Refundtalk

@admin

-

Refundtalk wrote a new post 1 year, 2 months ago

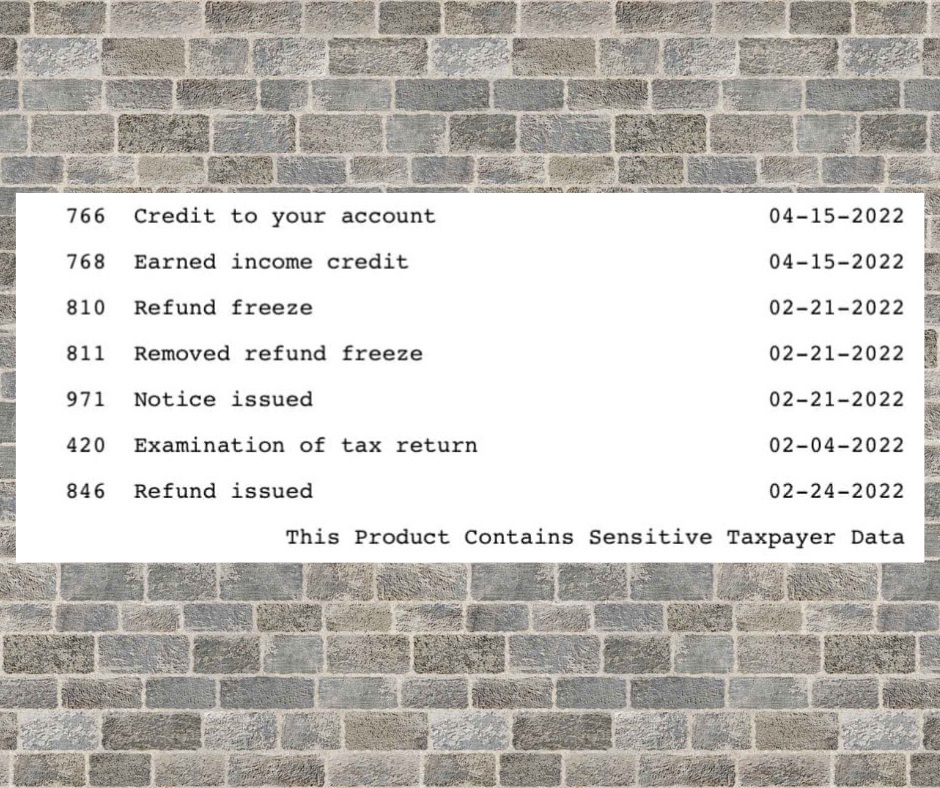

IRS Transcript Code 420: Understanding Examination of Tax Return

Tax season can be a stressful time for many individuals and businesses. It’s not just about filing your taxes; it’s also about understanding the various codes and messages that the IRS sends you. One such code…

Tax season can be a stressful time for many individuals and businesses. It’s not just about filing your taxes; it’s also about understanding the various codes and messages that the IRS sends you. One such code… -

Refundtalk wrote a new post 1 year, 2 months ago

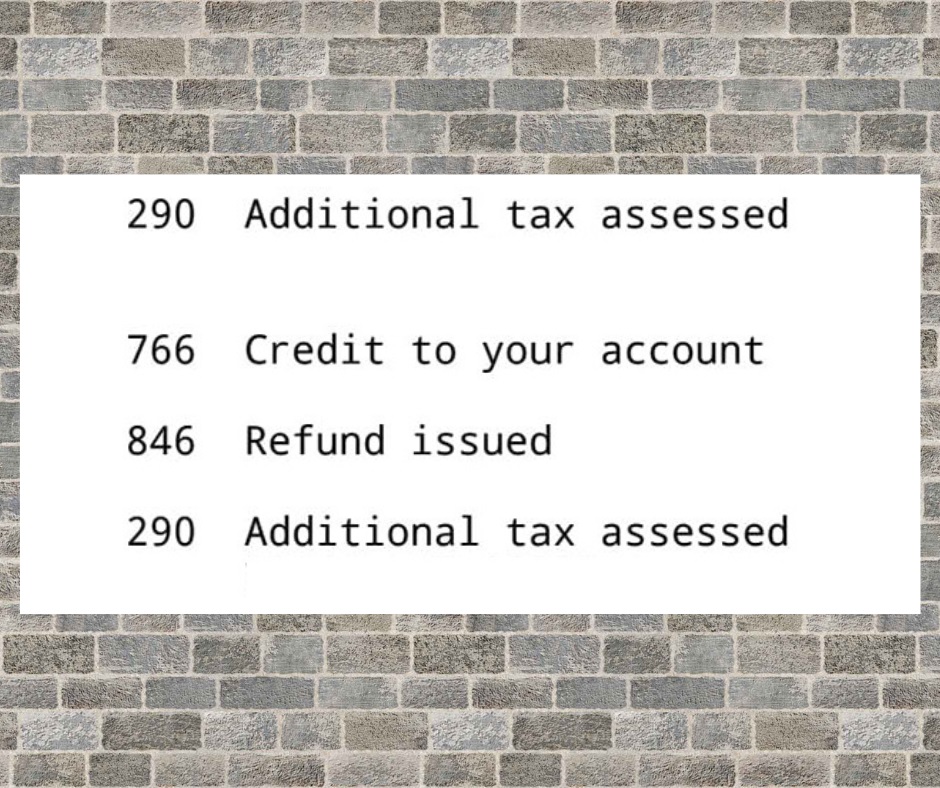

IRS Transcript Code 290: Understanding Additional Tax Assessed

Tax season can be a stressful time for many Americans, and receiving a notice from the Internal Revenue Service (IRS) with unfamiliar codes and jargon can be intimidating. One such code you might encounter is…

Tax season can be a stressful time for many Americans, and receiving a notice from the Internal Revenue Service (IRS) with unfamiliar codes and jargon can be intimidating. One such code you might encounter is… -

Refundtalk wrote a new post 1 year, 2 months ago

IRS Transcript Code 971: Injured Spouse AllocationTax season can be a stressful time, especially for couples who file joint tax returns. If one spouse has outstanding debts or obligations, it can impact the entire tax refund. Fortunately, the Internal Revenue…

-

Refundtalk wrote a new post 1 year, 2 months ago

IRS Transcript Code 766: Understanding the Credit to Your Account

Tax season can be a stressful time, filled with complicated forms, calculations, and endless paperwork. If you’ve recently requested an IRS transcript or have received one, you might have come across various…

Tax season can be a stressful time, filled with complicated forms, calculations, and endless paperwork. If you’ve recently requested an IRS transcript or have received one, you might have come across various… -

Refundtalk wrote a new post 1 year, 4 months ago

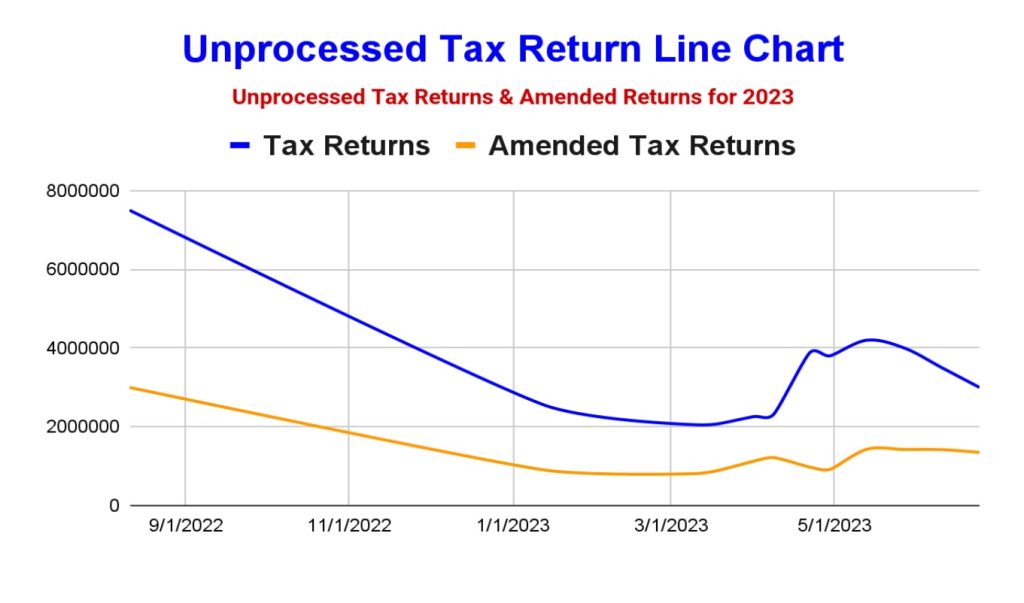

Reducing Unprocessed Tax Returns and Amended Returns in 2023

The Internal Revenue Service (IRS) has been working diligently to address the backlog of unprocessed tax returns and amended returns. In this blog post, we will highlight the significant progress made from…

The Internal Revenue Service (IRS) has been working diligently to address the backlog of unprocessed tax returns and amended returns. In this blog post, we will highlight the significant progress made from… -

Refundtalk wrote a new post 1 year, 4 months ago

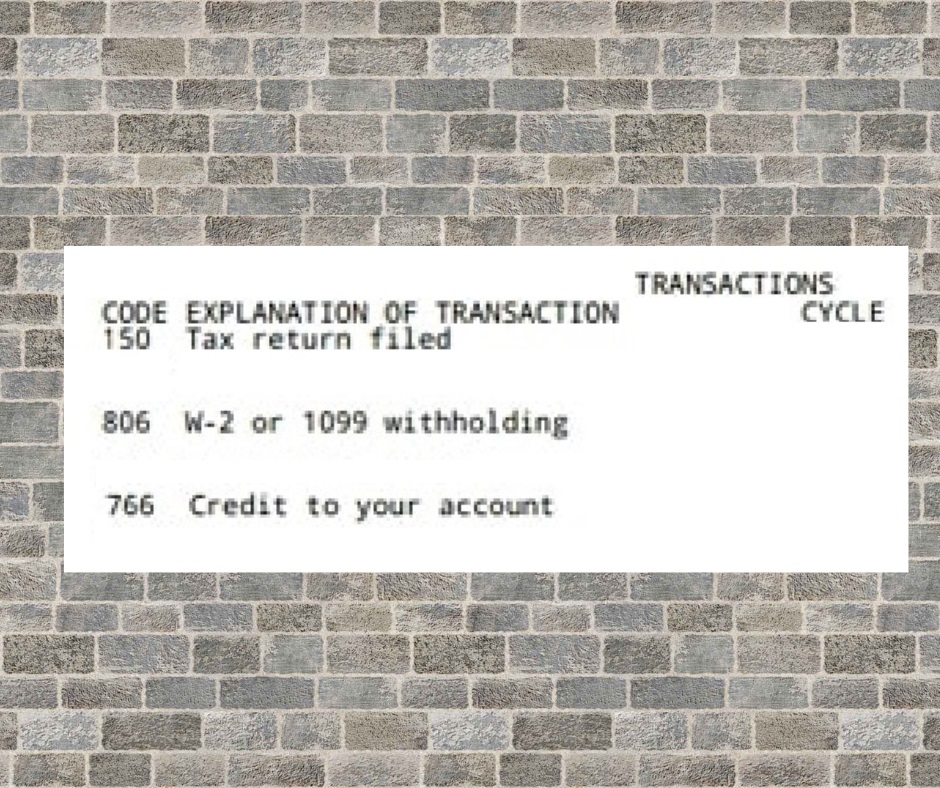

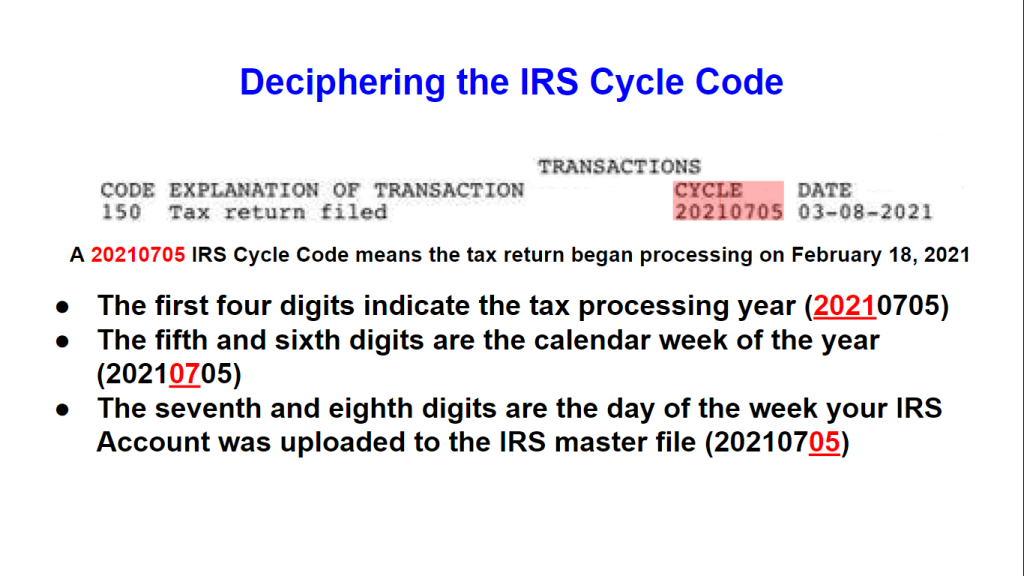

IRS Cycle Code: Understanding and Locating Your Processing Cycle Code

When it comes to deciphering the inner workings of the Internal Revenue Service (IRS), understanding the cycle code can be quite beneficial. This unique code provides valuable information about the processing…

When it comes to deciphering the inner workings of the Internal Revenue Service (IRS), understanding the cycle code can be quite beneficial. This unique code provides valuable information about the processing… -

Refundtalk wrote a new post 1 year, 4 months ago

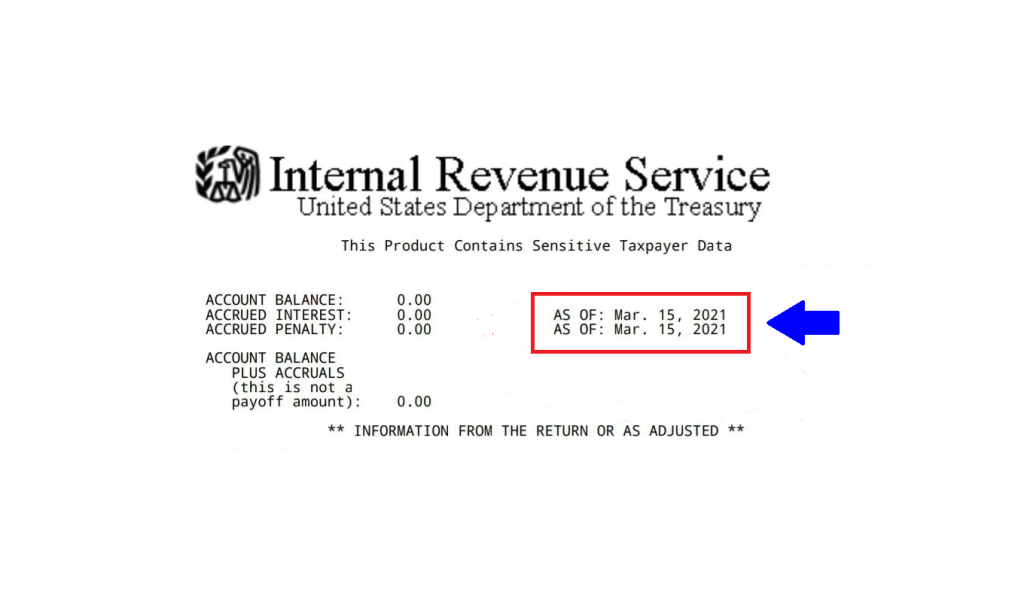

The As Of Date on IRS Tax Transcripts: Understanding its Significance

When obtaining IRS Tax Transcripts, you may come across an As Of Date mentioned on the document. This date holds significance and provides valuable information regarding the status of your tax account. In this…

When obtaining IRS Tax Transcripts, you may come across an As Of Date mentioned on the document. This date holds significance and provides valuable information regarding the status of your tax account. In this… -

Refundtalk wrote a new post 1 year, 4 months ago

How Tax Refund Checks Are Distributed and Delivered

As taxpayers, we eagerly anticipate the arrival of our tax refund checks. But have you ever wondered how the IRS handles the distribution process? In this blog post, we’ll take a closer look at how the IRS…

As taxpayers, we eagerly anticipate the arrival of our tax refund checks. But have you ever wondered how the IRS handles the distribution process? In this blog post, we’ll take a closer look at how the IRS… -

Refundtalk wrote a new post 1 year, 4 months ago

Tax Refund Status: "We Have Received Your Tax Return and It Is Being Processed" vs. "Your Tax Return Is Still Being Processed"

Filing taxes can be an anxious time, and waiting for your tax refund can add to the anticipation. When checking your refund status on the IRS “Where’s My Refund?” tool, you may come across different messages…

Filing taxes can be an anxious time, and waiting for your tax refund can add to the anticipation. When checking your refund status on the IRS “Where’s My Refund?” tool, you may come across different messages… -

Refundtalk wrote a new post 1 year, 5 months ago

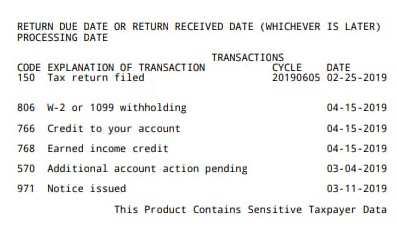

Tax Transcript Codes 570 and 971: Understanding Additional Account Action Pending and Notice Issued

Tax season can often bring confusion and anxiety, especially when encountering unfamiliar codes on your tax transcript. Two common codes that taxpayers may come across are 570 and 971. In this blog post, we’ll…

Tax season can often bring confusion and anxiety, especially when encountering unfamiliar codes on your tax transcript. Two common codes that taxpayers may come across are 570 and 971. In this blog post, we’ll… -

Refundtalk wrote a new post 1 year, 6 months ago

Decoding Tax Transcript Code 150: Understanding its SignificanceTax season can often leave us puzzled by the numerous codes and terminologies we encounter. One such code is “150” which appears on tax account transcripts. If you’ve come across tax transcript code 150 while…

-

Refundtalk wrote a new post 1 year, 6 months ago

Tax Transcripts: A Step-by-Step Guide to Break Down and Understand ThemTax transcripts are essential documents that provide a detailed summary of your tax return information. While they may appear complex and intimidating at first glance, understanding how to break down and interpret…

-

Refundtalk wrote a new post 1 year, 6 months ago

Unraveling the Delayed Tax Refunds: Unprecedented Challenges Faced by the IRS in 2023Tax season is a time that often evokes mixed emotions for individuals and businesses alike. While many eagerly await their tax refunds, it’s not uncommon to encounter delays in receiving them. In 2023, the Internal…

-

Refundtalk wrote a new post 1 year, 6 months ago

Patience and Precision: A Guide for Taxpayers Awaiting Amended Tax RefundsTax season can be both daunting and challenging, with numerous forms to fill out, calculations to double-check, and deadlines to meet. However, the process doesn’t always end with the submission of your tax return.…

-

Refundtalk wrote a new post 1 year, 6 months ago

IRS Account Transcripts: Unlocking Valuable Tax InformationTaxation is an integral part of our lives, and understanding our financial obligations to the Internal Revenue Service (IRS) is crucial. When it comes to accessing and interpreting your tax records, IRS account…

-

Refundtalk wrote a new post 1 year, 6 months ago

Navigating the Challenges of Delayed Tax Refunds: What You Need to KnowTax season is a period of anticipation for many individuals and businesses alike. It’s a time when taxpayers eagerly await their refunds, which can provide a much-needed financial boost or help cover important…

-

Refundtalk wrote a new post 1 year, 6 months ago

Patience Pays Off: A Guide for US Taxpayers Awaiting IRS Tax RefundsTax season is an annual event that can cause a mix of anticipation and anxiety for many Americans. While most taxpayers diligently file their returns on time, some unfortunate individuals find themselves waiting for…

-

Refundtalk wrote a new post 1 year, 6 months ago

Understanding Tax Refunds: When Can Taxpayers Expect Their Money?Tax season is a time of both anticipation and confusion for many individuals. While filing taxes can be a daunting task, the prospect of receiving a tax refund often brings a sense of relief and excitement. However,…

-

Refundtalk wrote a new post 1 year, 7 months ago

April 18, 2023, is the Tax Deadlines for 2022 Returns

The Internal Revenue Service reminds taxpayers that IRS.gov provides last-minute tax return filers with the resources they need to get taxes done before the April 18 deadline. IRS.gov remains a great resource…

The Internal Revenue Service reminds taxpayers that IRS.gov provides last-minute tax return filers with the resources they need to get taxes done before the April 18 deadline. IRS.gov remains a great resource… -

Refundtalk wrote a new post 1 year, 7 months ago

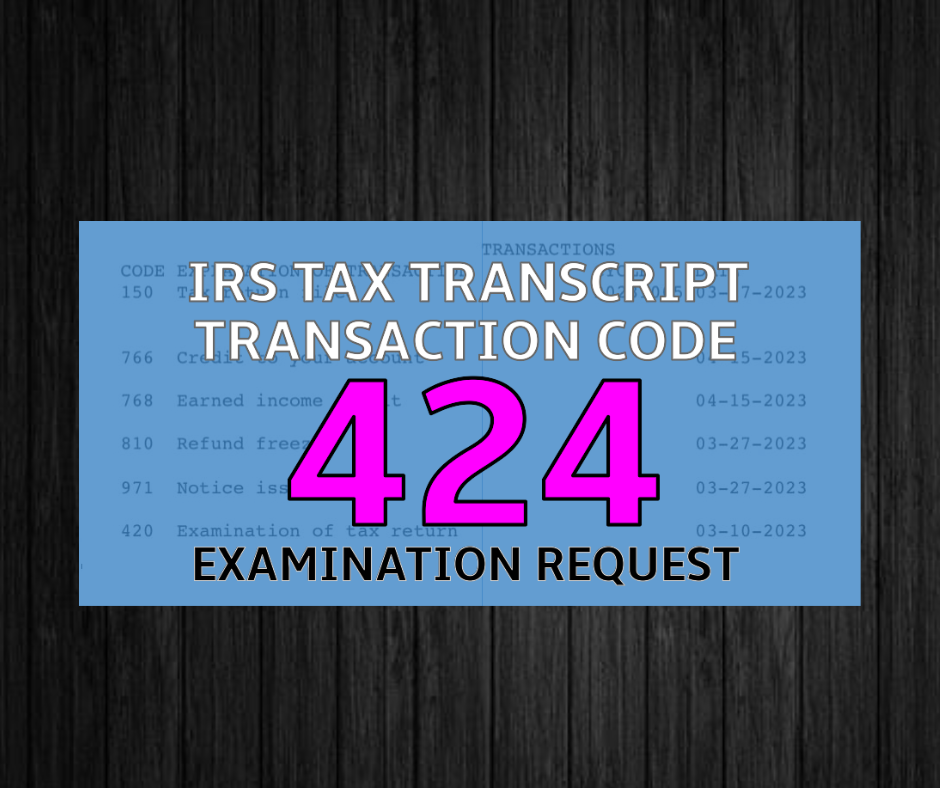

What does Transaction Code 424 mean on my Account Transcript?

The transaction code TC 424 is an Examination Request and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this code TC 424…

The transaction code TC 424 is an Examination Request and is the code that will appear on your tax transcript if your tax return has been referred for further examination or audit. The IRS uses this code TC 424… - Load More