Are you curious about the status of your tax refund? The IRS Where’s My Refund tool is your go-to resource for tracking your refund journey. To simplify the process, here’s a comprehensive guide on the most common things you’ll need when using the tool.

Essential Requirements for Checking Your Tax Refund Status with IRS Where’s My Refund?

To access your tax refund status through the IRS Where’s My Refund? Tools, the IRS will require key information: including your Social Security Number, the Tax Year, your Filing Status, and the exact Refund Amount as indicated on your tax return. These details serve as essential components to ensure accurate and secure tracking of your tax refund status through the IRS Where’s My Refund? online tools.

Refund Amount

Enter the exact refund amount you are expecting. This amount should match the one on your tax return. If there’s a discrepancy, it could affect the accuracy of the information provided.

How quickly will I get my tax refund?

Understand that it takes time for the IRS to process tax returns. The IRS issues most tax refunds in less than 21 calendar days. However, if you mailed your return and expect a refund, it could take four weeks or more to process your return. Where’s My Refund? has the most up-to-date information available about your refund.

Anticipating IRS Processing of Your Tax Return

For returns received in the current year, the IRS processes individual tax returns for which refunds are due first. Tax returns reflecting tax owed are processed last, but if a payment is mailed with the tax return, the payment is separated upon receipt and deposited to ensure the taxpayer account is credited for the payment. The IRS continues to process tax returns that need to be manually reviewed due to errors in the order received.

As the return is processed, whether it was filed electronically or on paper, it may be delayed due to:

- Mistakes

- Missing information

- Suspicious activity referred by banks

If the IRS can fix the issue without contacting you, they will. If the IRS needs more information or needs you to verify you sent the tax return, the IRS will send you a letter. The resolution of these issues could take more than 120 days depending on how quickly and accurately you respond, and how quickly the IRS can complete the processing of your tax return.

When can I start checking Where’s My Refund? for my refund’s status?

- 24 hours after e-filing a tax year 2023 return

- 3 or 4 days after e-filing a tax year 2021 or 2022 return

- 4 weeks after mailing a paper return

Avoid checking the Where’s My Refund tool obsessively. The system is updated only once a day, usually overnight. Checking too frequently may not yield new information.

What is happening when Where’s My Refund? shows my tax return status as received?

The IRS has your tax return and is processing it.

IRS Where’s My Refund? Calendar

Paper Check vs. Direct Deposit

Combining direct deposit with electronic filing is the fastest way to receive your tax refund. There’s no chance of it going uncashed, getting lost, stolen, or destroyed. The IRS issues more than nine out of ten refunds in less than 21 days. Please wait five days after the IRS sent the refund to check with your bank about your tax refund, since banks vary in how and when they credit funds. (It could take four weeks before you receive a mailed tax refund check.)

I requested a direct deposit tax refund. Why is the IRS mailing it to me as a paper check?

There are several reasons:

- The IRS can only deposit refunds electronically into accounts in your own name, your spouse’s name, or in a joint account.

- A financial institution may reject a direct deposit.

- The IRS can’t deposit more than three electronic refunds into a single financial account.

When should I call the IRS about the status of my tax refund?

Contact the IRS about your refund status only if Where’s My Refund? recommends you to contact them.

Does the refund hotline have all of the same information as the Where’s My Refund? website or on the IRS2Go mobile app?

The IRS automated refund hotline, 800-829-1954, will not be able to give you your refund status for any year other than the 2023 tax year.

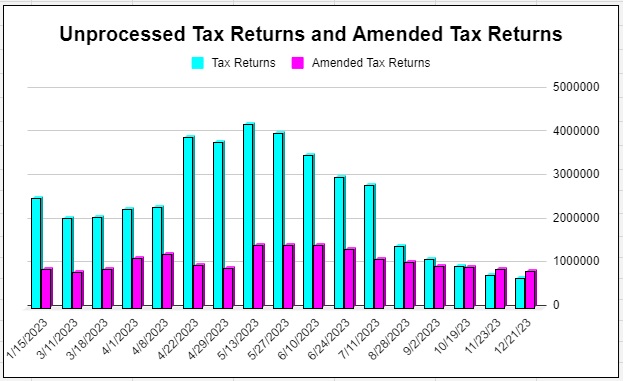

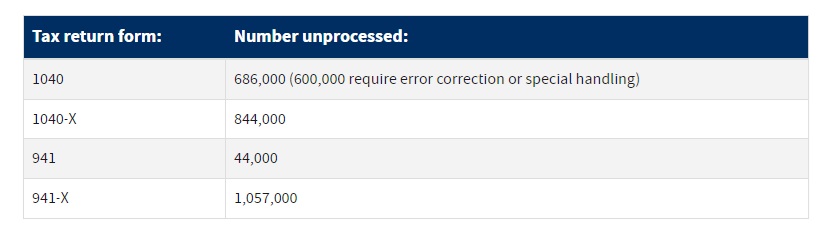

Current IRS Backlog of Unprocessed Tax Returns: Last Updated December 21, 2023

Tax return volumes: As of December 21, 2023