Refundtalk

@admin

-

Refundtalk wrote a new post 1 year, 10 months ago

The Most Useful IRS Tools for Taxpayers

The Internal Revenue Service encourages taxpayers to use their free online IRS tools and resources to find the information they need to get ready to file their federal tax returns. Specifically, IRS.gov is a…

The Internal Revenue Service encourages taxpayers to use their free online IRS tools and resources to find the information they need to get ready to file their federal tax returns. Specifically, IRS.gov is a… -

Refundtalk wrote a new post 1 year, 10 months ago

Did The IRS Reject Your Tax Return? Here’s What You Should Do

Most taxpayers now use e-file to submit their returns. The process is easy to use, especially with the help of tax preparation software. On occasion, however, you may find that your electronically filed tax return…

Most taxpayers now use e-file to submit their returns. The process is easy to use, especially with the help of tax preparation software. On occasion, however, you may find that your electronically filed tax return… -

Refundtalk wrote a new post 1 year, 10 months ago

IRS E-File Test Batch(HUB Testing) for 2023

Every year, the IRS accepts several batches of tax returns to test in a Controlled Launch before they are officially open. Every tax season about a week in advance the IRS routinely runs a Controlled Release…

Every year, the IRS accepts several batches of tax returns to test in a Controlled Launch before they are officially open. Every tax season about a week in advance the IRS routinely runs a Controlled Release… -

Refundtalk wrote a new post 1 year, 10 months ago

Do You Know if You Filed a False Tax Return?

Most of us would not intentionally commit tax fraud. Being convicted of filing fraudulent tax returns can put a crimp in your professional life, not to mention the possibility of going to prison. Yet, some people…

Most of us would not intentionally commit tax fraud. Being convicted of filing fraudulent tax returns can put a crimp in your professional life, not to mention the possibility of going to prison. Yet, some people… -

Refundtalk wrote a new post 1 year, 10 months ago

The Benefits of Filing Taxes Early: Maximizing Your Financial AdvantageAs tax season approaches, many individuals find themselves wondering when they can file their taxes. While the official tax filing deadline is typically April 15th in the United States, the good news is that you can…

-

Refundtalk wrote a new post 1 year, 10 months ago

2023 IRS E-File Tax Refund Direct Deposit Dates

2023 IRS E-File Refund Cycle Charts The IRS will begin accepting 2022 tax returns on January 23, 2023, with nearly 165 million individual tax returns expected to be filed in 2023. The nation’s tax deadline wi…

2023 IRS E-File Refund Cycle Charts The IRS will begin accepting 2022 tax returns on January 23, 2023, with nearly 165 million individual tax returns expected to be filed in 2023. The nation’s tax deadline wi… -

Refundtalk wrote a new post 1 year, 10 months ago

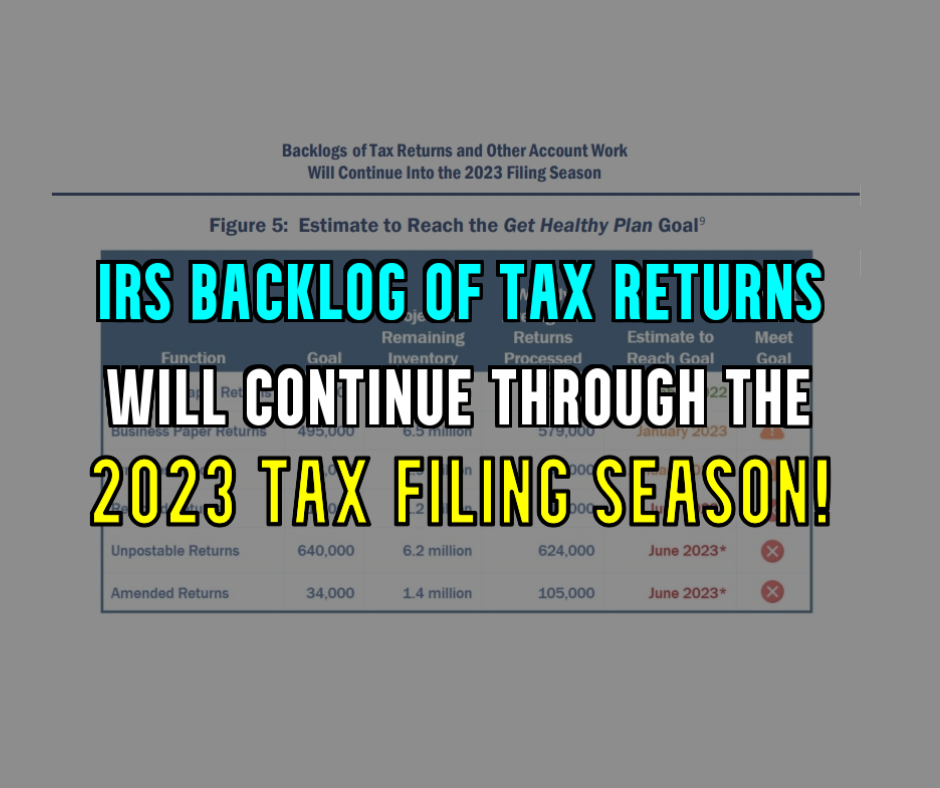

The IRS watchdog reported this week that the agency is unlikely to eliminate a huge backlog of tax returns this year, again leaving many U.S. taxpayers waiting for their returns and their tax refunds to be…

-

Refundtalk wrote a new post 1 year, 10 months ago

IRS Postpones Implementation Of $600 Form 1099-K Reporting By A Year

As a result of taxpayer confusion, lack of clear guidance, concerns about the existing backlog, and impact on the upcoming filing season, industry and stakeholders urged the IRS to postpone the implementation of…

As a result of taxpayer confusion, lack of clear guidance, concerns about the existing backlog, and impact on the upcoming filing season, industry and stakeholders urged the IRS to postpone the implementation of… -

Refundtalk wrote a new post 1 year, 10 months ago

Child Tax Credit Changes For 2023

The 2022 tax season is right around the corner, and now is a great time to start thinking about your upcoming tax return and refund. There have been many tax changes in 2022 that could have an impact on your return…

The 2022 tax season is right around the corner, and now is a great time to start thinking about your upcoming tax return and refund. There have been many tax changes in 2022 that could have an impact on your return… -

Refundtalk wrote a new post 1 year, 10 months ago

Several tax changes are effective in 2022. Some of the more significant changes are:

Child Tax Credits

Child tax credit reverts back to $2,000 per child under the age of 17 and is only refundable up to…

-

Refundtalk wrote a new post 1 year, 11 months ago

Are You a Tax Return Ghost Preparer?

With tax season approaching, the Internal Revenue Service (IRS) is again warning consumers and companies to avoid “ghost” tax return preparers. Are you a ghost preparer? Tax preparer fraud is a perennial iss…

With tax season approaching, the Internal Revenue Service (IRS) is again warning consumers and companies to avoid “ghost” tax return preparers. Are you a ghost preparer? Tax preparer fraud is a perennial iss… -

Refundtalk wrote a new post 1 year, 11 months ago

IRS Reference Code 1242 is a processing code the IRS uses to review tax returns it thinks might be fraudulent. The IRS will hold your return until they can validate certain information on it.

The IRS has…

-

Refundtalk wrote a new post 1 year, 11 months ago

The Internal Revenue Service encouraged taxpayers to take important actions this month to help them file their 2022 federal tax returns.

This is the second in a series of reminders to help taxpayers get ready…

-

Refundtalk wrote a new post 1 year, 11 months ago

2022 Education Tax Credits

Eligible taxpayers who pay college expenses for themselves, their spouses, or their dependents may be able to take advantage of two 2022 education tax credits. Both the American Opportunity Tax Credit and the…

Eligible taxpayers who pay college expenses for themselves, their spouses, or their dependents may be able to take advantage of two 2022 education tax credits. Both the American Opportunity Tax Credit and the… -

Refundtalk wrote a new post 2 years ago

Tax Transcript Processing Date

The Processing Date represents the date when the IRS expects to have your tax return and tax refund processed. IRS Transcript Processing Date What is a Tax Transcript Processing Date? This processing…

The Processing Date represents the date when the IRS expects to have your tax return and tax refund processed. IRS Transcript Processing Date What is a Tax Transcript Processing Date? This processing… -

Refundtalk wrote a new post 2 years ago

How to read your Account Transcript

Here’s a breakdown of what everything on your Account Transcripts means. Request and Response Dates The Request date shows the date you requested your transcripts and the response date shows when…

Here’s a breakdown of what everything on your Account Transcripts means. Request and Response Dates The Request date shows the date you requested your transcripts and the response date shows when… -

Refundtalk wrote a new post 2 years ago

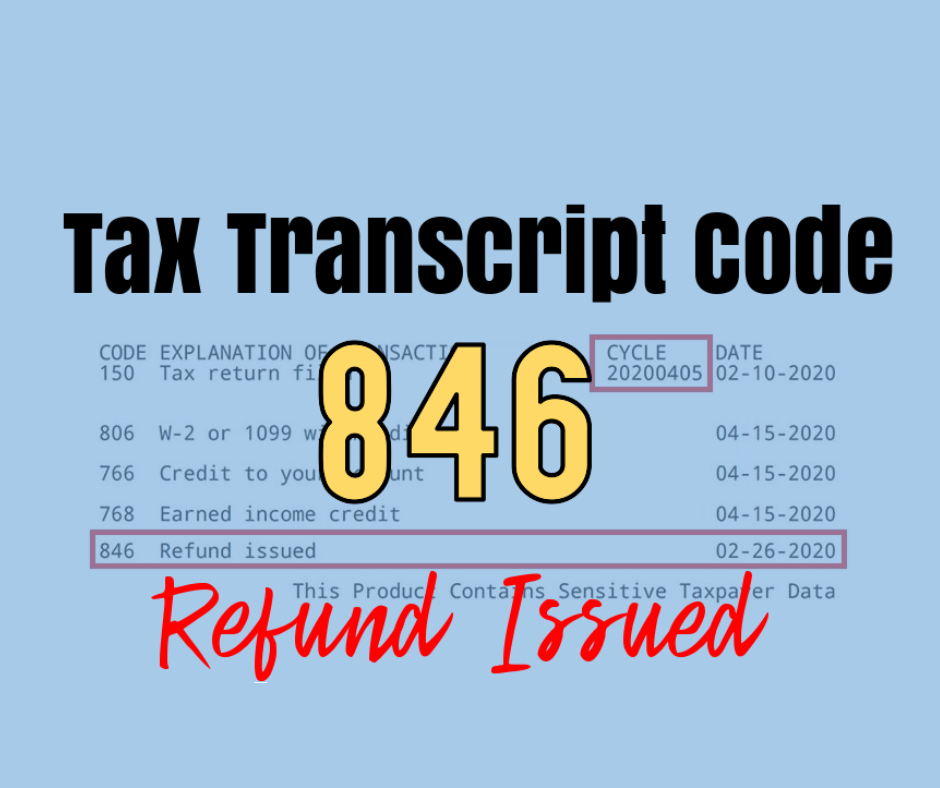

Tax Transcript Code 846 on your tax transcript means that the IRS has issued you a refund for your tax return. You can use the cycle code to find out when your tax return started processing and the explanation of…

-

Refundtalk wrote a new post 2 years ago

IRS Cycle Code

Deciphering Your IRS Cycle Code What is an IRS Cycle Code? The IRS cycle code is an eight-digit code that you can find on your online tax account transcript once your tax return has been accepted and…

Deciphering Your IRS Cycle Code What is an IRS Cycle Code? The IRS cycle code is an eight-digit code that you can find on your online tax account transcript once your tax return has been accepted and… -

Refundtalk wrote a new post 2 years ago

2023 Tax Refund Updates Calendar

IRS Where’s My Refund? Updates Calendar for 2023 IRS Transcript and the Where’s My Refund? Updates Calendars! Important Tax Transcript and Where’s My Refund update cycle. Tuesday Transcript Updates -…

IRS Where’s My Refund? Updates Calendar for 2023 IRS Transcript and the Where’s My Refund? Updates Calendars! Important Tax Transcript and Where’s My Refund update cycle. Tuesday Transcript Updates -… -

Refundtalk wrote a new post 2 years ago

Tax Refund Sent to The Wrong Account?

Last year, the IRS processed over 128 million refunds at an average amount of $2,775 each. The majority of those were sent through direct deposit. The IRS encourages taxpayers to use this method because it t…

Last year, the IRS processed over 128 million refunds at an average amount of $2,775 each. The majority of those were sent through direct deposit. The IRS encourages taxpayers to use this method because it t… - Load More