Refundtalk

@admin

-

Refundtalk replied to the topic When does Where my Amended Refund Update? in the forum

Amended Tax Returns 7 years, 8 months ago

Amended Tax Returns 7 years, 8 months agoWhere’s My Amended Return? updates once a day, usually at night. You can check it daily.

-

Refundtalk replied to the topic It has been more than 16 weeks and still no Amended Refund? in the forum

Amended Tax Returns 7 years, 8 months ago

Amended Tax Returns 7 years, 8 months agoSome amended returns take longer than 16 weeks for several reasons. Delays may occur when the return needs further review because of:

Errors

Is incomplete

Isn’t signed

Is returned to you requesting more information

Includes a Form 8379, Injured Spouse Allocation

Is affected by identity theft or fraud

Delays in processing also can happen when an a…[Read more] -

Refundtalk replied to the topic What types of Amended Returns can be viewd on Where my Amended Refund? in the forum

Amended Tax Returns 7 years, 8 months ago

Amended Tax Returns 7 years, 8 months agoYou can find out about amended returns mailed to the IRS processing operations. Form 1040X, Amended U.S. Individual Income Tax Return tells you where you need to mail your return.

Where’s My Amended Return? cannot give you the status of the following returns or claims:

Carryback applications and claims

Injured spouse claims

A Form 1040, U.S.…[Read more] -

Refundtalk wrote a new post 7 years, 9 months ago

The Internal Revenue Service didn’t properly implement some provisions of the PATH Act aimed at reducing improper payments for refundable tax credits, instead allowing an estimated $152 million in credits, a…

-

Refundtalk wrote a new post 7 years, 9 months ago

Tax-Free Weekends in 2017

Where You Can Shop Tax-Free for Back-To-School in 2017 If you’re lucky enough to live in a state that offers tax holidays for back-to-school shopping, this is your heads up — the first of those wonderful t…

Where You Can Shop Tax-Free for Back-To-School in 2017 If you’re lucky enough to live in a state that offers tax holidays for back-to-school shopping, this is your heads up — the first of those wonderful t… -

Refundtalk wrote a new post 8 years ago

The Internal Revenue Service is planning June 18 as the tentative date for moving its e-Services platform to what it promises will be more secure and modern technology.

In recent years, the IRS has experienced…

-

Refundtalk wrote a new post 8 years ago

When it comes to taxes, not much is simple, including knowing the day your individual tax return is due. For the second of three consecutive years, tax day is abandoning its traditional April 15 deadline and landing…

-

Refundtalk wrote a new post 8 years, 1 month ago

(adsbygoogle = window.adsbygoogle || []).push({});

Everyone that was accepted from January 1, 2017 – February 14, 2017 that have been sitting with no answers have you Received Any Updates?

We are seeing…

-

Refundtalk wrote a new post 8 years, 1 month ago

Remember that assurance from the Internal Revenue Service that its agents never call you about an overdue tax bill.

That’s changing.

(adsbygoogle = window.adsbygoogle || []).push({});

The IRS is…

-

Refundtalk wrote a new post 8 years, 2 months ago

Applying for financial aid just got a little bit harder for families looking to get a bit of help sending someone to college next fall. As of yesterday, the U.S. Department of Education and IRS jointly announced the…

-

Refundtalk wrote a new post 8 years, 2 months ago

If you discover an error after filing your return, you may need to amend your return. The IRS may correct mathematical or clerical errors on a return and may accept returns without certain required forms or…

-

Refundtalk wrote a new post 8 years, 2 months ago

Direct deposit is fast and convenient, though mistakes can cost your refund

Individuals have the option to have some or all of their federal tax refund directly deposited to their bank account. With direct deposit, the IRS electronically transfers your tax refund to your bank account,…

Individuals have the option to have some or all of their federal tax refund directly deposited to their bank account. With direct deposit, the IRS electronically transfers your tax refund to your bank account,… -

Refundtalk wrote a new post 8 years, 2 months ago

In 2016, the Criminal Investigation (CI) division of the Internal Revenue Service initiated 3,395 cases in the fiscal year 2016 that focused on tax-related identity theft, money laundering, public corruption, c…

-

Refundtalk wrote a new post 8 years, 2 months ago

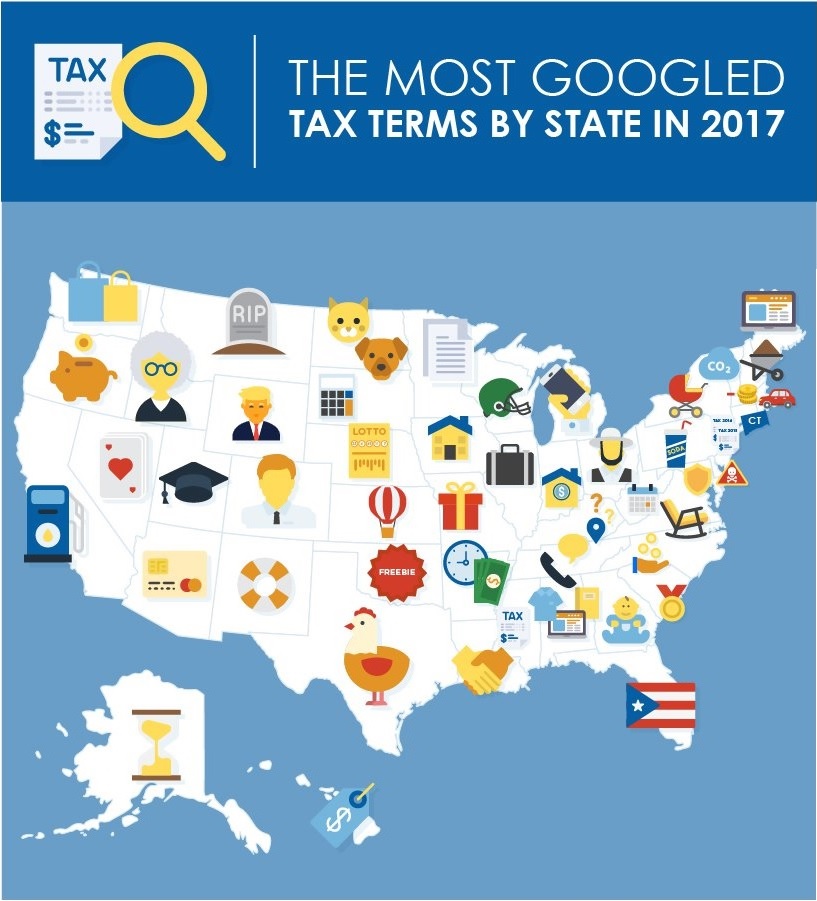

If you’ve ever tried to do your own taxes, you know how confusing they can be. Trying to pay taxes to two states or figure out what you can deduct and what you can’t? Good luck! No matter who you are, you can…

-

Refundtalk wrote a new post 8 years, 2 months ago

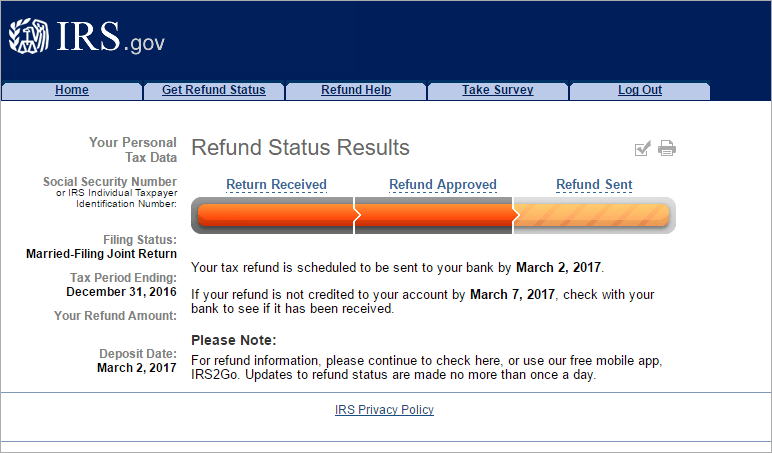

We confirmed the Fastest Refund Processing to Direct Deposit Date Today (Maybe the fastest in History). We have a follower that filed their Tax return on February 25, 2017, With EITC and they received a March 2,…

-

Refundtalk wrote a new post 8 years, 2 months ago

Common questions about tax refund checks and payments

I requested a direct deposit refund. Why is the IRS mailing it to me as a paper check?

There are three possible reasons. They are as…

-

Refundtalk wrote a new post 8 years, 2 months ago

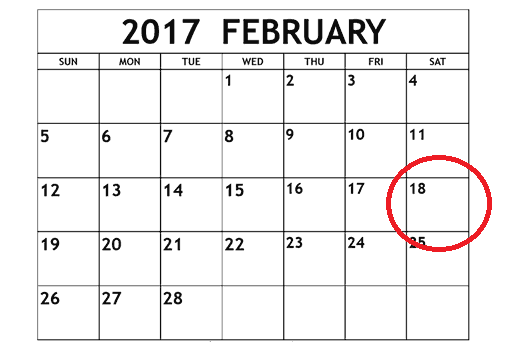

If you E-filed your Tax Return prior to February 18, 2017, Please take part in this Poll. We are trying to determine how many people have still not received a tax refund or direct deposit date…

-

Refundtalk wrote a new post 8 years, 2 months ago

Identity verification letters are mailed through the U.S. Postal Service to the address on the tax return. The notice will require the taxpayers to verify their identities in order for the IRS to complete the…

-

Refundtalk wrote a new post 8 years, 2 months ago

Tax Refund Offsets

Your tax return may show that you’re due a refund from the IRS. However, if you owe a federal tax debt from a prior tax year, or a debt to another federal agency, or certain debts under state law, the IRS may keep (…

Your tax return may show that you’re due a refund from the IRS. However, if you owe a federal tax debt from a prior tax year, or a debt to another federal agency, or certain debts under state law, the IRS may keep (… -

Refundtalk wrote a new post 8 years, 2 months ago

Please participate and vote so that we can keep a chart on how many people were expecting a tax refund on February 22 & 23 and did not receive one.

Thank You Very Much for your Support and Please…

- Load More