Refundtalk

@admin

-

Refundtalk wrote a new post 3 years, 5 months ago

College is a time for you to become independent, make lasting memories, and pursue an education that leads to a career you’re passionate about. However, higher education can come at a cost. Once you graduate, y…

-

Refundtalk wrote a new post 3 years, 5 months ago

IRS clarified how individuals who are not otherwise required to file 2020 federal income tax returns can claim advance child tax credit (CTC) payments as well as stimulus payments (i.e., third-round economic…

-

Refundtalk wrote a new post 3 years, 5 months ago

IRS Letter 6316

Audits are nothing new. Taxpayers may find themselves in the unfortunate situation of opening their mailboxes to an IRS examination letter. The IRS Letter 6316 (“Letter 6316”) is one such letter. The IRS iss…

Audits are nothing new. Taxpayers may find themselves in the unfortunate situation of opening their mailboxes to an IRS examination letter. The IRS Letter 6316 (“Letter 6316”) is one such letter. The IRS iss… -

Refundtalk wrote a new post 3 years, 5 months ago

The Internal Revenue Service is sending more than 2.8 million refunds this week to taxpayers who paid taxes on unemployment compensation that new legislation now excludes as income.

IRS efforts to correct…

-

Refundtalk wrote a new post 3 years, 5 months ago

As part of our response to the COVID-19 situation, we have taken steps to protect employees, taxpayers, and their representatives by minimizing the need for in-person contact. Taxpayer representatives have…

-

Refundtalk wrote a new post 3 years, 6 months ago

The IRS will have two online child tax credit portals open by July 1. That’s where you’ll change your status and more.

The child tax credit payments are coming — the good news is 88% of American f…

-

Refundtalk wrote a new post 3 years, 6 months ago

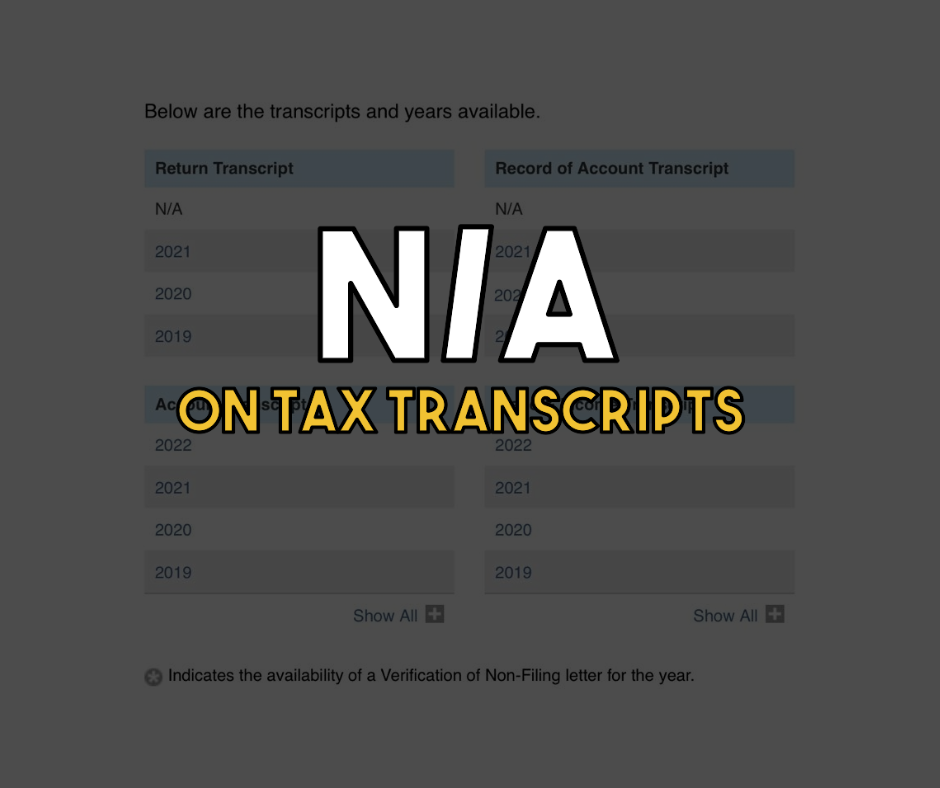

What does N/A on my Tax Transcripts mean?

What does N/A on my tax transcripts mean? When checking your tax transcripts and if you see a N/A in place of the most recently filed tax transcripts. The N/A is letting you know that your transcripts for the…

What does N/A on my tax transcripts mean? When checking your tax transcripts and if you see a N/A in place of the most recently filed tax transcripts. The N/A is letting you know that your transcripts for the… -

Refundtalk wrote a new post 3 years, 8 months ago

The IRS enables you to check when your 2021 Economic Impact Payment is available. The tool updates once each day, usually overnight. The IRS asks that you do not call them and encourage you to use this feature…

-

Refundtalk wrote a new post 3 years, 8 months ago

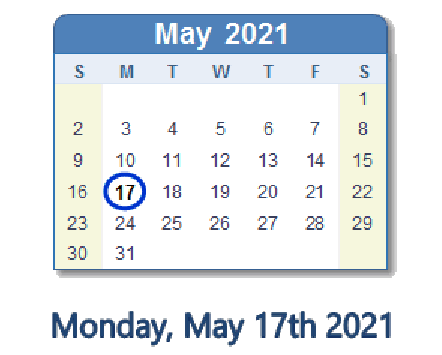

The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May…

-

Refundtalk wrote a new post 3 years, 8 months ago

Do student loans affect my tax returns?

It depends. If you are still in school and receiving money from student loans, you should not consider that income, since you are obligated to pay it back.

If you…

-

Refundtalk wrote a new post 3 years, 8 months ago

Earlier in February 2021, the IRS issued notices to approximately 260,000 taxpayers stating they haven’t filed their 2019 federal tax return. These notices, referred to as CP59 notices, are issued yearly to id…

-

Refundtalk wrote a new post 3 years, 8 months ago

Millions of Americans have already received refund payments after completing their tax filing, but there are concerns that tax return processing could soon face delays.

This year’s tax season is expected to b…

-

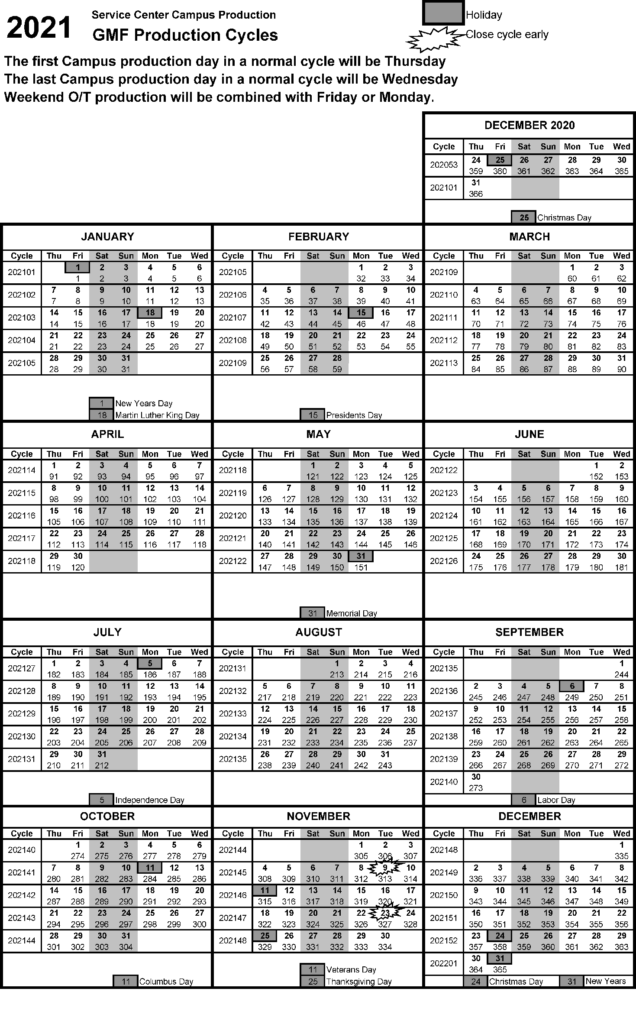

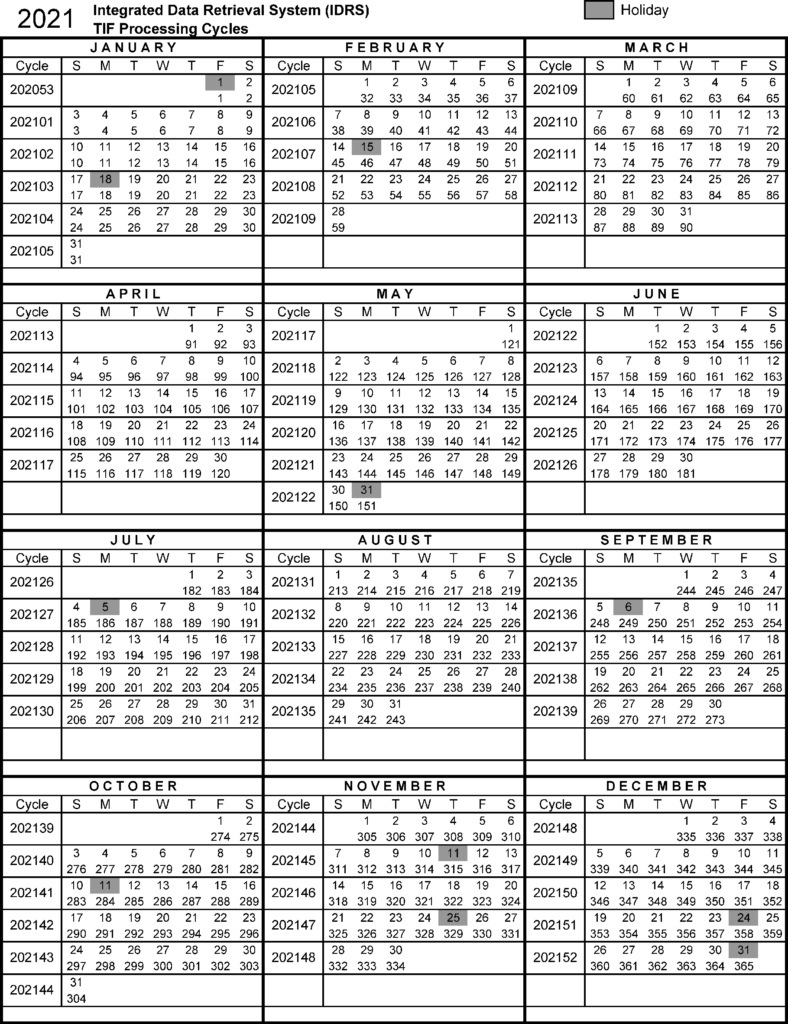

Refundtalk started the topic 2021 IRS Posting Cycles in the forum Cycle Charts 3 years, 8 months ago

-

Refundtalk started the topic 2021 IRS Production Cycles in the forum Cycle Charts 3 years, 8 months ago

-

Refundtalk started the topic 2021 IRS Processing Cycles in the forum Cycle Charts 3 years, 8 months ago

-

Refundtalk wrote a new post 3 years, 8 months ago

If 2020’s economic downturn put you in the position of needing to apply for unemployment benefits, you may have been under the impression that those benefits were not subject to state or federal taxes. U…

-

Refundtalk wrote a new post 3 years, 9 months ago

The Internal Revenue Service has issued an urgent warning to tax professionals over a new scam in which cyber-criminals impersonate the IRS over email in an attempt to steal Electronic Filing Identification…

-

Refundtalk wrote a new post 3 years, 9 months ago

-

Refundtalk wrote a new post 3 years, 9 months ago

Did the IRS reject your tax return because someone else claimed your dependent?

Claiming a dependent is usually pretty simple: you give the IRS their social security number, certifying that your relationship…

-

Refundtalk wrote a new post 3 years, 9 months ago

Whether you have just one on the way or five and counting, kids are expensive. That’s why you should take advantage of tax cuts whenever possible. In addition to claiming them as dependents, you may also q…

- Load More