Refundtalk

@admin

-

Refundtalk wrote a new post 4 years, 2 months ago

On August 28, the IRS announced that it will temporarily allow the use of digital signatures, or e-signatures, on certain forms that cannot be filed electronically, that must be maintained on paper or that otherwise…

-

Refundtalk wrote a new post 4 years, 3 months ago

After a big win on a lotto ticket or after a great night at the casino, the last thing you’re probably thinking about is those pesky tax obligations that come along with it. While that brand new sports car or f…

-

Refundtalk wrote a new post 4 years, 3 months ago

What is Tax Topic 151?

You may receive a tax topic 151 letters in lieu of a full tax refund, or any refund at all. It can be alarming, as the notice often says to take action immediately. If you’ve received t…

-

Refundtalk wrote a new post 4 years, 5 months ago

Health insurance can be pricey.

Luckily, you can get a refundable tax credit just for purchasing health insurance through the Marketplace.

Keep reading to find out how you qualify.

What is the Premium…

-

Refundtalk wrote a new post 4 years, 7 months ago

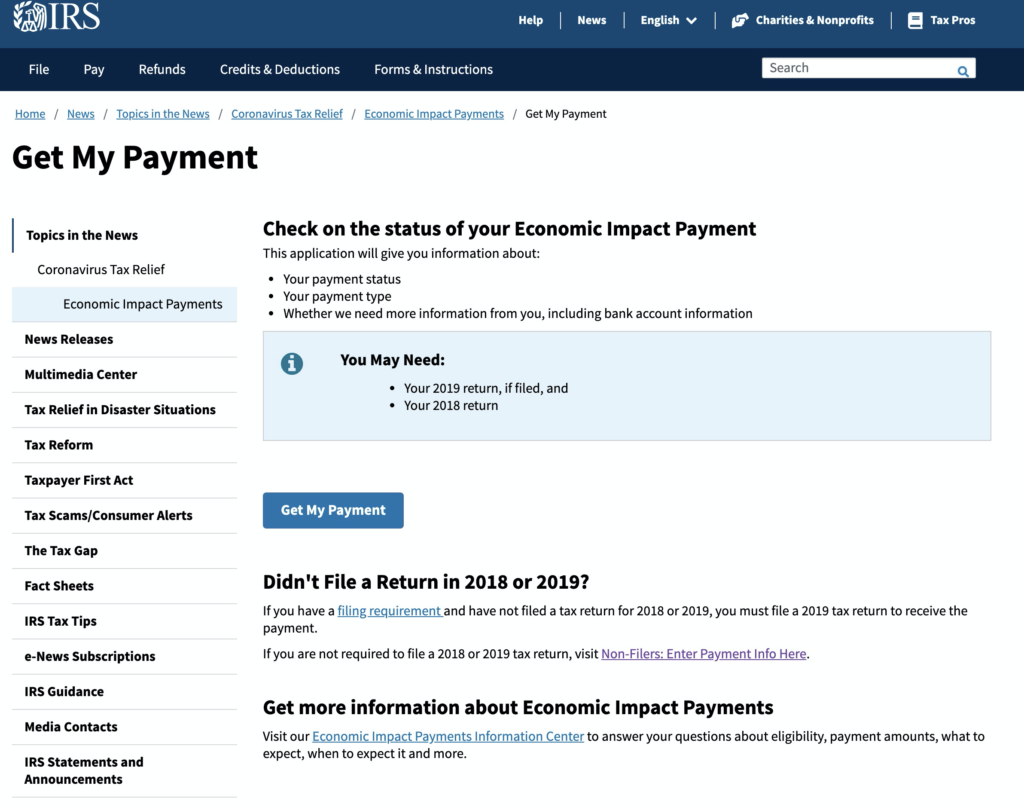

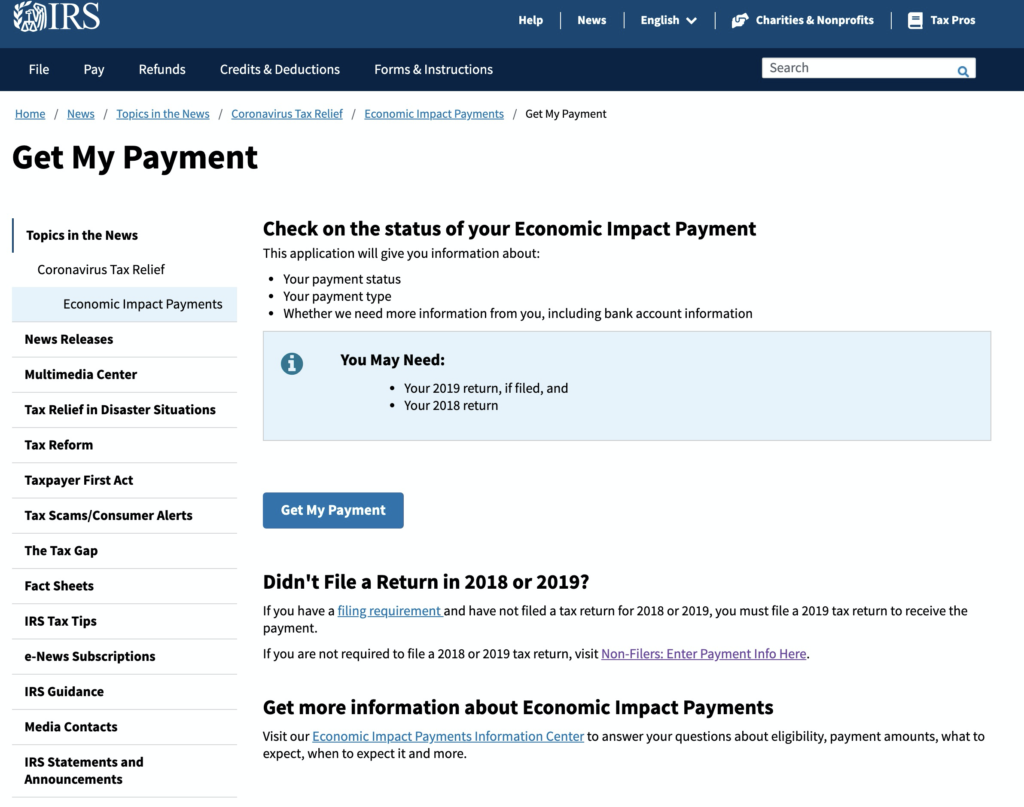

The IRS announced significant enhancements to the “Get My Payment” tool to deliver an improved and smoother experience for taxpayers eligible to receive Economic Impact Payments.

The enhancements adjust…

-

Refundtalk wrote a new post 4 years, 7 months ago

The Internal Revenue Service went live with its “Get My Payment” portal Wednesday, April 15th. This is the much-anticipated tool where you can get information on the status of your federal stimulus payment as we…

-

Refundtalk wrote a new post 4 years, 7 months ago

The U.S. Department of the Treasury and IRS launched the “Get My Payment” web application. The FREE app allows taxpayers who filed their tax return in 2018 or 2019 but did not provide their banking infor…

-

Refundtalk wrote a new post 4 years, 7 months ago

Millions of Americans are starting to see Economic Impact Payments deposited directly in their bank accounts. The U.S. Department of the Treasury and IRS expect tens of millions of Americans will receive their…

-

Refundtalk wrote a new post 4 years, 7 months ago

The U.S. Department of the Treasury and IRS will launch the “Get My Payment” web application by Friday, April, 17th. The FREE app—which will be found at IRS.gov—will allow taxpayers who filed their tax return…

-

Refundtalk wrote a new post 4 years, 7 months ago

IRS.gov feature helps people who normally don’t file get payments; second tool next week provides taxpayers with payment delivery date and provide direct deposit information

To help millions of people, the T…

-

Refundtalk wrote a new post 4 years, 7 months ago

The Internal Revenue Service today reminds taxpayers and tax professionals to use electronic options to support social distancing and speed the processing of tax returns, refunds and payments.

To protect the…

-

Refundtalk wrote a new post 4 years, 7 months ago

The stimulus payments being sent out are REALLY advanced tax credits. I believe eligibility will be based on 2020 taxable income, but the advance payments being sent out will be based on 2019 adjusted gross…

-

Refundtalk wrote a new post 4 years, 7 months ago

Federal student loan borrowers late on their payments have been granted some relief by the Department of Education, which will stop the collections process for federal student loans in default, including wage…

-

Refundtalk wrote a new post 4 years, 7 months ago

The Treasury Department and the Internal Revenue Service today announced that distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action…

-

Refundtalk wrote a new post 4 years, 8 months ago

As the COVID-19 (coronavirus) outbreak continues, the Internal Revenue Service is taking multiple steps to protect their employees, America’s taxpayers and their partners. Although they are curtailing some…

-

Refundtalk wrote a new post 4 years, 8 months ago

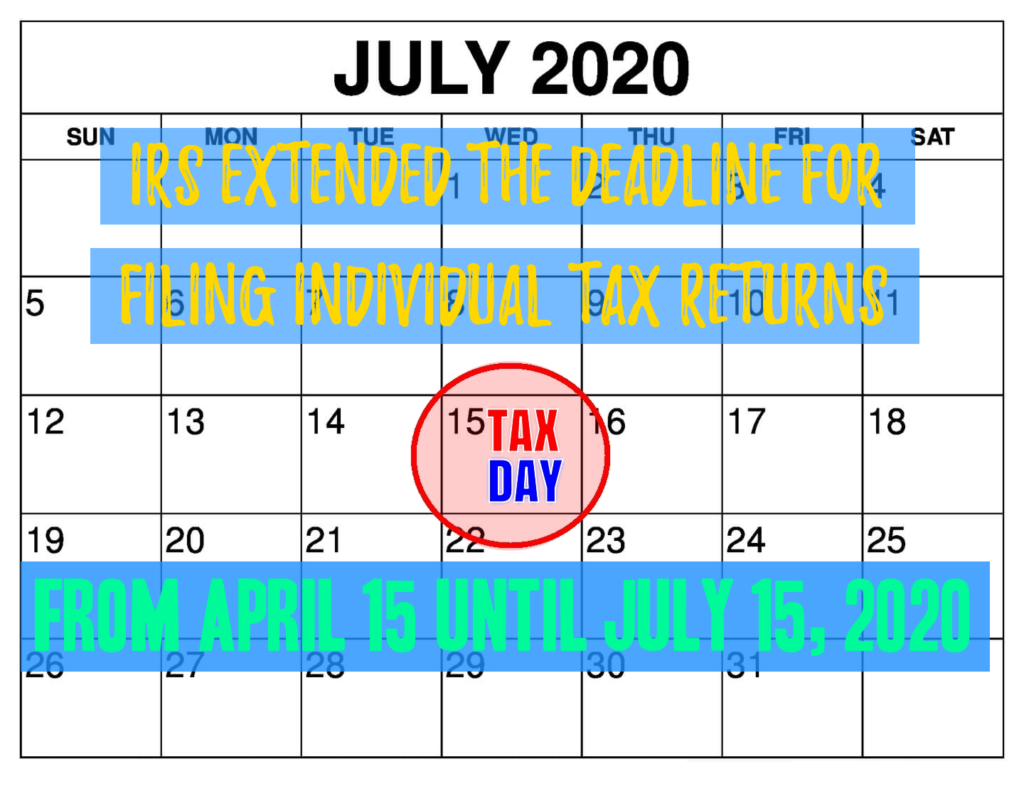

The Internal Revenue Service has extended the deadline for filing individual tax returns for 2019 to July 15, 2020 from April 15 in response to the coronavirus pandemic. The change came just two days after the…

-

Refundtalk wrote a new post 4 years, 8 months ago

Some taxpayers have good news and a deposit on the way: The Treasury Department and IRS are sending refund interest payments to about 13.9 million individual taxpayers who filed their 2019 federal income tax returns…

-

Refundtalk wrote a new post 4 years, 9 months ago

With millions of tax refunds being processed, the Internal Revenue Service reminds taxpayers they can get fast answers about their refund by using the “Where’s My Refund?” tool available on IRS.gov and through…

-

Refundtalk wrote a new post 4 years, 9 months ago

The Internal Revenue Service (IRS) recognized Presidents Day as a federal holiday and is therefore closed. In anticipation of the upcoming holiday, the IRS warned people who planned to call before and after the…

-

Refundtalk wrote a new post 4 years, 9 months ago

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted December…

- Load More