Refundtalk

@admin

-

Refundtalk wrote a new post 3 years, 4 months ago

If you had the opportunity to receive a refund from the IRS or pay less tax legally than you thought you had to, would you take the opportunity or just let it pass you by? 9.9 times out of 10, you’d jump at the o…

-

Refundtalk wrote a new post 3 years, 4 months ago

Kicking off a special week, the Internal Revenue Service and the Security Summit partners today warned taxpayers and tax professionals to beware of a dangerous combination of events that can increase their e…

-

Refundtalk wrote a new post 3 years, 4 months ago

The IRS reminds taxpayers there are things they should do before the current tax year ends on Dec.31.

Donate to charityTaxpayers may be able to deduct donations to tax-exempt organizations on their tax…

-

Refundtalk wrote a new post 3 years, 4 months ago

2022 Tax Refund Updates Calendar

IRS Where’s My Refund? Updates Calendar for 2022 IRS Transcript and the Where’s My Refund? Updates Calendars! Tuesday Transcript Updates – Daily accounts are processed Friday, Monday, Tuesday, or…

IRS Where’s My Refund? Updates Calendar for 2022 IRS Transcript and the Where’s My Refund? Updates Calendars! Tuesday Transcript Updates – Daily accounts are processed Friday, Monday, Tuesday, or… -

Refundtalk wrote a new post 3 years, 5 months ago

The Internal Revenue Service has improved its identity verification and sign-in process to enable more people to securely access and use IRS online tools and applications.

Taxpayers using the new…

-

Refundtalk wrote a new post 3 years, 5 months ago

We’ve based these timelines on historical data noting that most refunds will be issued by the IRS in less than 21 days after the return has been accepted. Certain things can affect the timing of your refund, in…

-

Refundtalk wrote a new post 3 years, 5 months ago

The last thing you want to do is frantically run up to your boss asking “How many allowances do I claim on my W-4?”.

Being aware of the number of allowances you are claiming on a Form W-4 [Employ…

-

Refundtalk wrote a new post 3 years, 5 months ago

Unemployment benefits saved a lot of American households this past year. Furloughs and lay-offs were at an all-time high due to the pandemic, leaving many without a lot of options.

However, unemployment c…

-

Refundtalk wrote a new post 3 years, 5 months ago

A taxpayer’s filing status defines the type of tax return form they should use when filing their taxes. Filing status can affect the amount of tax they owe, and it may even determine if they have to file a tax r…

-

Refundtalk wrote a new post 3 years, 5 months ago

The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit (CTC) payment for the month of November. Low-income…

-

Refundtalk wrote a new post 3 years, 5 months ago

The year 2020 is going to go down in the history books for a lot of reasons, and one of them is the enormous increase in the number of math errors that taxpayers made on their tax returns. The result has been…

-

Refundtalk wrote a new post 3 years, 5 months ago

The Internal Revenue Service today encouraged taxpayers, including those who received stimulus payments or advance Child Tax Credit payments, to take important steps this fall to help themselves file their…

-

Refundtalk wrote a new post 3 years, 5 months ago

The Internal Revenue Service today updated frequently-asked-questions (FAQs) for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of y…

-

Refundtalk wrote a new post 3 years, 5 months ago

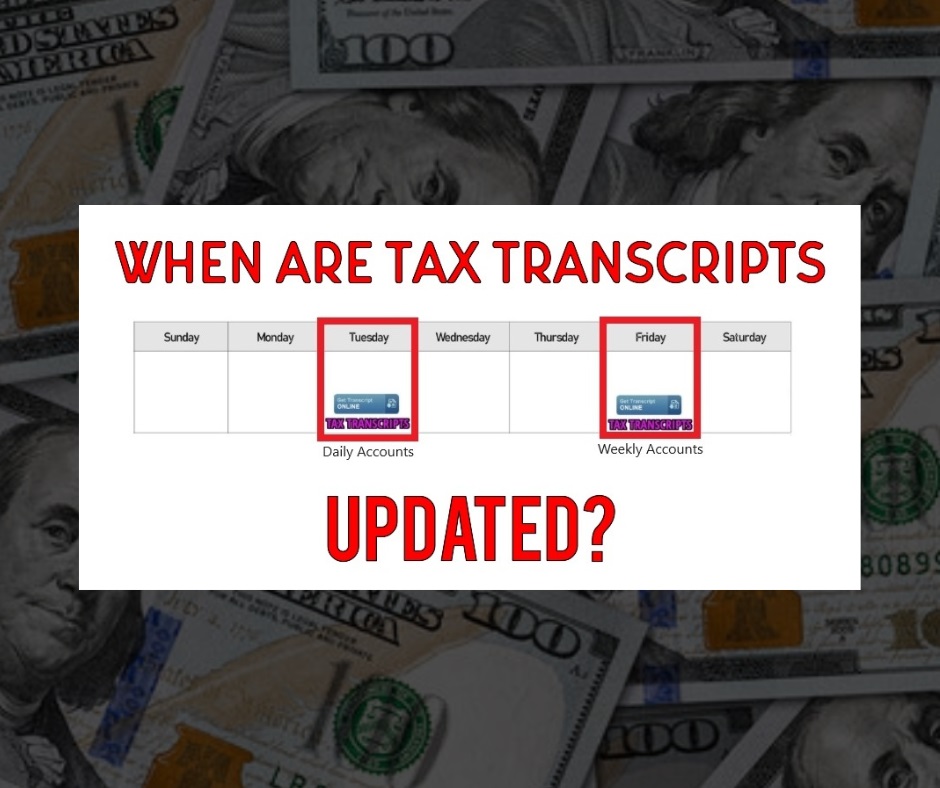

What day does IRS Update Tax Transcripts?

Daily & Weekly Tax Transcript updates Tax Transcripts typically reflect updates and changes each week on Tuesdays and Fridays Tuesday Transcript Updates – Daily accounts are processed on Monday,…

Daily & Weekly Tax Transcript updates Tax Transcripts typically reflect updates and changes each week on Tuesdays and Fridays Tuesday Transcript Updates – Daily accounts are processed on Monday,… -

Refundtalk wrote a new post 3 years, 5 months ago

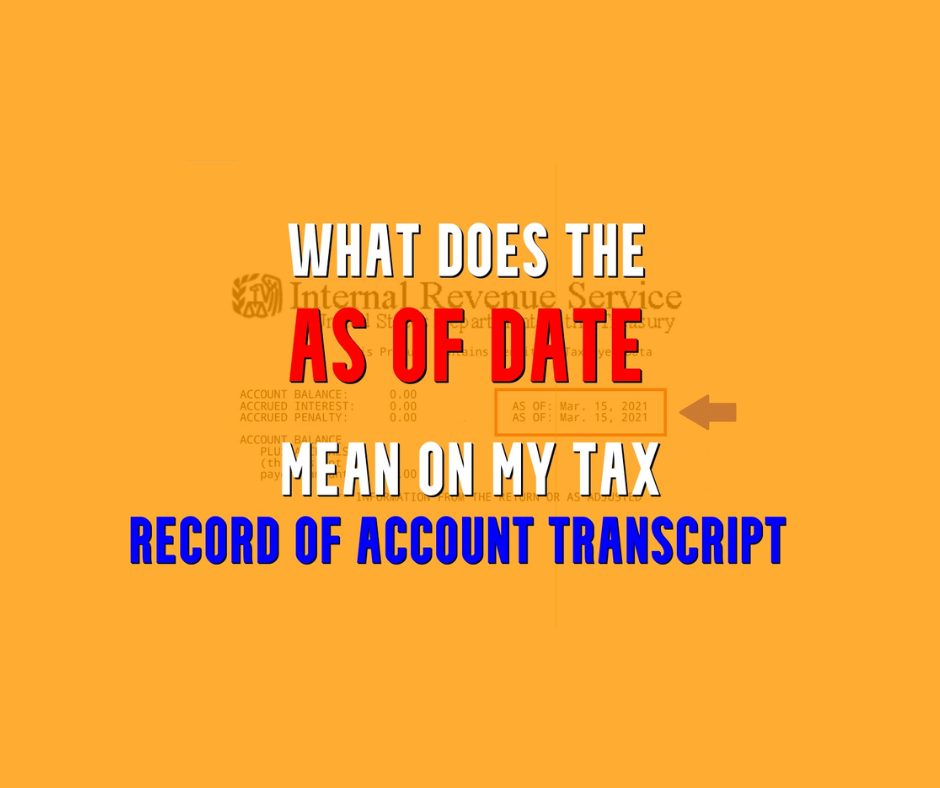

What is the "As Of" Date on the Tax Record of Account Transcripts

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case…

The “As Of” date on a Tax Account Transcript is the date your penalties and interest are estimated to be calculated to determine if you have a balance due or a tax refund. It’s computed to a future date in case… -

Refundtalk wrote a new post 3 years, 5 months ago

The Internal Revenue Service has issued another round of refunds to workers who paid taxes on their unemployment benefits in 2020.

This round of refunds totaled more than $510 million and went to 430,000…

-

Refundtalk wrote a new post 3 years, 5 months ago

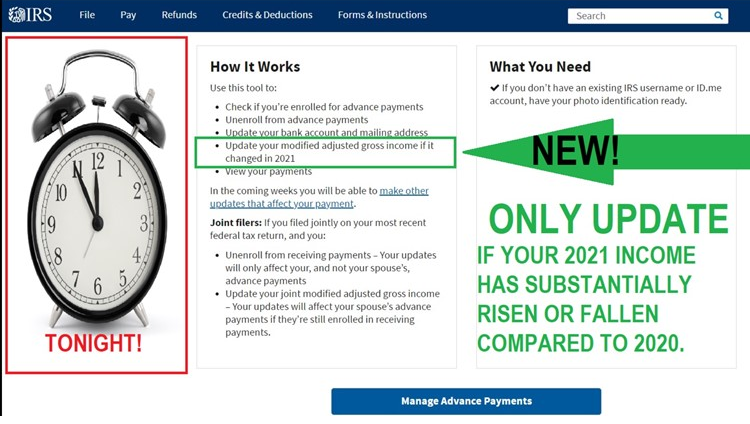

The next round of the advance child tax credit is set for Nov. 15. But if you’re worried that you’re getting too much or too little money, well, the IRS is asking that some people who saw their incomes change…

-

Refundtalk wrote a new post 3 years, 5 months ago

An IRS online account is a safe and easy way for individual taxpayers to view specific details about their federal tax account. The IRS recommends that tax professionals share with their clients the benefits o…

-

Refundtalk wrote a new post 3 years, 5 months ago

In the fall of 2020, the Internal Revenue Service announced that it was adding QR, or Quick Response, codes to some of the notices it sends taxpayers. Specifically, the codes are going on tax due…

-

Refundtalk wrote a new post 3 years, 5 months ago

The advance child tax credit allows qualifying families to receive early payments of the tax credit many people may claim on their 2021 tax return during the 2022 tax filing season. The IRS will disburse these…

- Load More