What is the difference between IRS Daily and Weekly Accounts?

The difference is when your tax return is processed, and when updates are made and posted to your account.

Daily Accounts:

Some transactions post to the Master File on a daily basis as opposed to during the weekly cycle.

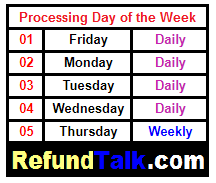

If your cycle code ends with a 01, 02, 03, 04 your account follows Daily processing and usually posts updates on Wednesday Mornings.

⦁ Daily Account tax returns are processed Friday(01), Monday(02), Tuesday(03), Wednesday(04)

⦁ Major updates with direct deposit dates for the Daily account usually take place on Wednesday mornings.

⦁ Accounts that follow Daily processing update on Where’s My Refund(WMR) on Wednesday early mornings with Friday Direct Deposit Dates.

Some individual tax returns require no additional actions to the taxpayer’s account process to the master file on a daily basis, unless you would meet one of the disqualifiers below on the tax account that would make you become a weekly account.

- ITIN Accounts

- Foreign Address

- Campus Address

- Freeze Codes

- Identity Theft Indicators

- Prisoner File

- Related MFT 31 (Bankruptcy, Offer in Compromise, Restitution Related, Tax Court, Innocent Spouse, Exam agreed/

unagreed cases, Taxpayer Assistance Order, Installment Agreement, Currently Not Collectible) - Criminal Investigation Activity

- Tax Module History (two years prior) with CI, Exam or Collection Activity

- Civil Penalty Account (MFT 55)

Weekly Accounts:

If your cycle code ends with 05 your account follows Weekly processing and usually posts updates on Saturday Mornings.

⦁ Weekly Account tax returns are processed only on Thursdays(05)

⦁ Major updates with direct deposit dates for the Weekly account usually take place on Saturday mornings.

⦁ Accounts that follow Weekly processing updates on Where’s My Refund(WMR) on Saturday early mornings with Wednesday Direct Deposit Dates.

Individual tax returns that require additional actions to ensure the tax return is accurate before it can be processed must continue to be processed on a weekly basis to allow the IRS time to verify and correct the tax return before it posts to the Master File. The IRS included efforts in its software planning to identify specific tax return transactions and taxpayer accounts that require additional review prior to processing the tax return. The IRS has identified approximately 148 million taxpayer accounts that contained characteristics that would cause a tax return to be processed weekly (called disqualifiers).

- Entity: Entity disqualifiers relate to transactions or characteristics that are in the entity portion of a tax account. Examples include accounts marked as identity theft, accounts in bankruptcy litigation, and accounts with an IRS processing center zip code.

- Tax Module – Freeze: Tax Module Freeze disqualifiers relate to conditions present on the individual tax periods within a tax account. Examples include tax periods with a claim pending, with an offer-in-compromise, or marked uncollectible.

- Tax Module – Transactions: Tax Module Transaction disqualifiers relate to codes or transactions present on the individual tax periods within a tax account. Examples include tax periods with certain penalty transactions or underreported issues.

- Incoming Transactions: Incoming transaction disqualifiers relate to conditions posting to tax periods during the prior tax Filing Season. Examples include changes to the tax account or adjustments made to the tax return as a result of actions taken at the time the tax return is processed.

*Watch this video about Daily and Weekly IRS Processing

Many people are wondering if they have a Daily Account or a Weekly Account.

Each year to find the most accurate information you will need to obtain a copy of your account transcript for the current tax year. No two tax years are the same some things may have changed since last year.

Example: You may have been weekly the last three tax years because of identity theft issues. The IRS may have cleared you and returned your account back to daily account processing this year, or you may have been a daily account the last two years and you filed bankruptcy and now this year the IRS has moved your account to weekly account processing.

The main thing is to never rely on last year’s information for this tax year. Obtain your copy of this year’s account transcript and use the information below to decipher if you are a daily or weekly account.

To figure out if you have a daily or a weekly account with the IRS:

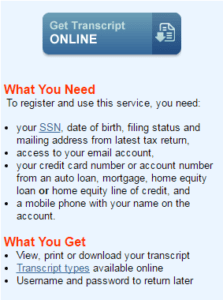

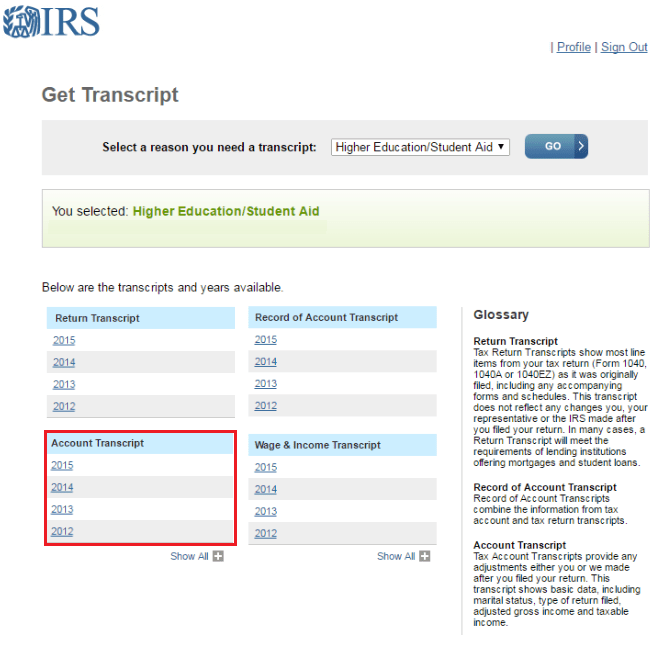

1. You have to have access to your current year’s Account Transcript!!

2. Obtain a Copy of your Account Transcripts (If you need help you can visit our Transcript Resources Page)

3. Click on the most recent tax year and your Account Transcript will appear in a new window

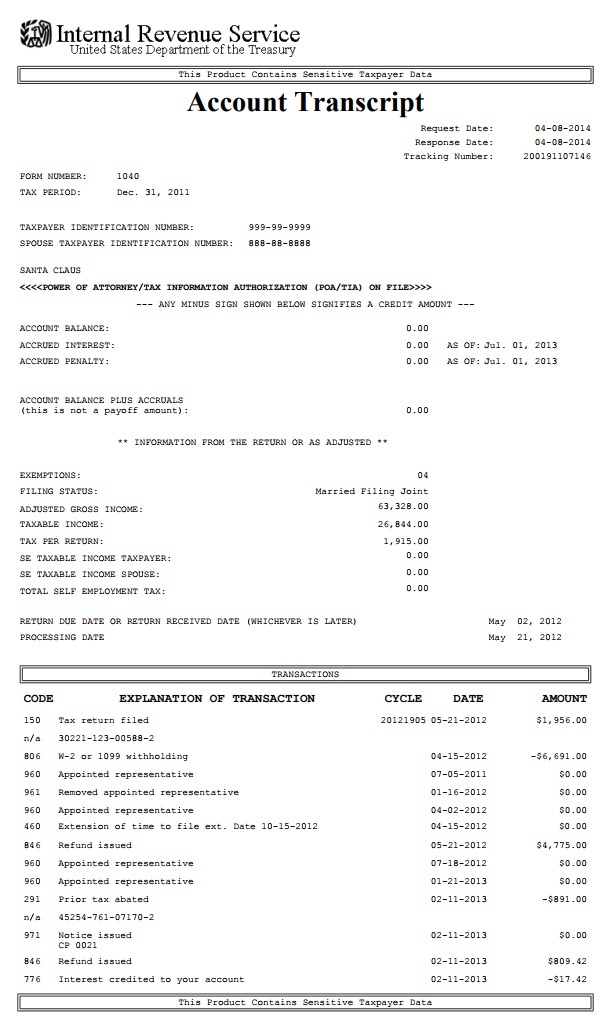

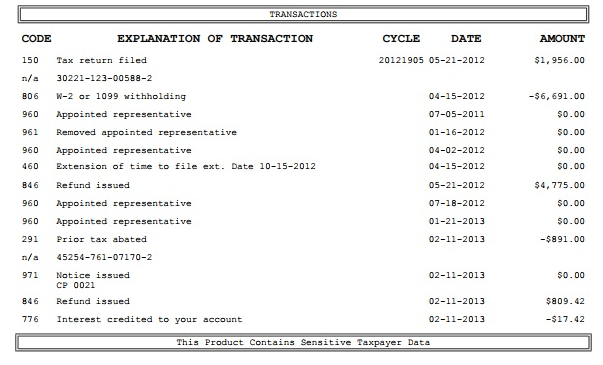

4. Look for the Transactions Sections on your Account Transcript

5. Locate your Cycle in the Transactions section of the Account Transcript

*The Processing Day of the Week the last two digits of your cycle code will determine if you are a Daily or Weekly Account.

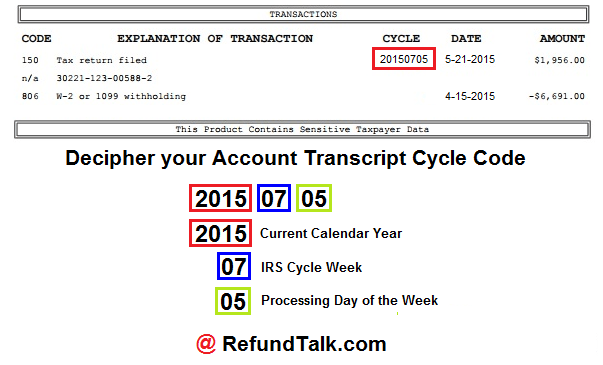

What is the Cycle Code?

A cycle code is an 8 digit number found on your account transcripts. This date indicates the 4 digits of the current calendar year, two-digit IRS cycle week, and two-digit processing day of the week.

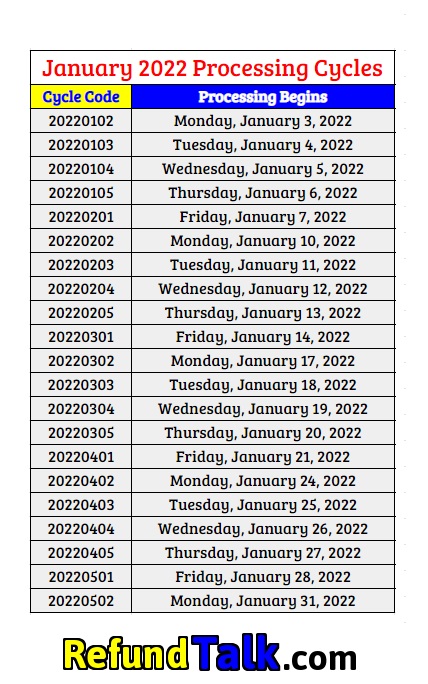

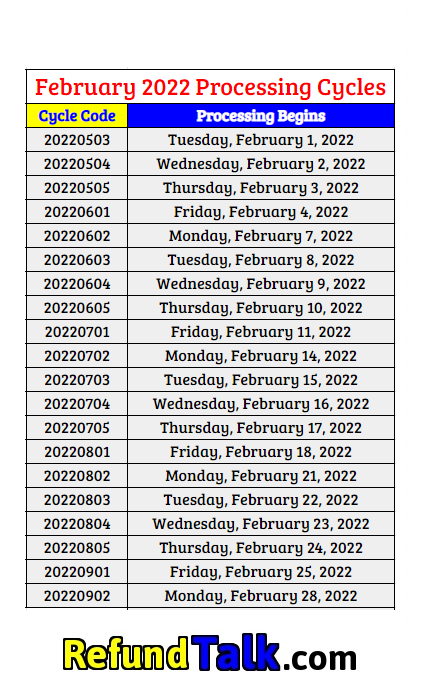

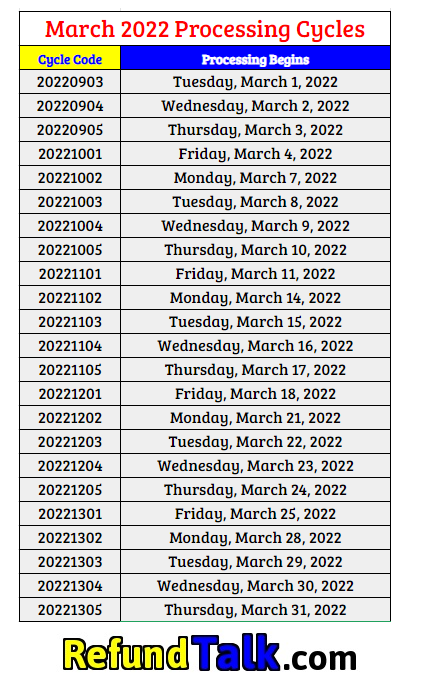

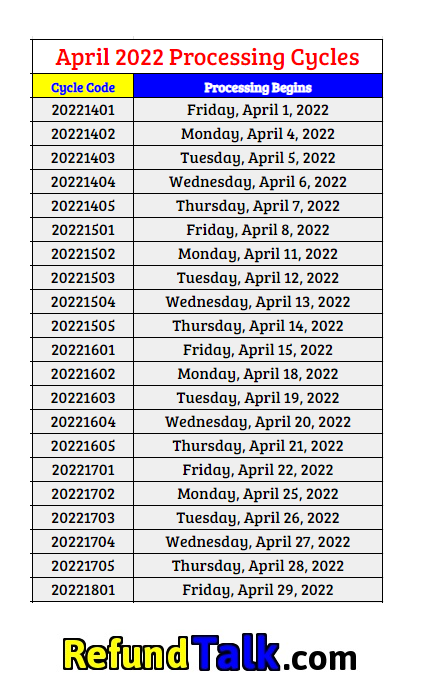

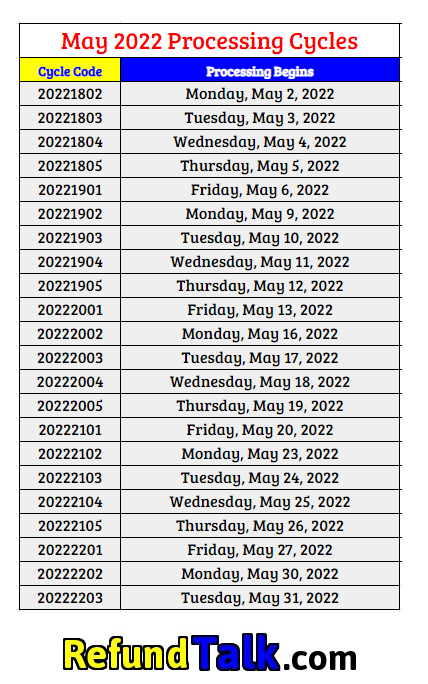

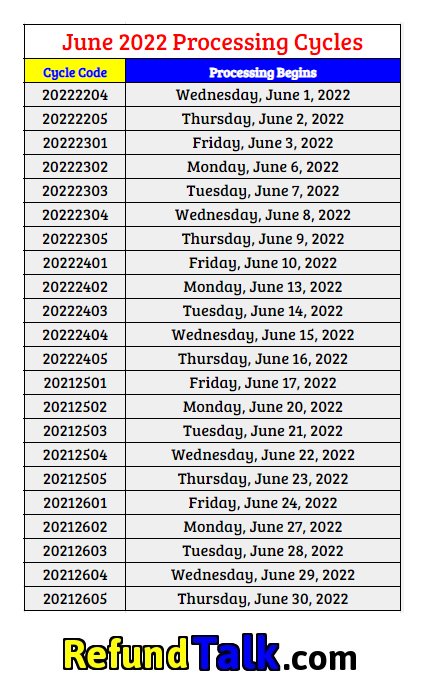

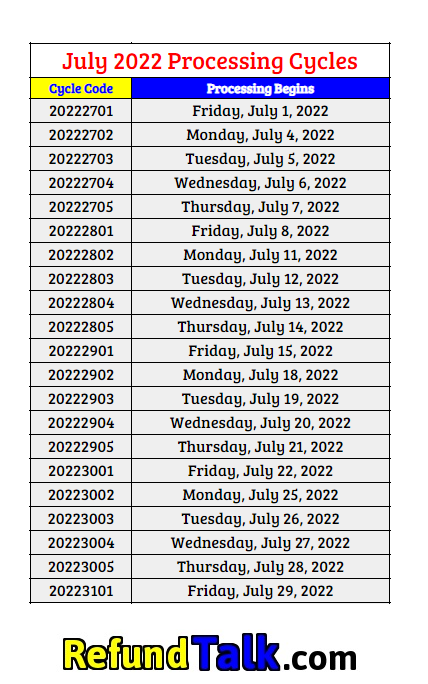

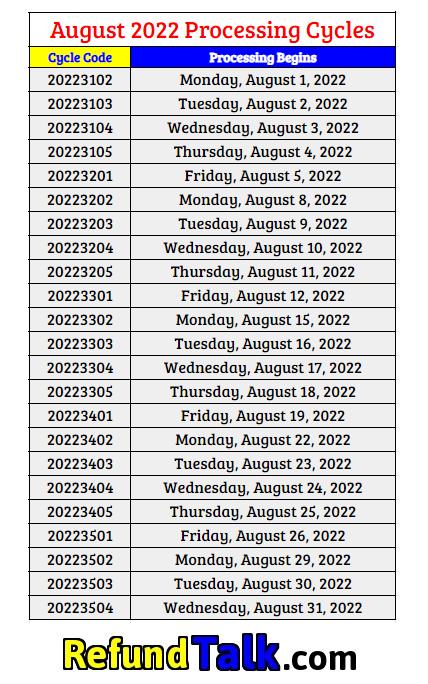

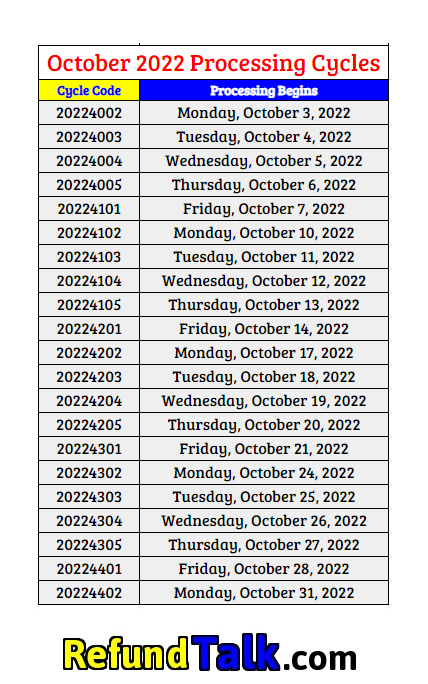

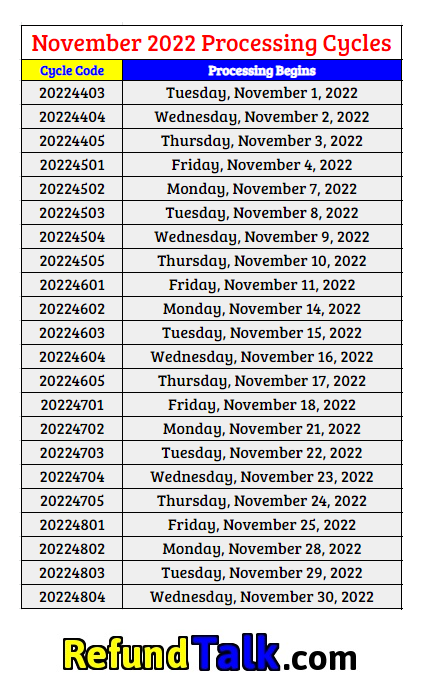

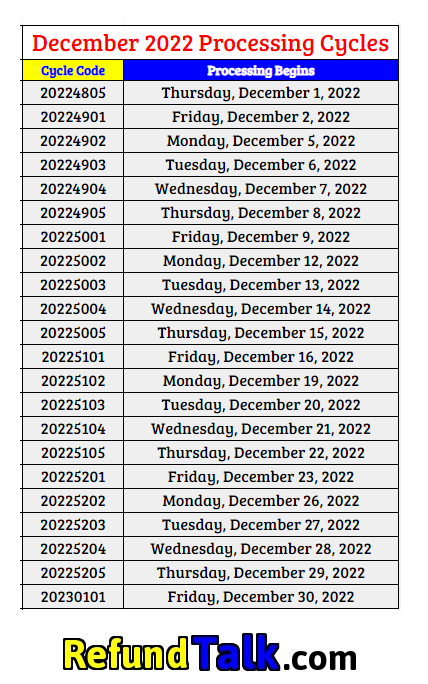

IRS Processing Cycles

We have simplified the IRS Processing Cycles from above to make them easier to read. All you have to do is find your cycle code on your account transcript and use these charts below to determine the day the IRS began to process your tax return.

Find your Cycle Code on the charts and determine the day the IRS began processing your tax return.

You can find more cycle codes here!

Please Remember: Determining your IRS Cycle Code Date does not determine the day you will get your tax refund. These charts will determine the day the IRS began to process your tax return.

If you have any questions deciphering if you are a daily or weekly account or want to help others on the tax refund hunt then comment below.