Refundtalk

@admin

-

Refundtalk wrote a new post 1 year, 6 months ago

Tax Refund Status: "We Have Received Your Tax Return and It Is Being Processed" vs. "Your Tax Return Is Still Being Processed"

Filing taxes can be an anxious time, and waiting for your tax refund can add to the anticipation. When checking your refund status on the IRS “Where’s My Refund?” tool, you may come across different messages…

Filing taxes can be an anxious time, and waiting for your tax refund can add to the anticipation. When checking your refund status on the IRS “Where’s My Refund?” tool, you may come across different messages… -

Refundtalk wrote a new post 1 year, 6 months ago

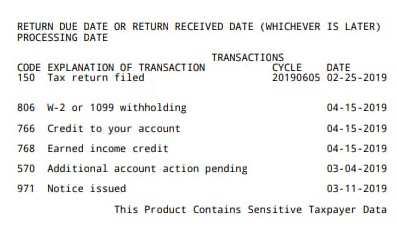

Tax Transcript Codes 570 and 971: Understanding Additional Account Action Pending and Notice Issued

Tax season can often bring confusion and anxiety, especially when encountering unfamiliar codes on your tax transcript. Two common codes that taxpayers may come across are 570 and 971. In this blog post, we’ll…

Tax season can often bring confusion and anxiety, especially when encountering unfamiliar codes on your tax transcript. Two common codes that taxpayers may come across are 570 and 971. In this blog post, we’ll… -

Refundtalk wrote a new post 1 year, 7 months ago

Decoding Tax Transcript Code 150: Understanding its SignificanceTax season can often leave us puzzled by the numerous codes and terminologies we encounter. One such code is “150” which appears on tax account transcripts. If you’ve come across tax transcript code 150 while…

-

Refundtalk wrote a new post 1 year, 7 months ago

Tax Transcripts: A Step-by-Step Guide to Break Down and Understand ThemTax transcripts are essential documents that provide a detailed summary of your tax return information. While they may appear complex and intimidating at first glance, understanding how to break down and interpret…

-

Refundtalk wrote a new post 1 year, 7 months ago

Unraveling the Delayed Tax Refunds: Unprecedented Challenges Faced by the IRS in 2023Tax season is a time that often evokes mixed emotions for individuals and businesses alike. While many eagerly await their tax refunds, it’s not uncommon to encounter delays in receiving them. In 2023, the Internal…

-

Refundtalk wrote a new post 1 year, 7 months ago

Patience and Precision: A Guide for Taxpayers Awaiting Amended Tax RefundsTax season can be both daunting and challenging, with numerous forms to fill out, calculations to double-check, and deadlines to meet. However, the process doesn’t always end with the submission of your tax return.…

-

Refundtalk wrote a new post 1 year, 7 months ago

IRS Account Transcripts: Unlocking Valuable Tax InformationTaxation is an integral part of our lives, and understanding our financial obligations to the Internal Revenue Service (IRS) is crucial. When it comes to accessing and interpreting your tax records, IRS account…

-

Refundtalk wrote a new post 1 year, 7 months ago

Navigating the Challenges of Delayed Tax Refunds: What You Need to KnowTax season is a period of anticipation for many individuals and businesses alike. It’s a time when taxpayers eagerly await their refunds, which can provide a much-needed financial boost or help cover important…

-

Refundtalk wrote a new post 1 year, 7 months ago

Patience Pays Off: A Guide for US Taxpayers Awaiting IRS Tax RefundsTax season is an annual event that can cause a mix of anticipation and anxiety for many Americans. While most taxpayers diligently file their returns on time, some unfortunate individuals find themselves waiting for…

-

Refundtalk wrote a new post 1 year, 7 months ago

Understanding Tax Refunds: When Can Taxpayers Expect Their Money?Tax season is a time of both anticipation and confusion for many individuals. While filing taxes can be a daunting task, the prospect of receiving a tax refund often brings a sense of relief and excitement. However,…

-

Refundtalk wrote a new post 1 year, 8 months ago

April 18, 2023, is the Tax Deadlines for 2022 Returns

The Internal Revenue Service reminds taxpayers that IRS.gov provides last-minute tax return filers with the resources they need to get taxes done before the April 18 deadline. IRS.gov remains a great resource…

The Internal Revenue Service reminds taxpayers that IRS.gov provides last-minute tax return filers with the resources they need to get taxes done before the April 18 deadline. IRS.gov remains a great resource… -

Refundtalk wrote a new post 1 year, 8 months ago

What does Transaction Code 424 mean on my Account Transcript?

The transaction code TC 424 is an Examination Request and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this code TC 424…

The transaction code TC 424 is an Examination Request and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this code TC 424… -

Refundtalk wrote a new post 1 year, 8 months ago

What does Transaction Code 420 mean on my Account Transcript?

The transaction code TC 420 is an Examination of the tax return and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this…

The transaction code TC 420 is an Examination of the tax return and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this… -

Refundtalk wrote a new post 1 year, 8 months ago

IRS advises early filers to consider filing an amended return if they reported tax refunds as taxable.

The Internal Revenue Service said that taxpayers who filed their federal income taxes early in this year’s filing season and reported certain state 2022 tax refunds as taxable income should consider filing an a…

The Internal Revenue Service said that taxpayers who filed their federal income taxes early in this year’s filing season and reported certain state 2022 tax refunds as taxable income should consider filing an a… -

Refundtalk wrote a new post 1 year, 9 months ago

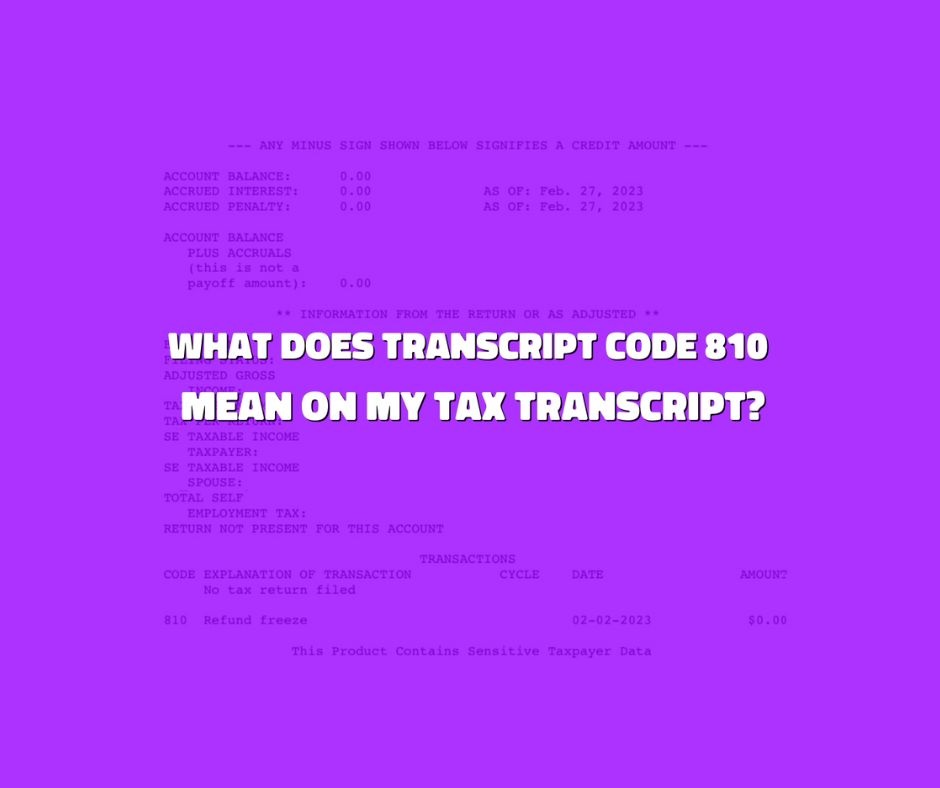

What does transaction code 810 mean on my Account Transcript?

The Transaction Code TC 810 Refund Freeze is a Freeze Code the IRS uses that will hold/stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and…

The Transaction Code TC 810 Refund Freeze is a Freeze Code the IRS uses that will hold/stop a refund from being issued until the impact of the action being taken on the account and the refund is determined and… -

Refundtalk wrote a new post 1 year, 9 months ago

IRS Warns of Dangerous New Tax Scam Involving W-2 Forms

The Internal Revenue Service issued a consumer alert today to warn taxpayers of new scams that urge people to use wage information on a tax return to claim false credits in hopes of getting a big refund. One…

The Internal Revenue Service issued a consumer alert today to warn taxpayers of new scams that urge people to use wage information on a tax return to claim false credits in hopes of getting a big refund. One… -

Refundtalk wrote a new post 1 year, 10 months ago

Avoid the holiday rush after Presidents Day. Get help with IRS online tools

The Internal Revenue Service (IRS) recognized Presidents Day as a federal holiday and is therefore closed. In anticipation of the upcoming holiday, the IRS warned people who planned to call before and after the…

The Internal Revenue Service (IRS) recognized Presidents Day as a federal holiday and is therefore closed. In anticipation of the upcoming holiday, the IRS warned people who planned to call before and after the… -

Refundtalk wrote a new post 1 year, 10 months ago

PATH ACT TAX REFUND HOLD 2023 ENDS TODAY

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted on…

The Protecting Americans from Tax Hikes (PATH) Act was created in order to protect taxpayers and their families against fraud and permanently extend many expiring tax laws. The law, which was enacted on… -

Refundtalk wrote a new post 1 year, 10 months ago

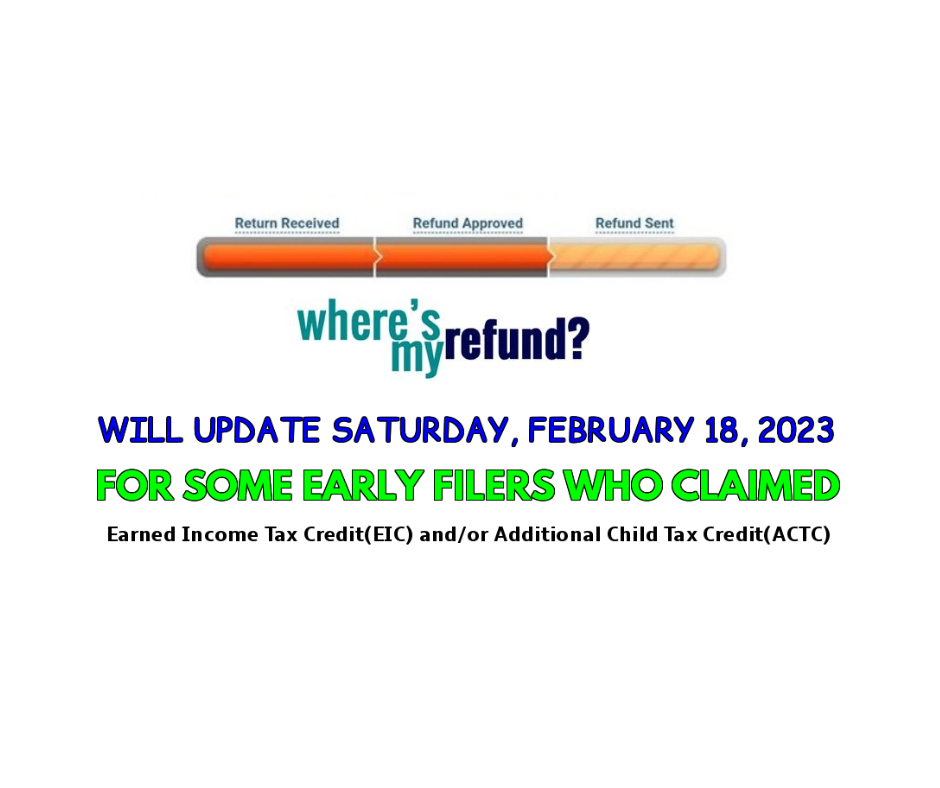

IRS Will Update Where’s My Refund? Tool by February 18

The IRS’s “Where’s My Refund?” tool will be updated by February 18, 2023, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some ta…

The IRS’s “Where’s My Refund?” tool will be updated by February 18, 2023, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some ta… -

Refundtalk wrote a new post 1 year, 10 months ago

New IRS Feature Allows Taxpayers to Electronically File Amended Returns to Opt for Direct Deposit for Faster Refunds

IRS has improved its services this tax season, people e-filing filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit and enter their banking or…

IRS has improved its services this tax season, people e-filing filing their Form 1040-X, Amended U.S Individual Income Tax Return, will for the first time be able to select direct deposit and enter their banking or… - Load More