Refundtalk

@admin

-

Refundtalk wrote a new post 2 years, 5 months ago

The Internal Revenue Service announced expanded voice bot options to help eligible taxpayers easily verify their identity to set up or modify a payment plan while avoiding long wait times.

“This is part of a…

-

Refundtalk wrote a new post 2 years, 6 months ago

If the IRS selects your tax return for audit (also called examination), it doesn’t automatically mean something is wrong.

The IRS performs audits by mail or in person. The notice you receive will have speci…

-

Refundtalk wrote a new post 2 years, 6 months ago

When taxpayers have a question, their first stop should be IRS.gov. The Let Us Help You page is a great way to get answers to tax questions fast. People who call the IRS for additional help will need to have i…

-

Refundtalk wrote a new post 2 years, 6 months ago

IRS Taking Steps to Boost Security to Avoid Cyberattacks

With the move to remote work, the Internal Revenue Service (IRS) continues to work to deter and prevent cyberattacks on confidential taxpayer information. Personal information is valuable to digital bad…

With the move to remote work, the Internal Revenue Service (IRS) continues to work to deter and prevent cyberattacks on confidential taxpayer information. Personal information is valuable to digital bad… -

Refundtalk wrote a new post 2 years, 7 months ago

IRS Letters and Notices

The Internal Revenue Service (IRS) sends millions of letters to taxpayers every year. The majority of these will be mailed out after the tax filing and payment deadline have passed. If you receive an IRS letter,…

The Internal Revenue Service (IRS) sends millions of letters to taxpayers every year. The majority of these will be mailed out after the tax filing and payment deadline have passed. If you receive an IRS letter,… -

Refundtalk wrote a new post 2 years, 7 months ago

Understanding How to Dispute an IRS Notice

It is not unusual for the Internal Revenue Service (IRS) to question a tax return or note an adjustment if you have been through an IRS audit. If you do not agree with a correction on your returns, you can dispute…

It is not unusual for the Internal Revenue Service (IRS) to question a tax return or note an adjustment if you have been through an IRS audit. If you do not agree with a correction on your returns, you can dispute… -

Refundtalk wrote a new post 2 years, 7 months ago

Study Finds IRS Audits Not Focused on High-Income Earners

New research finds the Internal Revenue Service (IRS) is aiming civil audits at low-wage earners, demonstrating a confounding approach to a group less known for tax fraud than those with greater wealth. The…

New research finds the Internal Revenue Service (IRS) is aiming civil audits at low-wage earners, demonstrating a confounding approach to a group less known for tax fraud than those with greater wealth. The… -

Refundtalk wrote a new post 2 years, 8 months ago

Monday is Tax Day, the federal deadline for individual tax filings and payments.

Monday is Tax Day — the federal deadline for individual tax filing and payments — and the IRS expects to receive tens of mil…

-

Refundtalk wrote a new post 2 years, 8 months ago

Was your identity stolen? Request an Identity Protection PIN from the IRS

The Internal Revenue Service today reminded all taxpayers – particularly those who are identity theft victims – of an important ste…

-

Refundtalk wrote a new post 2 years, 8 months ago

What is a Badge of Fraud?

A “badge of fraud” is an indicator used by the Internal Revenue Service (IRS) to flag a potentially fraudulent return, transaction, or activity. A better understanding of what triggers IRS interest can help you ste…

A “badge of fraud” is an indicator used by the Internal Revenue Service (IRS) to flag a potentially fraudulent return, transaction, or activity. A better understanding of what triggers IRS interest can help you ste… -

Refundtalk wrote a new post 2 years, 9 months ago

The IRS has a numbered notice for almost any communication they provide to a taxpayer. In some cases, the taxpayer may safely review a communication without taking any further action. For example, the IRS ro…

-

Refundtalk wrote a new post 2 years, 9 months ago

IRS LT11 Notices (“LT11”) and Letters 1058. The IRS issues these particular “final” notices to taxpayers before it takes certain levy actions. Taxpayers must pay attention to these notices, as well as others,…

-

Refundtalk wrote a new post 2 years, 9 months ago

You might receive an IRS Notice CP2000 (“CP2000”) in the mail. The IRS issues these particular notices to taxpayers based on discrepancies between tax return reporting and third-party reporting. Taxpayers must pay…

-

Refundtalk wrote a new post 2 years, 9 months ago

To help people during this year’s filing season, many IRS Taxpayer Assistance Centers across the country will have special Saturday hours.

These centers provide taxpayers with in-person help. The TACs are…

-

Refundtalk wrote a new post 2 years, 9 months ago

IRS Letter 5071C – Potential Identity Theft During Original Processing

The IRS is requesting additional information to validate your identity before they will continue to process your tax return.

What d…

-

Refundtalk wrote a new post 2 years, 10 months ago

Faced with a class-action suit filed on behalf of customers who claim they were tricked into paying to file their taxes, TurboTax-maker Intuit knocked the case down. The company insisted its customers had agreed…

-

Refundtalk wrote a new post 2 years, 10 months ago

Most people think of the IRS as the agency that collects taxes, but you may not know that every year, our agency distributes billions of dollars in tax credits to eligible individuals, families and businesses. The…

-

Refundtalk wrote a new post 2 years, 10 months ago

Have you received a Direct Deposit Date yet?

Please take part in the poll below if you have received your tax refund in 2024 How many early filers have already received a Direct Deposit Date? If you filed your taxes before February 15, 2024, have you…

Please take part in the poll below if you have received your tax refund in 2024 How many early filers have already received a Direct Deposit Date? If you filed your taxes before February 15, 2024, have you… -

Refundtalk wrote a new post 2 years, 10 months ago

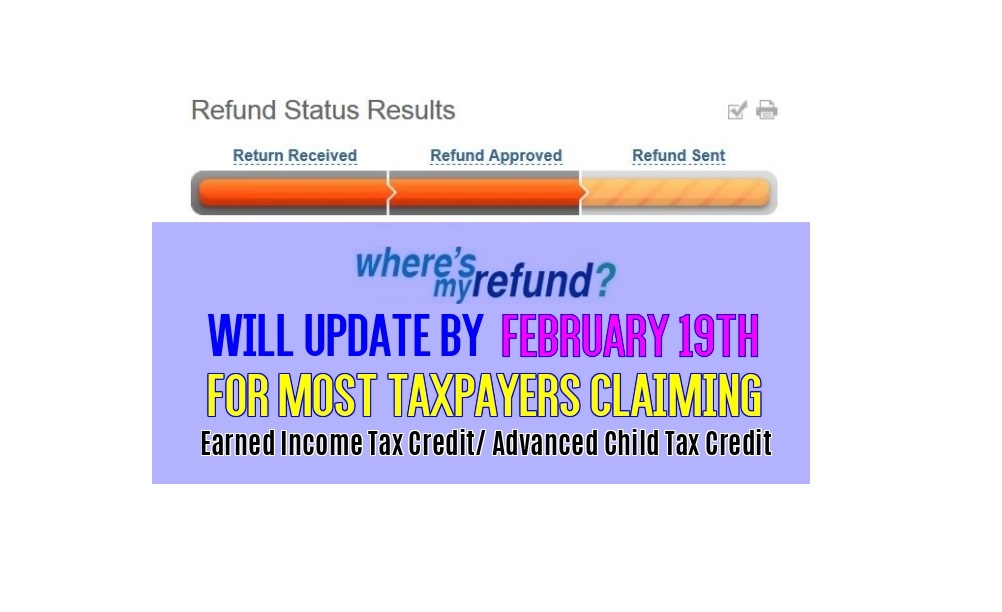

The IRS’s “Where’s My Refund?” tool will be updated by February 19, 2022, for many taxpayers who claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Before February 15, some ta…

-

Refundtalk wrote a new post 2 years, 10 months ago

About Your Notice

If you receive a letter or notice from the IRS, they will explain the reason for sending the letter and provide instructions. Many of these messages and notices can be handled simply without…

- Load More