The IRS watchdog reported this week that the agency is unlikely to eliminate a huge backlog of tax returns this year, again leaving many U.S. taxpayers waiting for their returns and their tax refunds to be processed.

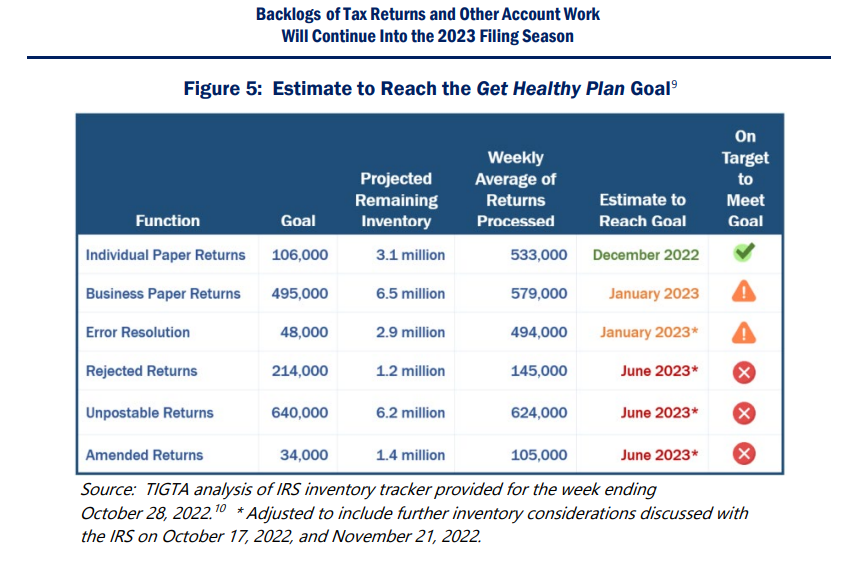

“The delays in processing backlogged tax returns continue to burden taxpayers,” the report released Thursday from the Treasury Inspector General for the Tax Administration (TIGTA) said. “Our assessment of the remaining inventory and increased production levels indicates that the IRS will not meet all of its goals by the end of 2022 and will continue to have a backlog into the 2023 filing season.”

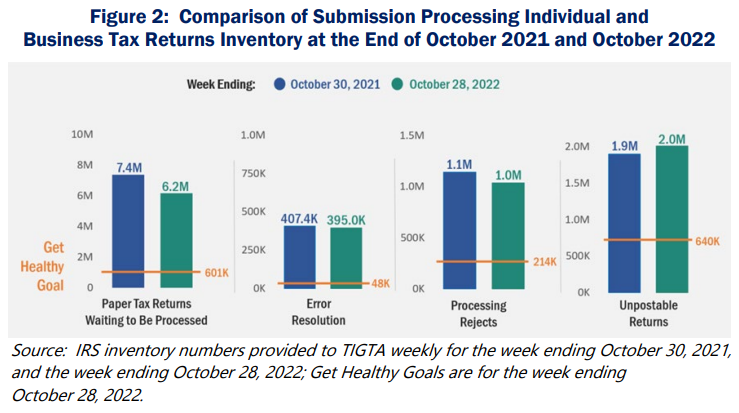

The audit found that, as of the week ending Oct. 28, 2022, 9.6 million tax returns were awaiting processing or other resolution compared with 10.8 million returns a year ago.

This comes even after the IRS reportedly began to process between 900,000 to 1.1 million total individual and business returns per week in November, the National Taxpayer Advocate reported, in an effort to meet its goal of reducing the backlog altogether.

“Millions of taxpayers continued to endure unreasonably long refund delays, as the IRS administered another filing season while simultaneously trying to catch up on its backlog of work carried over from the previous year.”

Getting the IRS back on track

The IRS has struggled to reduce its backlog of work for the third straight year, a separate report released this month from the Government Accountability Office cited, but the agency has made some progress.

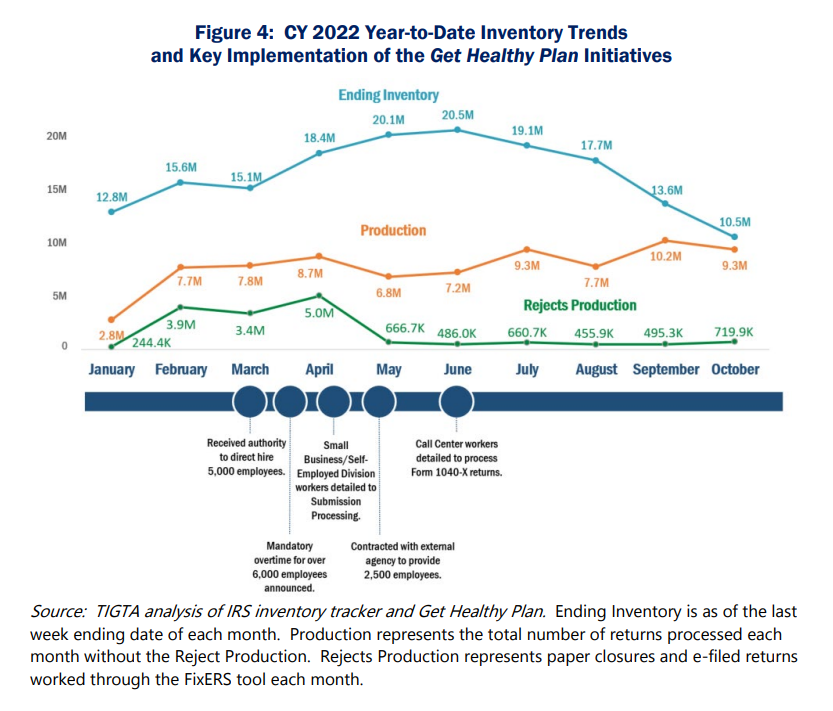

During the past year, the IRS has taken an “all-hands-on-deck” approach to returning its inventory backlog to “healthy levels,” according to the TIGTA report. Those measures included hiring new employees, reassigning existing employees to assist with submission processing and accounts management, and utilizing outside consultants to identify digital solutions to address its paper jam.

The improvements have been notable. In June 2022, the IRS faced a record 20.5 million individual and business tax returns that still needed processing, the TIGTA found, and that figure declined by nearly half to 10.5 million by the end of October.

Production levels also showed signs of improvement. For instance, the number of tax returns processed per month rose by over 2.1 million when comparing June with October.

Planning the process for the upcoming 2023 tax filing season is a daunting task, with all the backlog and the IRS team working tirelessly over the past few months to prepare, but they are far from reaching their objective.

Roughly 6.2 million paper returns were waiting to be processed as of the week ending Oct. 28, according to TIGTA. That’s down from 7.4 million a year earlier, but well beyond the 601,000 unprocessed returns the IRS considers to be a healthy goal.

At the same time, the number of tax returns held up in error resolution was 395,000, up from 407,400 in 2021 and far more than the 48,000 that’s considered a healthy goal, according to the IRS.

“The IRS is getting closer to meeting its objectives, but unfortunately, millions of individual and business returns still await processing, millions more have been pulled out due to errors or discrepancies that must be addressed, and millions of amended returns and correspondence are still awaiting processing.”

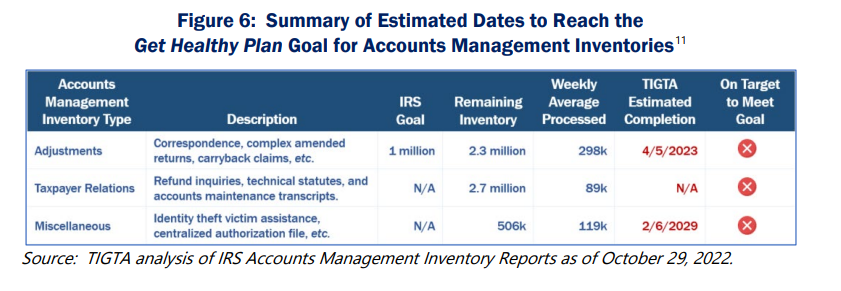

As shown in Figure 6, the Taxpayer Relations inventory of 2.7 million and the Miscellaneous inventory of 506,000 remain well above January 4, 2020, pre-pandemic levels of 1 million and 169,000, respectively. In addition, the IRS is receiving almost as many new cases into its Miscellaneous Accounts Management inventory as it is processing weekly, resulting in an estimated completion in early 2029.

Tax refunds are a lifeline

According to Collins, processing the backlog is essential for many taxpayer families who may be owed a refund, noting that a significant majority of taxpayers receive refunds and count on the funds to make ends meet.

The average refund for the 2022 filing season was $3,176 as of Oct. 28, the IRS reported, up nearly 14% from $2,791 in 2021.

“Tax refunds are a lifeline for some taxpayers and important for almost all,” Collins said in the blog. “Some taxpayers will use refunds to care for their families or just to meet basic living expenses. Others will use refunds to pay employees or keep their businesses operating. To state the obvious, the 2022 filing season was another frustrating one for taxpayers, tax professionals, and the IRS.”

Despite the challenging year, more than 164 million individual tax returns were filed — 92% filed electronically — as of the end of October. According to the IRS, some 109 million refunds have been issued, totaling nearly $345 billion.

“For some, this filing season may have felt like Groundhog Day,” Collins said in a statement. “We will soon find out whether the upcoming filing season adds a similar chapter to this series or whether the IRS can work through its backlog, process tax returns, and correspondence quickly, and can answer its phone calls at a level that substantially improves the taxpayer experience in the next filing season.”

You can read the full report here!