Refundtalk

@admin

-

Refundtalk wrote a new post 3 years, 9 months ago

The IRS will begin accepting tax returns on Feb. 12, 2021. Here’s a breakdown of what you should know before you file.

Tax filing season will start a bit later this year and look a bit different too. T…

-

Refundtalk wrote a new post 3 years, 9 months ago

Filed your taxes and expecting a refund? Here’s how to check the status and how long you may have to wait.

So, you’ve been proactive and turned in your tax return already or are planning to do so shortly. H…

-

Refundtalk wrote a new post 3 years, 9 months ago

There are pros and cons to either filing your taxes now or holding off a few more weeks in terms of the proposal for $1,400 stimulus payments.

As Democrats push forward with crafting the next massive…

-

Refundtalk wrote a new post 3 years, 9 months ago

Two items in the COVID relief package affect how much money the government will send parents to cover their children in 2021.

Inside the COVID relief package that could be voted on by the full House as e…

-

Refundtalk wrote a new post 3 years, 9 months ago

Are you wondering if there’s a hard and fast rule about what income is taxable and what income is not taxable? The quick answer is that all income is taxable unless the law specifically excludes it. But as you m…

-

Refundtalk wrote a new post 3 years, 9 months ago

The first step of tax preparation is gathering records

As taxpayers get ready to file their tax returns, they should start by gathering their records. Taxpayers should gather all year-end income documents to…

-

Refundtalk wrote a new post 3 years, 9 months ago

If you didn’t receive your Economic Impact Payments (EIPs) and a 2018 or 2019 joint return was filed in your name without your consent, you may be eligible to claim the Recovery Rebate Credit (RRC) on your 2…

-

Refundtalk wrote a new post 3 years, 9 months ago

We have received your tax return and it is being processed

“We have received your tax return and it is being processed”refund status message is a good sign and indicates the tax return is being processed and your tax return is still on track to a refund date. When you see…

“We have received your tax return and it is being processed”refund status message is a good sign and indicates the tax return is being processed and your tax return is still on track to a refund date. When you see… -

Refundtalk wrote a new post 3 years, 9 months ago

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted December…

-

Refundtalk wrote a new post 3 years, 9 months ago

Nearly every taxpayer with dependent children could be impacted by the PATH Act at some point. In addition to other tax-related provisions, the PATH act affects two extremely common tax credits: the Earned…

-

Refundtalk wrote a new post 3 years, 9 months ago

Opening Day for the IRS is Today February 12, 2021.

The Internal Revenue Service has set the opening day for the 2021 tax filing season for Friday, Feb. 12, 2021. That’s the day the IRS will begin accepting and p…

-

Refundtalk wrote a new post 3 years, 9 months ago

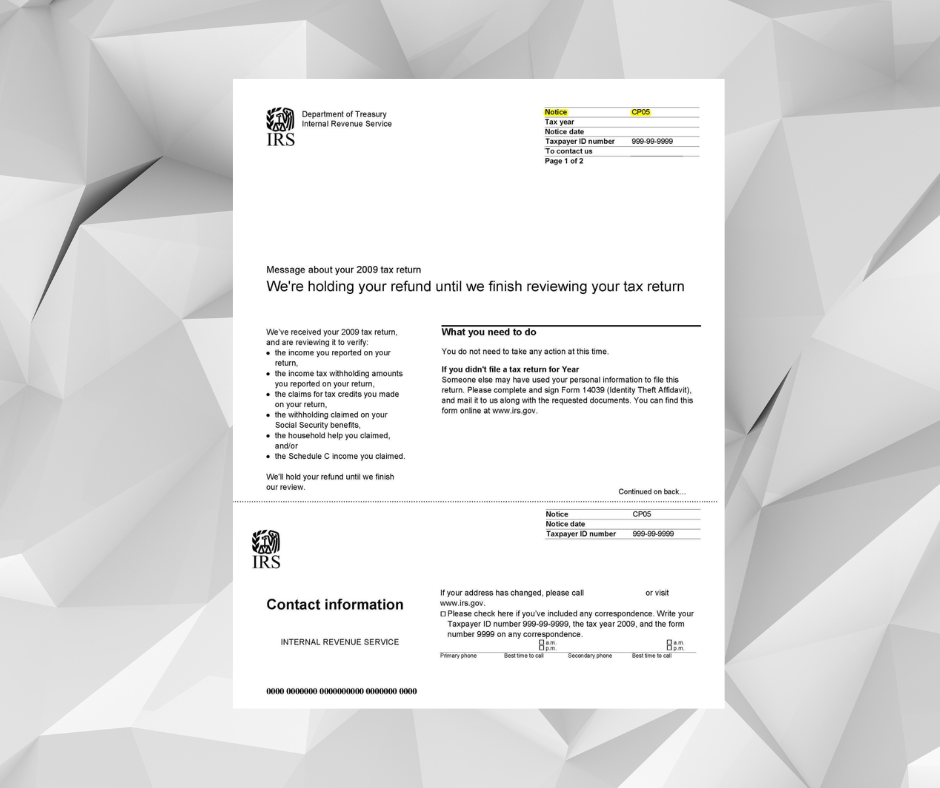

IRS Notice CP05 – Your Tax Refund is Being Held While The IRS Reviews Your Tax Return

Your tax refund is being held, pending a review of your tax return. The IRS may contact third parties to verify the information shown on the tax return. IRS Notices CP05 & CP05A both indicate that the IRS is…

Your tax refund is being held, pending a review of your tax return. The IRS may contact third parties to verify the information shown on the tax return. IRS Notices CP05 & CP05A both indicate that the IRS is… -

Refundtalk wrote a new post 3 years, 9 months ago

The Internal Revenue Service today urged taxpayers who receive Forms 1099-G for unemployment benefits they did not actually get because of identity theft to contact their appropriate state agency for a corrected…

-

Refundtalk wrote a new post 3 years, 9 months ago

Identity theft is a crime that affects victims for years after it’s committed—from ruined credit to tax debt, recovering in the aftermath of having your personal information stolen and used is an enormous ord…

-

Refundtalk wrote a new post 3 years, 9 months ago

If your $600 stimulus payment (also referred to as the second economic impact payment, or EIP2) still hasn’t arrived in your bank account or mailbox, you may be wondering if you should wait to file your tax r…

-

Refundtalk wrote a new post 3 years, 9 months ago

Now that many taxpayers have received (and most likely spent) their Economic Impact Payments (EIPs), they’re wondering how that extra cash is going to affect tax returns in the winter and spring of 2021. Let’s go…

-

Refundtalk wrote a new post 3 years, 9 months ago

The IRS has announced that the 2021 tax filing season will begin on February 12, 2021. Tax preparation companies will be participating in the controlled launch of the e-file system (HUB Testing) with the IRS…

-

Refundtalk wrote a new post 3 years, 9 months ago

If your stimulus check is lost in the mail, or something else happens to it before you get it, you can ask the IRS to trace your payment.

It’s bad enough if a new shirt you ordered on Amazon gets lost in the mail…

-

Refundtalk wrote a new post 3 years, 9 months ago

The Internal Revenue Service is reminding taxpayers that organizing tax records is an important first step for getting ready to prepare and file their 2020 tax return.

Taxpayers should keep all necessary records,…

-

Refundtalk wrote a new post 3 years, 9 months ago

The Internal Revenue Service today reminds taxpayers that the fastest way to get their tax refund is by filing electronically and choosing direct deposit.

Direct deposit is free, fast, simple, safe and secure.…

- Load More