If you’ve checked the IRS “Where’s My Refund?” tool and received the status message stating, “We cannot provide any information about your refund,” don’t panic. This message, often associated with Reference Number 9001, usually indicates the IRS requires additional information or processing time to complete your refund. Here’s what you need to know and how to resolve the situation.

Why Am I Seeing This Message?

The IRS uses this generic message for several reasons, including but not limited to:

- Your electronically filed return is still being processed.

- Your return was recently mailed and not yet entered into the IRS system.

- Additional verification or reviews are required.

- Identity confirmation may be needed due to potential discrepancies or flagged information.

What Steps Should You Take?

Here’s how to address this status:

1️⃣ Wait for Standard Processing Time:

- Electronically Filed Returns: Most refunds are issued within 21 days of the IRS receiving your return.

- Paper Returns: Processing may take up to 6 weeks.

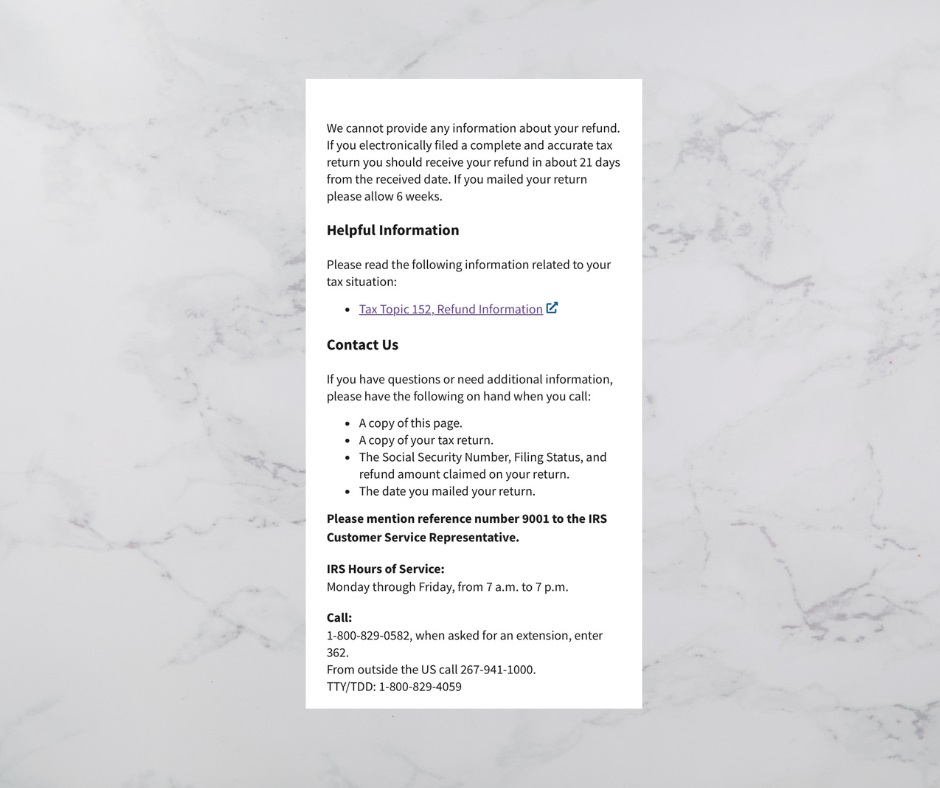

2️⃣ Review Tax Topic 152 for More Information:

Visit the IRS Tax Topic 152 page for general information about refund timing and potential delays.

👉 Tax Topic 152, Refund Information

3️⃣ Contact the IRS Directly:

If it’s been more than 21 days (electronically filed) or 6 weeks (paper filed), and you’re still seeing this message, call the IRS for assistance. Before contacting them, gather the following details to expedite the process:

- A copy of your tax return.

- The exact amount of your refund.

- Your Social Security Number (SSN) and filing status.

- The date you filed or mailed your return.

4️⃣ Call the IRS Using the Provided Reference Number:

Mention Reference Number 9001 to help the IRS representative locate your case.

IRS Contact Information:

- Phone: 1-800-829-0582, Extension 362 (Monday–Friday, 7 a.m. to 7 p.m.)

- Outside the U.S.: 267-941-1000

- TTY/TDD: 1-800-829-4059

Proactive Tips to Prevent Refund Delays

While you can’t control every aspect of IRS processing, there are ways to reduce the likelihood of delays:

- E-File Your Return: Electronic filing is faster, more secure, and reduces the chances of errors compared to paper returns.

- Double-Check Details: Verify all information, including Social Security numbers, income, and bank account details, before submitting your return.

- Protect Your Identity: Avoid identity theft by safeguarding your personal information and using secure passwords for your online accounts.

Track Your Refund Status

To monitor your refund, use the IRS’s tools:

- “Where’s My Refund?” Tool: Check your status online at irs.gov/refunds.

- IRS2Go App: Download this mobile app to track your refund status conveniently from your phone.

Receiving the message “We cannot provide any information about your refund” can be frustrating, but it’s often a temporary issue. By understanding the possible causes and following these steps, you can resolve the situation and ensure your refund gets to you as quickly as possible.

Have you experienced this status before? Share your story or tips in the comments below to help others navigating the same issue.