The IRS “Where’s My Refund?” tool is an online resource that allows taxpayers to track the status of their federal income tax refund. Whether you’re eagerly awaiting your refund or just curious about its status, this tool provides a simple, step-by-step way to stay updated on your return’s progress.

Here’s a detailed guide to help you navigate and use the IRS “Where’s My Refund?” tool effectively.

How Does the ‘Where’s My Refund?’ Tool Work?

The tool monitors your tax return as it moves through three stages:

- Return Received: The IRS has received your tax return and is processing it.

- Refund Approved: Your refund has been approved and is being prepared for payment.

- Refund Sent: Your refund has been sent to your bank (for direct deposit) or a check has been mailed.

Each stage includes helpful updates so you know where your return stands and when you can expect your refund.

Step-by-Step Guide to Using the Tool

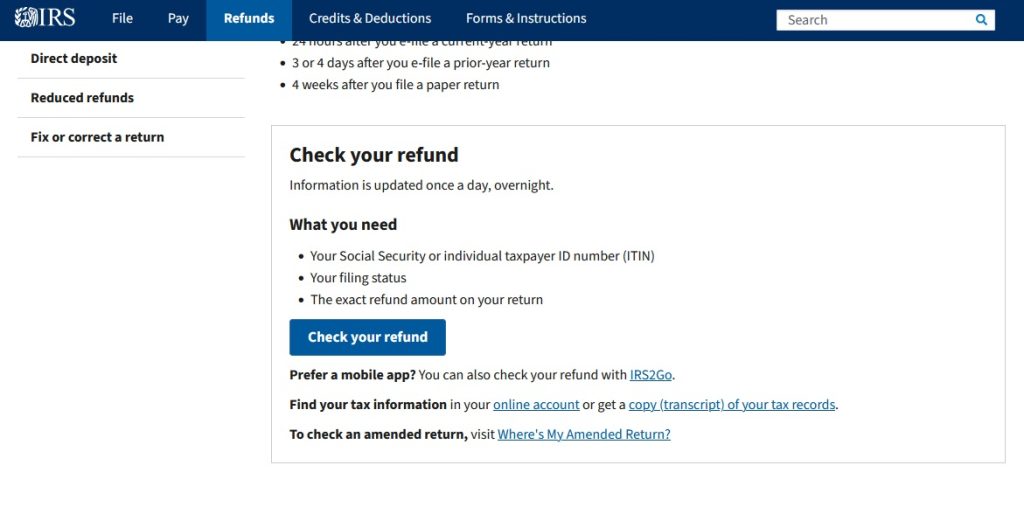

Step 1: Gather Your Information

Before accessing the tool, make sure you have the following details handy:

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): This is required to identify your return.

- Filing Status: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er).

- Exact Refund Amount: This can be found on your tax return. Make sure to input the exact dollar amount (no rounding).

Step 2: Access the ‘Where’s My Refund?’ Tool

- Visit the IRS “Where’s My Refund?” page.

- Alternatively, download the IRS2Go mobile app from the App Store or Google Play for easy tracking on the go.

Step 3: Enter Your Information

- Input your SSN or ITIN in the designated field.

- Select your filing status from the drop-down menu.

- Enter your exact refund amount as listed on your tax return.

- Click Submit to proceed.

Step 4: Review Your Refund Status

After submitting your details, the tool will display your current refund status. Here’s what each status means:

- Return Received: Your return is being processed. No further action is needed at this stage.

- Refund Approved: Your refund has been approved, and a payment date will be provided soon.

- Refund Sent: Your refund has been sent. If you opted for direct deposit, check your bank account. If you chose a paper check, allow additional time for delivery.

Key Tips for Using the Tool

- Check Once a Day: The IRS updates the “Where’s My Refund?” tool daily, typically overnight. Checking more than once a day won’t yield new information.

- Allow Processing Time: The IRS suggests waiting at least 24 hours after e-filing (or 4 weeks after mailing a paper return) before checking your status.

- Be Accurate: Ensure the information you enter matches your tax return exactly to avoid errors.

What to Do If You Can’t Access Your Status

If the tool doesn’t recognize your information or displays a message saying your return isn’t in the system:

- Double-check your entries for accuracy.

- Ensure enough time has passed since filing.

- Contact the IRS for assistance if the issue persists. You can reach their Refund Hotline at 1-800-829-1954.

Frequently Asked Questions

1. When will I receive my refund?

Most refunds are issued within 21 days of e-filing. However, some returns may require additional review, which could delay processing.

2. Can I use the tool for amended returns?

No, the “Where’s My Refund?” tool only tracks the status of original returns. For amended returns, use the “Where’s My Amended Return?” tool.

3. Does the tool work for state refunds?

No, this tool is only for federal tax refunds. Check your state’s tax agency website for state refund tracking options.

The IRS “Where’s My Refund?” tool is an essential resource for tracking your federal tax refund. By following these simple steps and tips, you can stay informed every step of the way.

Have more questions about your refund status? Drop a comment below or reach out to us for more guidance!