Refundtalk

@admin

-

Refundtalk wrote a new post 2 years, 2 months ago

IRS Identity and Tax Return Verification Service

The IRS Identity and Tax Return Verification Service can help you prove that you are who you say you are. The IRS wants you to verify your identity to make you eligible for a tax return. To verify your…

The IRS Identity and Tax Return Verification Service can help you prove that you are who you say you are. The IRS wants you to verify your identity to make you eligible for a tax return. To verify your… -

Refundtalk wrote a new post 2 years, 2 months ago

The Adoption Tax Credit

The adoption tax credit lets families who were in the adoption process during 2022 claim up to $14,890 in eligible adoption expenses for each eligible child. Taxpayers can apply the credit to international,…

The adoption tax credit lets families who were in the adoption process during 2022 claim up to $14,890 in eligible adoption expenses for each eligible child. Taxpayers can apply the credit to international,… -

Refundtalk wrote a new post 2 years, 2 months ago

FAQ on Student Loan Cancellation

What is the Student Loan Cancellation? Last month, President Biden laid out a plan to cancel up to $20,000 in federal student loan debt per borrower. Beneath this seemingly simple plan comes quite a few…

What is the Student Loan Cancellation? Last month, President Biden laid out a plan to cancel up to $20,000 in federal student loan debt per borrower. Beneath this seemingly simple plan comes quite a few… -

Refundtalk wrote a new post 2 years, 2 months ago

Last month, Congress passed the Inflation Reduction Act (IRA22), which provides the IRS with supplemental funding of nearly $80 billion over the next ten years. More than half the funding has been earmarked for…

-

Refundtalk wrote a new post 2 years, 3 months ago

The Problem with Past Due Tax Returns

Tax Day rolls around each year. If you have delayed or simply passed on filing your tax return, you may be surprised at the difficulties it can cause. Everyone of working age is aware of the necessity of…

Tax Day rolls around each year. If you have delayed or simply passed on filing your tax return, you may be surprised at the difficulties it can cause. Everyone of working age is aware of the necessity of… -

Refundtalk wrote a new post 2 years, 3 months ago

Tips from IRS Security Summit to Reduce Identity Theft

Tax fraud involving identity theft is big business. The Internal Revenue Service (IRS) wants to help you understand your risks, and be proactive in preventing others from gaining access to your tax ID and…

Tax fraud involving identity theft is big business. The Internal Revenue Service (IRS) wants to help you understand your risks, and be proactive in preventing others from gaining access to your tax ID and… -

Refundtalk wrote a new post 2 years, 3 months ago

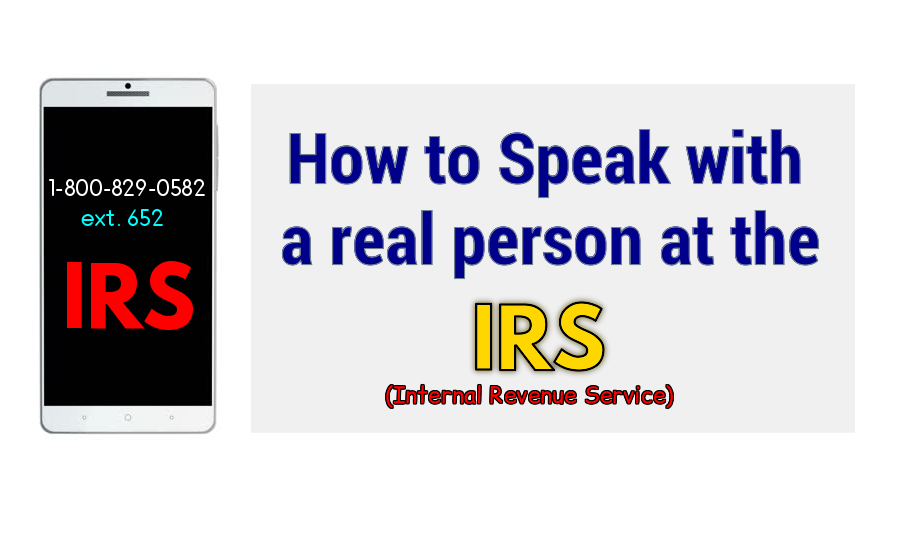

How Can I Talk to a Live Agent at the IRS?

Simple steps you can take to reach a live agent at the IRS For many taxpayers, the most frustrating part about doing their taxes is getting ahold of a real person at the IRS. The IRS is understaffed and…

Simple steps you can take to reach a live agent at the IRS For many taxpayers, the most frustrating part about doing their taxes is getting ahold of a real person at the IRS. The IRS is understaffed and… -

Refundtalk wrote a new post 2 years, 4 months ago

It’s filing extension crunch time, but people rushing to get their tax return filed should be cautious when choosing a tax preparer. Anyone can be a paid tax return preparer if they have an IRS preparer tax…

-

Refundtalk wrote a new post 2 years, 4 months ago

The Internal Revenue Service announced expanded voice bot options to help eligible taxpayers easily verify their identity to set up or modify a payment plan while avoiding long wait times.

“This is part of a…

-

Refundtalk wrote a new post 2 years, 5 months ago

If the IRS selects your tax return for audit (also called examination), it doesn’t automatically mean something is wrong.

The IRS performs audits by mail or in person. The notice you receive will have speci…

-

Refundtalk wrote a new post 2 years, 5 months ago

When taxpayers have a question, their first stop should be IRS.gov. The Let Us Help You page is a great way to get answers to tax questions fast. People who call the IRS for additional help will need to have i…

-

Refundtalk wrote a new post 2 years, 5 months ago

IRS Taking Steps to Boost Security to Avoid Cyberattacks

With the move to remote work, the Internal Revenue Service (IRS) continues to work to deter and prevent cyberattacks on confidential taxpayer information. Personal information is valuable to digital bad…

With the move to remote work, the Internal Revenue Service (IRS) continues to work to deter and prevent cyberattacks on confidential taxpayer information. Personal information is valuable to digital bad… -

Refundtalk wrote a new post 2 years, 6 months ago

IRS Letters and Notices

The Internal Revenue Service (IRS) sends millions of letters to taxpayers every year. The majority of these will be mailed out after the tax filing and payment deadline have passed. If you receive an IRS letter,…

The Internal Revenue Service (IRS) sends millions of letters to taxpayers every year. The majority of these will be mailed out after the tax filing and payment deadline have passed. If you receive an IRS letter,… -

Refundtalk wrote a new post 2 years, 6 months ago

Understanding How to Dispute an IRS Notice

It is not unusual for the Internal Revenue Service (IRS) to question a tax return or note an adjustment if you have been through an IRS audit. If you do not agree with a correction on your returns, you can dispute…

It is not unusual for the Internal Revenue Service (IRS) to question a tax return or note an adjustment if you have been through an IRS audit. If you do not agree with a correction on your returns, you can dispute… -

Refundtalk wrote a new post 2 years, 6 months ago

Study Finds IRS Audits Not Focused on High-Income Earners

New research finds the Internal Revenue Service (IRS) is aiming civil audits at low-wage earners, demonstrating a confounding approach to a group less known for tax fraud than those with greater wealth. The…

New research finds the Internal Revenue Service (IRS) is aiming civil audits at low-wage earners, demonstrating a confounding approach to a group less known for tax fraud than those with greater wealth. The… -

Refundtalk wrote a new post 2 years, 7 months ago

Monday is Tax Day, the federal deadline for individual tax filings and payments.

Monday is Tax Day — the federal deadline for individual tax filing and payments — and the IRS expects to receive tens of mil…

-

Refundtalk wrote a new post 2 years, 7 months ago

Was your identity stolen? Request an Identity Protection PIN from the IRS

The Internal Revenue Service today reminded all taxpayers – particularly those who are identity theft victims – of an important ste…

-

Refundtalk wrote a new post 2 years, 7 months ago

What is a Badge of Fraud?

A “badge of fraud” is an indicator used by the Internal Revenue Service (IRS) to flag a potentially fraudulent return, transaction, or activity. A better understanding of what triggers IRS interest can help you ste…

A “badge of fraud” is an indicator used by the Internal Revenue Service (IRS) to flag a potentially fraudulent return, transaction, or activity. A better understanding of what triggers IRS interest can help you ste… -

Refundtalk wrote a new post 2 years, 8 months ago

The IRS has a numbered notice for almost any communication they provide to a taxpayer. In some cases, the taxpayer may safely review a communication without taking any further action. For example, the IRS ro…

-

Refundtalk wrote a new post 2 years, 8 months ago

IRS LT11 Notices (“LT11”) and Letters 1058. The IRS issues these particular “final” notices to taxpayers before it takes certain levy actions. Taxpayers must pay attention to these notices, as well as others,…

- Load More