Refundtalk

@admin

-

Refundtalk started the topic Change of Address in the forum FAQ’s 7 years, 11 months ago

If you have moved, file your return using your new address. If you move after you filed your return, you should give the IRS clear and concise notification of your change of address. The notification may be written, electronic, or oral. Send written notification to the Internal Revenue Service Center serving your old address. You can use Form…[Read more]

-

Refundtalk started the topic Change of Address in the forum FAQ’s 7 years, 11 months ago

If you have moved, file your return using your new address. If you move after you filed your return, you should give the IRS clear and concise notification of your change of address. The notification may be written, electronic, or oral. Send written notification to the Internal Revenue Service Center serving your old address. You can use Form…[Read more]

-

Refundtalk started the topic Interest on Refunds in the forum Refunds 7 years, 11 months ago

If you are due a refund, you may get interest on it. The Interest rates are adjusted quarterly. If the refund is made within 45 days after the due date of your return, no interest will be paid. If you file your return after the due date (including extensions), no interest will be paid if the refund is made within 45 days after the date you filed.…[Read more]

-

Refundtalk started the topic Interest on Refunds in the forum Refunds 7 years, 11 months ago

If you are due a refund, you may get interest on it. The Interest rates are adjusted quarterly. If the refund is made within 45 days after the due date of your return, no interest will be paid. If you file your return after the due date (including extensions), no interest will be paid if the refund is made within 45 days after the date you filed.…[Read more]

-

Refundtalk started the topic Refund Information in the forum Refunds 7 years, 11 months ago

You can go online to check the status of your 2016 refund 24 hours after the IRS receives your e-filed return or 4 weeks after you mail a paper return. If you filed Form 8379 with your return allow 14 weeks (11 weeks if you filed electronically) before checking your refund status. Be sure to have a copy of your 2016 tax return handy because you…[Read more]

-

Refundtalk started the topic Refund Information in the forum Refunds 7 years, 11 months ago

You can go online to check the status of your 2016 refund 24 hours after the IRS receives your e-filed return or 4 weeks after you mail a paper return. If you filed Form 8379 with your return allow 14 weeks (11 weeks if you filed electronically) before checking your refund status. Be sure to have a copy of your 2016 tax return handy because you…[Read more]

-

Refundtalk wrote a new post 7 years, 11 months ago

The Internal Revenue Service has launched the second year of its public awareness campaign aimed at improving taxpayer security in partnership with tax software companies, tax preparation chains, and state tax…

-

Refundtalk wrote a new post 7 years, 11 months ago

In life, there are things you just know, chief among which is the fact that you never, ever mess with Trey Gowdy, especially when you’re clueless on a particular issue because he will knock you squarely into the m…

-

Refundtalk wrote a new post 7 years, 11 months ago

The IRS has unjustly seized $43 million from over 600 people under the guise of violating structuring laws, despite the fact that no legitimate crimes were committed.

(adsbygoogle =…

-

Refundtalk wrote a new post 7 years, 11 months ago

IRS Wasted $12 Million Dollars on Unusable Email System

A report released by the Treasury Inspector General for Tax Administration (TIGTA) revealed that the IRS (Internal Revenue Service) spent $12 million on…

-

Refundtalk wrote a new post 7 years, 11 months ago

The IRS has yet to release an official first day to file taxes in 2017, but we estimate January 24th, 2017 to be the first day to file in 2017.

The IRS will begin accepting the 2016 Tax Returns on January 24th,…

-

Refundtalk wrote a new post 7 years, 11 months ago

Most taxpayers know about the big itemized deductions that can lower your tax bill, like mortgage interest, state income taxes, real estate taxes, and charitable donations. But these are just the most obvious ones…

-

Refundtalk wrote a new post 7 years, 11 months ago

The information being stolen is a big problem for taxpayers. At first, they thought that this was only a rumor until the rumors became reality when the IRS was staggered by a number of complaints from taxpayers,…

-

Refundtalk wrote a new post 7 years, 11 months ago

Last year’s income tax season was marked by an explosion of refund theft. Will this year be any different?

Increased protections may cut down on fraud but will likely draw out the wait for your money. C…

-

Refundtalk wrote a new post 7 years, 11 months ago

An Update on IRS Funding Patterns

As of this morning, the IRS has paid approximately 70% of refunds related to taxpayers who filed within the first weeks of the season. That leaves approximately 30% of these…

-

Refundtalk wrote a new post 7 years, 11 months ago

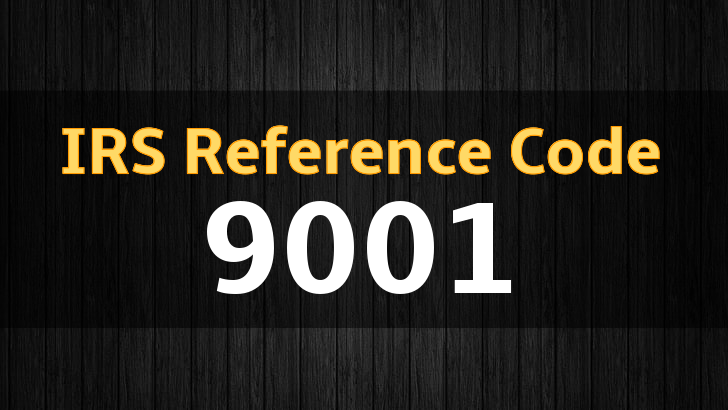

IRS Reference Code 9001

IRS Reference Code 9001: “Taxpayer accessed Refund Status using a secondary TIN. The refund Status could not be returned. Get a Primary TIN Analyze account and follow appropriate IR…

-

Refundtalk wrote a new post 7 years, 11 months ago

Ever wonder what happens to your return once you hit the submit button and e-file your Income Tax Return? Once you submit your tax return it is submitted to one of the five processing centers across the…

-

Refundtalk wrote a new post 7 years, 11 months ago

Things can get a little overwhelming towards the end of January. You begin to see everyone able to file their taxes. You’re still waiting for your W-2. You know you’re getting a refund and you want to file…

-

Refundtalk wrote a new post 7 years, 11 months ago

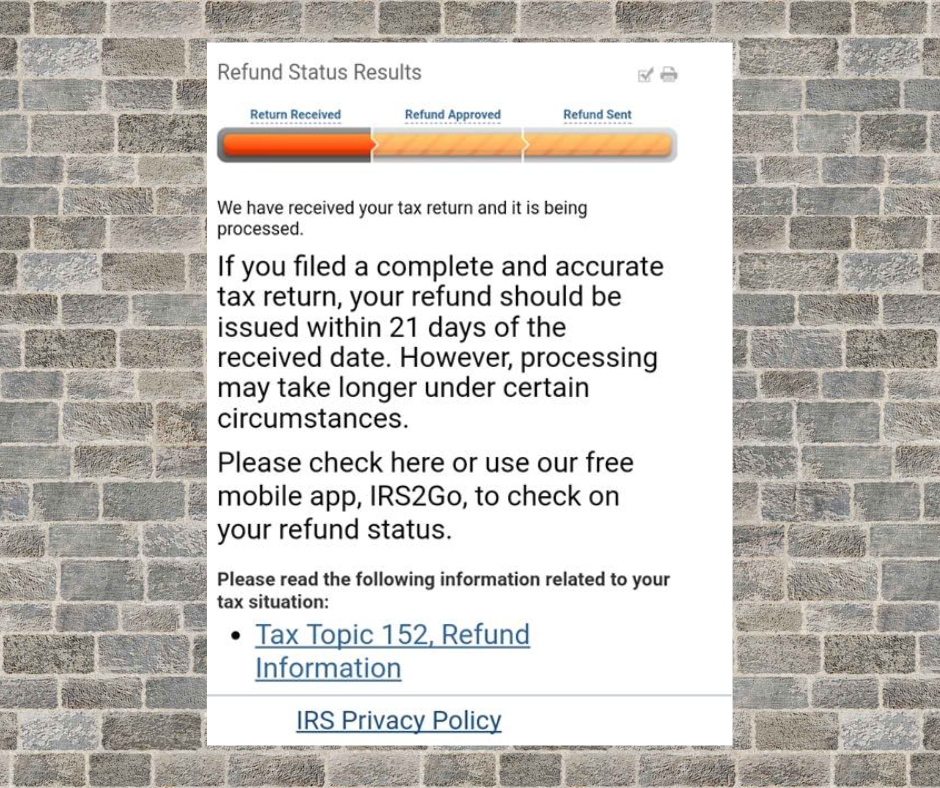

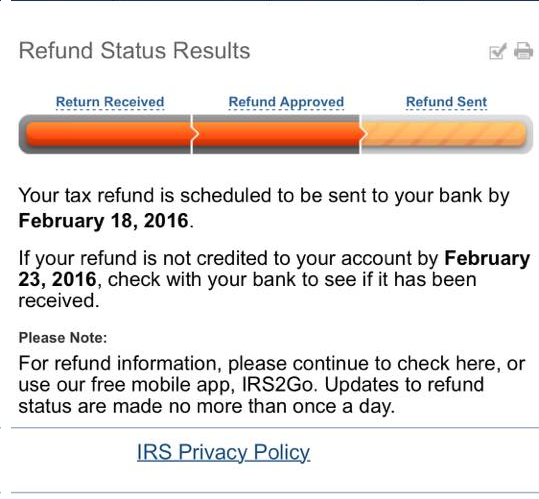

Refund Status

IRS Where’s My Refund? Refund Status Messages What does your tax refund status look like today? Have you submitted your Income Tax Return to the IRS to be E-Filed? Now the waiting game begins to see if we get…

IRS Where’s My Refund? Refund Status Messages What does your tax refund status look like today? Have you submitted your Income Tax Return to the IRS to be E-Filed? Now the waiting game begins to see if we get… -

Refundtalk wrote a new post 7 years, 11 months ago

"Where's My Refund" Status Results

What does my Tax Refund Status Mean? Return Received/Accepted: This simply means that the government has received your e-filed tax return. If you’re getting a refund, the next step is for the government to…

What does my Tax Refund Status Mean? Return Received/Accepted: This simply means that the government has received your e-filed tax return. If you’re getting a refund, the next step is for the government to… - Load More