Refundtalk

@admin

-

Refundtalk wrote a new post 1 year, 11 months ago

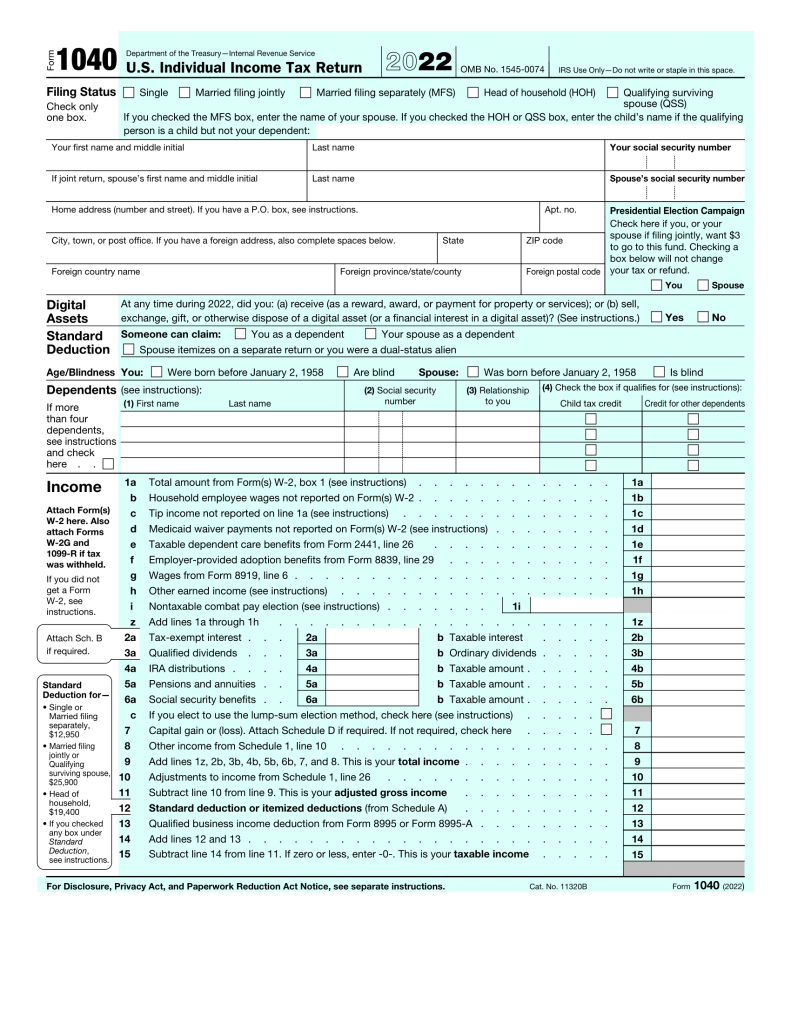

Child Tax Credit Changes For 2023

The 2022 tax season is right around the corner, and now is a great time to start thinking about your upcoming tax return and refund. There have been many tax changes in 2022 that could have an impact on your return…

The 2022 tax season is right around the corner, and now is a great time to start thinking about your upcoming tax return and refund. There have been many tax changes in 2022 that could have an impact on your return… -

Refundtalk wrote a new post 1 year, 12 months ago

Several tax changes are effective in 2022. Some of the more significant changes are:

Child Tax Credits

Child tax credit reverts back to $2,000 per child under the age of 17 and is only refundable up to…

-

Refundtalk wrote a new post 1 year, 12 months ago

Are You a Tax Return Ghost Preparer?

With tax season approaching, the Internal Revenue Service (IRS) is again warning consumers and companies to avoid “ghost” tax return preparers. Are you a ghost preparer? Tax preparer fraud is a perennial iss…

With tax season approaching, the Internal Revenue Service (IRS) is again warning consumers and companies to avoid “ghost” tax return preparers. Are you a ghost preparer? Tax preparer fraud is a perennial iss… -

Refundtalk wrote a new post 2 years ago

IRS Reference Code 1242 is a processing code the IRS uses to review tax returns it thinks might be fraudulent. The IRS will hold your return until they can validate certain information on it.

The IRS has…

-

Refundtalk wrote a new post 2 years ago

The Internal Revenue Service encouraged taxpayers to take important actions this month to help them file their 2022 federal tax returns.

This is the second in a series of reminders to help taxpayers get ready…

-

Refundtalk wrote a new post 2 years ago

2022 Education Tax Credits

Eligible taxpayers who pay college expenses for themselves, their spouses, or their dependents may be able to take advantage of two 2022 education tax credits. Both the American Opportunity Tax Credit and the…

Eligible taxpayers who pay college expenses for themselves, their spouses, or their dependents may be able to take advantage of two 2022 education tax credits. Both the American Opportunity Tax Credit and the… -

Refundtalk wrote a new post 2 years, 1 month ago

Tax Transcript Processing Date

The Processing Date represents the date when the IRS expects to have your tax return and tax refund processed. IRS Transcript Processing Date What is a Tax Transcript Processing Date? This processing…

The Processing Date represents the date when the IRS expects to have your tax return and tax refund processed. IRS Transcript Processing Date What is a Tax Transcript Processing Date? This processing… -

Refundtalk wrote a new post 2 years, 1 month ago

How to read your Account Transcript

Here’s a breakdown of what everything on your Account Transcripts means. Request and Response Dates The Request date shows the date you requested your transcripts and the response date shows when…

Here’s a breakdown of what everything on your Account Transcripts means. Request and Response Dates The Request date shows the date you requested your transcripts and the response date shows when… -

Refundtalk wrote a new post 2 years, 1 month ago

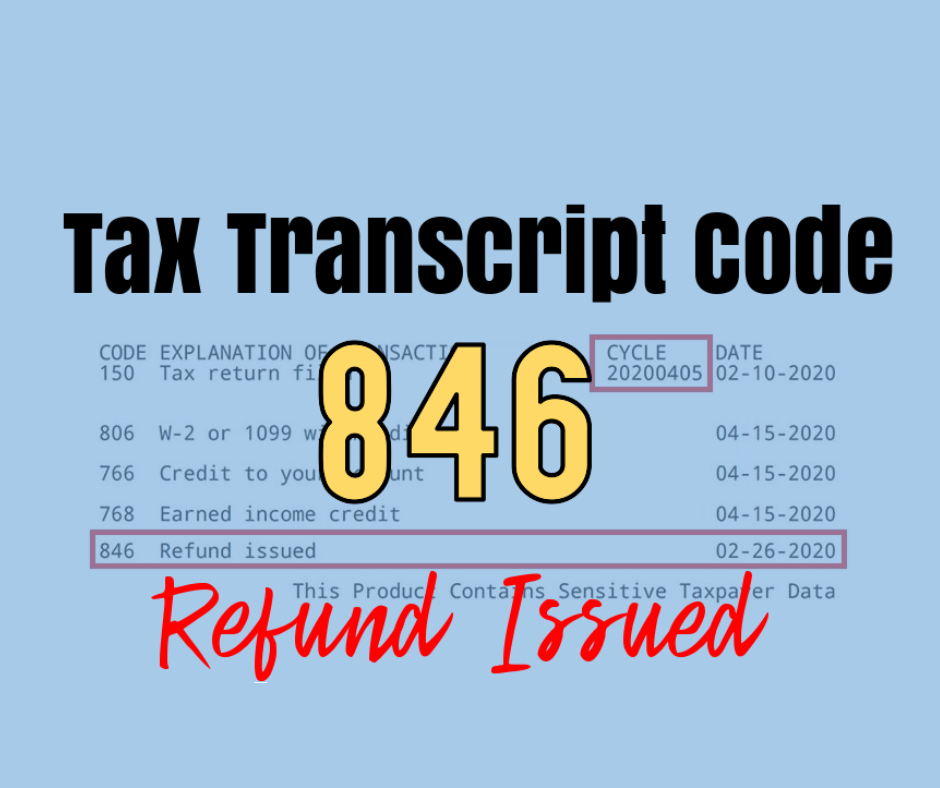

Tax Transcript Code 846 on your tax transcript means that the IRS has issued you a refund for your tax return. You can use the cycle code to find out when your tax return started processing and the explanation of…

-

Refundtalk wrote a new post 2 years, 1 month ago

IRS Cycle Code

Deciphering Your IRS Cycle Code What is an IRS Cycle Code? The IRS cycle code is an eight-digit code that you can find on your online tax account transcript once your tax return has been accepted and…

Deciphering Your IRS Cycle Code What is an IRS Cycle Code? The IRS cycle code is an eight-digit code that you can find on your online tax account transcript once your tax return has been accepted and… -

Refundtalk wrote a new post 2 years, 1 month ago

2023 Tax Refund Updates Calendar

IRS Where’s My Refund? Updates Calendar for 2023 IRS Transcript and the Where’s My Refund? Updates Calendars! Important Tax Transcript and Where’s My Refund update cycle. Tuesday Transcript Updates -…

IRS Where’s My Refund? Updates Calendar for 2023 IRS Transcript and the Where’s My Refund? Updates Calendars! Important Tax Transcript and Where’s My Refund update cycle. Tuesday Transcript Updates -… -

Refundtalk wrote a new post 2 years, 1 month ago

Tax Refund Sent to The Wrong Account?

Last year, the IRS processed over 128 million refunds at an average amount of $2,775 each. The majority of those were sent through direct deposit. The IRS encourages taxpayers to use this method because it t…

Last year, the IRS processed over 128 million refunds at an average amount of $2,775 each. The majority of those were sent through direct deposit. The IRS encourages taxpayers to use this method because it t… -

Refundtalk wrote a new post 2 years, 1 month ago

2023 Tax Transcript Cycle Code Charts

A cycle code is an eight-digit code found on your account transcripts. The cycle code indicates the day your account was posted to the IRS Master File. This date indicates the four digits of the current cycle…

A cycle code is an eight-digit code found on your account transcripts. The cycle code indicates the day your account was posted to the IRS Master File. This date indicates the four digits of the current cycle… -

Refundtalk started the topic 2023 IRS Production Cycles in the forum Cycle Charts 2 years, 1 month ago

-

Refundtalk started the topic 2023 IRS Processing Cycles in the forum Cycle Charts 2 years, 1 month ago

-

Refundtalk wrote a new post 2 years, 1 month ago

Unreported Income Can Trigger an IRS Investigation

If you fail to fully report your income to the Internal Revenue Service (IRS), you could be heading for tax troubles ahead. Most taxpayers are aware that failure to file a tax return could catch up with them.…

If you fail to fully report your income to the Internal Revenue Service (IRS), you could be heading for tax troubles ahead. Most taxpayers are aware that failure to file a tax return could catch up with them.… -

Refundtalk wrote a new post 2 years, 1 month ago

4 Common Mistakes The IRS Makes

Every tax season, you take great care to file everything you need to file and report everything you need to report. After you are satisfied you have completed everything truthfully, you finally send your return…

Every tax season, you take great care to file everything you need to file and report everything you need to report. After you are satisfied you have completed everything truthfully, you finally send your return… -

Refundtalk wrote a new post 2 years, 1 month ago

5 Items On Tax Returns The IRS Will Notice

The good news for taxpayers is that the risk of being audited is historically low. While just over one percent of taxpayers were audited in 2010, that number dipped to 0.45 percent in 2019. Still, a significant…

The good news for taxpayers is that the risk of being audited is historically low. While just over one percent of taxpayers were audited in 2010, that number dipped to 0.45 percent in 2019. Still, a significant… -

Refundtalk wrote a new post 2 years, 1 month ago

The next tax season seems far away, but this is actually the perfect time for taxpayers to review their withholding and estimated tax payments. Because federal taxes are pay-as-you-go, it’s important for taxpa…

-

Refundtalk wrote a new post 2 years, 1 month ago

The Internal Revenue Service announced today significant progress to prepare for the 2023 tax filing season as the agency passed a milestone of hiring 4,000 new customer service representatives to help answer…

- Load More