Refundtalk

@admin

-

Refundtalk wrote a new post 7 years, 10 months ago

Any change in your income can impact your income tax return since the IRS taxes different types of income at different rates. The most important thing to determine when assessing your tax situation is whether your…

-

Refundtalk wrote a new post 7 years, 10 months ago

Everybody loves tax exemptions. They reduce the amount of your taxable income, which affects the amount of taxes you pay. You can take a personal exemption for yourself, and you get an exemption for each of your…

-

Refundtalk wrote a new post 7 years, 10 months ago

Every spring, taxpayers across the USA gather their tax documents to file taxes and get that coveted refund check. The IRS issues tax refunds based on a tentative schedule they release in early January. Simply…

-

Refundtalk wrote a new post 7 years, 10 months ago

The IRS will begin to release EITC/ACTC refunds starting Feb. 15. However, the IRS cautions taxpayers that these refunds likely won’t arrive in bank accounts or debit cards until the week of February 27 — if t…

-

Refundtalk wrote a new post 7 years, 10 months ago

The IRS is proposing to change its position on when taxpayers may qualify as childless for purposes of the Sec. 32 earned income tax credit (REG-137604-07). The proposed regulations, issued on Thursday, would also…

-

Refundtalk started the topic Documents You Need to Send to the IRS to Claim the Earned Income Credit in the forum Earned Income Tax Credit (EITC) 7 years, 10 months ago

Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children for Tax Year 2016. Each child that you claim must have lived with you for more than half of 2016 in the United States. The United States includes the 50 states and the District of Columbia. It doesn’t include Puerto Rico or U.S. possessions…[Read more]

-

Refundtalk started the topic Earned Income Tax Credit Changes in the forum Earned Income Tax Credit (EITC) 7 years, 10 months ago

A lot of mixed emotions about if the CTC will be held up with the ACTC, and EITC, the answer is YES.

Please read:

The integrity provision of the PATH Act that will have the greatest impact on taxpayers that claim EITC is the one that requires the IRS to not release refunds for returns that claim EITC or the Additional Child Tax Credit until…[Read more] -

Refundtalk started the topic 2017 Tax Season IRS Refund Schedule in the forum Cycle Charts 7 years, 10 months ago

Below is the latest table showing estimated 2016–2017 tax season refund payment dates based on past refund cycles and IRS guidelines. It shows the date your refund will be processed and paid based on the week your return is accepted by the IRS. For refund dates specific to your tax filing go to the Where is my Refund (WMR) page or IRS2Go mobile ap…[Read more]

-

Refundtalk started the topic Mississippi in the forum Mississippi 7 years, 10 months ago

Do you have questions or updates about Mississippi State Tax Refunds? Use this thread to connect with others in your state that may have the same questions or answers.

Direct Link to State Website: Mississippi Tax!

-

Refundtalk started the topic Michigan in the forum Michigan 7 years, 10 months ago

Do you have questions or updates about Michigan State Tax Refunds? Use this thread to connect with others in your state that may have the same questions or answers.

Direct Link to State Website: Michigan Tax!

-

Refundtalk started the topic Illinois in the forum Illinois 7 years, 10 months ago

Do you have questions or updates about Illinois State Tax Refunds? Use this thread to connect with others in your state that may have the same questions or answers.

Direct Link to State Website: Illinois Tax!

-

Refundtalk wrote a new post 7 years, 10 months ago

Getting your tax return rejected by the IRS can mark the outset of a serious freak-out session. Thankfully the process of correcting and re-submitting your return often turns out to be fairly painless. Once you file…

-

Refundtalk wrote a new post 7 years, 10 months ago

Combating identity theft is a top priority, and across the IRS many important steps are being taken to fight it. A key part of this involves the Security Summit Initiative, a unique partnership between the IRS,…

-

Refundtalk started the topic Idaho Income Tax Discussion in the forum Idaho 7 years, 10 months ago

Do you have questions or updates about Idaho State Tax Refunds? Use this thread to connect with others in your state that may have the same questions or answers.

Direct Link to State Website: Idaho Tax!

-

Refundtalk wrote a new post 7 years, 10 months ago

The IRS is delaying tax refunds for more than 40 million low-income families this year as the agency steps up efforts to fight identity theft and fraud.

The delays will affect families claiming the earned…

-

Refundtalk wrote a new post 7 years, 10 months ago

Starting in 2017, tax refunds that include an Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) will be held until February 15.

WHY IS THE DELAY HAPPENING?

On December 18, 2015,…

-

Refundtalk wrote a new post 7 years, 10 months ago

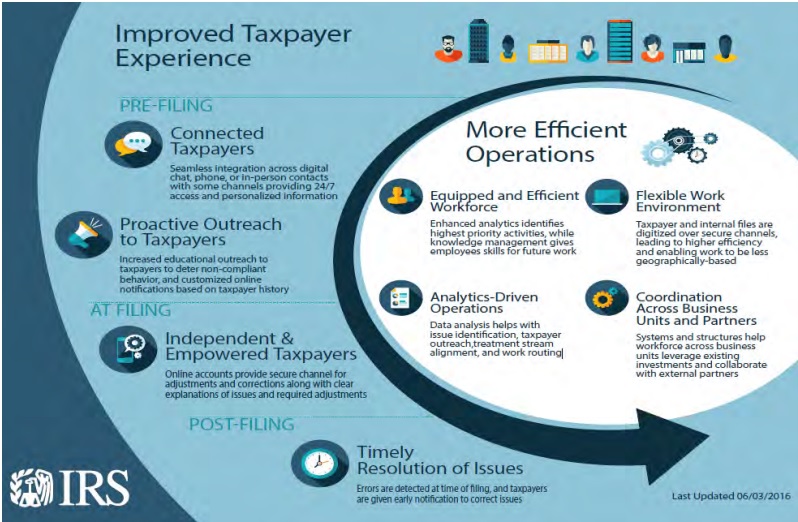

The Internal Revenue Service and its in-house watchdog the National Taxpayer Advocate’s office are debating the future of the agency and how that will affect us and our filings in the coming years.

The IRS is…

-

Refundtalk wrote a new post 7 years, 10 months ago

Friday Jan. 13th may be a Lucky Day for some Tax Filers

The first Friday the 13th of 2017 is lucky for some taxpayers. That’s the day that Free File once again opens, allowing eligible folks to electronically prepare and file their 2016 tax returns. The Internal…

The first Friday the 13th of 2017 is lucky for some taxpayers. That’s the day that Free File once again opens, allowing eligible folks to electronically prepare and file their 2016 tax returns. The Internal… -

Refundtalk wrote a new post 7 years, 10 months ago

One of the big sticks that the Internal Revenue Service wields is penalties for our mistakes or willful disregard of tax laws.

Some of the penalties were increased in 2016 thanks to law changes. Others are hiked…

-

Refundtalk wrote a new post 7 years, 10 months ago

Did you know about 27 percent of Earned Income Tax Credit returns are paid in error? According to the IRS, the five most common errors account for more than 60 percent of erroneous claims. Remember, EITC preparers…

- Load More