Refundtalk

@admin

-

Refundtalk wrote a new post 7 years, 8 months ago

(adsbygoogle = window.adsbygoogle || []).push({});

Everyone that was accepted from January 1, 2017 – February 14, 2017 that have been sitting with no answers have you Received Any Updates?

We are seeing…

-

Refundtalk wrote a new post 7 years, 8 months ago

Remember that assurance from the Internal Revenue Service that its agents never call you about an overdue tax bill.

That’s changing.

(adsbygoogle = window.adsbygoogle || []).push({});

The IRS is…

-

Refundtalk wrote a new post 7 years, 8 months ago

Applying for financial aid just got a little bit harder for families looking to get a bit of help sending someone to college next fall. As of yesterday, the U.S. Department of Education and IRS jointly announced the…

-

Refundtalk wrote a new post 7 years, 8 months ago

If you discover an error after filing your return, you may need to amend your return. The IRS may correct mathematical or clerical errors on a return and may accept returns without certain required forms or…

-

Refundtalk wrote a new post 7 years, 8 months ago

Direct deposit is fast and convenient, though mistakes can cost your refund

Individuals have the option to have some or all of their federal tax refund directly deposited to their bank account. With direct deposit, the IRS electronically transfers your tax refund to your bank account,…

Individuals have the option to have some or all of their federal tax refund directly deposited to their bank account. With direct deposit, the IRS electronically transfers your tax refund to your bank account,… -

Refundtalk wrote a new post 7 years, 8 months ago

In 2016, the Criminal Investigation (CI) division of the Internal Revenue Service initiated 3,395 cases in the fiscal year 2016 that focused on tax-related identity theft, money laundering, public corruption, c…

-

Refundtalk wrote a new post 7 years, 8 months ago

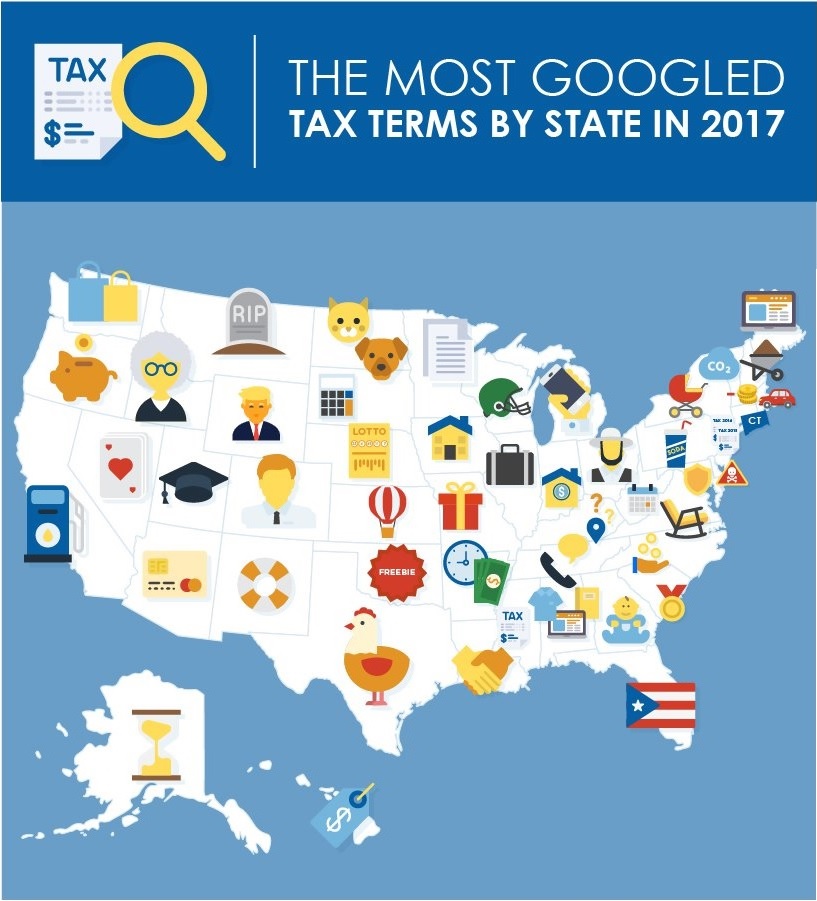

If you’ve ever tried to do your own taxes, you know how confusing they can be. Trying to pay taxes to two states or figure out what you can deduct and what you can’t? Good luck! No matter who you are, you can…

-

Refundtalk wrote a new post 7 years, 8 months ago

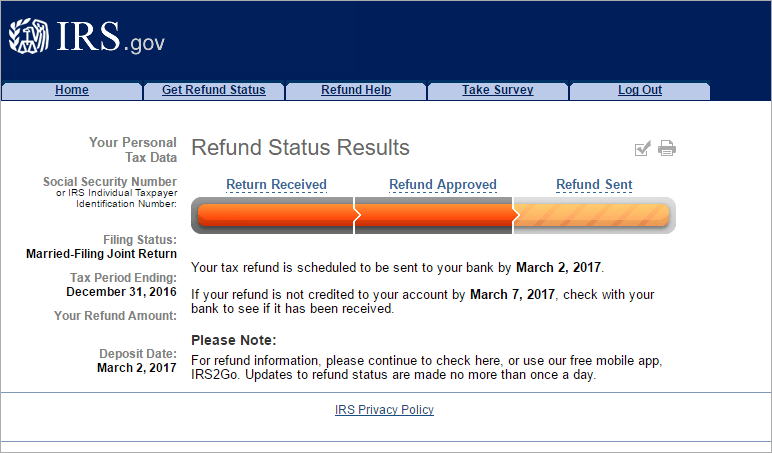

We confirmed the Fastest Refund Processing to Direct Deposit Date Today (Maybe the fastest in History). We have a follower that filed their Tax return on February 25, 2017, With EITC and they received a March 2,…

-

Refundtalk wrote a new post 7 years, 8 months ago

Common questions about tax refund checks and payments

I requested a direct deposit refund. Why is the IRS mailing it to me as a paper check?

There are three possible reasons. They are as…

-

Refundtalk wrote a new post 7 years, 8 months ago

If you E-filed your Tax Return prior to February 18, 2017, Please take part in this Poll. We are trying to determine how many people have still not received a tax refund or direct deposit date…

-

Refundtalk wrote a new post 7 years, 8 months ago

Identity verification letters are mailed through the U.S. Postal Service to the address on the tax return. The notice will require the taxpayers to verify their identities in order for the IRS to complete the…

-

Refundtalk wrote a new post 7 years, 8 months ago

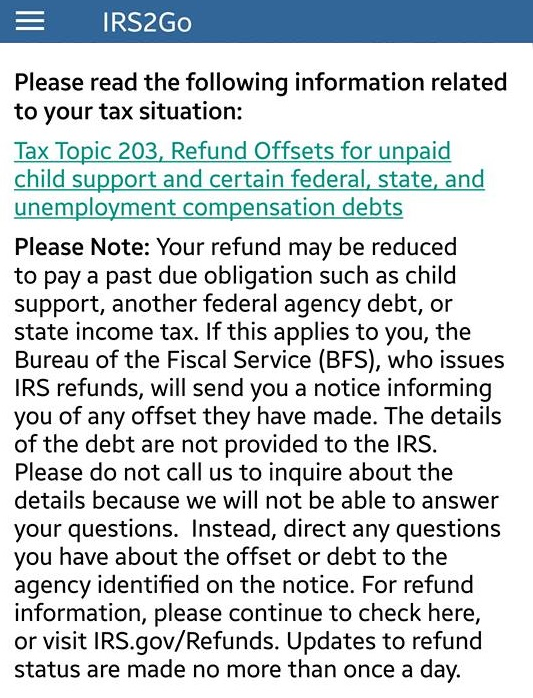

Your tax return may show that you’re due a refund from the IRS. However, if you owe a federal tax debt from a prior tax year, or a debt to another federal agency, or certain debts under state law, the IRS may keep (…

-

Refundtalk wrote a new post 7 years, 8 months ago

Please participate and vote so that we can keep a chart on how many people were expecting a tax refund on February 22 & 23 and did not receive one.

Thank You Very Much for your Support and Please…

-

Refundtalk wrote a new post 7 years, 8 months ago

Filing taxes can be stressful and when the IRS opts to take a closer look at your return, that can only increase your anxiety level. Getting your return flagged for review doesn’t mean you’ll be audited, but it can…

-

Refundtalk wrote a new post 7 years, 8 months ago

What Is an IRS Letter 5071C?

If the IRS suspects that a tax return with your name on it is potentially the result of identity theft, the agency will send you a special letter, called a 5071C Letter. This…

-

Refundtalk wrote a new post 7 years, 8 months ago

The IRS uses LTR 12C (see upper right corner of your letter) to request Form 8962, Premium Tax Credit. It’s required when someone on your tax return had health insurance through Healthcare.gov (or a state M…

-

Refundtalk wrote a new post 7 years, 8 months ago

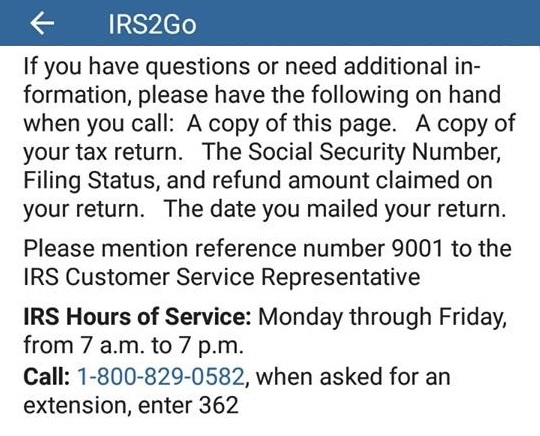

If you’ve filed your taxes already, then you’re probably waiting anxiously for your refund. If you’re like many people, you use the IRS “Where’s My Refund” tool or APP a few times each day in hopes that the status…

-

Refundtalk started the topic 5071C? in the forum IRS Letters & Notices 7 years, 9 months ago

What Is an IRS Letter 5071C?

If the IRS suspects that a tax return with your name on it is potentially the result of identity theft, the agency will send you a special letter, called a 5071C Letter. This letter is to notify you that the agency received a tax return with your name and Social Security number and it believes it may not be yours. The…[Read more] -

Refundtalk wrote a new post 7 years, 9 months ago

Full List of IRS Tax Topics

We have had many people asking what certain tax topics mean. Here is a Full list of all the IRS Tax Topics taxpayers may see on the Where’s my Refund? app or tool. Please find your topic listed below and follow the…

We have had many people asking what certain tax topics mean. Here is a Full list of all the IRS Tax Topics taxpayers may see on the Where’s my Refund? app or tool. Please find your topic listed below and follow the… -

Refundtalk wrote a new post 7 years, 9 months ago

So I woke up this morning and my inbox is full of people that did not get their money in last night’s updates. We are not IRS officials so Please don’t YELL at us. We have no control over when you get your money. W…

- Load More