Refundtalk

@admin

-

Refundtalk wrote a new post 6 years, 10 months ago

Daily vs. Weekly Account Processing

What is the difference between IRS Daily and Weekly Accounts? The difference is when your tax return is processed, and when updates are made and posted to your account. Daily Accounts: Some…

What is the difference between IRS Daily and Weekly Accounts? The difference is when your tax return is processed, and when updates are made and posted to your account. Daily Accounts: Some… -

Refundtalk wrote a new post 6 years, 10 months ago

How to Read an IRS Account Transcript

IRS transcripts are notorious for being extremely complex and very hard to follow. So in many cases, the IRS will tell you that ordering a Tax Transcript can not help you get your refund any faster. This is true…

IRS transcripts are notorious for being extremely complex and very hard to follow. So in many cases, the IRS will tell you that ordering a Tax Transcript can not help you get your refund any faster. This is true… -

Refundtalk wrote a new post 6 years, 10 months ago

Now that tax season is here, consumers are looking for a reliable, easy way to file their taxes. Why not use an online tax service? These services allow you to easily and safely file your taxes online from the…

-

Refundtalk wrote a new post 6 years, 10 months ago

The Internal Revenue Service announced today that the nation’s tax season will begin Monday, Jan. 29, 2018 and reminded taxpayers claiming certain tax credits that refunds won’t be available before late Feb…

-

Refundtalk wrote a new post 6 years, 11 months ago

2018 Tax Refund Updates Calendar

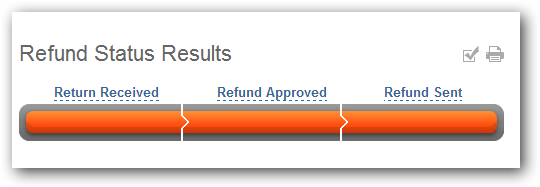

Where’s my Refund? Updates Calendar for 2018 Below we will show you how to use Where’s My Refund? Updates Calendars! Return Accepted Updates – This is the intake process of your tax return meaning once y…

Where’s my Refund? Updates Calendar for 2018 Below we will show you how to use Where’s My Refund? Updates Calendars! Return Accepted Updates – This is the intake process of your tax return meaning once y… -

Refundtalk wrote a new post 6 years, 11 months ago

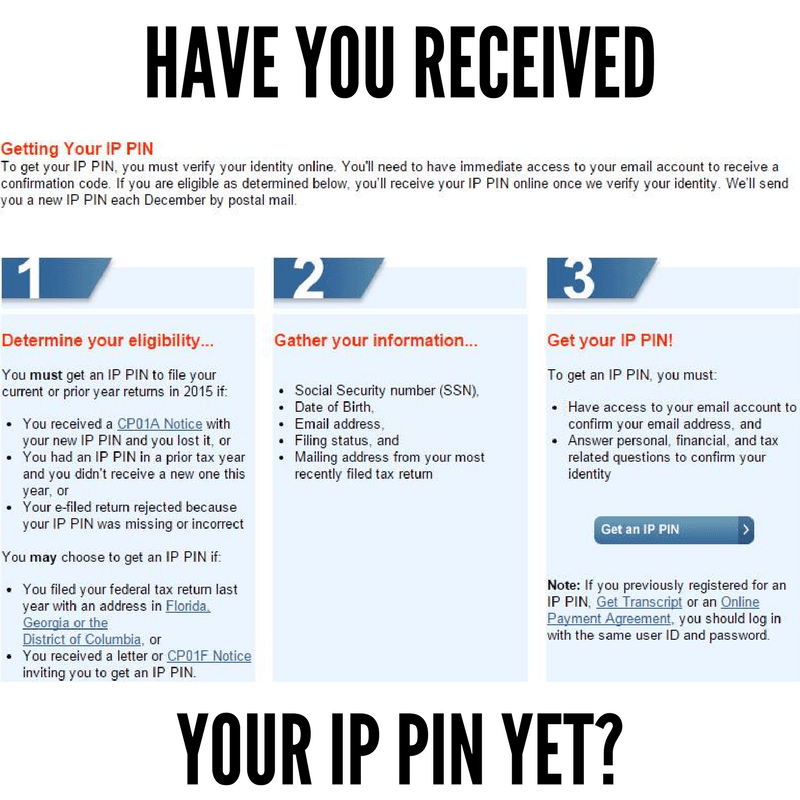

Attention identity theft victims: IP Pin Number should be mailed by Early January each year. Here’s how to get one, reissued if it was lost or if you moved…

The Identity Protection PIN is the result of an IRS…

-

Refundtalk wrote a new post 6 years, 11 months ago

We have been getting multiple reports that some taxpayer tax refunds never hit their cards or banks. If you never received your tax refund after seeing a scheduled direct deposit date message here are a couple of…

-

Refundtalk wrote a new post 6 years, 11 months ago

Again this year, the IRS Tax Refund Site, Where’s my Refund? is often overloaded. When you e-file, your tax return is usually accepted within 24 hours of filing by the IRS. Then your seemingly endless wait begins f…

-

Refundtalk wrote a new post 6 years, 11 months ago

The Tax Cuts and Jobs Act is the most sweeping update to the U.S. tax code in more than 30 years. The reforms will simplify taxpaying for many individual Americans, lower taxes on individuals and businesses, and…

-

Refundtalk wrote a new post 6 years, 11 months ago

A cycle code is an 8 digit code found on your account transcripts. The cycle code indicates the day your account was posted to the IRS Master File. This date indicates the 4 digits of the current cycle year,…

-

Refundtalk wrote a new post 6 years, 11 months ago

Your ITIN may expire before you file a tax return in 2018

The Internal Revenue Service reminds taxpayers with expiring Individual Taxpayer Identification Numbers (ITIN) to submit their renewal applications as soon as possible. Failing to renew them by the end of the year…

The Internal Revenue Service reminds taxpayers with expiring Individual Taxpayer Identification Numbers (ITIN) to submit their renewal applications as soon as possible. Failing to renew them by the end of the year… -

Refundtalk wrote a new post 6 years, 12 months ago

If you receive a letter or notice from the IRS, it will explain the reason for the correspondence and provide instructions. Many of these letters and notices can be dealt with simply, without having to call or…

-

Refundtalk wrote a new post 6 years, 12 months ago

The number of data breaches was already on a record pace for 2017 before the reported theft of nearly 145 million Americans’ names, addresses and Social Security numbers brought the issue to the f…

-

Refundtalk wrote a new post 6 years, 12 months ago

During the online holiday shopping season, the IRS, state tax agencies, and the tax industry remind people to be vigilant with their personal information. While shopping for gifts, criminals are shopping for…

-

Refundtalk wrote a new post 7 years ago

The Internal Revenue Service today advised taxpayers about steps they can take now to ensure smooth processing of their 2017 tax return and avoid a delay in getting their refund next year. This is the first in a…

-

Refundtalk wrote a new post 7 years ago

The fiscal year 2018 budget plan the House Budget Committee approved in July calls for a radical change in the Earned Income Tax Credit (EITC) that could harm millions of low-income working families and cause serious…

-

Refundtalk wrote a new post 7 years, 1 month ago

The Internal Revenue Service (IRS) announced that they would start enforcing ObamaCare’s individual mandate with the 2018 tax filing season, the first time the agency has done so since the mandate took effect back i…

-

Refundtalk wrote a new post 7 years, 1 month ago

WASHINGTON — The Internal Revenue Service today urged taxpayers who have a filing extension through Oct. 16 to check their returns for often-overlooked tax benefits. When they are ready to file, the IRS recommends t…

-

Refundtalk replied to the topic The Notice Review Processing System (NRPS) in the forum Under Review 7 years, 2 months ago

The Notice Review Processing System (NRPS) selects Settlement notices, Adjustment notices, Associated notices and Refund Transcripts

for review by analyzing data from the following sources:CP Notice Records—NRPS also uses this information to print a copy of selected notices for the review.

Entity and Tax Modules—NRPS uses the Tra…[Read more]

-

Refundtalk replied to the topic What are CP Notices? in the forum IRS Letters & Notices 7 years, 2 months ago

CP Notices

-A Computer Paragraph (CP) Notice is a computer generated message resulting from:-A tax examiner entering Taxpayer Notice Codes (TPNCs) on a return

-A Master File analysis of a taxpayers account

-Certain transactions posting to an account

Notices can generate to:

-Request information or payment from a…[Read more]

- Load More