax Refund Check with W-2 and 1040 U.S. Individual Income Tax Return Forms

With less than a week to go before the official end of summer, many patient Americans are still wondering if they’ll ever receive one o…

-

Refundtalk wrote a new post 3 years, 2 months ago

Remember what it felt like when your teacher marked something as “incorrect” on your homework, but then the correction itself turned out to be incorrect? Well, millions of American taxpayers may feel like the…

-

Refundtalk wrote a new post 3 years, 2 months ago

Tax Refund Check with W-2 and 1040 U.S. Individual Income Tax Return Forms

For months the IRS has been working to clear a massive backlog of unprocessed tax returns. Many Americans are owed hundreds – if not th…

-

Refundtalk wrote a new post 3 years, 2 months ago

IRS Encourages Modernization Of Electronic Filings: 30 Million Taxpayer Paper Filed Tax Returns Destroyed

According to the Inspector General’s audit, the IRS destroyed 30 million paper documents while millions of…

-

Refundtalk wrote a new post 3 years, 2 months ago

It’s been almost four months since the filing deadline for your 2020 tax return, and you haven’t gotten your refund check yet.

Should you be worried? Not necessarily.What should you do? Probably not…

-

Refundtalk wrote a new post 3 years, 2 months ago

Parents who share custody of their children should be aware of how the advance child tax credit payments are distributed. It is important to remember that these are advance payments of a tax credit that taxpayers…

-

Refundtalk wrote a new post 3 years, 2 months ago

The Internal Revenue Service added a new feature to its online portal for the Child Tax Credit allowing parents to update the mailing address where they should receive the monthly payments.

The new feature…

-

Refundtalk wrote a new post 3 years, 2 months ago

The IRS has provided instructions for returning advance child tax credit payments (CTCs) that the recipient did not qualify for or, for other reasons, wishes to return.

Because of one or more of the…

-

Refundtalk wrote a new post 3 years, 3 months ago

Tax refund transfers are a valuable business for tax preparation companies. Here’s what they are, how they work, and how they can benefit taxpayers.

What are refund transfers?

Also called bank products a…

-

Refundtalk wrote a new post 3 years, 3 months ago

Each year, the IRS collects payments from millions of money-earning, taxpaying Americans. And while, in days of old, payment had to be completed via check or cash payment, today there are more ways to pay the…

-

Refundtalk wrote a new post 3 years, 3 months ago

Tax season is quickly approaching, and the sooner you get your information in order, the better. The first thing to do is to get your W-2. A W-2 form is a statement of annual earnings and taxes w…

-

Refundtalk wrote a new post 3 years, 3 months ago

On its website, the IRS has posted answers to frequently asked questions (FAQs) about Online Account. Online Account provides individuals with online access to their tax account information. Online Account is an…

-

Refundtalk wrote a new post 3 years, 4 months ago

What is a “Potentially Dangerous Taxpayer?”

Even when aggravated, treat others with respect—especially if it is the Internal Revenue Service (IRS). Those who do not may end up with a special designation with the IRS—a Potentially Dangerous Taxpayer (PD…

Even when aggravated, treat others with respect—especially if it is the Internal Revenue Service (IRS). Those who do not may end up with a special designation with the IRS—a Potentially Dangerous Taxpayer (PD… -

Refundtalk wrote a new post 3 years, 4 months ago

Have you received a Notice of Deficiency from the IRS? Taxpayer debt is not an uncommon situation. Many American taxpayers have found themselves in debt with the IRS and feel unsure where to turn. Taxpayers w…

-

Refundtalk wrote a new post 3 years, 4 months ago

We know changes to your taxes can be confusing and difficult to navigate at the best of times, and the coronavirus pandemic has only added more uncertainty. But there’s no need to stress — we’ve broken it all d…

-

Refundtalk wrote a new post 3 years, 5 months ago

If you see that the IRS sent a notice claiming they made a change to your refund check amount, there’s no need to be alarmed. Every year, the IRS issues thousands of adjusted refund letters to taxpayers across t…

- Load More