The IRS has announced the suspension of over a dozen additional letters including the mailing of automated collection notices. These mailings include balance due notices and unfiled tax return notices. Several million original and amended returns filed by individuals and businesses have not been processed due to pandemic-related challenges. The IRS has taken this step to avoid confusion for the taxpayers.

The suspended notices include:

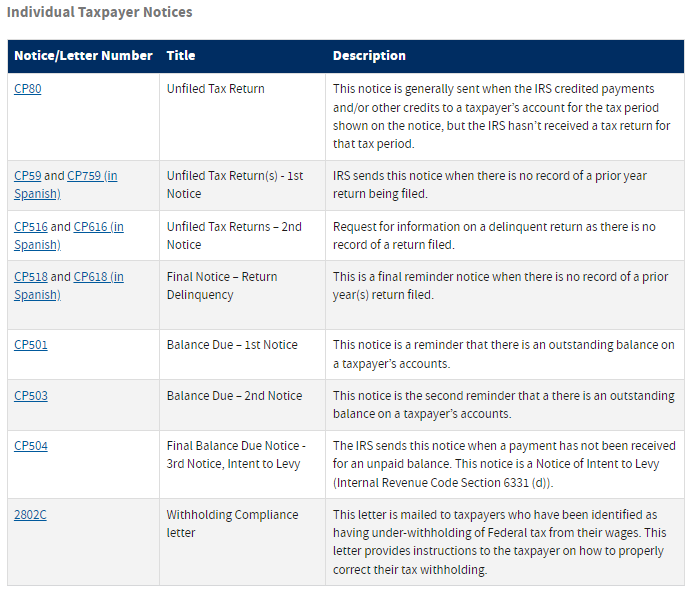

The following Individual Taxpayer Notices are temporarily suspended:

- CP80 – Unfiled Tax Return: Generally sent when the IRS credited payments or other credits to a taxpayer’s account for the tax period shown on the notice, but the IRS hasn’t received a tax return for that tax period.

- CP59 and CP759 – Unfiled Tax Return(s)- 1st Notice: The IRS sends this notice when there is no record of a prior year return being filed.

- CP516 and CP616 (Spanish) – Unfiled Tax Returns- 2nd Notice: Request for information on a delinquent return as there is no record of a return filed.

- CP518 and CP618 (Spanish) – Final Notice- Return Delinquency: This is a final reminder notice when there is no record of a prior year(s) return filed.

- CP501 – Balance Due- 1st Notice: A reminder that there is an outstanding balance on a taxpayer’s account.

- CP503 – Balance Due- 2nd Notice: The second reminder that there is an outstanding balance on a taxpayer’s account.

- CP504 – Final Balance Due Notice- 3rd Notice, Intent to Levy: The IRS sends this notice when a payment has not been received for an unpaid balance. This is a Notice of Intent to Levy.

- 2802C – Withholding Compliance Letter: This letter is mailed to taxpayers who have been identified as having under-withholding of Federal tax from their wages and provides instructions on how to properly correct their tax withholding.

The following Business Notices are temporarily suspended:

- CP259 and CP959 (Spanish) – Return Delinquency: IRS sends this notice when there is no record of a prior tax return being filed.

- CP518 and CP618 (Spanish) – Final Notice- Return Delinquency: This is a final reminder notice that the IRS still has no record of a prior tax return(s).

As part of ongoing efforts to provide additional help for people during this period, the IRS announced the suspension of more than a dozen additional letters, including the mailing of automated collection notices normally issued when a taxpayer owes additional tax, and the IRS has no record of a taxpayer filing a tax return.

These mailings include balance due notices and unfiled tax return notices. The IRS entered this filing season with several million original and amended returns filed by individuals and businesses that have not been processed due to challenges of the historic pandemic and is taking this step to help avoid confusion for taxpayers and tax professionals.

“IRS employees are committed to doing everything possible with our limited resources to help people during this period,” said IRS Commissioner Chuck Rettig. “We are working hard, long hours pushing creative paths forward in an effort to be part of the solution, rather than the problem. Our employees continue to expend every effort to balance a confluence of multiple, unprecedented demands − including successfully starting the filing season, working our inventory of unprocessed tax returns as well as looking for additional ways to minimize the burden for taxpayers, tax professionals, and businesses.

“Our efforts are not limited to suspension of these additional letters and the possibility of similar actions going forward. We have redeployed and reallocated resources throughout the IRS and have implemented innovative strategies in an ongoing effort to provide a meaningful reduction in our inventories,” Rettig said.

These automatic notices have been temporarily stopped until the backlog is worked through. The IRS will continue to assess the inventory of prior year returns to determine the appropriate time to resume the notices.

Some taxpayers and tax professionals may still receive these notices during the next few weeks. Generally, there is no need to call or respond to the notice as the IRS continues to process prior-year tax returns as quickly as possible.

However, if a taxpayer or tax professional believes a notice is accurate, they should act to rectify the situation for the well-being of the taxpayer. For example, the IRS cautions people with a balance due that interest and penalties can continue to accrue. In addition, IRS employees may in select circumstances issue notices to particular taxpayers to resolve specific compliance issues.

The IRS does not have the authority to stop all notices as many are legally required to be issued within a certain timeframe. The IRS will continue to assess other changes and system modifications that the IRS may be able to implement to assist taxpayers on an array of issues. The IRS will continue to make information available to taxpayers throughout the filing season.

The IRS encourages those who have a filing requirement and have yet to file a prior-year tax return or to pay any tax due to promptly do so as interest and penalties will continue to accrue. Visit IRS.gov for payment options.