The Internal Revenue Service (IRS) sends millions of letters to taxpayers every year. The majority of these will be mailed out after the tax filing and payment deadline have passed. If you receive an IRS letter, don’t panic. Most notices are routine and can be easily resolved.

Reasons Why You May Receive an IRS Letter

Not every letter the IRS sends will result in a tax audit. Some IRS letters simply provide information, while others may require a response. There are a variety of reasons why you could receive a notice, including:

- You have a balance due

- Your refund amount is smaller or larger than expected

- The IRS needs to verify your identity

- The agency has questions or needs additional information

- The IRS made changes to your return

- There is a delay in processing your return

Do not automatically assume that the letter contains unwelcome news. It could contain information regarding your eligibility for certain tax credits or notify you of an unexpected tax refund due to a math error.

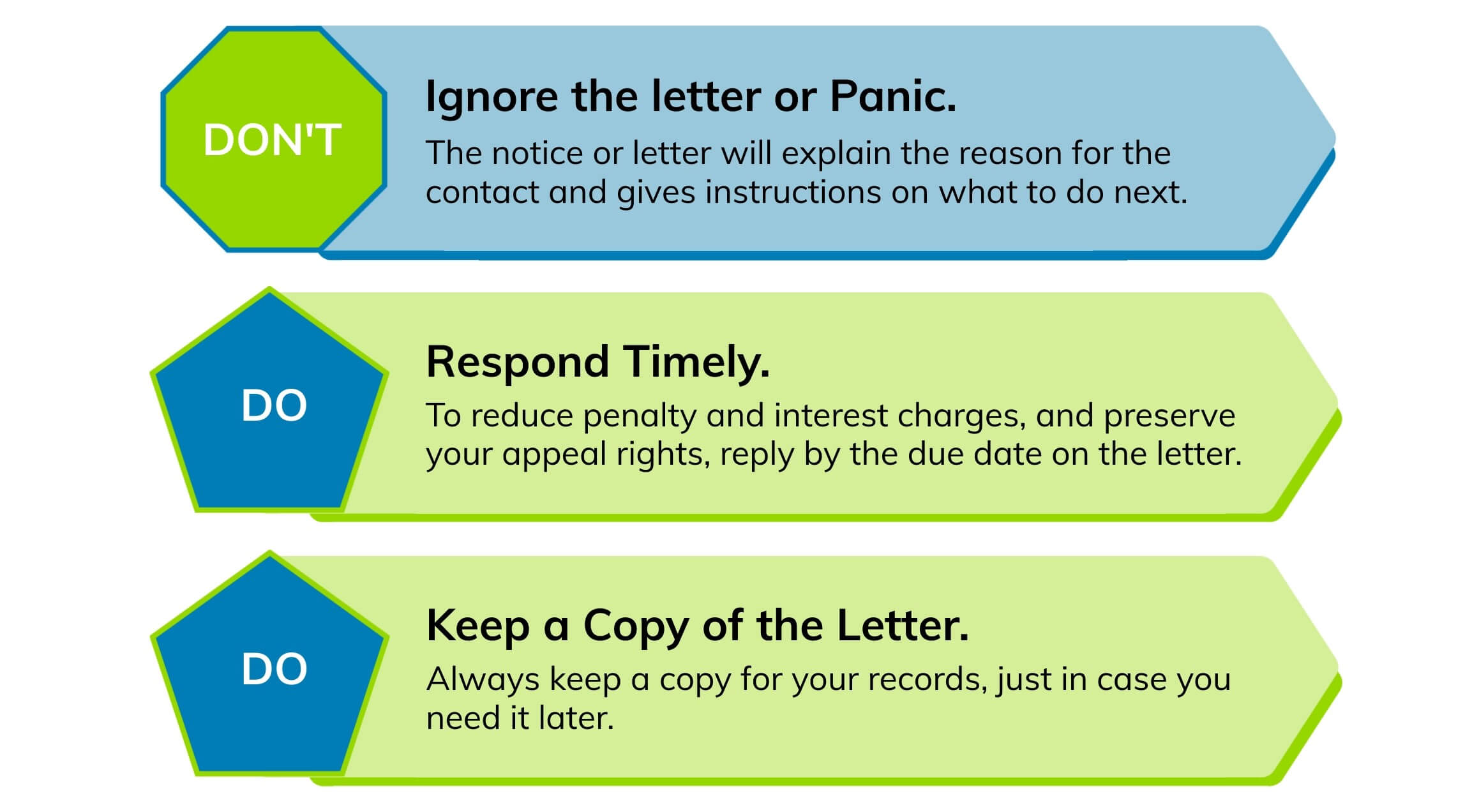

IRS Letter Do’s & Don’ts

The first thing you should do when you receive an IRS letter is open it up and read it from top to bottom. That may seem like common sense, but many taxpayers set the notices aside and never open them. This is a huge mistake. To ensure you do not get into any trouble with the IRS, follow these simple do’s and don’ts.

If the notice contains a balance due, you’ll need to submit the payment by the deadline date. If you can’t afford to pay in full, send what you can and apply for an installment agreement. In some cases, you may be eligible for an Offer in Compromise or Currently Not Collectible status. Ignoring the payment request will only lead to a higher balance and aggressive IRS collection actions. This could include wage garnishment, liens, and tax levies.