Every year, the IRS accepts several batches of tax returns to test in a Controlled Launch before they are officially open.

Every tax season about a week in advance the IRS routinely runs a Controlled Release Process(“HUB Testing”) from various e-file providers (including free online e-file services) every year to test their systems. A small number of e-filed tax returns may be transmitted to the IRS, and taxpayers may see real acknowledgments and rejects as a result. The income tax returns included in this testing procedure are randomly selected from “batches” of completed tax returns that are queued for transmission for the official opening date of January 29, 2024, when the general e-file processing begins. This testing period DOES include not only the acceptance of these tax returns via e-file but also the processing of the returns including the issuing of any tax refunds. Based on previous years we have seen test batch returns actually receive their tax refunds usually in the first batch of deposits as long as they filed an accurate and honest return that had no processing issues.

What is an IRS HUB Testing or IRS Test Batch?

HUB Testing or Controlled Launch is the period when the IRS tests the electronic filing system by receiving a limited number of tax returns in advance of the official opening of the e-file. The IRS processes the tax returns it receives as it normally would, which means that some tax returns will be accepted by the IRS even before e-file is officially opened.

When does IRS HUB testing start in 2024?

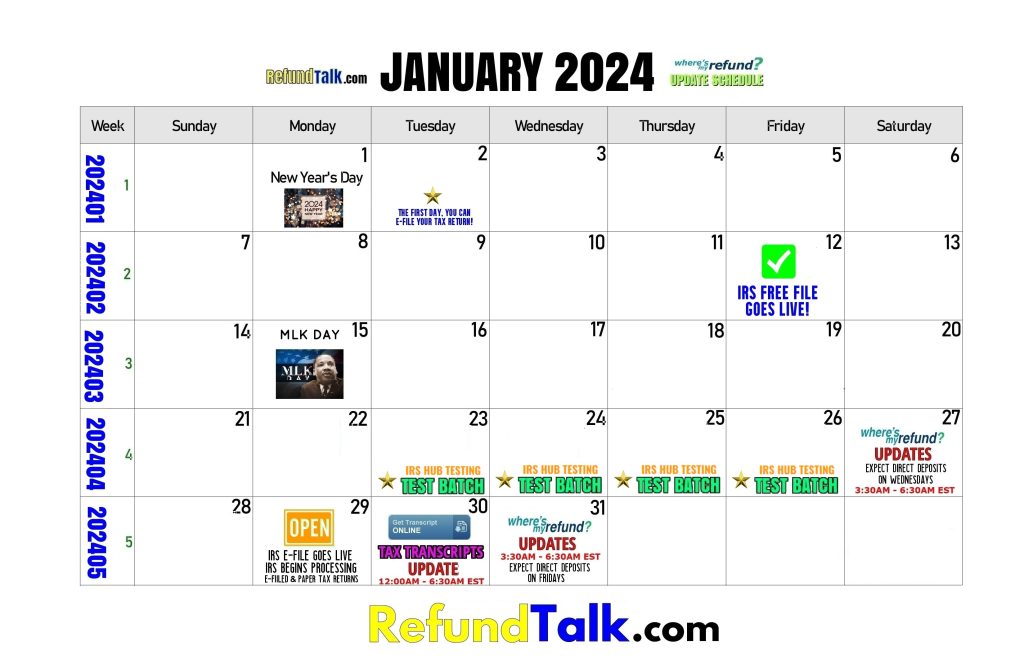

The IRS HUB Testing will take place starting on Tuesday, January 23, 2024, and will continue daily until Friday, January 26, 2024.

The dates the IRS begins and ends HUB testing vary each year, but the testing is typically performed within the first week or two before the official opening of the e-file.

Some taxpayers may begin to receive IRS acknowledgments as early as Tuesday, January 23, 2024.

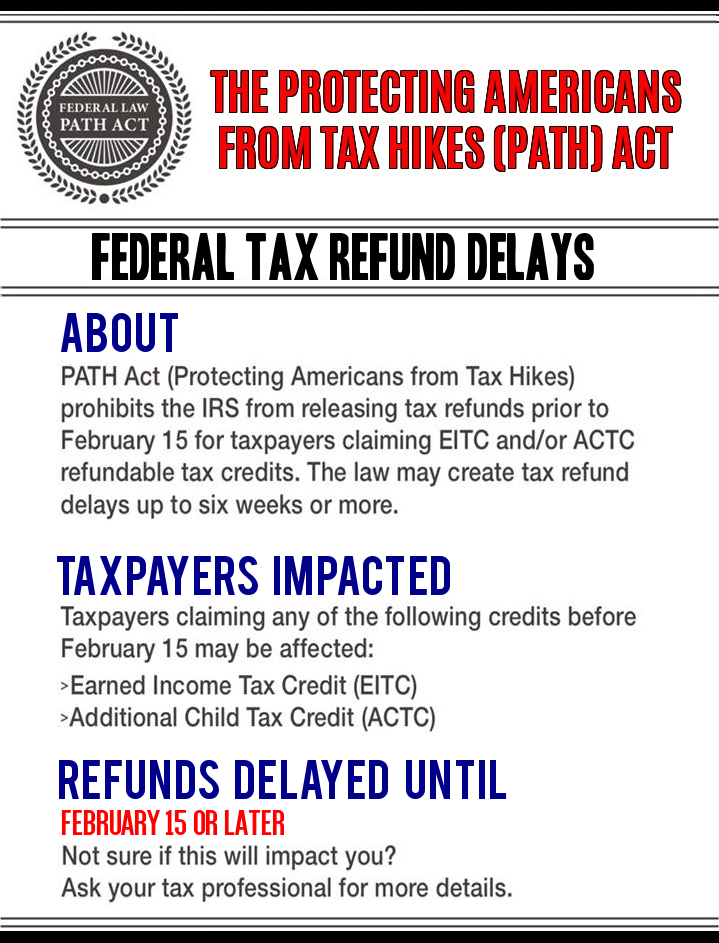

Due to tax law changes put in place by the PATH Act in 2017, the IRS cannot issue refunds for taxpayers claiming the Earned Income Tax Credit (EITC) or additional Child Tax Credit (ACTC), until after February 17, 2024. It is recommended you use the Where’s My Refund? tools on IRS.gov to get information about when you may receive your tax refund.

When do State Tax departments start accepting Taxes in 2024?

- State Tax Departments will begin processing state-only return transmissions on January 29, 2024.

HUB Testing or (Test Batch) is an initial run of a batch of tax returns. The IRS will pull a few early tax returns from all their registered tax preparers to make sure the software is running up to speed.

How many tax returns does the IRS pull for test batches?

The IRS will pull a few early tax returns from all their registered tax preparers to make sure the software is running up to speed. There is no set number of tax returns that the IRS will test every year. The majority of returns submitted early will wait in a queue until the e-file season is officially opened.

- The IRS Processed around 165,000,000 E-Filed Returns in 2021 and the number of early filed tax returns selected for test batches is said to be fewer than 10 million.

- There is no set number of tax returns that the IRS will test each year.

Please Don’t Get Your Hopes Too High… The majority of all e-filed returns submitted early will wait in a queue until the IRS Modernized e-File (MeF) system opens this year on January 29, 2024.

Can I select to have my tax return selected for HUB testing?

No. Tax companies have no control or influence over what returns the IRS randomly chooses for processing during HUB Testing. You should transmit returns as you normally would, understanding that there is no guarantee that a particular return will be selected.

Can I change and retransmit my tax return during HUB Testing?

No. As with any tax return transmitted, you need to wait until it is acknowledged, either with an acceptance or a rejection, before knowing the next steps to take. Once the tax return has been submitted and forwarded to the IRS, transmission cannot be stopped or reversed.

Please be advised that any tax return you transmit will be sent to the IRS for processing. Due to MeF (Modernized e-File), once you transmit a return, the tax return CANNOT be deleted from the server.

If my tax return is selected in the test batches will I get my tax refund any sooner?

Tax Returns NOT claiming EITC and/or ACTC credits will be processed as normal.

If your tax return is selected and you did not claim the Earned Income Tax Credit(EITC) and/or Additional Child Tax Credit(ACTC) credits, those tax returns will be processed as normal and you could receive a tax refund sooner than tax returns submitted after the official opening date.

- If you have a tax return that does not have the EITC/ACTC Credits you could possibly get a refund as soon as the first few weeks in February.

Tax Returns with EITC and/or ACTC credits will be on HOLD until after February 15th.

Beginning in 2017, if you claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) on your tax return, the IRS must hold those tax refunds until at least February 15. This law, approved by Congress, requires the IRS to hold the entire refund — even the portion not associated with EITC or ACTC. Tax returns with refunds including EITC or ACTC credits will be processed normally and refunds will not be issued until after February 15.

- If your tax return includes the EITC/ACTC Credits and completes the test batches your tax return will still be on hold with a PATH message until after February 17, 2024.

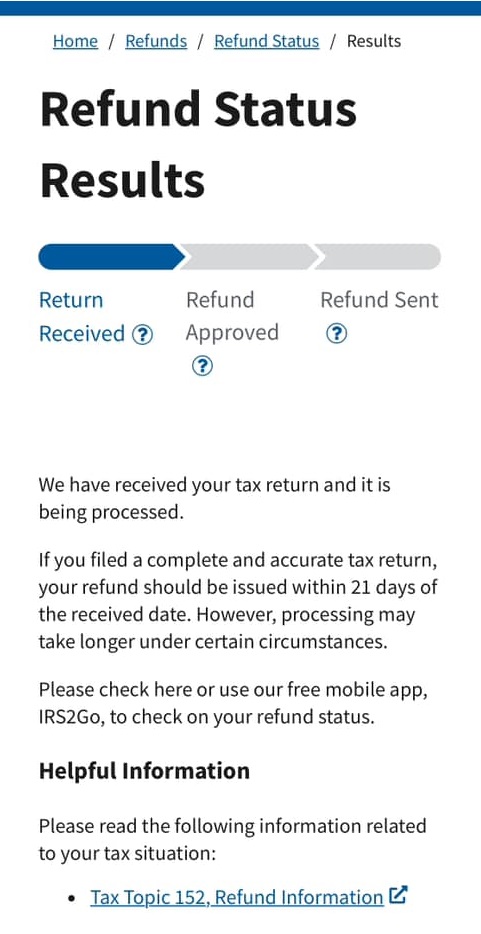

Many different factors can affect the timing of your tax refund after the IRS receives your return. Even though the IRS issue most refunds in less than 21 days, it’s possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

Taxpayers who claim the Earned Income Tax Credit or the Additional Child Tax Credit may experience a tax refund hold. According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot issue these refunds before mid-February. The IRS expects the earliest EITC/ACTC-related refunds to be available in taxpayer bank accounts or debit cards starting February 28, 2024, if these taxpayers chose direct deposit and there are no other issues with their tax return.

Where’s My Refund? on IRS.gov and the IRS2Go mobile app will be updated on February 17th for the vast majority of early filers who claimed the Earned Income Tax Credit or the Additional Child Tax Credit. Before February 17, some of these filers may see a projected date or a message that the IRS is processing their return. These taxpayers will not see a refund date on Where’s My Refund? or through their software packages until then. The IRS, tax preparers, and tax software will not have additional information on refund dates, so Where’s My Refund? remains the best way to check the status of a refund.

Remember, it doesn’t matter how early you file your tax return electronically. There is no guarantee that tax returns submitted to the IRS Electronic Filing Center from your tax preparation service will be transmitted to IRS early.