Refundtalk

@admin

-

Refundtalk wrote a new post 2 years, 2 months ago

An Offer in Compromise can be an effective way for individuals and businesses to settle federal tax debt. This federal program allows taxpayers to enter into an agreement, with the IRS, that settles a tax debt f…

-

Refundtalk wrote a new post 2 years, 2 months ago

IRS sending letters to over 9 million people who did not claim various tax benefits

Starting this week, the Internal Revenue Service is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021…

Starting this week, the Internal Revenue Service is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021… -

Refundtalk wrote a new post 2 years, 2 months ago

Time is running out. The October 17 filing extension deadline is just days away. Most taxpayers who requested an extension of time to file their 2021 tax return must file by Monday to avoid the penalty for…

-

Refundtalk wrote a new post 2 years, 2 months ago

An IRS online account makes it easy for people to quickly get the tax planning info they need. With the same ease that taxpayers have when banking online or placing an online shopping order, they can log in a…

-

Refundtalk wrote a new post 2 years, 2 months ago

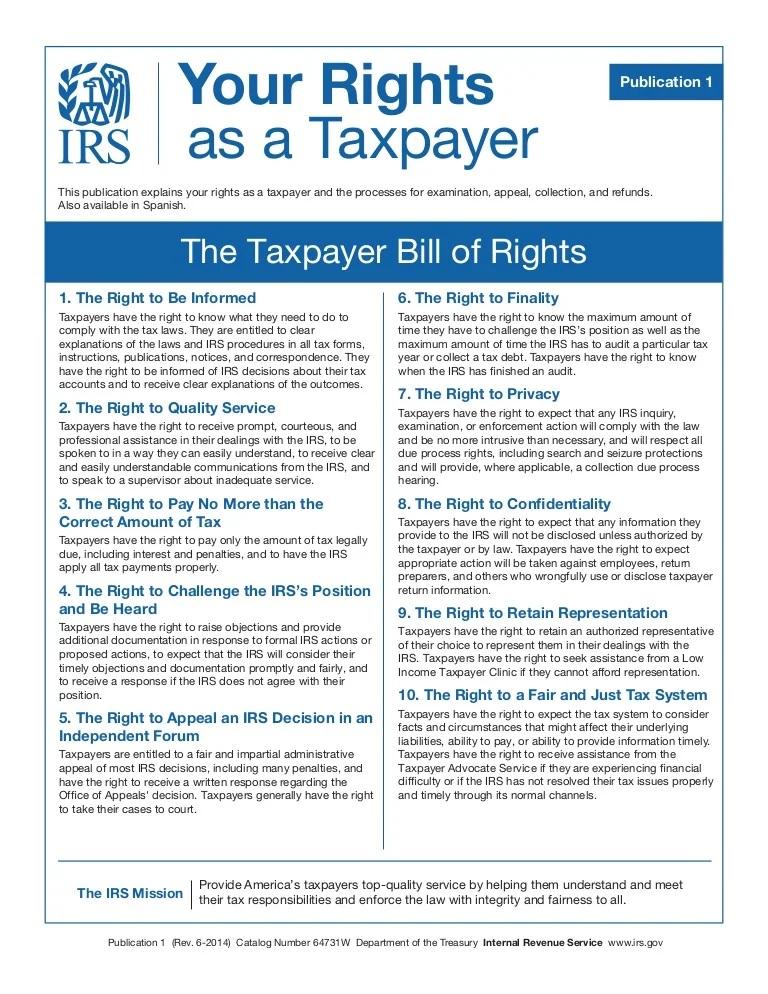

Your Rights as a Taxpayer

Tax fairness means the tax system is equitable to all citizens. This is not just a concept – it is the law. The right to a fair and just tax system is one of the 10 rights in…

-

Refundtalk wrote a new post 2 years, 2 months ago

What You Should Know About the IRS Automated Underreporter

The Automated Underreporter (AUR) program is an important part of compliance efforts at the Internal Revenue Service (IRS). Most people are aware they could be audited by the IRS. The thought of an IRS audit…

The Automated Underreporter (AUR) program is an important part of compliance efforts at the Internal Revenue Service (IRS). Most people are aware they could be audited by the IRS. The thought of an IRS audit… -

Refundtalk wrote a new post 2 years, 2 months ago

Who Can You Claim as a Tax Dependent?

One of the most common elements of a fraudulent income tax return is a claim for unqualified dependents. So—who can you claim? There are important tax benefits available for taxpayers who support d…

One of the most common elements of a fraudulent income tax return is a claim for unqualified dependents. So—who can you claim? There are important tax benefits available for taxpayers who support d… -

Refundtalk wrote a new post 2 years, 2 months ago

Amending Your Tax Return – the How, Why, and When

So, we are all on the same foot, amending your tax return is basically sending the IRS a new tax return, correcting errors made on the last tax return you filed for that year. You technically can amend more than…

So, we are all on the same foot, amending your tax return is basically sending the IRS a new tax return, correcting errors made on the last tax return you filed for that year. You technically can amend more than… -

Refundtalk wrote a new post 2 years, 2 months ago

IRS Gains New Funding To Expand Operations And Audits

The Internal Revenue Service (IRS) will receive a significant increase in funding with the passing of the Inflation Reduction Act, potentially leading to an increase in its compliance and enforcement…

The Internal Revenue Service (IRS) will receive a significant increase in funding with the passing of the Inflation Reduction Act, potentially leading to an increase in its compliance and enforcement… -

Refundtalk wrote a new post 2 years, 2 months ago

Tax Transcript Code 806 – W-2 or 1099 Withholding

The IRS transaction code 806 will appear on your tax transcript to show the total amount of federal income tax withheld from your paycheck throughout the year that was reported on forms W-2 and 1099’s. Once y…

The IRS transaction code 806 will appear on your tax transcript to show the total amount of federal income tax withheld from your paycheck throughout the year that was reported on forms W-2 and 1099’s. Once y… -

Refundtalk wrote a new post 2 years, 2 months ago

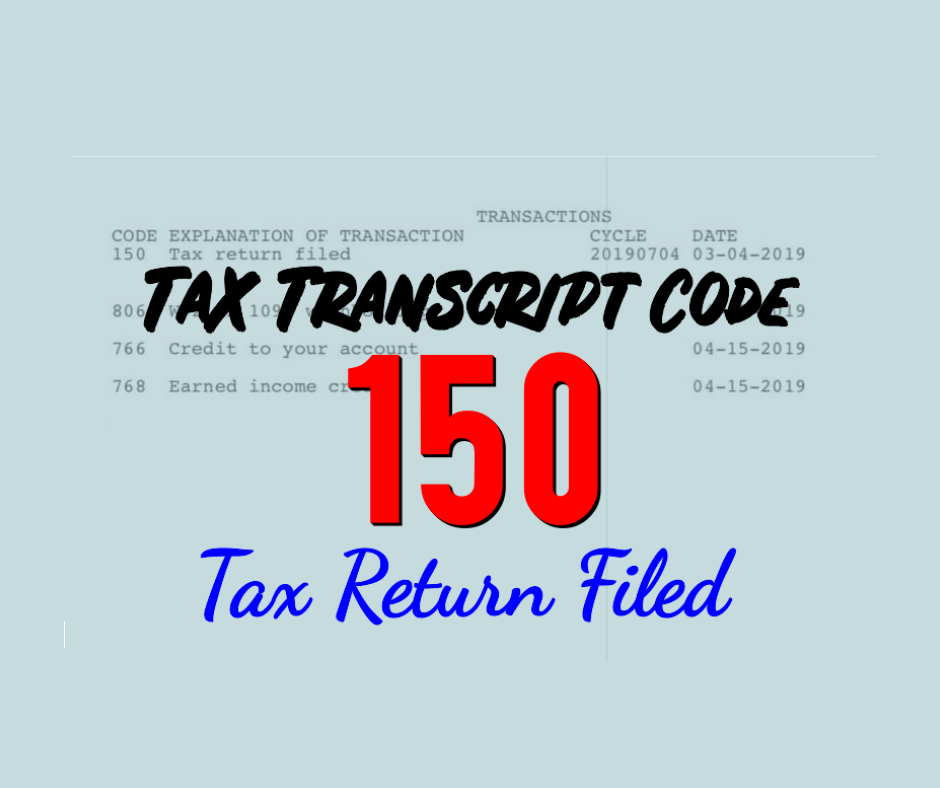

Tax Transcript Code 150 – Tax Return Filed

Once your tax return has been accepted by the IRS and added to the IRS Master File for processing. An IRS transaction code of 150 will appear on your tax return to indicate that your tax liability has been…

Once your tax return has been accepted by the IRS and added to the IRS Master File for processing. An IRS transaction code of 150 will appear on your tax return to indicate that your tax liability has been… -

Refundtalk wrote a new post 2 years, 3 months ago

Tax Refund Status – Received, Approved, Sent

You can start using the Where’s My Refund? website or IRS2Go app to start checking on the status of your return 24 Hours after the IRS receives your e-filed return or 6 Months after you mail a paper retu…

You can start using the Where’s My Refund? website or IRS2Go app to start checking on the status of your return 24 Hours after the IRS receives your e-filed return or 6 Months after you mail a paper retu… -

Refundtalk wrote a new post 2 years, 3 months ago

IRS Identity and Tax Return Verification Service

The IRS Identity and Tax Return Verification Service can help you prove that you are who you say you are. The IRS wants you to verify your identity to make you eligible for a tax return. To verify your…

The IRS Identity and Tax Return Verification Service can help you prove that you are who you say you are. The IRS wants you to verify your identity to make you eligible for a tax return. To verify your… -

Refundtalk wrote a new post 2 years, 3 months ago

The Adoption Tax Credit

The adoption tax credit lets families who were in the adoption process during 2022 claim up to $14,890 in eligible adoption expenses for each eligible child. Taxpayers can apply the credit to international,…

The adoption tax credit lets families who were in the adoption process during 2022 claim up to $14,890 in eligible adoption expenses for each eligible child. Taxpayers can apply the credit to international,… -

Refundtalk wrote a new post 2 years, 3 months ago

FAQ on Student Loan Cancellation

What is the Student Loan Cancellation? Last month, President Biden laid out a plan to cancel up to $20,000 in federal student loan debt per borrower. Beneath this seemingly simple plan comes quite a few…

What is the Student Loan Cancellation? Last month, President Biden laid out a plan to cancel up to $20,000 in federal student loan debt per borrower. Beneath this seemingly simple plan comes quite a few… -

Refundtalk wrote a new post 2 years, 3 months ago

Last month, Congress passed the Inflation Reduction Act (IRA22), which provides the IRS with supplemental funding of nearly $80 billion over the next ten years. More than half the funding has been earmarked for…

-

Refundtalk wrote a new post 2 years, 4 months ago

The Problem with Past Due Tax Returns

Tax Day rolls around each year. If you have delayed or simply passed on filing your tax return, you may be surprised at the difficulties it can cause. Everyone of working age is aware of the necessity of…

Tax Day rolls around each year. If you have delayed or simply passed on filing your tax return, you may be surprised at the difficulties it can cause. Everyone of working age is aware of the necessity of… -

Refundtalk wrote a new post 2 years, 4 months ago

Tips from IRS Security Summit to Reduce Identity Theft

Tax fraud involving identity theft is big business. The Internal Revenue Service (IRS) wants to help you understand your risks, and be proactive in preventing others from gaining access to your tax ID and…

Tax fraud involving identity theft is big business. The Internal Revenue Service (IRS) wants to help you understand your risks, and be proactive in preventing others from gaining access to your tax ID and… -

Refundtalk wrote a new post 2 years, 4 months ago

How Can I Talk to a Live Agent at the IRS?

Simple steps you can take to reach a live agent at the IRS For many taxpayers, the most frustrating part about doing their taxes is getting ahold of a real person at the IRS. The IRS is understaffed and…

Simple steps you can take to reach a live agent at the IRS For many taxpayers, the most frustrating part about doing their taxes is getting ahold of a real person at the IRS. The IRS is understaffed and… -

Refundtalk wrote a new post 2 years, 5 months ago

It’s filing extension crunch time, but people rushing to get their tax return filed should be cautious when choosing a tax preparer. Anyone can be a paid tax return preparer if they have an IRS preparer tax…

- Load More