Refundtalk

@admin

-

Refundtalk wrote a new post 1 year, 7 months ago

What does Transaction Code 420 mean on my Account Transcript?

The transaction code TC 420 is an Examination of the tax return and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this…

The transaction code TC 420 is an Examination of the tax return and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this… -

Refundtalk wrote a new post 1 year, 7 months ago

IRS advises early filers to consider filing an amended return if they reported tax refunds as taxable.

The Internal Revenue Service said that taxpayers who filed their federal income taxes early in this year’s filing season and reported certain state 2022 tax refunds as taxable income should consider filing an a…

The Internal Revenue Service said that taxpayers who filed their federal income taxes early in this year’s filing season and reported certain state 2022 tax refunds as taxable income should consider filing an a… -

Refundtalk wrote a new post 1 year, 8 months ago

What does transaction code 810 mean on my Account Transcript?

The Transaction Code TC 810 Refund Freeze is a Freeze Code the IRS uses that will hold/stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and…

The Transaction Code TC 810 Refund Freeze is a Freeze Code the IRS uses that will hold/stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and… -

Refundtalk wrote a new post 1 year, 8 months ago

IRS Warns of Dangerous New Tax Scam Involving W-2 Forms

The Internal Revenue Service issued a consumer alert today to warn taxpayers of new scams that urge people to use wage information on a tax return to claim false credits in hopes of getting a big refund. One…

The Internal Revenue Service issued a consumer alert today to warn taxpayers of new scams that urge people to use wage information on a tax return to claim false credits in hopes of getting a big refund. One… -

Refundtalk wrote a new post 1 year, 9 months ago

Avoid the holiday rush after Presidents Day. Get help with IRS online tools

The Internal Revenue Service (IRS) recognized Presidents Day as a federal holiday and is therefore closed. In anticipation of the upcoming holiday, the IRS warned people who planned to call before and after the…

The Internal Revenue Service (IRS) recognized Presidents Day as a federal holiday and is therefore closed. In anticipation of the upcoming holiday, the IRS warned people who planned to call before and after the… -

Refundtalk wrote a new post 1 year, 9 months ago

PATH ACT TAX REFUND HOLD 2023 ENDS TODAY

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted on…

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted on… -

Refundtalk wrote a new post 1 year, 9 months ago

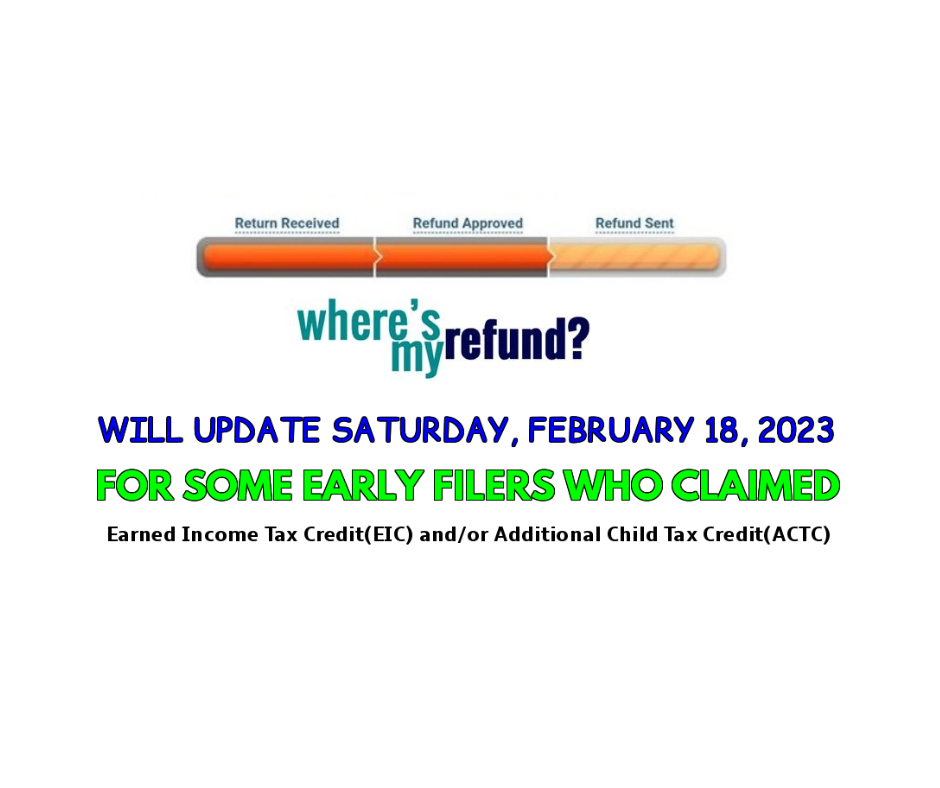

IRS Will Update Where’s My Refund? Tool by February 18

The IRS’s “Where’s My Refund?” tool will be updated by February 18, 2023, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some ta…

The IRS’s “Where’s My Refund?” tool will be updated by February 18, 2023, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some ta… -

Refundtalk wrote a new post 1 year, 9 months ago

New IRS Feature Allows Taxpayers to Electronically File Amended Returns to Opt for Direct Deposit for Faster Refunds

IRS has improved its services this tax season, people e-filing filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit and enter their banking or…

IRS has improved its services this tax season, people e-filing filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit and enter their banking or… -

Refundtalk wrote a new post 1 year, 9 months ago

IRS announces special Saturday hours for face-to-face help at Taxpayer Assistance Centers across the nation

As part of a continuing effort to improve service this tax season, the Internal Revenue Service today announced special Saturday hours for the next four months at Taxpayer Assistance Centers (TACs) across the c…

As part of a continuing effort to improve service this tax season, the Internal Revenue Service today announced special Saturday hours for the next four months at Taxpayer Assistance Centers (TACs) across the c… -

Refundtalk wrote a new post 1 year, 10 months ago

Join us for EITC Awareness Day on Friday, January 27, 2023

The Internal Revenue Service and partners nationwide today kicked off their Earned Income Tax Credit Awareness Day outreach campaign to help millions of Americans who earned $59,187 or less last year take a…

The Internal Revenue Service and partners nationwide today kicked off their Earned Income Tax Credit Awareness Day outreach campaign to help millions of Americans who earned $59,187 or less last year take a… -

Refundtalk wrote a new post 1 year, 10 months ago

Top Facts Filers Should Know for IRS Opening Day 2023!

Opening Day for the IRS is Today January 23, 2023. The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file electronically with…

Opening Day for the IRS is Today January 23, 2023. The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file electronically with… -

Refundtalk wrote a new post 1 year, 10 months ago

How Much is The Child Tax Credit Worth?

During the coronavirus pandemic, the American Rescue Plan temporarily boosted the maximum Child Tax Credit amount to $3,000 (children between the ages of 6 and 17) and $3,600 (children under age 6) for the 2021…

During the coronavirus pandemic, the American Rescue Plan temporarily boosted the maximum Child Tax Credit amount to $3,000 (children between the ages of 6 and 17) and $3,600 (children under age 6) for the 2021… -

Refundtalk wrote a new post 1 year, 10 months ago

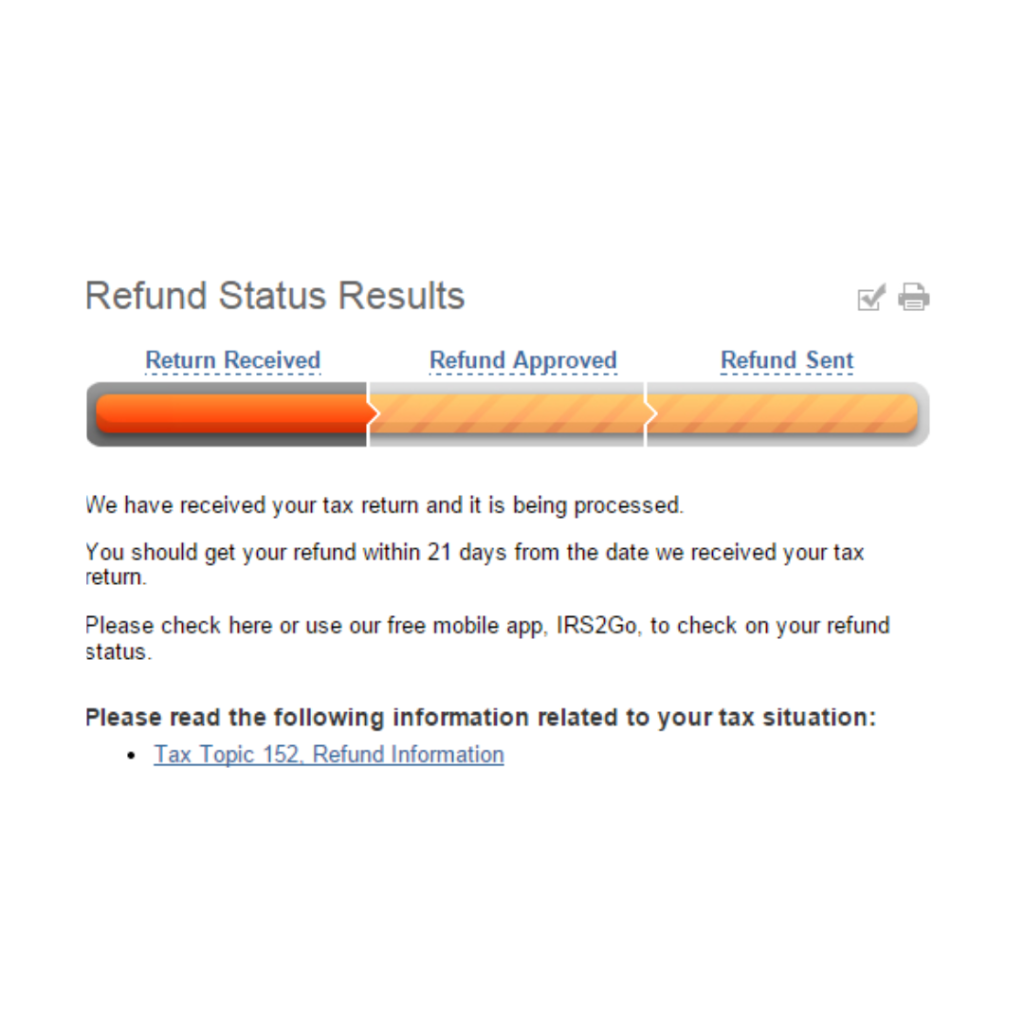

Was your tax return accepted before the IRS Opening day in 2023?

The 2023 tax season has now officially started and some early taxpayers have already received notifications from Where’s My Refund? and their tax services. If you’ve prepared and filed your taxes early, keep…

The 2023 tax season has now officially started and some early taxpayers have already received notifications from Where’s My Refund? and their tax services. If you’ve prepared and filed your taxes early, keep… -

Refundtalk wrote a new post 1 year, 10 months ago

Tax Tips for the 2023 Tax Season

Tax Refunds May Be Smaller This Year Plan now to learn these 2023 tax tips to avoid surprises in the future! If you’re expecting a tax refund in 2023, it may be smaller than last year, according to the IRS. Y…

Tax Refunds May Be Smaller This Year Plan now to learn these 2023 tax tips to avoid surprises in the future! If you’re expecting a tax refund in 2023, it may be smaller than last year, according to the IRS. Y… -

Refundtalk wrote a new post 1 year, 10 months ago

Choose Your Tax Preparer Wisely

You’ve heard it before. Since it’s tax time, you’ll hear it again. Choose your tax preparer wisely. This past year has been difficult for most of us as we were on the verge of a recession. Prices are…

You’ve heard it before. Since it’s tax time, you’ll hear it again. Choose your tax preparer wisely. This past year has been difficult for most of us as we were on the verge of a recession. Prices are… -

Refundtalk wrote a new post 1 year, 10 months ago

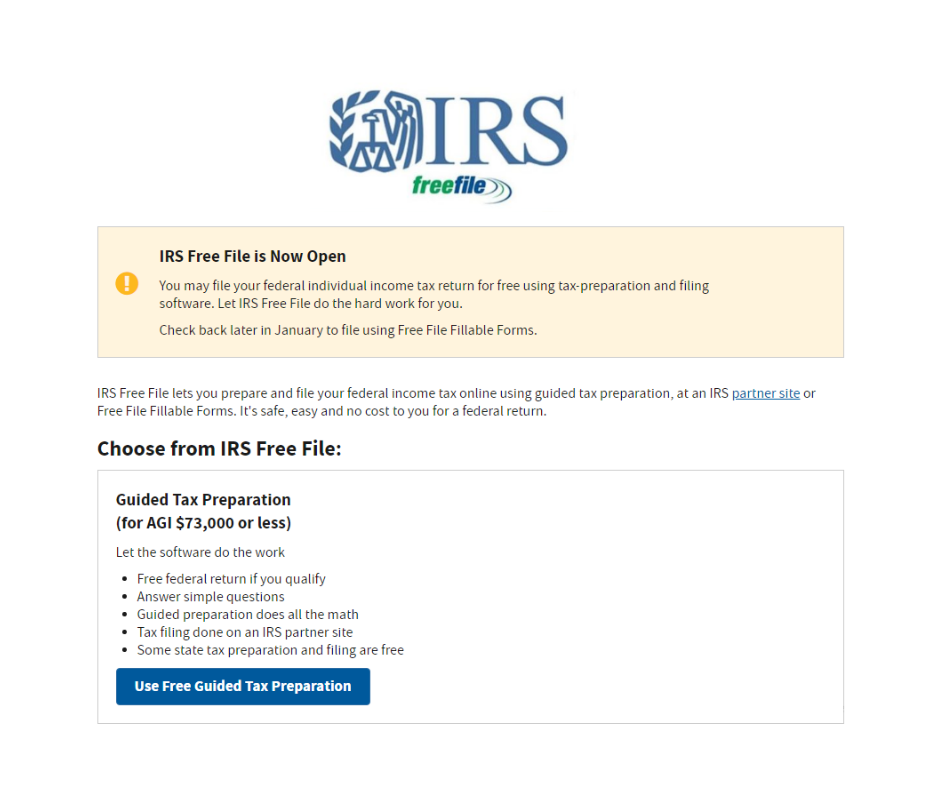

IRS Free File Opens Jan. 13, 2023!

Most taxpayers can get an early start on their federal tax returns as IRS Free File – an online tax preparation product available at no charge − opens today January 13, 2023, for the 2023 tax filing seaso…

Most taxpayers can get an early start on their federal tax returns as IRS Free File – an online tax preparation product available at no charge − opens today January 13, 2023, for the 2023 tax filing seaso… -

Refundtalk wrote a new post 1 year, 10 months ago

Taxpayer Advocacy Service report highlights top 10 issues facing taxpayers

A new report by the IRS Taxpayer Advocate says processing delays are the “Most Serious Problem” faced by taxpayers during 2022. From the report’s Executive Summary: In 2020, the IRS quickly fell beh…

A new report by the IRS Taxpayer Advocate says processing delays are the “Most Serious Problem” faced by taxpayers during 2022. From the report’s Executive Summary: In 2020, the IRS quickly fell beh… -

Refundtalk wrote a new post 1 year, 10 months ago

How To File Your Taxes For Free

Millions of U.S. taxpayers are eligible to have their federal income tax returns filed for free through the IRS Free File program. Depending on your adjusted gross income (AGI), you may be able to use the…

Millions of U.S. taxpayers are eligible to have their federal income tax returns filed for free through the IRS Free File program. Depending on your adjusted gross income (AGI), you may be able to use the… -

Refundtalk wrote a new post 1 year, 10 months ago

IRS Opening Day for the 2023 Tax Season

The Internal Revenue Service has announced that the nation’s tax season will start on Monday, Jan. 24, 2023, when the tax agency will begin accepting and processing 2022 tax year returns. The Internal R…

The Internal Revenue Service has announced that the nation’s tax season will start on Monday, Jan. 24, 2023, when the tax agency will begin accepting and processing 2022 tax year returns. The Internal R… -

Refundtalk wrote a new post 1 year, 10 months ago

Why You Can Expect A Smaller IRS Tax Refund In 2023

Changes to tax rules for charitable contributions and the end of pandemic-related stimulus and credits could mean less money for you. It’s highly likely your tax refund will be smaller in 2023, the Internal R…

Changes to tax rules for charitable contributions and the end of pandemic-related stimulus and credits could mean less money for you. It’s highly likely your tax refund will be smaller in 2023, the Internal R… - Load More