Know When IRS Systems Are Updating

Use this hub to see typical weekly update patterns for Where’s My Refund?, tax transcripts, and amended refunds. Plan your check-in times, compare your dates, and avoid refreshing all day with no context.

Update Types Covered

This calendar focuses on the three systems most taxpayers watch during tax season.

How To Use The Calendar

Match your filing date and transcript activity with typical update days to see when you are most likely to see movement.

- Check transcript windows before logging in

- Use refund update days for direct deposit expectations

- Watch amended windows for 1040-X progress

How The Update Calendar Works

The calendar is built around recurring IRS processing patterns. While individual cases can differ, most taxpayers will see activity follow these general windows.

Transcript Posting Windows

IRS account transcripts usually refresh overnight on specific days each week, depending on whether your account is in a daily or weekly processing cycle.

- Daily accounts: multiple weekday posting windows

- Weekly accounts: a single major weekly refresh

- Use cycle codes and “As of” dates to interpret timing

Refund Status Updates

The Where’s My Refund tool typically updates after overnight processing, with certain mornings showing more “big wave” movement than others.

- Original refund status for e-filed returns

- Major morning refreshes on specific weekdays

- Messages like “Return Received” and “Refund Approved” tied to posting

1040-X Amended Updates

Amended returns follow a slower pipeline with their own update rhythm. The calendar highlights typical windows for new activity on amended refund cases.

- Longer processing timelines than original returns

- Fewer weekly update windows

- Status changes from “Received” to “Adjusted/Completed”

RefundTalk Calendar & Timing Resources

Pair the update calendar with these RefundTalk tools to decode what your codes and dates mean and how close you may be to a payout.

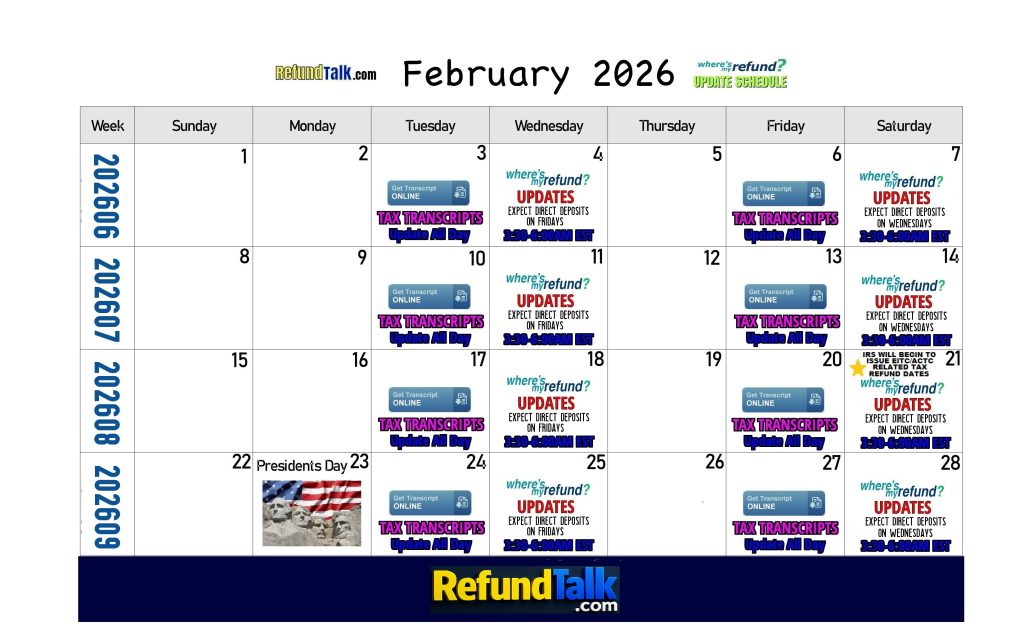

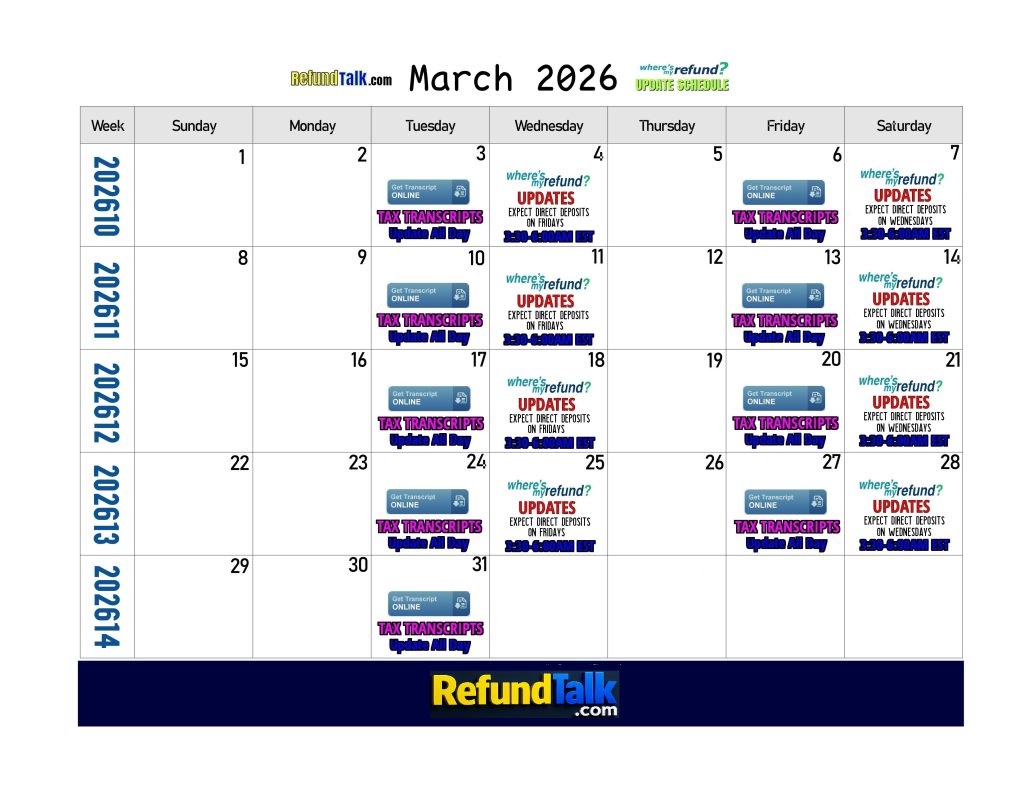

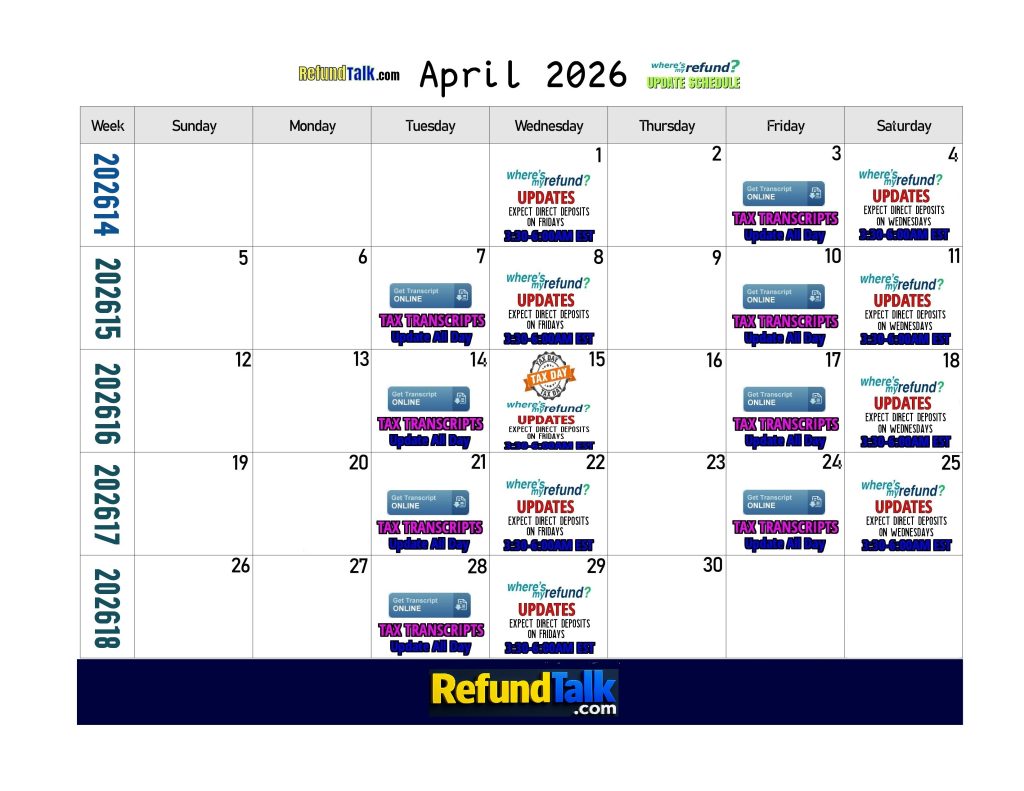

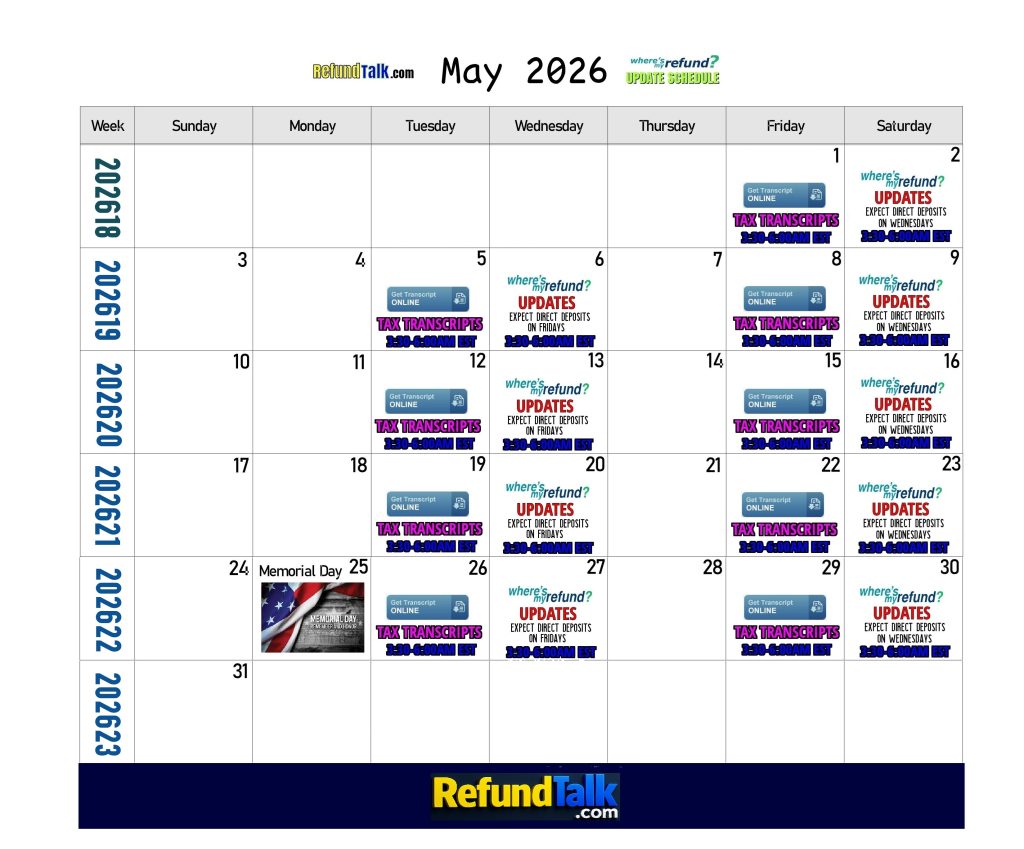

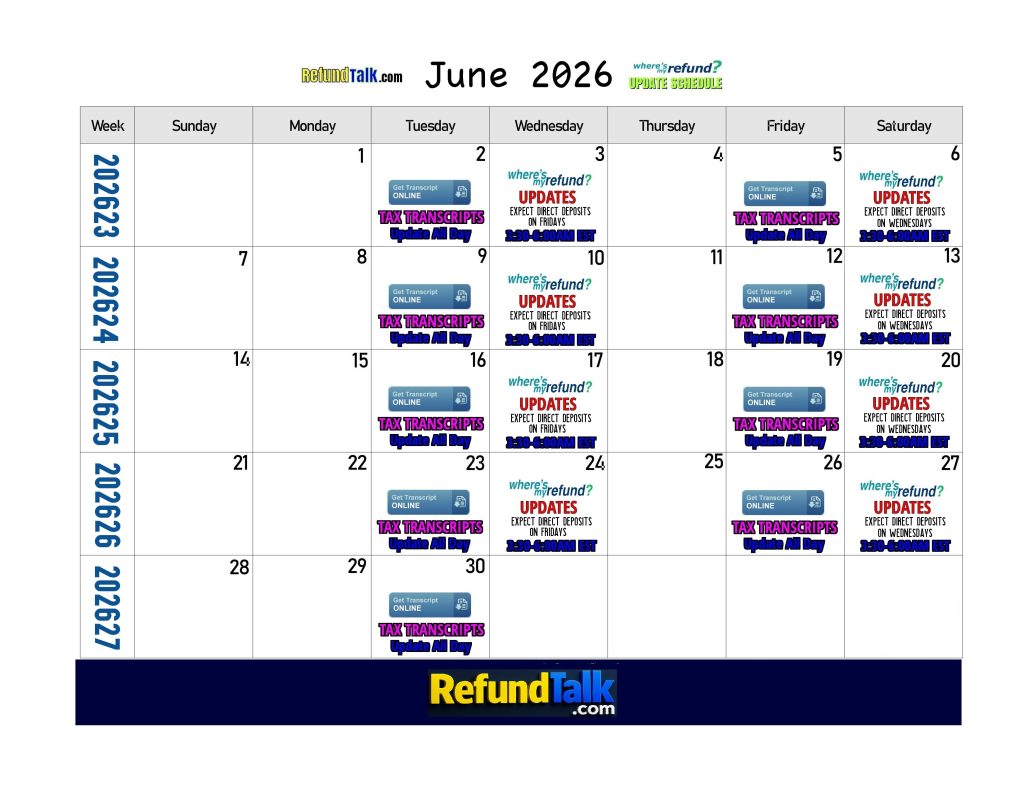

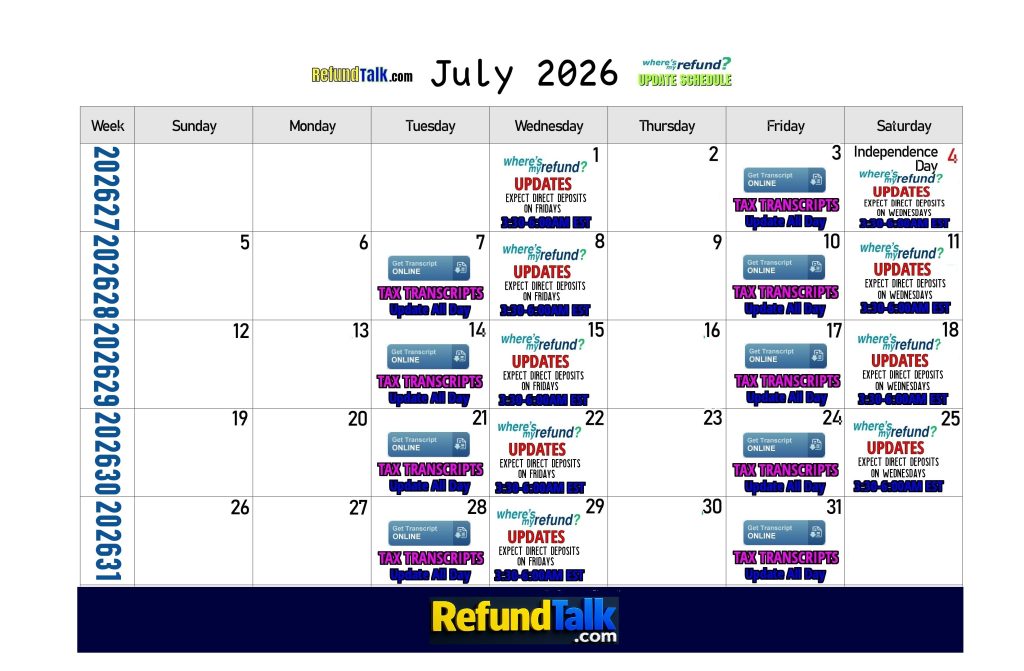

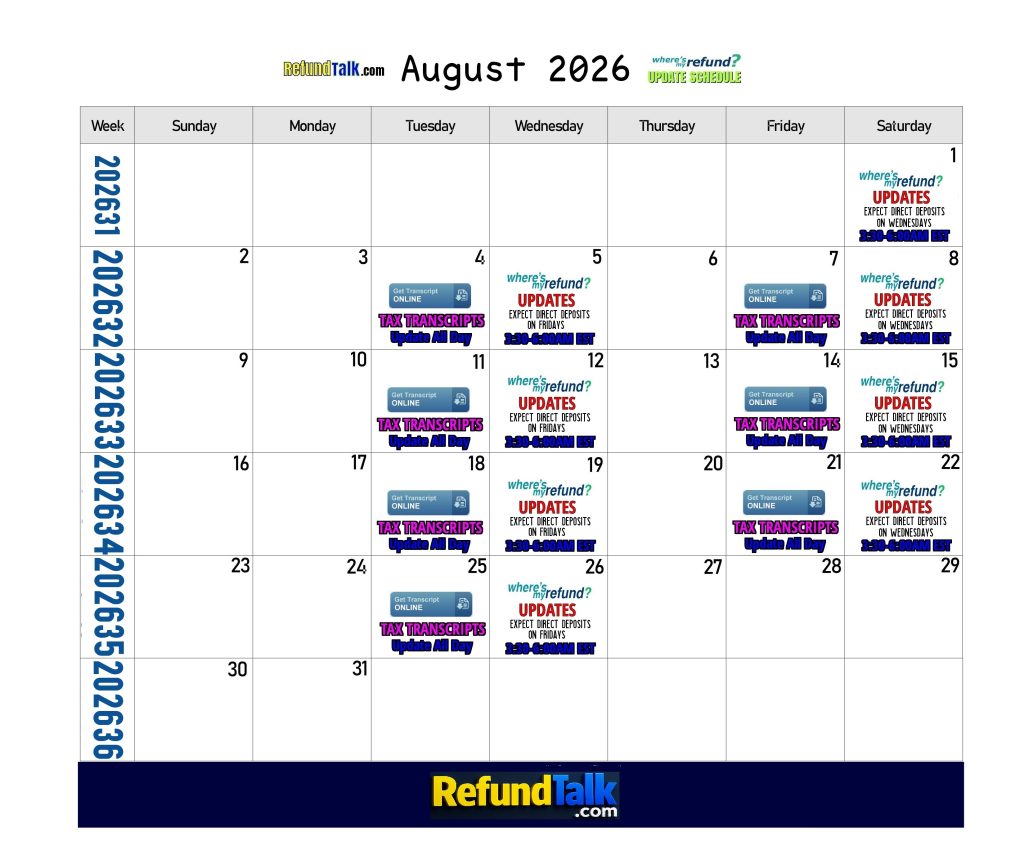

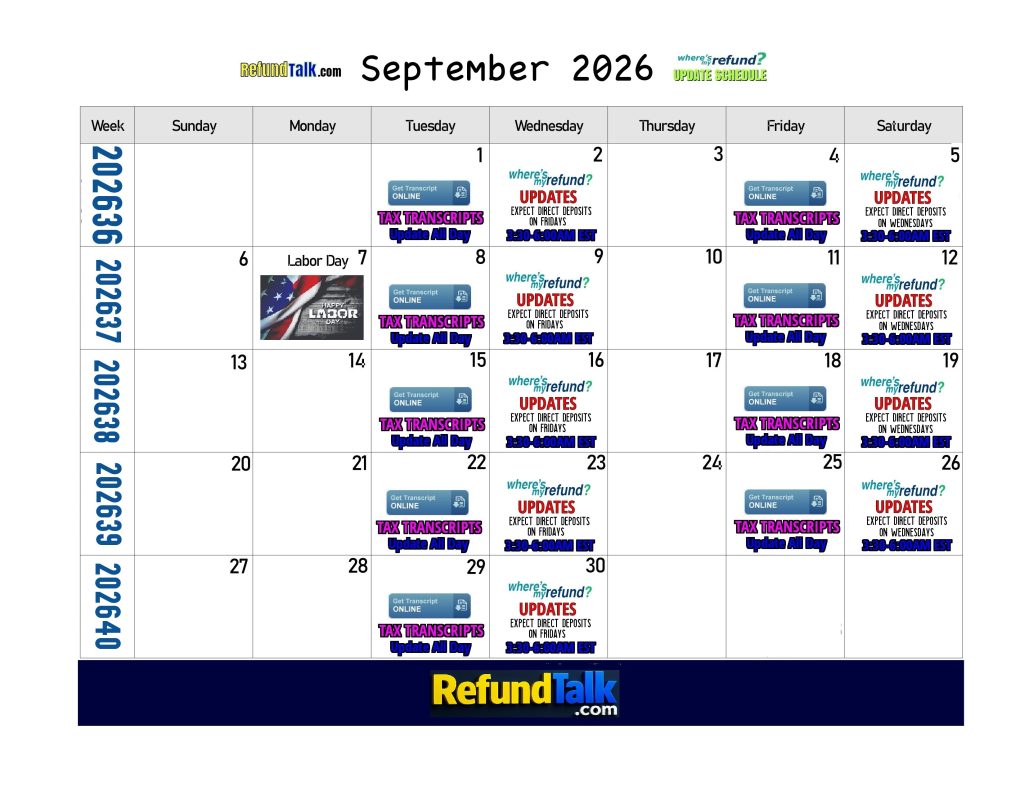

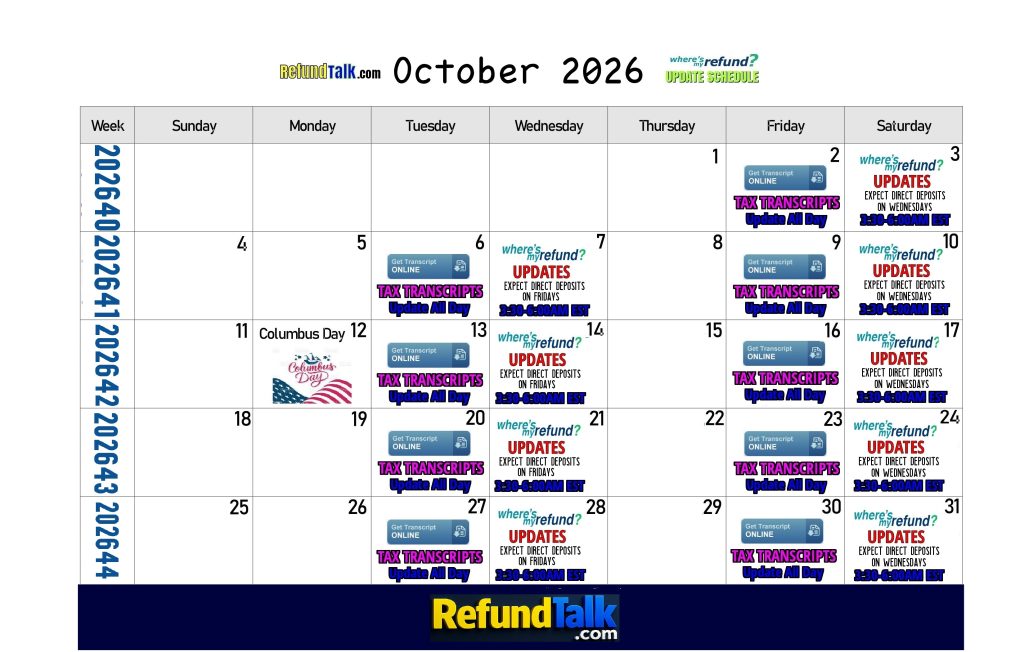

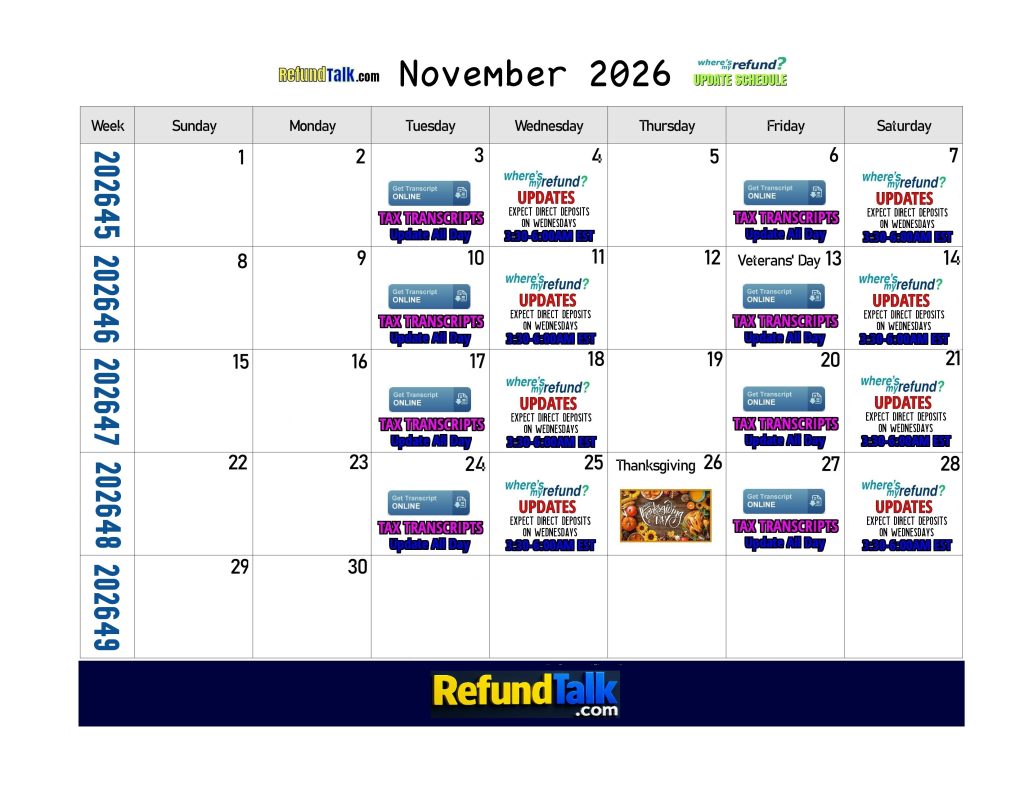

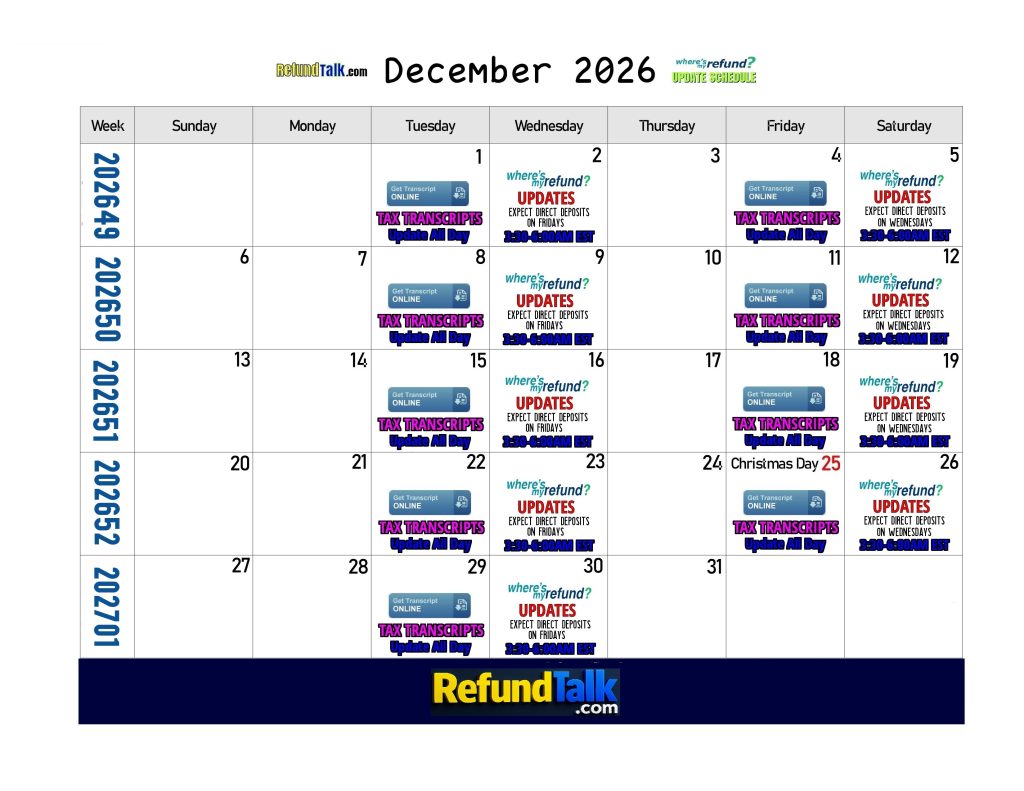

2026 IRS Update Calendar

Month-by-month view of expected transcript, refund, and amended update days for the 2026 filing season, organized for desktop and mobile viewing.

- Highlight days for transcript, refund, and amended activity

- Color-coded by update type

- Designed to match Tax Authority navy and gold theme

IRS Processing Cycles & Posting Patterns

Learn how IRS cycle codes, processing dates, and “As of” dates connect to real-world movement on your transcript and refund status.

- Daily vs weekly account rules

- Typical posting windows for each cycle

- How updates flow into direct deposits

Transcript Codes & Refund Messages

Use this directory to translate the codes and messages you see when your account updates, including key items like TC 150, 570, 846, 971 and more.

- Plain-English explanations for IRS codes

- What usually happens after each code appears

- Links to deeper guides for complex situations

Update Calendar FAQ

Common questions taxpayers have when using the Tax Refund Updates Calendar to watch transcripts, refunds, and amended returns.

Does the calendar guarantee my refund date?

How often should I check Where’s My Refund?

Why does my transcript update but my refund tool does not?

Are amended refund updates on the same schedule?

What if I see no movement on my dates for several weeks?

Does PATH Act timing change the update pattern?

Start Using The Update Calendar

Open the Tax Refund Updates Calendar, match your dates and codes, then use the linked tools and guides on RefundTalk to understand what each movement really means for your refund.

IRS Update Timing Guide

The IRS operates two primary return posting cycles: Daily and Weekly. Your transcript, refund status, and amended return updates depend on which cycle your return is assigned to. Below is the typical update schedule taxpayers experience each filing season.

Tuesday – Transcript Updates (Daily Accounts)

Daily cycle returns processed Friday–Wednesday typically show new Account Transcript activity early Tuesday morning.

Wednesday – Where’s My Refund (Daily Accounts)

Major WMR changes for Daily cycle filers—such as “Refund Approved”—often appear early Wednesday morning.

Friday – Transcript Updates (Weekly Accounts)

Weekly cycle filers see their single major weekly transcript refresh every Friday morning following Thursday’s processing.

Saturday – Where’s My Refund (Weekly Accounts)

Weekly filers typically see their major WMR movement—such as approval or deposit dates—on Saturday mornings.

Friday – Amended Return Transcript Updates

Amended return transcripts (Form 1040-X) update weekly on Fridays after Thursday processing completes.

Saturday – Where’s My Amended Refund?

WMAR (Where’s My Amended Return) updates generally follow the same weekly cycle as transcript updates, posting early Saturday.

Federal Holidays

No IRS processing, transcript updates, or refund tool changes occur on federal holidays. Expect slight delays during affected weeks.

Updates to Where’s my Refund are recorded in the EST time zone. If you are in a different time zone use this chart to determine when you should be looking for updates on WMR.

| Time Zone | Area | Time to Check WMR for Updates |

|---|---|---|

| Eastern Standard Time | Washington, DC (GMT-5) | 3:30-6:00 AM |

| Central Standard Time | Chicago (GMT-6) | 2:30-5:00 AM |

| Mountain Standard Time | Denver/Phoenix (GMT-7) | 1:30-4:00 AM |

| Pacific Standard Time | Los Angeles (GMT-8) | 12:30-3:00 AM |

Click Here to find out about Daily or Weekly Accounts

2026 IRS UPDATE CALENDAR

Where’s my Refund? Updates Calendar for 2025

IRS Transcript and the Where’s My Refund? Updates Calendars!

Click Here for More Tax Refund Update Calendars! 2018 | 2019 | 2020 | 2021 | 2022