When obtaining IRS Tax Transcripts, you may come across an As Of Date mentioned on the document. This date holds significance and provides valuable information regarding the status of your tax account. In this blog post, we will delve into the details of the As Of Date, demystifying its meaning and explaining its relevance for taxpayers.

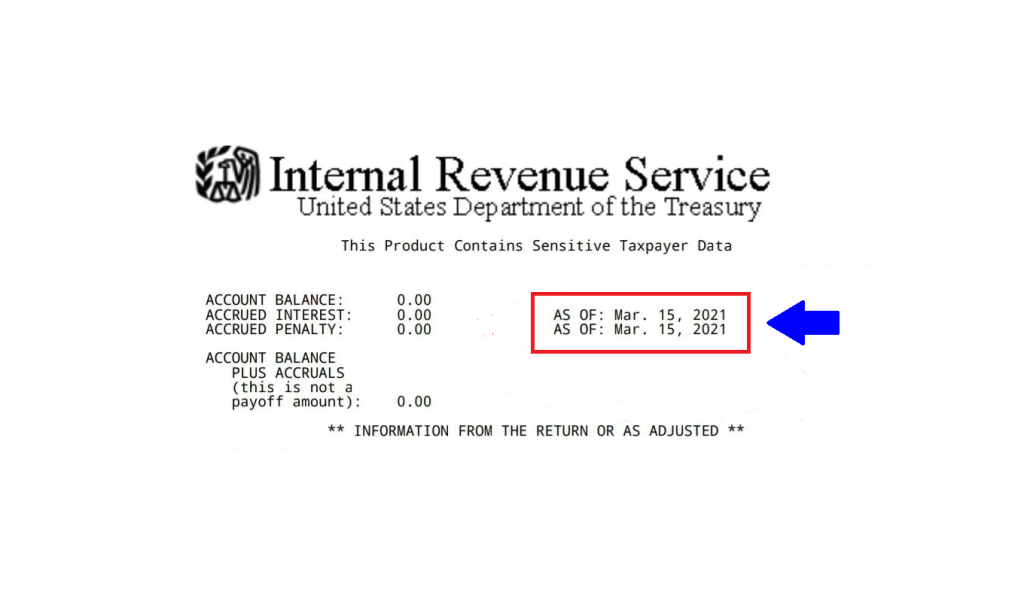

- Definition and Purpose: The As Of Dateon IRS Tax Transcripts represents the specific point in time when the information included in the transcript was current and accurate. It serves as a reference point for the tax information reflected in the document. This date is important for both taxpayers and the IRS to ensure accurate recordkeeping and processing of tax-related matters.

- Tax Return Processing: The As Of Date indicates the timeframe up to which the IRS has processed your tax return and updated your tax account. It signifies that the information contained in the transcript is current as of that particular date. Any changes or updates made to your tax account after the As Of Date will not be reflected in the transcript.

- Impact on Account Inquiries: When communicating with the IRS or other parties, the As Of Date helps establish the most recent tax information available. It enables accurate responses to account inquiries and ensures that the information provided aligns with the specific date mentioned on the transcript.

- Timeliness of Transcripts: It’s important to note that the As Of Date on a tax transcript may not always reflect the most recent date. Processing times can vary, and there may be a delay between the As Of Date and the date you request or receive the transcript. Thus, it’s essential to consider the timeframe and any subsequent updates that may have occurred since the As Of Date mentioned.

- Keeping Track of Changes: To stay updated on any changes or updates to your tax account, it is recommended to regularly request new tax transcripts, especially if you anticipate needing the most current information for financial or legal purposes. This ensures that you have the latest documentation reflecting your tax status.

Understanding the significance of the As Of Date on IRS Tax Transcripts is crucial for accurate recordkeeping and communication with the IRS. By recognizing its role as a reference point for the currency of tax information, taxpayers can ensure they have the most up-to-date documentation for their financial and legal needs. Remember to request updated tax transcripts as needed to keep track of any changes that occur beyond the As Of Date.