Refundtalk

@admin

-

Refundtalk started the topic April 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

April 2018 IRS Where’s my Refund? Updates Calendar

Visit the Where’s my Refund? Updates Calendar Page for more information! -

Refundtalk replied to the topic March 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

-

Refundtalk started the topic March 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

March 2018 IRS Where’s my Refund? Updates Calendar

Visit the Where’s my Refund? Updates Calendar Page for more information! -

Refundtalk replied to the topic February 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

-

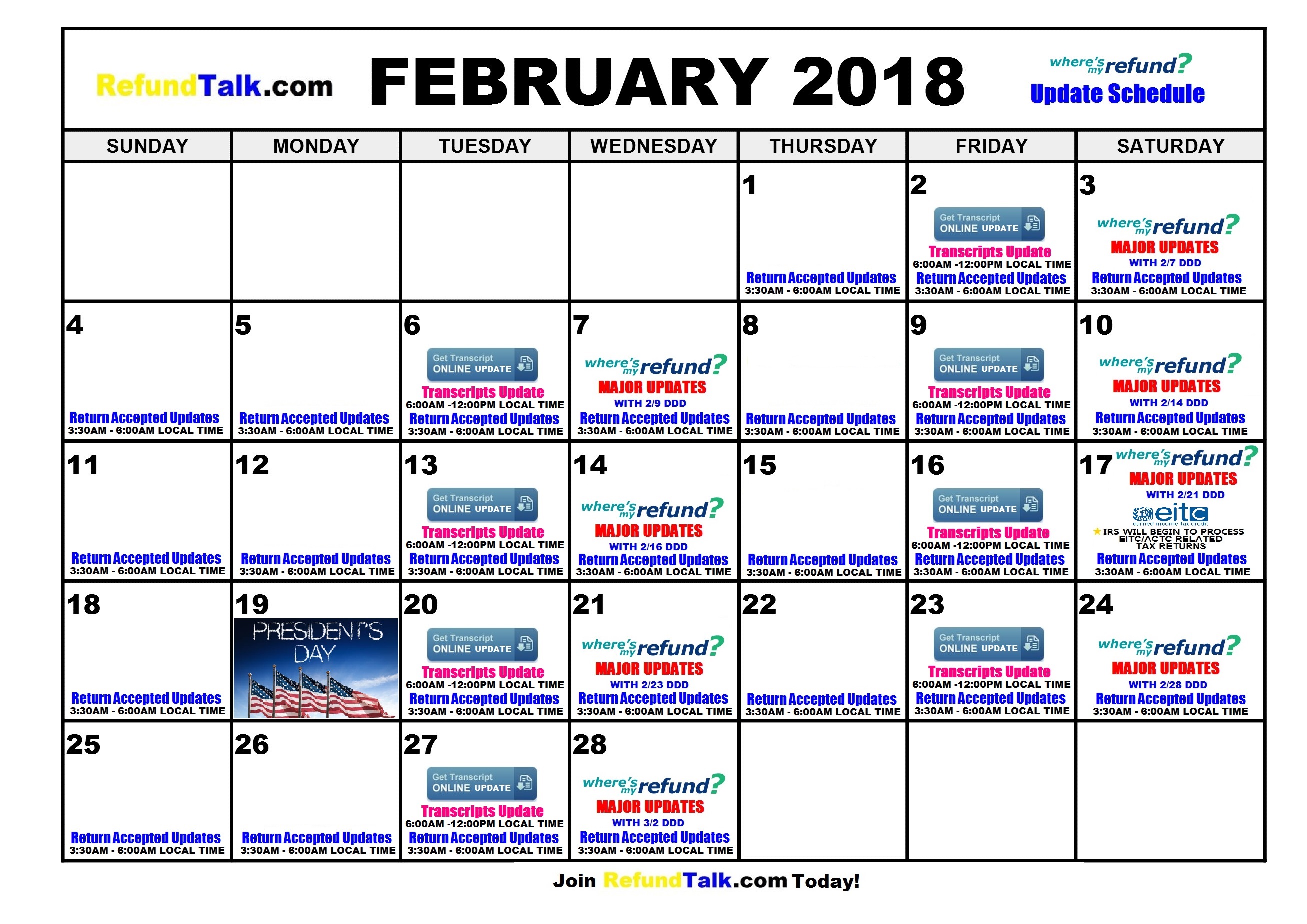

Refundtalk started the topic February 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

February 2018 IRS Where’s my Refund? Updates Calendar

Visit the Where’s my Refund? Updates Calendar Page for more information! -

Refundtalk replied to the topic January 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

-

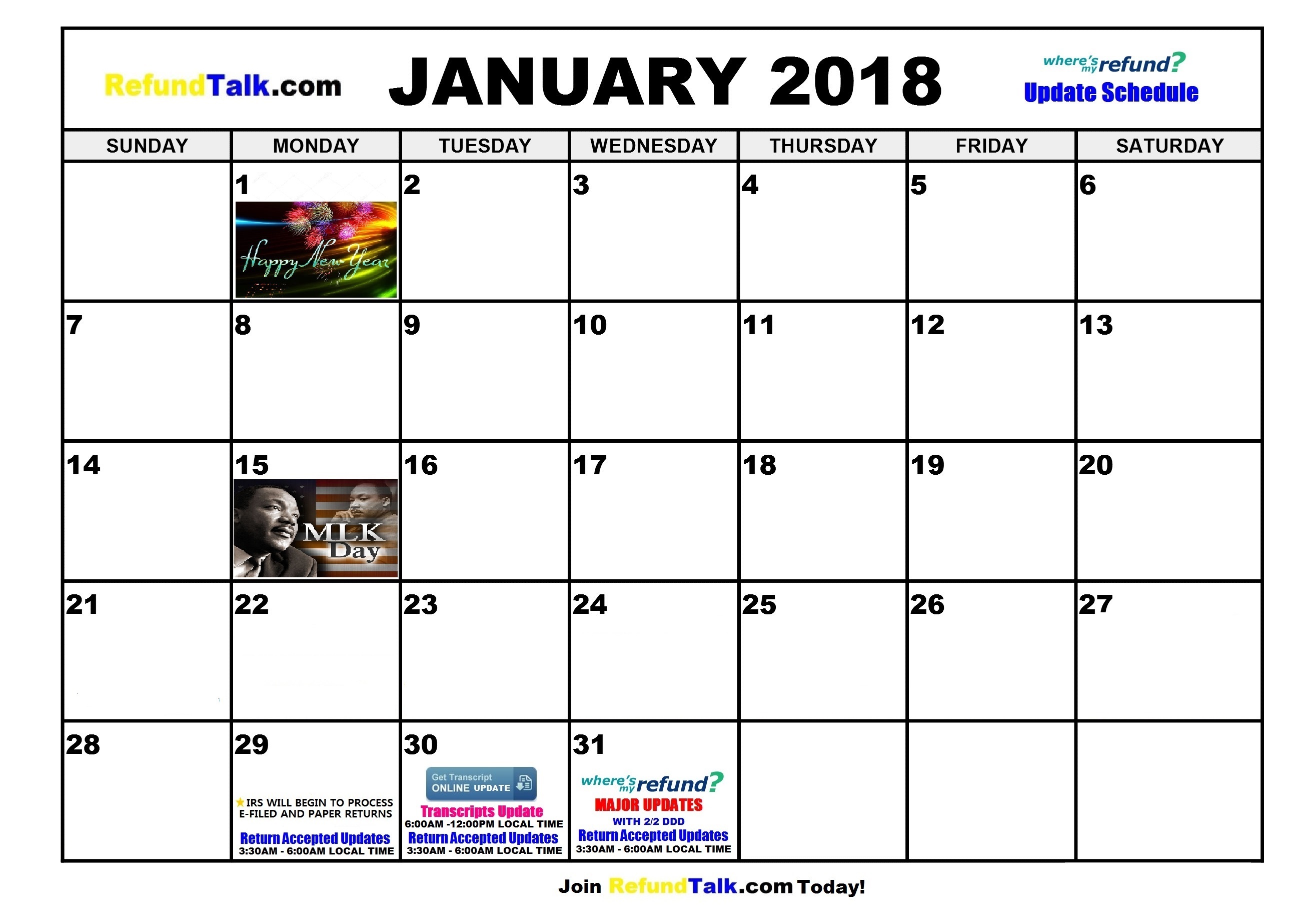

Refundtalk started the topic January 2018 IRS Where’s my Refund? Updates Calendar in the forum Cycle Charts 7 years, 2 months ago

January 2018 IRS Where’s my Refund? Updates Calendar

Visit the Where’s my Refund? Updates Calendar Page for more information! -

Refundtalk replied to the topic When is Where's My Refund Available? in the forum Where’s My Refund? Status 7 years, 2 months ago

Where’s My Refund? is available almost all of the time. However, IRS systems may not be available every Monday, early, from 12:00 am (Midnight) to 3:00 am Eastern Time.

IRS Change of Address and Refund Trace features are not available during the following times (Eastern Time):

Sunday: 12:00 am (Midnight) to 7:00 pm

Monday: 12:00 am (Midnight) t…[Read more] -

Refundtalk replied to the topic How can I speed up the process to get my refund faster? in the forum FAQ’s 7 years, 2 months ago

Unfortunately, there is no way to speed up the refund process. The IRS handles thousands of tax returns a day and it is important to just be patient and wait.

-

Refundtalk wrote a new post 7 years, 2 months ago

IRS Making Important Changes to e-Services Platform

The Internal Revenue Service has announced a couple of big changes they have planned for the e-Services system in the coming months. The first is the transfer of the e-Services system to a new platform,…

The Internal Revenue Service has announced a couple of big changes they have planned for the e-Services system in the coming months. The first is the transfer of the e-Services system to a new platform,… -

Refundtalk replied to the topic What is the Taxpayer Bill of Rights? in the forum Tax Advocate Service 7 years, 2 months ago

The Taxpayer Bill of Rights describes ten basic rights that all taxpayers have when dealing with the IRS. TAS taxpayer rights page can help you understand what these rights mean to you and how they apply. These are your rights. Know them. Use them.

Taxpayer Advocate Service can help you with common tax issues and situations: what to do if you…[Read more]

-

Refundtalk replied to the topic What can I do if I have a Federal Government Tax Lien? in the forum Past Due/Back Taxes 7 years, 2 months ago

Liens give the IRS a legal claim to your property as security or payment for your tax debt. A Notice of Federal Government Tax Lien may be filed only after:

- IRS assesses the liability;

- IRS send you a Notice and Demand for Payment – a bill that tells you how much you owe in taxes; and

- You neglect or refuse to fully pay the debt within 10…

-

Refundtalk replied to the topic What should I do if I have a tax problem? in the forum FAQ’s 7 years, 2 months ago

If you are experiencing a tax problem you should start out by checking out our website to see if you can find an answer to your problem. If your tax problem is more in depth, you will need to consult the IRS and/or perhaps a CPA. IRS Topic 104 – Taxpayer Advocate Program – Help for Problem Situations While the IRS strives to provide accurate and…[Read more]

-

Refundtalk replied to the topic How long will my Bank hold my tax refund? in the forum Banks 7 years, 2 months ago

Federal Regulation CC governs how long you can be made to wait before drawing funds against your account based on the timing, the type and, in certain cases, the amount of the deposit. Generally, a bank or credit union has until at least the next business day to make most deposits available but can make them available sooner if it wishes.

The…[Read more]

-

Refundtalk replied to the topic How can I receive official IRS Tax Forms? in the forum Tax Forms 7 years, 2 months ago

The IRS provides two methods to receive official IRS Tax Forms. Call 1-800-TAX-FORM (1-800-829-3676) or click here to order Information Returns and Employer Returns Online, and the IRS will mail you the forms and other products.

-

Refundtalk replied to the topic Does the PATH ACT impact when I should file my taxes? in the forum PATH ACT 7 years, 2 months ago

No. Taxpayers do not need to file differently. While people who claim the EITC or ACTC may have their refund delayed, the IRS still expects to issue refunds within 21 days of filing for most taxpayers. Therefore, even if impacted by the PATH Act, taxpayers should file as normal when they have received all their tax documents.

-

Refundtalk replied to the topic What is the PATH Act? in the forum PATH ACT 7 years, 2 months ago

The Protecting Americans from Tax Hikes (PATH) Act is a tax law passed in 2015 that has a provision requiring the IRS to hold many taxpayers’ refunds until February 15th in order to verify their information and prevent fraud. This will impact returns claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC).…[Read more]

-

Refundtalk replied to the topic What information do I need to file my taxes? in the forum How Do you Prepare Your Taxes? 7 years, 2 months ago

- W-2: This form shows how much income you made and how much you paid in taxes while working for your employer during the tax year.

- 1099: You will receive a 1099-Misc if you were not paid as an employee, but worked as an independent contractor or did work on the side and made more than $600. A 1099-INT form shows interest earned from your…

-

Refundtalk replied to the topic Why do I owe taxes? in the forum FAQ’s 7 years, 2 months ago

The first income tax in the U.S. was authorized by Congress in 1861 and levied the following year, to help pay for the Civil War, according to the Civil War Trust, but taxes have been around nearly as long as civilization itself. Historians have found tax records that go back to 6,000 B.C. in what is now Iraq, and the ancient Greek, Egyptian and…[Read more]

-

Refundtalk replied to the topic How long should I keep my tax records? in the forum FAQ’s 7 years, 2 months ago

The IRS says you should hang onto your tax documents for three years; if you get audited, that’s generally the look back period they’re allowed to cover. However, if they suspect fraud or underpayment of income tax, or if you’ve written off worthless securities, they can request up to seven years’ worth of tax records. Hang onto documents like re…[Read more]

- Load More