Refundtalk

@admin

-

Refundtalk wrote a new post 1 year, 10 months ago

IRS announces special Saturday hours for face-to-face help at Taxpayer Assistance Centers across the nation

As part of a continuing effort to improve service this tax season, the Internal Revenue Service today announced special Saturday hours for the next four months at Taxpayer Assistance Centers (TACs) across the c…

As part of a continuing effort to improve service this tax season, the Internal Revenue Service today announced special Saturday hours for the next four months at Taxpayer Assistance Centers (TACs) across the c… -

Refundtalk wrote a new post 1 year, 11 months ago

Join us for EITC Awareness Day on Friday, January 27, 2023

The Internal Revenue Service and partners nationwide today kicked off their Earned Income Tax Credit Awareness Day outreach campaign to help millions of Americans who earned $59,187 or less last year take a…

The Internal Revenue Service and partners nationwide today kicked off their Earned Income Tax Credit Awareness Day outreach campaign to help millions of Americans who earned $59,187 or less last year take a… -

Refundtalk wrote a new post 1 year, 11 months ago

Top Facts Filers Should Know for IRS Opening Day 2023!

Opening Day for the IRS is Today January 23, 2023. The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file electronically with…

Opening Day for the IRS is Today January 23, 2023. The Internal Revenue Service kicked off the 2023 tax filing season with a focus on improving service and a reminder to taxpayers to file electronically with… -

Refundtalk wrote a new post 1 year, 11 months ago

How Much is The Child Tax Credit Worth?

During the coronavirus pandemic, the American Rescue Plan temporarily boosted the maximum Child Tax Credit amount to $3,000 (children between the ages of 6 and 17) and $3,600 (children under age 6) for the 2021…

During the coronavirus pandemic, the American Rescue Plan temporarily boosted the maximum Child Tax Credit amount to $3,000 (children between the ages of 6 and 17) and $3,600 (children under age 6) for the 2021… -

Refundtalk wrote a new post 1 year, 11 months ago

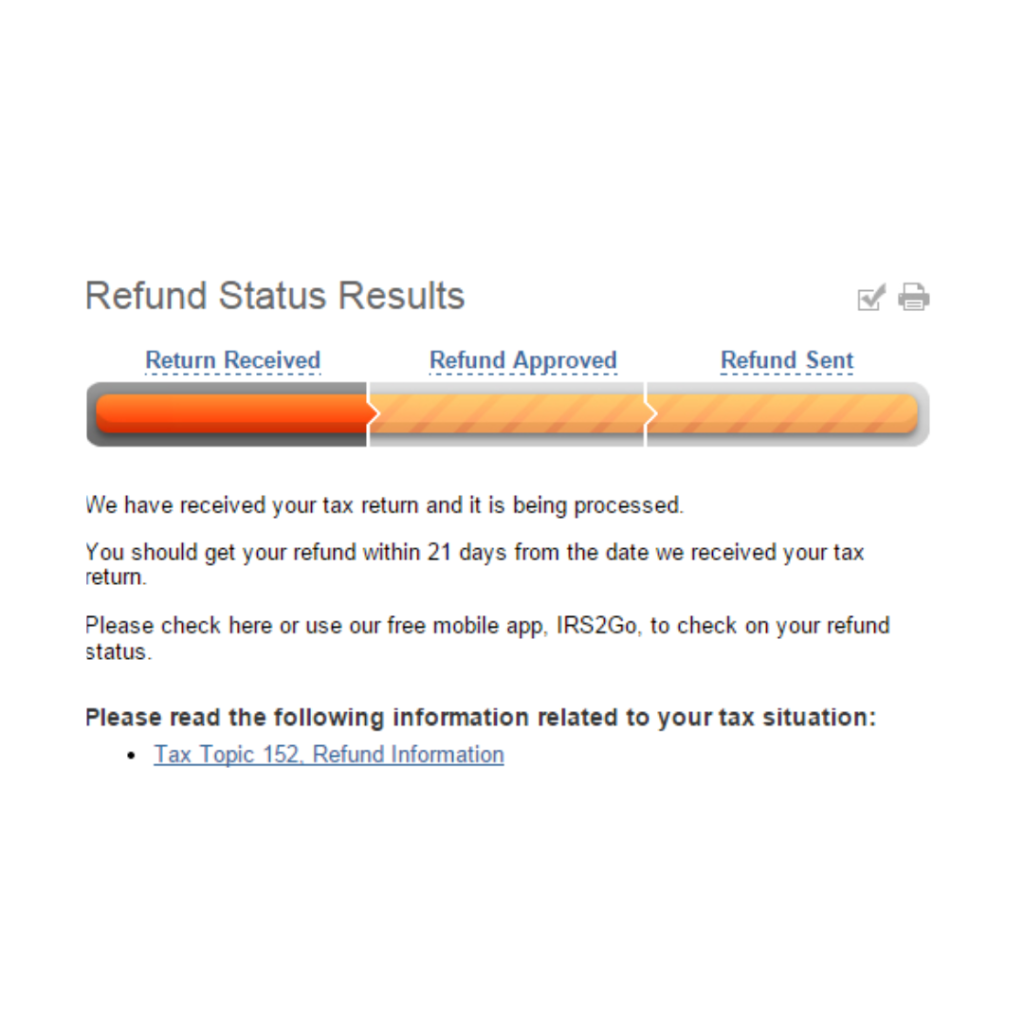

Was your tax return accepted before the IRS Opening day in 2023?

The 2023 tax season has now officially started and some early taxpayers have already received notifications from Where’s My Refund? and their tax services. If you’ve prepared and filed your taxes early, keep…

The 2023 tax season has now officially started and some early taxpayers have already received notifications from Where’s My Refund? and their tax services. If you’ve prepared and filed your taxes early, keep… -

Refundtalk wrote a new post 1 year, 11 months ago

Tax Tips for the 2023 Tax Season

Tax Refunds May Be Smaller This Year Plan now to learn these 2023 tax tips to avoid surprises in the future! If you’re expecting a tax refund in 2023, it may be smaller than last year, according to the IRS. Y…

Tax Refunds May Be Smaller This Year Plan now to learn these 2023 tax tips to avoid surprises in the future! If you’re expecting a tax refund in 2023, it may be smaller than last year, according to the IRS. Y… -

Refundtalk wrote a new post 1 year, 11 months ago

Choose Your Tax Preparer Wisely

You’ve heard it before. Since it’s tax time, you’ll hear it again. Choose your tax preparer wisely. This past year has been difficult for most of us as we were on the verge of a recession. Prices are…

You’ve heard it before. Since it’s tax time, you’ll hear it again. Choose your tax preparer wisely. This past year has been difficult for most of us as we were on the verge of a recession. Prices are… -

Refundtalk wrote a new post 1 year, 11 months ago

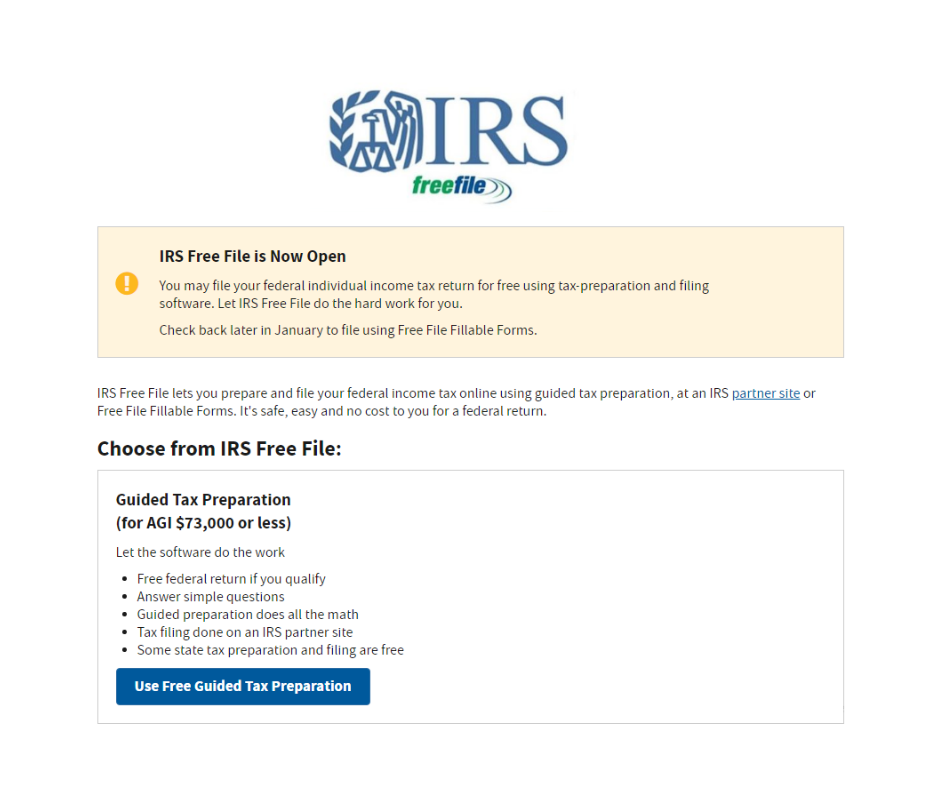

IRS Free File Opens Jan. 13, 2023!

Most taxpayers can get an early start on their federal tax returns as IRS Free File – an online tax preparation product available at no charge − opens today January 13, 2023, for the 2023 tax filing seaso…

Most taxpayers can get an early start on their federal tax returns as IRS Free File – an online tax preparation product available at no charge − opens today January 13, 2023, for the 2023 tax filing seaso… -

Refundtalk wrote a new post 1 year, 11 months ago

Taxpayer Advocacy Service report highlights top 10 issues facing taxpayers

A new report by the IRS Taxpayer Advocate says processing delays are the “Most Serious Problem” faced by taxpayers during 2022. From the report’s Executive Summary: In 2020, the IRS quickly fell beh…

A new report by the IRS Taxpayer Advocate says processing delays are the “Most Serious Problem” faced by taxpayers during 2022. From the report’s Executive Summary: In 2020, the IRS quickly fell beh… -

Refundtalk wrote a new post 1 year, 11 months ago

How To File Your Taxes For Free

Millions of U.S. taxpayers are eligible to have their federal income tax returns filed for free through the IRS Free File program. Depending on your adjusted gross income (AGI), you may be able to use the…

Millions of U.S. taxpayers are eligible to have their federal income tax returns filed for free through the IRS Free File program. Depending on your adjusted gross income (AGI), you may be able to use the… -

Refundtalk wrote a new post 1 year, 11 months ago

IRS Opening Day for the 2023 Tax Season

The Internal Revenue Service has announced that the nation’s tax season will start on Monday, Jan. 24, 2023, when the tax agency will begin accepting and processing 2022 tax year returns. The Internal R…

The Internal Revenue Service has announced that the nation’s tax season will start on Monday, Jan. 24, 2023, when the tax agency will begin accepting and processing 2022 tax year returns. The Internal R… -

Refundtalk wrote a new post 1 year, 11 months ago

Why You Can Expect A Smaller IRS Tax Refund In 2023

Changes to tax rules for charitable contributions and the end of pandemic-related stimulus and credits could mean less money for you. It’s highly likely your tax refund will be smaller in 2023, the Internal R…

Changes to tax rules for charitable contributions and the end of pandemic-related stimulus and credits could mean less money for you. It’s highly likely your tax refund will be smaller in 2023, the Internal R… -

Refundtalk wrote a new post 1 year, 11 months ago

The Most Useful IRS Tools for Taxpayers

The Internal Revenue Service encourages taxpayers to use their free online IRS tools and resources to find the information they need to get ready to file their federal tax returns. Specifically, IRS.gov is a…

The Internal Revenue Service encourages taxpayers to use their free online IRS tools and resources to find the information they need to get ready to file their federal tax returns. Specifically, IRS.gov is a… -

Refundtalk wrote a new post 1 year, 11 months ago

Did The IRS Reject Your Tax Return? Here’s What You Should Do

Most taxpayers now use e-file to submit their returns. The process is easy to use, especially with the help of tax preparation software. On occasion, however, you may find that your electronically filed tax return…

Most taxpayers now use e-file to submit their returns. The process is easy to use, especially with the help of tax preparation software. On occasion, however, you may find that your electronically filed tax return… -

Refundtalk wrote a new post 1 year, 11 months ago

IRS E-File Test Batch(HUB Testing) for 2023

Every year, the IRS accepts several batches of tax returns to test in a Controlled Launch before they are officially open. Every tax season about a week in advance the IRS routinely runs a Controlled Release…

Every year, the IRS accepts several batches of tax returns to test in a Controlled Launch before they are officially open. Every tax season about a week in advance the IRS routinely runs a Controlled Release… -

Refundtalk wrote a new post 1 year, 11 months ago

Do You Know if You Filed a False Tax Return?

Most of us would not intentionally commit tax fraud. Being convicted of filing fraudulent tax returns can put a crimp in your professional life, not to mention the possibility of going to prison. Yet, some people…

Most of us would not intentionally commit tax fraud. Being convicted of filing fraudulent tax returns can put a crimp in your professional life, not to mention the possibility of going to prison. Yet, some people… -

Refundtalk wrote a new post 1 year, 11 months ago

The Benefits of Filing Taxes Early: Maximizing Your Financial AdvantageAs tax season approaches, many individuals find themselves wondering when they can file their taxes. While the official tax filing deadline is typically April 15th in the United States, the good news is that you can…

-

Refundtalk wrote a new post 1 year, 11 months ago

2023 IRS E-File Tax Refund Direct Deposit Dates

2023 IRS E-File Refund Cycle Charts The IRS will begin accepting 2022 tax returns on January 23, 2023, with nearly 165 million individual tax returns expected to be filed in 2023. The nation’s tax deadline wi…

2023 IRS E-File Refund Cycle Charts The IRS will begin accepting 2022 tax returns on January 23, 2023, with nearly 165 million individual tax returns expected to be filed in 2023. The nation’s tax deadline wi… -

Refundtalk wrote a new post 1 year, 11 months ago

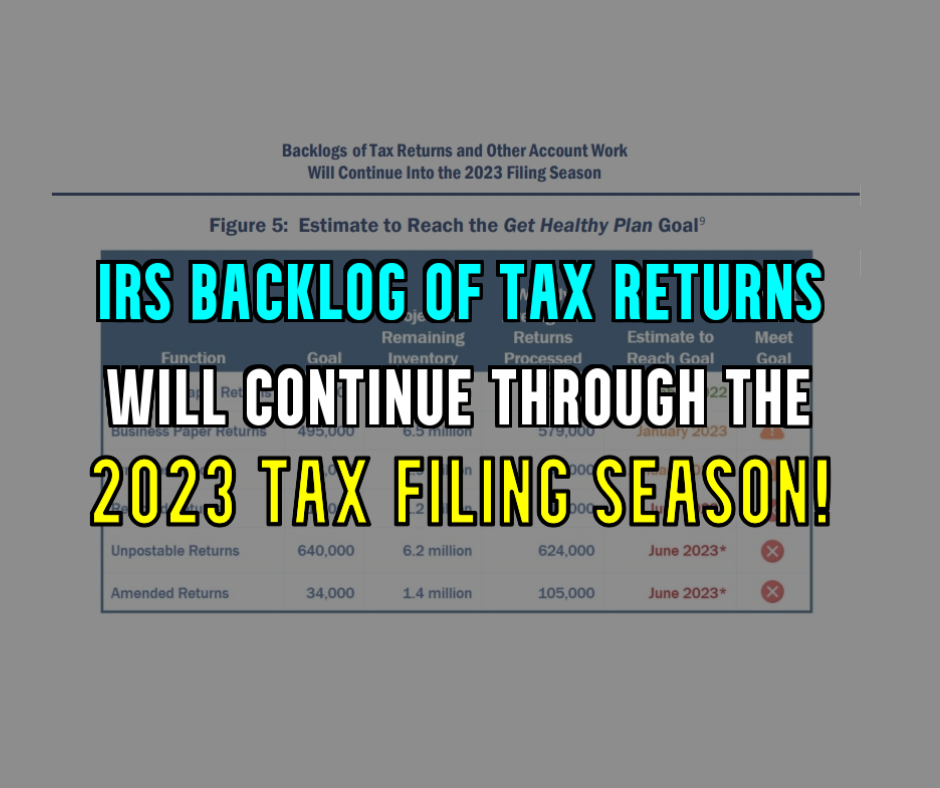

The IRS watchdog reported this week that the agency is unlikely to eliminate a huge backlog of tax returns this year, again leaving many U.S. taxpayers waiting for their returns and their tax refunds to be…

-

Refundtalk wrote a new post 1 year, 11 months ago

IRS Postpones Implementation Of $600 Form 1099-K Reporting By A Year

As a result of taxpayer confusion, lack of clear guidance, concerns about the existing backlog, and impact on the upcoming filing season, industry and stakeholders urged the IRS to postpone the implementation of…

As a result of taxpayer confusion, lack of clear guidance, concerns about the existing backlog, and impact on the upcoming filing season, industry and stakeholders urged the IRS to postpone the implementation of… - Load More