-

Refundtalk wrote a new post 6 years, 8 months ago

The Taxpayer Advocate Service (TAS) is an organization within the Internal Revenue Service that is designed to help taxpayers resolve problems with the IRS.

HOW IT WORKS

The TAS was first formed in 1978. Over…

-

Refundtalk wrote a new post 6 years, 8 months ago

The Department of Treasury’s Bureau of the Fiscal Service (BFS) issues IRS tax refunds and Congress authorizes BFS to conduct the Treasury Offset Program (TOP). Through the TOP program, BFS may reduce your refund (ov…

-

Refundtalk wrote a new post 6 years, 8 months ago

The IRS’s Failure to Establish Goals to Reduce High False Positive Rates for Its Fraud Detection Programs Increases Taxpayer Burden and Compromises Taxpayer Rights

Over the past decade, the IRS has been s…

-

What about a 4464c letter ? I got that in the mail dates 2/22 but I️ filed 1/30

-

Verification Letter 4464c confirms that you filed your taxes, but – and here’s the cringe – it also says the IRS is holding up any refund to make a thorough review of some type of information on your tax return.

“Typically, the IRS checks with a third party, such as the employer, to verify information on the return.”

The letter does not announce an audit. However, it is telling you not to expect any refund to arrive for another 60 days. What should you do? Typically, taxpayers should do nothing but wait for the entire 60 days. If a refund hasn’t arrived by then, the taxpayer can call an IRS phone number to check on it.

With millions of income tax returns flooding into its computers, the Internal Revenue Service is trying to filter out bogus returns before taxpayers get bilked. Letter 4464c comes from the Integrity & Verifications Operations Office, which is charged with preventing fraudulent refunds.

-

-

-

Refundtalk wrote a new post 6 years, 8 months ago

A system the IRS uses to identify potentially fraudulent electronically filed tax returns. It enhances the IRS’s capabilities to detect, resolve, and prevent criminal and civil noncompliance and reduces issuance o…

-

Refundtalk wrote a new post 6 years, 9 months ago

IRS Still Being Processed vs. Being Processed

There are two different being processed messages. One is “still being processed” and the other is “being processed” and they both have different meanings. What does “Your tax return is still being p…

There are two different being processed messages. One is “still being processed” and the other is “being processed” and they both have different meanings. What does “Your tax return is still being p… -

Refundtalk wrote a new post 6 years, 9 months ago

Early Direct Deposit Accounts

Direct deposit is the “fastest, safest way to receive your tax refund,” According to the IRS.

There are several advantages to direct deposit of a tax refund:

You can…

-

Refundtalk wrote a new post 6 years, 9 months ago

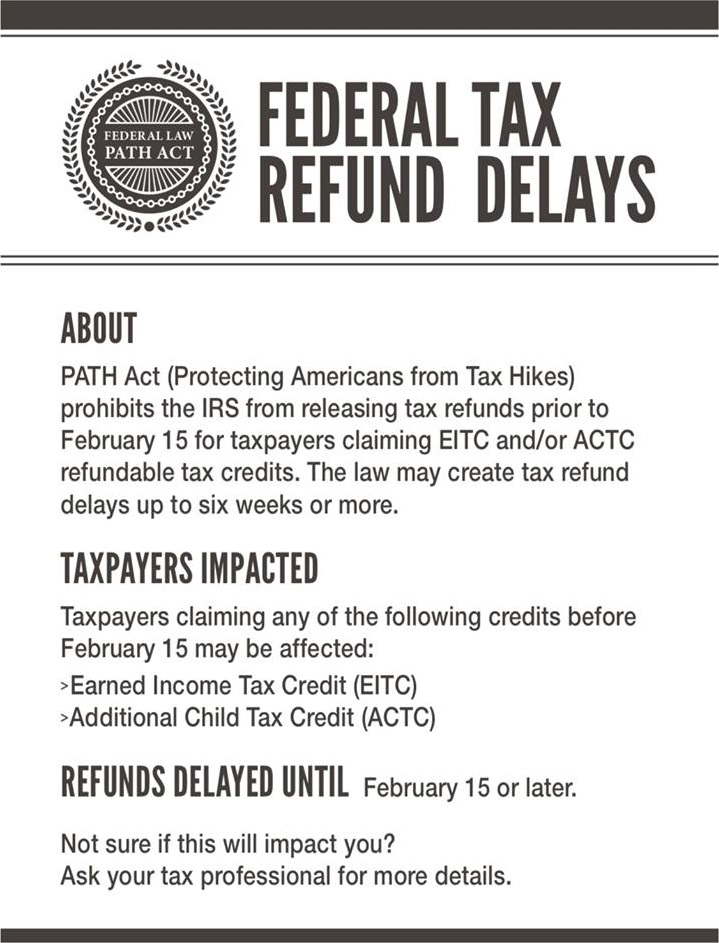

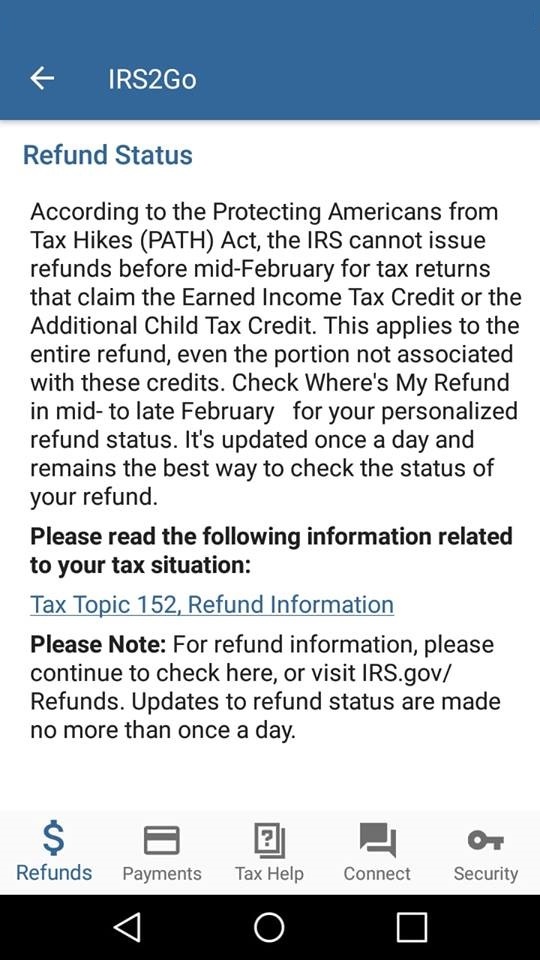

The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act), was enacted on December 18, 2015. The PATH Act contains several changes to the tax law that affect individuals, families, and businesses, and…

-

Refundtalk wrote a new post 6 years, 9 months ago

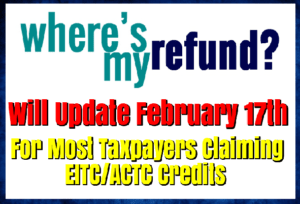

With millions of tax refunds being processed, the Internal Revenue Service reminds taxpayers they can get fast answers about their refund by using the “Where’s My Refund?” tool available on IRS.gov and through…

-

Refundtalk wrote a new post 6 years, 9 months ago

Even without a government shutdown, taxpayers are having trouble getting through to the IRS at the start of the 2018 tax filing season. Busy signals and long hold times are leading to frustration. We’ve even heard o…

-

Refundtalk wrote a new post 6 years, 9 months ago

The Internal Revenue Service today announced steep declines in tax-related identity theft in 2017, attributing the success to the Security Summit initiatives that help safeguard the nation’s taxpayers.

Key i…

-

Refundtalk wrote a new post 6 years, 9 months ago

With the surge of tax returns expected during the upcoming Presidents Day weekend, the Internal Revenue Service is offering taxpayers several tips and various time-saving resources to get them the help they need from…

-

Refundtalk wrote a new post 6 years, 9 months ago

The IRS mails millions of letters to taxpayers every year for many reasons. Here are seven simple suggestions on how individuals can handle a letter or notice from the IRS:

1. Don’t panic. Simply res…

-

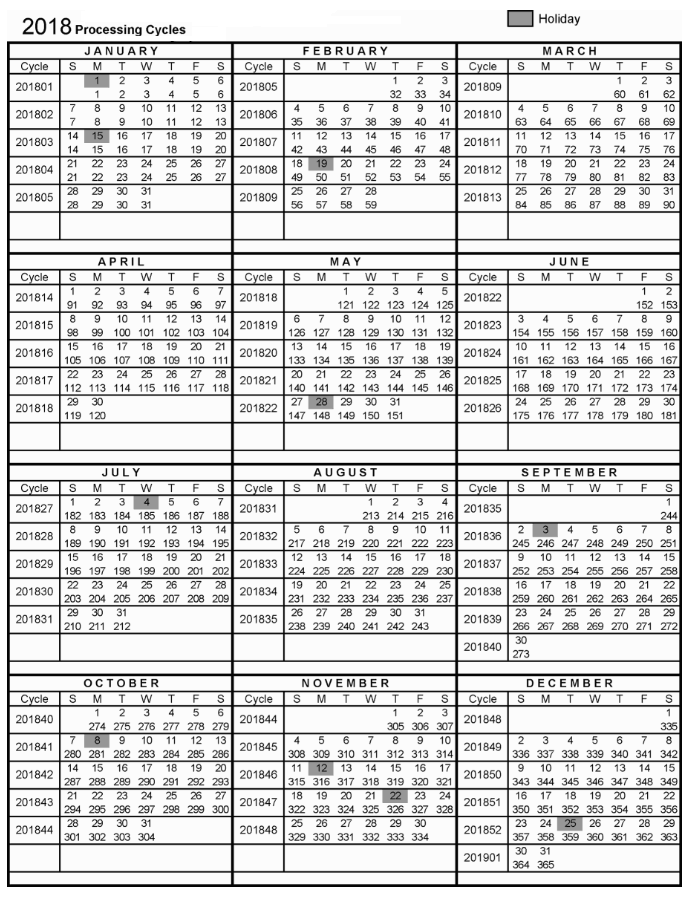

Refundtalk started the topic 2018 IRS Processing Cycles in the forum Cycle Charts 6 years, 9 months ago

-

Refundtalk wrote a new post 6 years, 9 months ago

If your Where’s My Refund? Status Bars Have Disappeared PLEASE READ!

One way to determine what is going on with your tax return is to go to the IRS website and request an Account Transcript. The IRS has made the…

-

Refundtalk wrote a new post 6 years, 9 months ago

IRS Transcript Transaction Codes

Transaction Codes (TC) are essential three-digit identifiers used by the IRS to track and manage transactions on taxpayer accounts within the Master File system. These codes play a critical role in accounting…

Transaction Codes (TC) are essential three-digit identifiers used by the IRS to track and manage transactions on taxpayer accounts within the Master File system. These codes play a critical role in accounting…-

SO based on this. Should I hear something tomorrow or the next day? I filed in February and have been waiting. I did get a hold of somebody at the IRS a few weeks ago and it sounds like they were missing a 1099R. Since the date next to the 570 code is a future date what does that mean?

570 Additional account action pending 03-30-2020

-

-

Refundtalk wrote a new post 6 years, 9 months ago

No matter how hard you try to safeguard personal information, there is still a chance that someone could steal or otherwise misuse your dependent’s Social Security number. Often, the use of another taxpayer’s Social…

-

Refundtalk wrote a new post 6 years, 10 months ago

Millions of taxpayers are going transcript crazy right now and wasting the IRS time that they could be processing our returns. We all need to slow down if you order your transcripts by mail the IRS says to allow…

-

Refundtalk wrote a new post 6 years, 10 months ago

Congratulations, Wednesday, January 24 marks the First day for movement on some taxpayers accounts in the 2018 tax filing season. Many taxpayers woke up this morning with a change to their refund status.

If your…

-

Refundtalk wrote a new post 6 years, 10 months ago

Congratulations! Accepted means your e-filed tax return has passed the initial inspection (Social Security numbers are correct, dependents haven’t already been claimed, etc.) and the government has your tax r…

-

Refundtalk wrote a new post 6 years, 10 months ago

It turns out that there is no set time schedule for when refunds have to be given to people who file taxes (and who qualify). This is probably not the answer that you wanted and is slightly unsettling. The IRS…

- Load More

Activity

Advertisement

Related Posts