Refundtalk

@admin

-

Refundtalk wrote a new post 6 years ago

Many taxpayers, at risk for having too little tax withheld from their pay, can avoid a surprise year-end tax bill by quickly updating the withholding form they give to their employer, according to the Internal…

-

Refundtalk wrote a new post 6 years ago

Every year, the IRS works a large batch of ”unpostable” tax returns. An Unpostable tax return happens when your tax return is unable to be posted to the master file. An unpostable condition occurs if there is a…

-

Refundtalk wrote a new post 6 years ago

More families will be able to get more money under the newly revised Child Tax Credit, according to the Internal Revenue Service.

The Tax Cuts and Jobs Act (TCJA), the tax reform legislation passed in December…

-

Refundtalk wrote a new post 6 years, 1 month ago

Before you start your search, you might be wondering about all the different kinds of tax pros out there or who can do your taxes. Basically, anyone can call himself a tax preparer and file your return for you.…

-

Refundtalk wrote a new post 6 years, 2 months ago

Systemic verification is one element of the IRS’s Return Review Program (RRP), its primary system to detect fraud and noncompliance. The Return Review Program is a platform that runs individual tax returns through a…

-

Refundtalk wrote a new post 6 years, 2 months ago

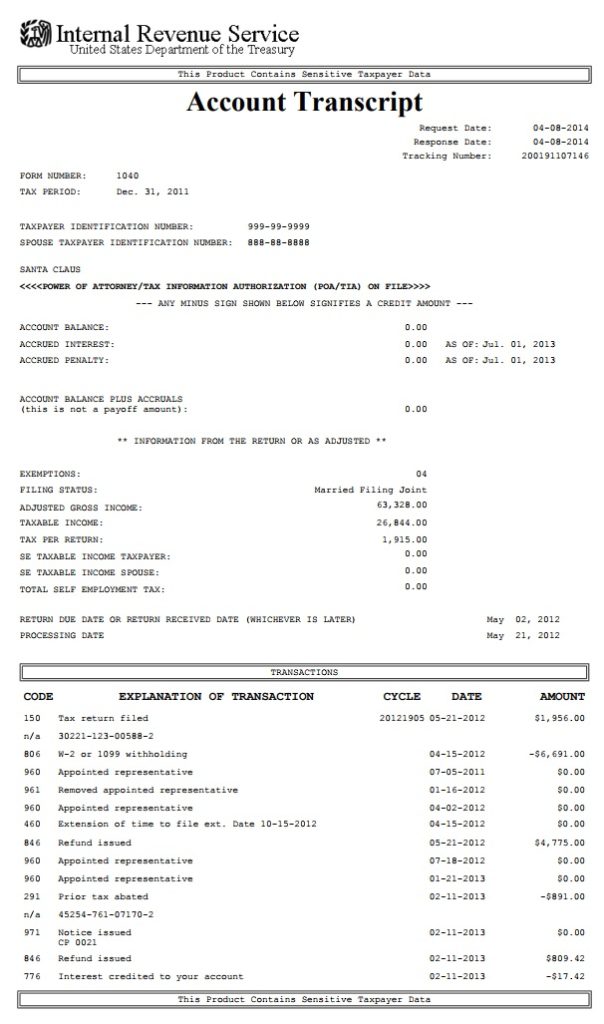

What Is an IRS Tax Transcript?

An IRS tax transcript serves as a record of an individual’s tax-related information. This document contains details about one’s previous tax returns, with information such as…

-

Refundtalk wrote a new post 6 years, 3 months ago

Need Help with Your Tax Troubles?

Dealing with tax issues can be frustrating, confusing, and frightening.

The IRS Taxpayer Advocate Service is made up of individuals who are knowledgeable about the inner…

-

Refundtalk wrote a new post 6 years, 8 months ago

The Taxpayer Advocate Service (TAS) is an organization within the Internal Revenue Service that is designed to help taxpayers resolve problems with the IRS.

HOW IT WORKS

The TAS was first formed in 1978. Over…

-

Refundtalk commented on the post, IRS Fraud Filters Delay Tax Refunds 6 years, 9 months ago

Verification Letter 4464c confirms that you filed your taxes, but – and here’s the cringe – it also says the IRS is holding up any refund to make a thorough review of some type of information on your tax return.

“Typically, the IRS checks with a third party, such as the employer, to verify information on the return.”

The letter does not announc…[Read more]

-

Refundtalk wrote a new post 6 years, 9 months ago

The Department of Treasury’s Bureau of the Fiscal Service (BFS) issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program (TOP). Through the TOP program, BFS may reduce your refund (ov…

-

Refundtalk wrote a new post 6 years, 9 months ago

The IRS’s Failure to Establish Goals to Reduce High False Positive Rates for Its Fraud Detection Programs Increases Taxpayer Burden and Compromises Taxpayer Rights

Over the past decade, the IRS has been s…

-

What about a 4464c letter ? I got that in the mail dates 2/22 but I️ filed 1/30

-

Verification Letter 4464c confirms that you filed your taxes, but – and here’s the cringe – it also says the IRS is holding up any refund to make a thorough review of some type of information on your tax return.

“Typically, the IRS checks with a third party, such as the employer, to verify information on the return.”

The letter does not announce an audit. However, it is telling you not to expect any refund to arrive for another 60 days. What should you do? Typically, taxpayers should do nothing but wait for the entire 60 days. If a refund hasn’t arrived by then, the taxpayer can call an IRS phone number to check on it.

With millions of income tax returns flooding into its computers, the Internal Revenue Service is trying to filter out bogus returns before taxpayers get bilked. Letter 4464c comes from the Integrity & Verifications Operations Office, which is charged with preventing fraudulent refunds.

-

-

-

Refundtalk wrote a new post 6 years, 9 months ago

A system the IRS uses to identify potentially fraudulent electronically filed tax returns. It enhances the IRS’s capabilities to detect, resolve, and prevent criminal and civil noncompliance and reduces issuance o…

-

Refundtalk wrote a new post 6 years, 9 months ago

IRS Still Being Processed vs. Being Processed

There are two different being processed messages. One is “still being processed” and the other is “being processed” and they both have different meanings. What does “Your tax return is still being p…

There are two different being processed messages. One is “still being processed” and the other is “being processed” and they both have different meanings. What does “Your tax return is still being p… -

Refundtalk wrote a new post 6 years, 9 months ago

Early Direct Deposit Accounts

Direct deposit is the “fastest, safest way to receive your tax refund,” According to the IRS.

There are several advantages to direct deposit of a tax refund:

You can…

-

Refundtalk wrote a new post 6 years, 9 months ago

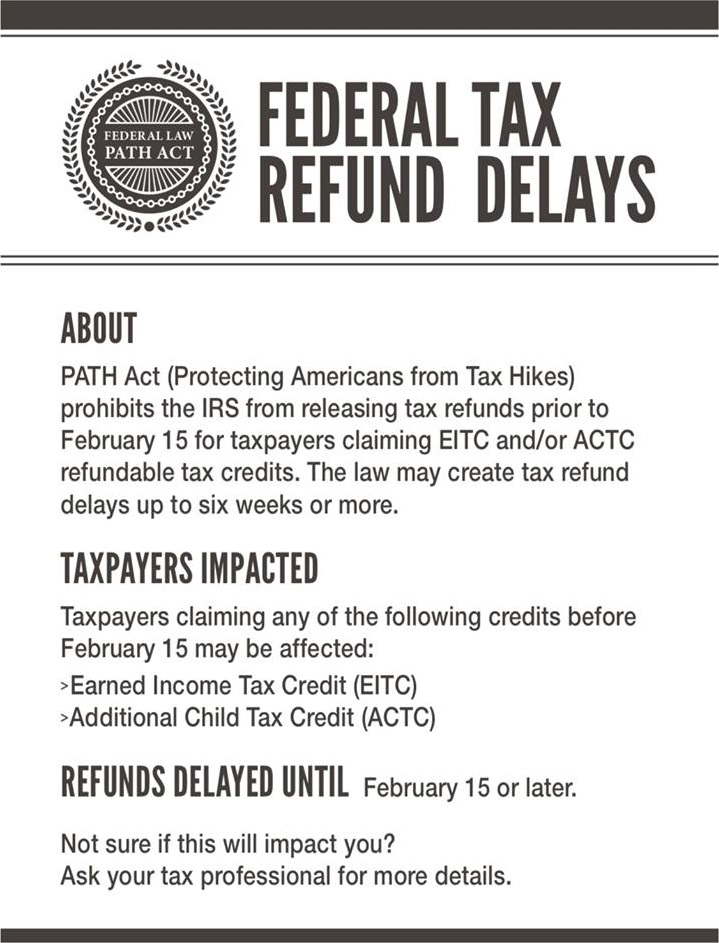

The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act), was enacted on December 18, 2015. The PATH Act contains several changes to the tax law that affect individuals, families, and businesses, and…

-

Refundtalk wrote a new post 6 years, 9 months ago

With millions of tax refunds being processed, the Internal Revenue Service reminds taxpayers they can get fast answers about their refund by using the “Where’s My Refund?” tool available on IRS.gov and through…

-

Refundtalk wrote a new post 6 years, 9 months ago

Even without a government shutdown, taxpayers are having trouble getting through to the IRS at the start of the 2018 tax filing season. Busy signals and long hold times are leading to frustration. We’ve even heard o…

-

Refundtalk wrote a new post 6 years, 9 months ago

The Internal Revenue Service today announced steep declines in tax-related identity theft in 2017, attributing the success to the Security Summit initiatives that help safeguard the nation’s taxpayers.

Key i…

-

Refundtalk wrote a new post 6 years, 9 months ago

With the surge of tax returns expected during the upcoming Presidents Day weekend, the Internal Revenue Service is offering taxpayers several tips and various time-saving resources to get them the help they need from…

-

Refundtalk wrote a new post 6 years, 9 months ago

The IRS mails millions of letters to taxpayers every year for many reasons. Here are seven simple suggestions on how individuals can handle a letter or notice from the IRS:

1. Don’t panic. Simply res…

- Load More