Are you curious about the status of your Amended tax refund? The IRS Where’s My Amended Refund? tool is your go-to resource for tracking your refund journey. To simplify the process, here’s a comprehensive guide on the most common things you’ll need when using the tool.

Essential Requirements for Checking Your Tax Refund Status with IRS Where’s My Amended Refund?

Easily track the status of your Form 1040-X, Amended U.S. Individual Income Tax Return through the user-friendly Where’s My Amended Return? online tool or by calling the toll-free telephone number at 866-464-2050, just three weeks after filing. Both tools are accessible in English and Spanish and cover amended returns for the current year and up to three prior years.

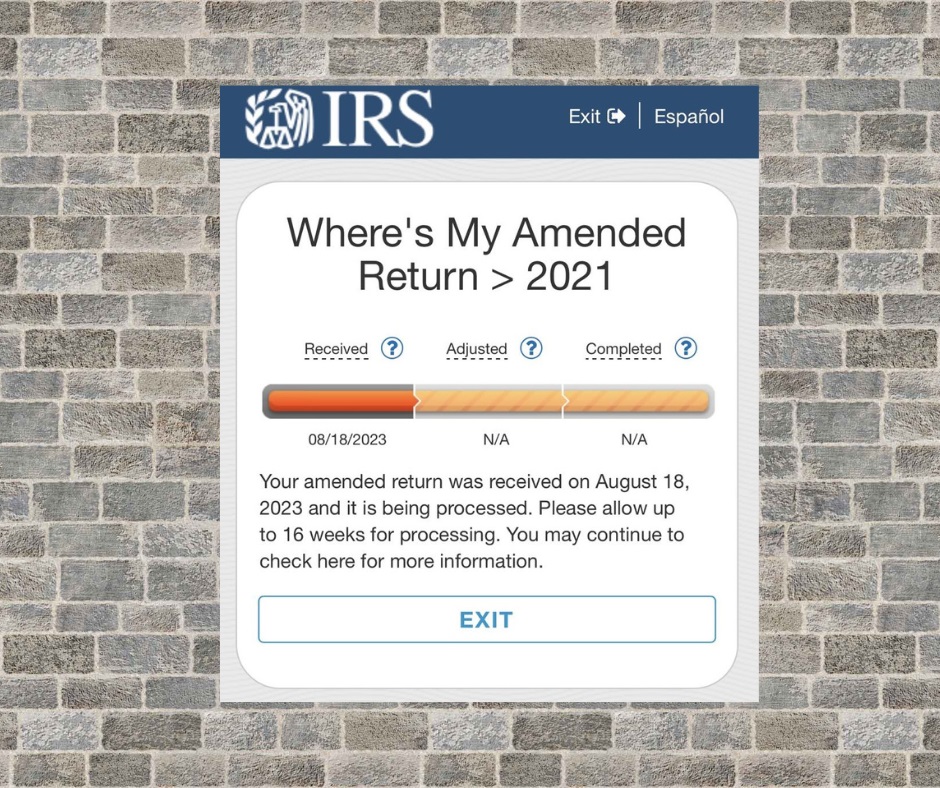

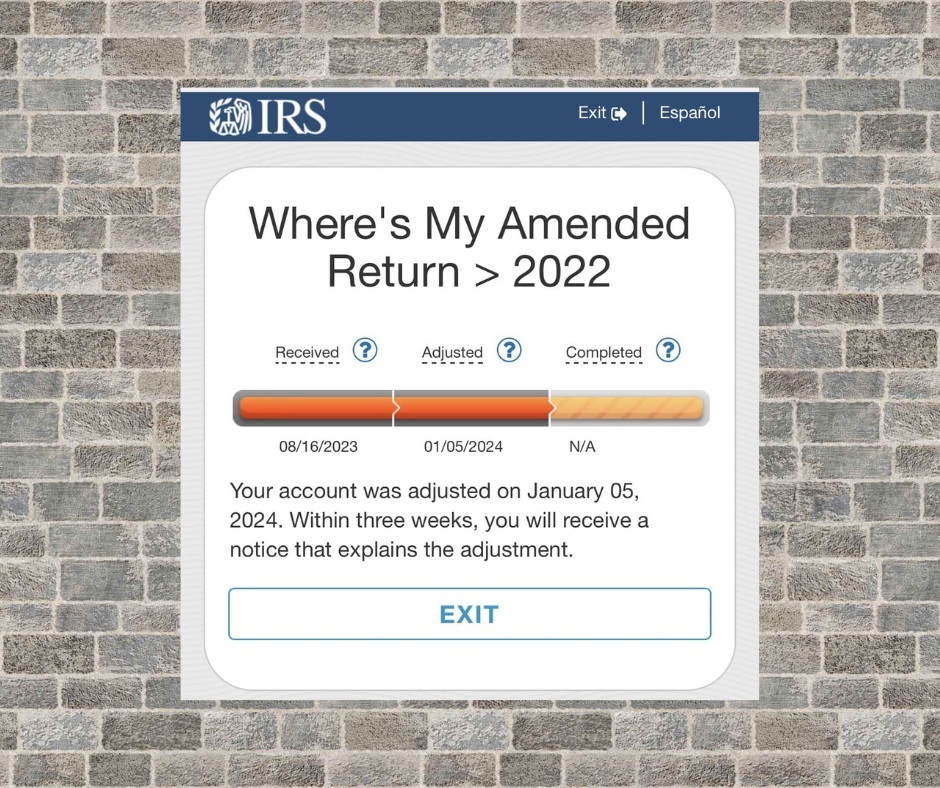

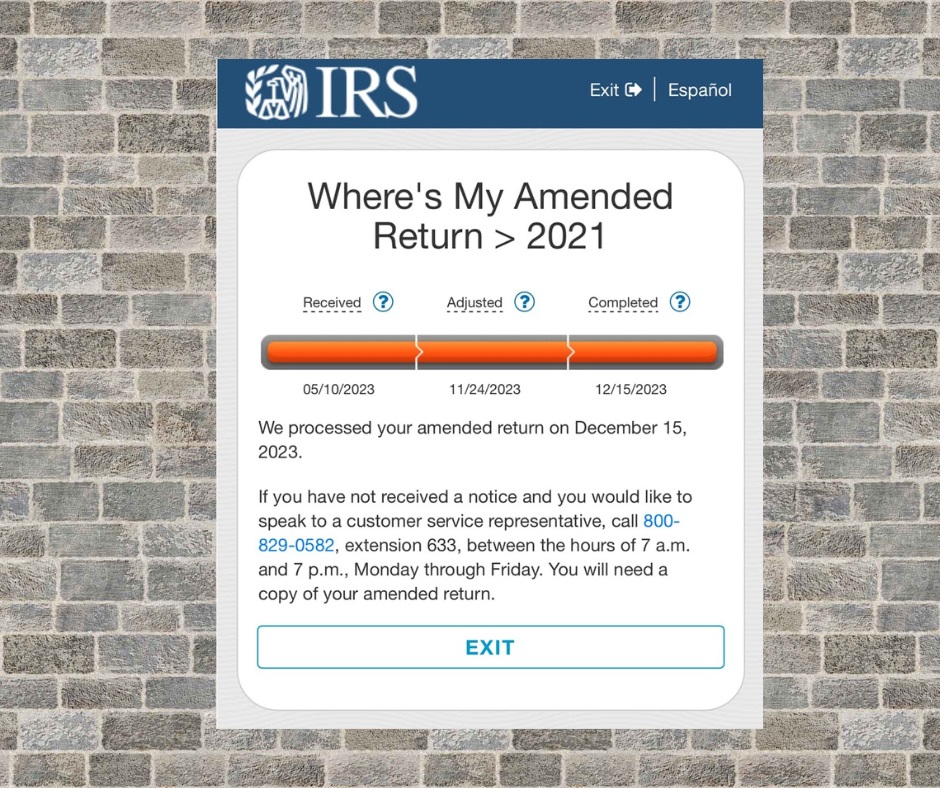

To utilize either tool, simply provide your taxpayer identification number (e.g., social security number), date of birth, and ZIP code for identity verification. Once authenticated, monitor your amended return’s progress through three stages: Received, Adjusted, and Completed.

The online tool features an illustrative graphic visually guiding you through the processing stages. Remember, amended returns take up to 16 weeks to process and may not appear in the system until three weeks after filing. No need to contact the IRS during this period unless prompted by the tool.

Can I file my amended return electronically?

Yes. If you need to amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods, you can amend these forms electronically using available tax software products.

How many amended returns can be filed electronically?

You can electronically file up to three amended returns per tax year. If you file a third amended return that is accepted, all subsequent attempts will be rejected.

Can I file my amended return electronically for previous tax years?

You can amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods electronically.

How quickly will I get my Amended Tax Refund?

The present processing duration exceeds 20 weeks for both paper and electronically submitted amended returns. It’s important to note that reaching out to the IRS via phone won’t expedite the processing of your return. IRS phone and in-person representatives can only investigate the status of your amended return 20 weeks or later following its mailing. Alternatively, you may contact the IRS directly if Where’s My Amended Retund? advises you to do so.

How soon can I use the Where’s My Amended Return? application to check the status of an electronically filed amended return?

The Where’s My Amended Return? (WMAR) online tool or the toll-free telephone number 866-464-2050 can be used for status updates three weeks after filing the return. Both tools are available in English and Spanish and have the most up-to-date information available.

Can I get the status of an amended return for multiple tax years?

Where’s My Amended Return? or the toll-free telephone number 866-464-2050 can get you the status of your amended returns for the current tax year and up to three prior tax years.

What happens when my amended return’s status shows as received?

Your amended return was received and is being processed. It currently takes more than 20 weeks to complete processing.

What happens when my amended return’s status shows as adjusted?

An adjustment was made to your account. The adjustment will result in a refund, balance due, or in no tax change.

What happens when my amended return’s status shows as completed?

Your amended return has been processed. You will receive all the information connected to its processing by mail.

It’s been longer than 20 weeks since the IRS received my amended return. Why hasn’t it been processed?

Some amended returns take longer than 20 weeks for several reasons. Your return may need further review if it:

- Has errors

- Is incomplete

- Isn’t Signed

- Is returned to you requesting more information

- Includes a Form 8379, Injured Spouse Allocation

- Is affected by identity theft or fraud

Delays in processing may also occur when an amended return needs:

- Routing to a specialized area

- Clearance by the bankruptcy area within the IRS

- Review and approval by a revenue officer

- Review of an appeal or a requested reconsideration of an IRS decision

You will be contacted if more information is needed to process your amended return.

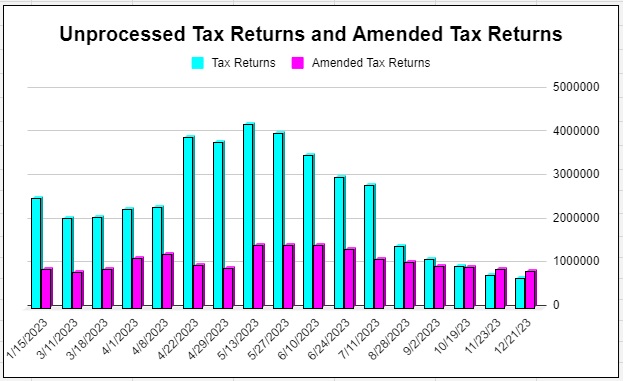

IRS Where’s My Amended Refund? Calendar

Is direct deposit available for electronically filed Form 1040-X?

Beginning in processing year 2023, direct deposit can be requested for electronically filed amended returns for tax year 2021 and later. The bank account information should be entered on the electronically filed Form 1040-X (or Corrected Form 1040-SS/PR).

When should I call the IRS about the status of my Amended Refund?

Contact the IRS about your amended refund status only if Where’s My Amended Refund? recommends you to contact them.

Does the refund hotline have all of the same information as the Where’s My Amended Refund? applications?

Where’s My Amended Return? or the toll-free telephone number 866-464-2050 can get you the status of your amended returns for the current tax year and up to three prior tax years.

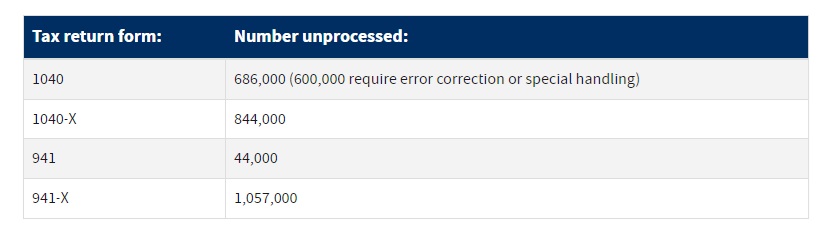

Current IRS Backlog of Unprocessed Tax Returns: Last Updated December 21, 2023

Tax return volumes: As of December 21, 2023