Refundtalk

@admin

-

Refundtalk wrote a new post 5 years, 6 months ago

Unfiled Tax Returns

Some people avoid filing their tax returns because they don’t want to, or can’t afford to pay taxes they owe to the IRS. Others simply forget or don’t know they need to file. Whatever the…

-

Refundtalk wrote a new post 5 years, 6 months ago

Military members benefit from a variety of special tax benefits. These include certain nontaxable allowances, non-taxable combat pay, and a variety of other special tax provisions. Here is a rundown on the most…

-

Refundtalk wrote a new post 5 years, 7 months ago

In a report issued by the Treasury Department on February 14, the average refund it is paying in 2019 has dropped to $1,949 from $2,135 in the prior year. In addition, the number of returns filed so far has…

-

Refundtalk wrote a new post 5 years, 7 months ago

If you aren’t one of those lucky Americans who get a tax refund from the IRS, you might be wondering how you go about paying your balance due. Here are some electronic and manual payment options that you can u…

-

Refundtalk wrote a new post 5 years, 8 months ago

According to the IRS Strategic Plan FY 2018 to 2020, these are the major Trends and Challenges going forward:

SERVING AN INCREASINGLY COMPLEX TAX BASE

The U.S. tax base is becoming more complex. Economic…

-

Refundtalk wrote a new post 5 years, 8 months ago

Are you planning on claiming the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) on your federal tax return this year? If yes, then you should know some things have changed since last…

-

Refundtalk wrote a new post 5 years, 8 months ago

I thought it would be a good idea to discuss an issue that affects many taxpayer returns, namely the IRS processes for identifying and stopping refund fraud. Attempted refund fraud has become a significant problem…

-

Refundtalk wrote a new post 5 years, 8 months ago

The Earned Income Tax Credit (EITC) is a refundable tax credit given to taxpayers that earn a low-to-moderate income from a job or through self-employment. According to the IRS, around 25 million eligible filers…

-

Refundtalk wrote a new post 5 years, 9 months ago

The IRS established the Taxpayer Protection Program (TPP) to proactively identify and prevent the processing of identity theft tax returns and assist taxpayers whose identities are used to file such returns.…

-

Refundtalk wrote a new post 5 years, 9 months ago

Having the heat of the IRS on your back is never a fun experience. The unrelenting pressure of the federal government can be incredibly stressful and often intimidating, making back tax relief seem nearly impossible…

-

Refundtalk wrote a new post 5 years, 9 months ago

Thanks to the tax reform, beginning in 2019, the penalty for not having adequate health insurance, which the government refers to as the “individual shared responsibility payment,” will no longer app…

-

Refundtalk started the topic IRS Transcript Transaction Codes in the forum IRS Transcript Codes 5 years, 9 months ago

Transaction Codes (TC) consist of three digits. They are used to identify a transaction being processed and to maintain a

history of actions posted to a taxpayer’s account on the Master File. Every transaction processed must contain a

Transaction Code to maintain Accounting Controls of debits and credits, to cause the computer to post t…[Read more] -

Refundtalk wrote a new post 5 years, 9 months ago

The Internal Revenue Service reminded taxpayers who need their prior-year tax records to either complete their tax return or to validate their income and use Get Transcript Online or Get Transcript by…

-

Refundtalk wrote a new post 5 years, 9 months ago

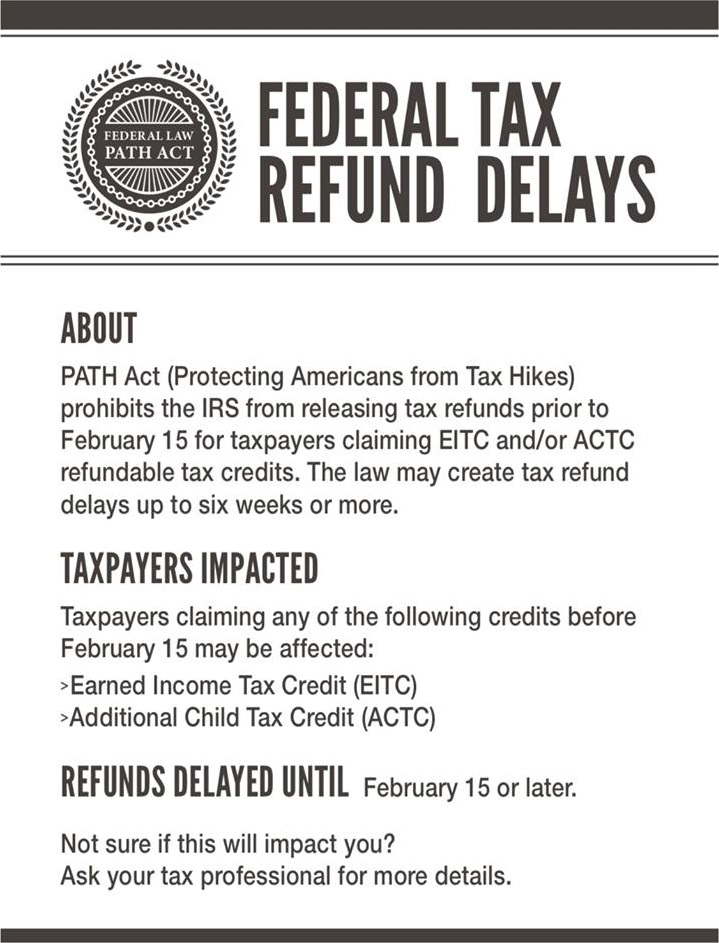

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted December…

-

Refundtalk wrote a new post 5 years, 9 months ago

With Refund Transfer, you can pay your tax preparation fees and other authorized amounts from your refund. Plus, it’s a convenient, secure way to get your tax refund. When filing your taxes with us, you can use R…

-

Refundtalk wrote a new post 5 years, 9 months ago

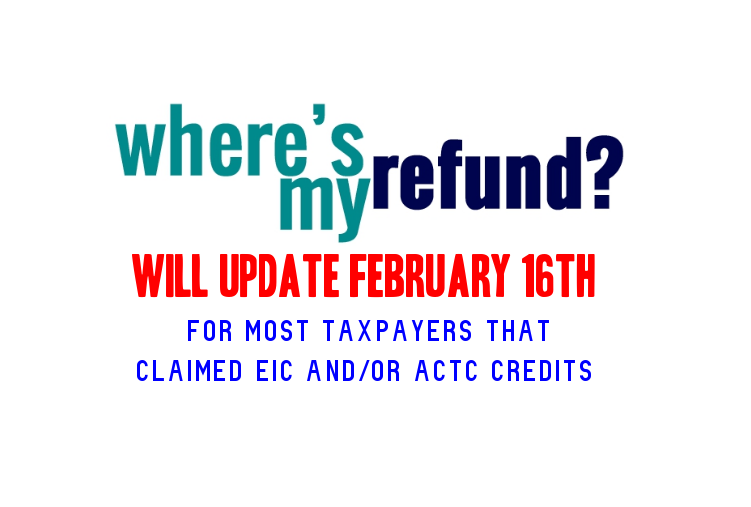

With millions of tax refunds being processed, the Internal Revenue Service reminds taxpayers they can get fast answers about their refund by using the “Where’s My Refund?” tool available on IRS.gov and through…

-

Refundtalk wrote a new post 5 years, 9 months ago

National Taxpayer Advocate Nina E. Olson today released her 2018 Annual Report to Congress, describing challenges the IRS is facing as a result of the recent government shutdown and recommending that Congress…

-

Refundtalk wrote a new post 5 years, 9 months ago

With a new tax law in effect and a surge of tax returns expected during the Presidents Day weekend, the Internal Revenue Service is offering taxpayers several tips and various time-saving resources to get them…

-

Refundtalk wrote a new post 5 years, 9 months ago

Today, towards the end of the second full week of the 2019 tax filing season, the Internal Revenue Service warned taxpayers to avoid unethical tax return preparers, known as ghost preparers.

By law, anyone…

-

Refundtalk started the topic IRS Reference Code 1541 in the forum IRS Reference Codes 5 years, 9 months ago

Do you have IRS Reference Code 1541?

Share your experience with filing your tax return and seeing “IRS Reference code 1541”If you check where’s my refund? and see this status share what you found out here!

- Load More