Eligible taxpayers who pay college expenses for themselves, their spouses, or their dependents may be able to take advantage of two 2022 education tax credits. Both the American Opportunity Tax Credit and the Lifetime Learning Credit can help offset the cost of a college education by reducing the amount of taxes owed. In this post, we’ll review the eligibility requirements of each, how to apply, and compare the two credits so you can determine which is best for you.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit (AOTC) has a maximum value of $2,500 per eligible student and can only be claimed during the first four years of enrollment in a post-secondary school. If the credit reduces your tax to zero, you may be eligible to receive a refund of up to $1,000.

Who is Eligible?

To be eligible for the AOTC, students must:

- Be pursuing a degree or other recognized education credential.

- Be enrolled at least half-time for at least one academic period beginning in the tax year.

- Not have finished the first four years of higher education at the beginning of the tax year.

- Not have claimed the AOTC or the former Hope credit for more than four tax years.

- Not have a felony drug conviction at the end of the tax year.

An academic period may be a semester, trimester, quarter, or any other period of study such as a summer session. Academic periods are determined by the schools. For schools that use clock or credit hours, the payment period may be treated as an academic period.

Income Limitations

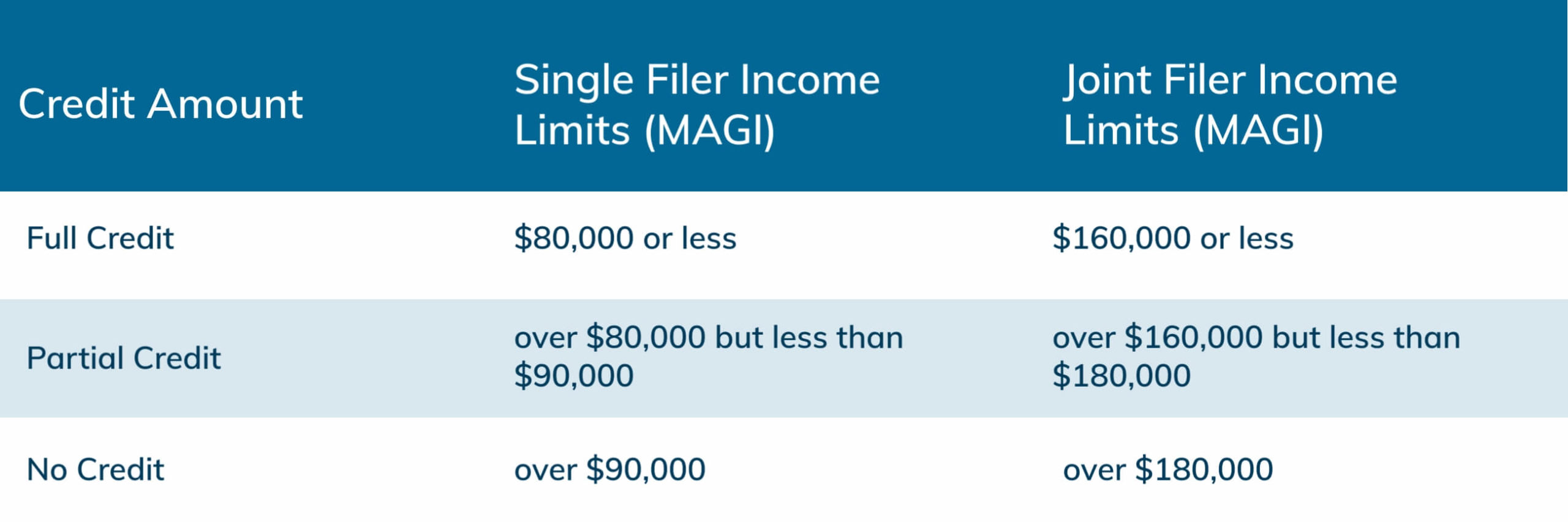

In addition to the above eligibility requirements, you must not exceed the maximum adjusted gross income (MAGI) limitations.

If you are married but file separately, you cannot claim the LLC, regardless of your income.

Eligible Expenses

To claim the AOTC, you must also incur eligible educational expenses for yourself, your spouse, or your dependents. Eligible expenses include:

- Tuition and fees are required to enroll at an eligible educational institution

- Required course materials (textbooks, calculators, etc.)

Expenses for books, supplies, and equipment needed for a course of study are included in qualified education expenses even if it is not paid to the school. Meal plans required by a school are also considered an eligible expense.

Lifetime Learning Credit (LLC)

The Lifetime Learning Credit (LLC) has no limit on the number of years it can be claimed. The maximum credit amount allowed is $2,000 (total annually, not per student) or 20% of the first $10,000 of qualified education expenses. Unlike the AOTC, however, the LLC is non-refundable.

Eligibility Requirements

To claim the LLC, you must meet all three of the following:

- You, your dependent, or a third party paid qualified education expenses for higher education.

- You, your dependent, or a third party paid the education expenses for an eligible student enrolled at an eligible educational institution.

- The eligible student is yourself, your spouse, or a dependent listed on your tax return.

Additionally, the student must be enrolled in one academic period beginning in the tax year. They must also take at least one course to get a degree or other recognized education credential, or improve job their skills.

Income Limits

The income limits for the LLC are the same as those for the AOTC. Single filers earning more than $90,000 and joint filers with a MAGI above $180,000 are ineligible. Taxpayers who are married but file separately cannot claim the LLC, regardless of their income.

Expenses That Qualify

Qualified expenses under the LLC include tuition and required fees at an eligible educational institution. Textbooks and other course materials may also qualify but only if they are required to be purchased directly from the school.

How to Claim The AOTC or LLC

You must receive Form 1098-T, Tuition Statement, from an eligible educational institution to claim either the AOTC or LLC. This form is typically sent out by schools by January 31. It will list tuition and other expenses paid during the tax year. You will use Form 1098-T to help complete IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), when filing your federal income tax return. Be sure to include credit amounts on Schedule 3 (Form 1040), as well.

It’s important to note that you can’t claim both the AOTC and LLC in the same tax year for the same student. You may, however, claim the AOTC for one student and the LLC for another.

2022 Education Tax Credits Side-By-Side Comparison

Not sure which tax credit is best for your situation? Take a look at our side-by-side comparison.

Source: Internal Revenue Service